Recent surges in food and energy prices have pushed up headline inflation to levels well above its underlying trend. In contrast, core inflation, which excludes food and energy prices, has remained low and stable. Historical data suggest that, since the early 1990s, headline inflation has tended to converge toward core inflation. Thus, high inflation is unlikely to persist as long as inflation expectations remain anchored.

Recent spikes in food and energy prices have pushed up headline inflation. Core inflation, which excludes food and energy prices, has remained relatively subdued. Will headline inflation come back to core inflation when the effects of food and energy prices subside, or will high inflation persist? This issue is important for monetary policymakers because Congress has mandated that the Federal Reserve maintain stability of all prices, including those of food and energy. Since monetary policy operates with long and variable lags, today’s policy changes can affect future inflation. If inflation is expected to remain elevated for a sustained period, then the Fed should act aggressively now to bring inflation down to the long-term objective. However, if the inflation run-up turns out to be transitory, then overly aggressive policy tightening would likely hinder economic recovery.

This Economic Letter examines whether headline inflation converges toward core inflation when the two measures deviate. Historical data suggest that headline inflation has tended to return to core inflation since the early 1990s, although it did not do so in the 1960s and 1970s. These changes in inflation behavior since the early 1990s are consistent with better-anchored inflation expectations and a more credible monetary policy commitment to maintaining low and stable inflation.

Relations between headline inflation and core inflation

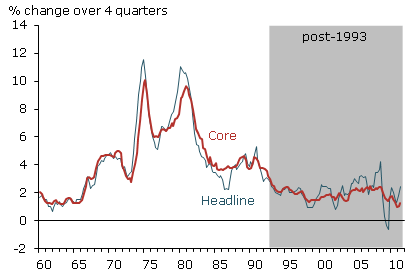

Figure 1

Headline and core inflation rates

Headline inflation deviates from core inflation frequently. Figure 1 shows headline and core inflation since 1959 measured by four-quarter changes in the personal consumption expenditures price index (PCEPI), an inflation indicator that the Fed watches closely. Deviations of headline from core inflation were particularly pronounced during periods of large food and energy price fluctuations. For example, in the two 1970s oil price shocks, headline inflation went well above core. After the 1986 plunge in oil prices, headline inflation dropped well below core. Similarly, the 2007–08 spike and subsequent collapse of energy prices led to large deviations of headline inflation from core.

Figure 1 also suggests that the relationship between headline and core inflation has changed since the early 1990s. In the 1960s through the 1980s, deviations of headline inflation from core seem to have been resolved by core inflation catching up with headline. For example, the two episodes of high headline inflation in the 1970s were followed by significant run-ups of core inflation. However, since the early 1990s, core inflation has remained stable despite fluctuations in headline. This observation is confirmed by empirical studies and formal statistical analysis showing that the behavior of inflation has substantially changed since the late 1980s and early 1990s (see Rosengren 2011 for a discussion of this pattern in the consumer price index). For example, Cogley and Sargent (2005) document that, after adjusting for changes in volatility, inflation persistence increased during the 1970s and decreased in the 1980s and 1990s (see also Stock and Watson, 2007).

Evidence of inflation convergence

We use a statistical model based on quarterly PCEPI data from the third quarter of 1959 to the fourth quarter of 2006 to examine whether headline inflation converges with core inflation. Changes in current headline inflation from the previous period are related to past changes in headline inflation and deviations of headline inflation from core in the previous period. We generate separate estimates for the periods before and after 1993. We follow Williams (2009) and split the sample around 1993 to capture the separate inflation regimes before and after the early 1990s.

Before 1993, current deviations of headline inflation from core had an insignificant impact on the behavior of future headline inflation. However, since 1993, deviations of headline inflation from core have had a large negative impact on headline. When current headline inflation has gone above core, it has tended to decline and come back to core. Headline has converged to core fairly quickly, with a half-life shorter than two quarters.

Inflation convergence illustrated: The disinflation of late 2008

We perform a statistical experiment on the energy price boom and bust of 2007–08 to examine inflation convergence. Crude oil prices surged from a little over $60 per barrel in the summer of 2007 to over $130 in the summer of 2008 and then plummeted to about $40 by the end of 2008. Reflecting these gyrations, the year-over-year change in headline PCEPI surged from a little under 2.5% in the summer of 2007 to close to 4.5% in the summer of 2008. By the second quarter of 2009, it had plunged to deflationary territory. As headline inflation accelerated steeply in late 2007 and early 2008, core inflation stayed in a range between 2 and 2.5%. Then, in the depth of the recession from the second half of 2008 to 2009, core inflation declined substantially, although not nearly as much as headline inflation. Liu and Rudebusch (2010) argue that this decline was not driven primarily by the collapse in oil prices, but rather by the widening of the unemployment gap, which is the difference between observed unemployment and its potential.

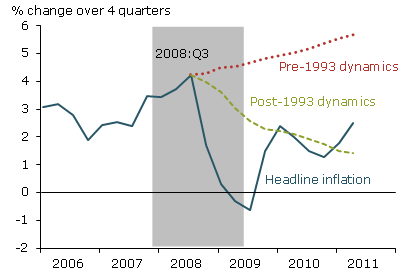

Figure 2

Headline inflation and sample projections

Note: Gray bar indicates recession.

We use our statistical model to examine what would have happened to headline inflation from the third quarter of 2008, when it reached a peak, to the fourth quarter of 2010 had it followed the convergence pattern observed in the pre- or post-1993 samples. We take the actual path of core inflation and calculate the projected headline inflation path based on these two samples. Figure 2 shows the four-quarter changes in the headline PCEPI. The solid line represents actual data, the red dotted line represents the estimated path of headline inflation using pre-1993 data, and the green dashed line represents the path using post-1993 data. If the pre-1993 inflation dynamics had prevailed, headline inflation would have remained high and possibly accelerated from the third quarter of 2008 to the fourth quarter of 2010. However, if the post-1993 inflation dynamics had prevailed, headline would have declined quickly to close the gap with core inflation. The figure shows that the path based on the post-1993 data comes very close to actual headline inflation in 2010.

