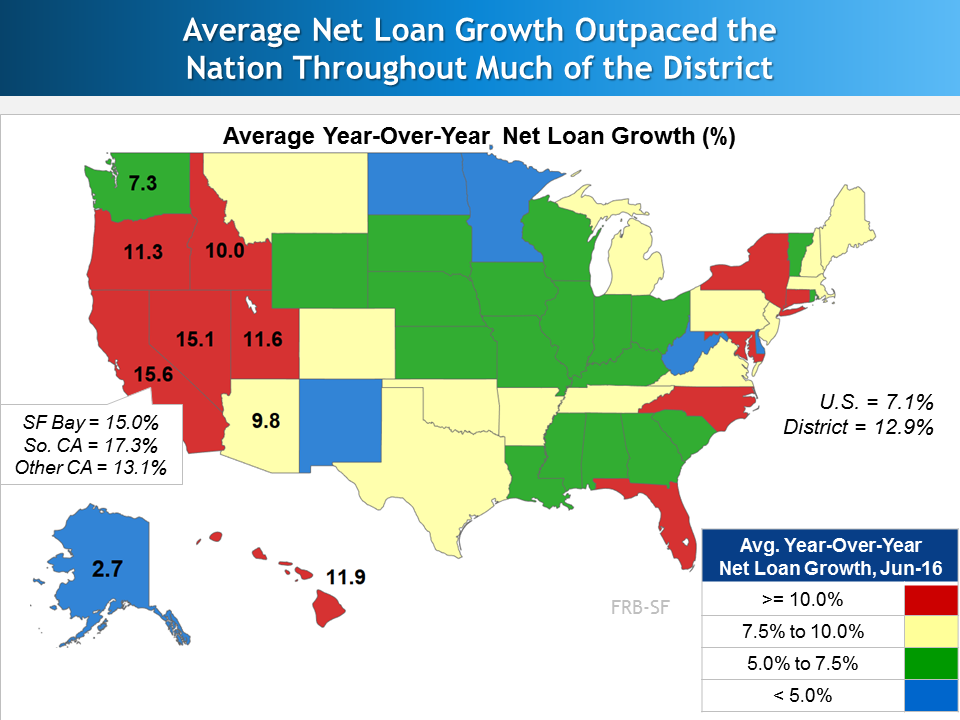

First Glance 12L provides a quarterly look at economic and banking conditions within the 12th District. For 2Q16, new data shows overall District bank performance was further improved over last quarter. The report, “Strong Growth: A Double-Edged Sword?,” notes that solid employment growth helped propel demand for new and existing commercial and residential real estate. As a result, loan portfolios expanded briskly at District banks, benefiting earnings-related ratios. On-balance sheet liquidity and capital positions tightened modestly because loan growth outpaced increases in liquid assets, core deposits, and regulatory capital. Loan growth continued to be concentrated in commercial real estate (CRE) categories, pushing up CRE exposures in relation to capital. There were some signs that lenders recently tightened underwriting standards; however, regulatory concerns linger about the rapid run up in real estate prices and potential over-reliance on collateral values to mitigate underwriting concessions such as length, pricing, and recourse. As banks face increased competition from bank and fintech firms, they are beginning to partner with alternative lenders – arrangements which pose their own set of opportunities and challenges. The report also summarizes several other “Hot Topics” that bank supervisors are monitoring closely.