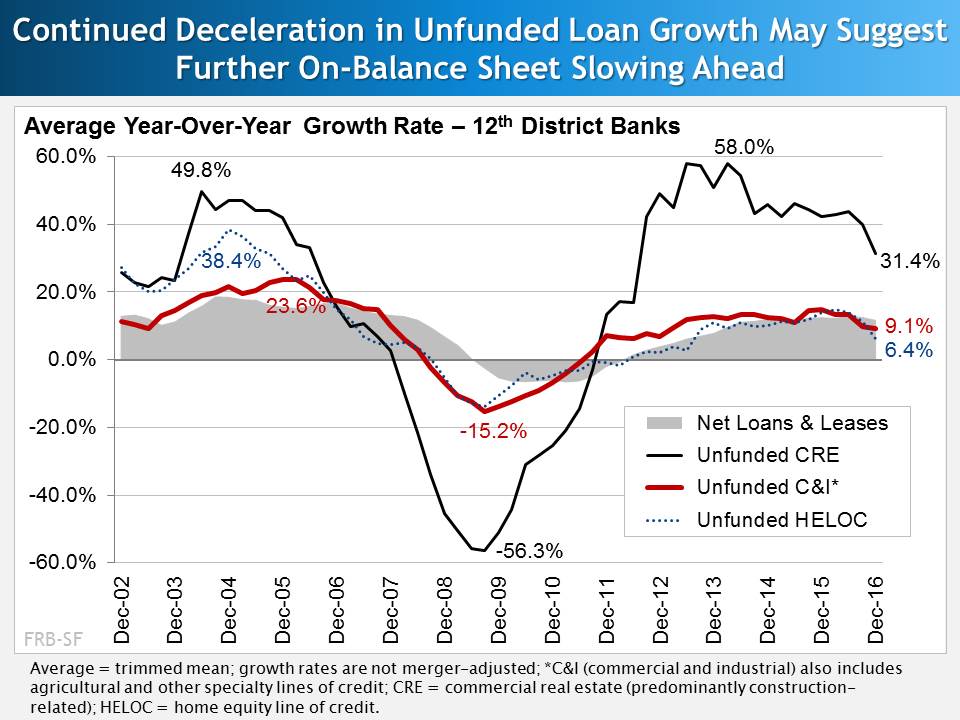

First Glance 12L provides a quarterly look at economic and banking conditions within the 12th District. Data from 4Q16 shows that overall District bank performance remained solid. The report, “Signs of a Maturing Economic and Banking Cycle Continued,” notes that job growth remained strong, supporting increased demand for real estate and loans, but downshifted in several District states. Similarly, average banks’ annual loan growth outpaced the nation, but decelerated for the second quarter in a row. For most banks, full-year earnings benefited from improved net interest income and noninterest expense ratios. Annual loan growth continued to outpace other balance sheet segments, contributing to year-over-year declines in on-balance sheet liquidity and risk-based capital ratios. Surveys of lenders and examiners provided somewhat contradictory indicators of underwriting trends. Regulators remained concerned about the pace of commercial real estate price appreciation and potential lender over-reliance on collateral values to mitigate other underwriting concessions. In addition to discussing several “Hot Topics,” the report notes potential headwinds from shifting trade conditions, immigration policies, and interest rates.