Can high inflation continue?

The run-up of headline inflation in the first quarter of 2011 has generated fears that high inflation might persist. Since changes in food and energy prices are transitory, the dynamic behavior of headline inflation depends on how core inflation responds to changes in food and energy prices. If core remains low and stable despite large swings in food and energy prices, then headline inflation is likely to converge towards core over time as the effects of food and energy prices wane. Core can be destabilized if energy price increases are passed through to core prices or if inflation expectations are unanchored.

We expect core inflation to remain low and stable for two reasons. First, pass-through from energy and other commodity prices to final consumer prices is likely to be limited. Hobijn (2008) finds that commodity price surges affect the cost of a narrow range of consumer goods and thus have limited direct pass-through to final consumer prices. Williams (2011) argues that the structural and institutional factors that led to runaway inflation in the 1970s, such as automatic cost-of-living adjustments in many labor contracts, are largely absent today. Blanchard and Gali (2007) show that, in contrast with the 1970s, an oil price shock in the past 25 years has caused headline inflation to rise, but nominal wages have shown muted responses. In the first quarter of 2011, wages and labor compensation remained stable despite sharp increases in headline inflation.

Second, well-anchored inflation expectations are crucial for maintaining price stability. Orphanides and Williams (2007) show that well-anchored expectations help mute and shorten the response of inflation to adverse supply shocks. Evans and Fisher (2011) show that core inflation has responded very little to oil price shocks in the past 25 years. Taken together, these findings suggest that inflation expectations have been well anchored since the late 1980s.

If inflation expectations are well anchored and pass-through is limited, then deviations of headline inflation from core should have very little effect on the path of core. To examine whether this hypothesis is supported by data, we estimate a statistical model for core inflation similar to our model for headline inflation. In the core inflation model, changes in core depend on past changes in core and the past difference between headline and core. We find that, in the pre-1993 period, core inflation rises when headline goes above core in the past period. However, since 1993, past deviations of headline from core have had little impact on core inflation. Thus, the post-1993 data are consistent with well-anchored inflation expectations and limited pass-through.

Of course, in the current situation, continued commodity price increases could cause inflation expectations to rise. Some commentators argue that the recent uptick in consumer inflation expectations in the Thomson Reuters/University of Michigan Surveys of Consumers is cause for serious concern. However, Trehan (2009) shows that changes in consumer inflation expectations mostly reflect recent headline inflation rather than genuine shifts in perceptions about future economic conditions. When the effects of commodity price changes dissipate and headline inflation subsides, consumer inflation expectations should fall back to normal levels, as they did in late 2008.

It is possible that inflation expectations could become unanchored. But there is little evidence that such an unmooring has occurred so far. In fact, inflation projections of professional forecasters and measures of expectations derived from inflation-protected securities have been stable. To keep inflation expectations well anchored, the Fed will have to demonstrate continued credible commitment to maintaining low and stable inflation in the medium term.

Conclusion

The recent rise in headline inflation following surges in food and energy prices has prompted concerns that high inflation could persist. However, sustained high inflation is unlikely as long as inflation expectations remain well anchored. With low pass-through of commodity prices to consumer prices and well-anchored inflation expectations, core inflation is likely to remain low and stable, and headline inflation is likely to fall to the levels of core inflation as the effects of commodity price increases dissipate.

References

Blanchard, Olivier J., and Jordi Gali. 2007. “The Macroeconomic Effects of Oil Shocks: Why Are the 2000s So Different from the 1970s?” NBER Working Paper 13368.

Cogley, Timothy, and Thomas J. Sargent. 2005. “The Conquest of U.S. Inflation: Learning and Robustness to Model Uncertainty.” Review of Economic Dynamics 8(2, April), pp. 528–563.

Evans, Charles L., and Jonas D.M. Fisher. 2011. “What Are the Implications of Rising Commodity Prices for Inflation and Monetary Policy?” Chicago Fed Letter 286 (May).

Hobijn, Bart. 2008. “Commodity Price Movements and PCE Inflation.” Current Issues in Economics and Finance 14(8, November).

Liu, Zheng, and Glenn D. Rudebusch. 2010. “Inflation: Mind the Gap.” 2010-02 (January 19).

Orphanides, Athanasios, and John C. Williams. 2007. “Inflation Targeting under Imperfect Knowledge.” In Monetary Policy under Inflation Targeting 11, ed. by Frederic S. Mishkin and Klaus Schmidt-Hebbel. Santiago: Central Bank of Chile, pp. 77–123.

Rosengren, Eric S. 2011. “A Look Inside a Key Economic Debate: How Should Monetary Policy Respond to Price Increases Driven by Supply Shocks?” Remarks to the Massachusetts Chapter of NAIOP, the Commercial Real Estate Development Association, May 4.

Stock, James, and Mark Watson. 2007. “Why Has U.S. Inflation Become Harder to Forecast?” Journal of Money, Credit, and Banking 39(s1), pp. 3-34.

Trehan, Bharat. 2009. “Survey Measures of Inflation and the Inflation Process.” FRB San Francisco Working Paper 2009-10.

Williams, John C. 2009. “The Risk of Deflation.” FRBSF Economic Letter 2009-12 (March 27).

Williams, John C. 2011. “Maintaining Price Stability in a Global Economy.” FRBSF Economic Letter 2011-14 (May 9).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org