In 2010, statistical experiments based on components of the Conference Board’s Leading Economic Index showed a significant possibility of a U.S. recession over a 24-month period. Since then, the European sovereign debt crisis has aggravated international threats to the U.S. economy. Moreover, the Japanese earthquake and tsunami demonstrated that the U.S. economy is vulnerable to outside disruptions. Updated forecasts suggest that the probability of a U.S. recession has remained elevated and may have increased over the past year, in part because of foreign financial and economic crises.

Gathering storms across the Atlantic threaten a U.S. economy not yet recovered from the last recession. The September Economic Outlook from the Organisation for Economic Co-operation and Development (OECD) indicates that growth prospects have significantly dimmed for major industrialized economies (OECD 2011). Growth in the G-7 countries is expected to remain below 1% for the rest of the year, while the odds of a contraction are fifty-fifty. The semiannual Global Financial Stability Report of the International Monetary Fund (IMF) highlights risks the European sovereign debt crisis poses to the stability of the financial system (IMF 2011a). The crisis has resulted in escalating volatility in equity markets and the lowest interest rates on long-term U.S. Treasury securities since the 1940s. In its World Economic Outlook, the IMF sees the softening U.S. economy and the euro area fiscal crisis as the two major factors threatening the world economy (IMF 2011b).

On cue, economic forecasters have been flourishing their recession trumpets, sounding a symphony of predictions that put the odds of a U.S. recession in the neighborhood of one in three over the next twelve months. In this Economic Letter, we join this ensemble, updating the recession probabilities provided last year in Berge and Jordà (2010). In that Economic Letter, we put the odds of recession at about one in three by the end of the summer of 2011, rising to even odds of one in two toward the first half of 2012. Measured by the growing number of forecasters who now share our views, these predictions have held up well.

Since the summer of 2010, the situation on the ground has changed. Japan’s March 2011 earthquake and tsunami disrupted supply chains in the U.S. automobile industry far more than expected. Meanwhile, the deteriorating fiscal realities in Europe have been keeping many a trader awake at night, reliving the nightmare of the near-collapse of financial markets in the wake of the Lehman Brothers bankruptcy. The European situation was highlighted by the September 2011 release of the euro zone purchasing managers index data, which indicated that the manufacturing and services sectors contracted in August. Christine Lagarde, the IMF’s managing director, sounded the financial alarm by suggesting that European banks are in “urgent need of capital” in a speech on August 27 at the Federal Reserve’s Jackson Hole Economic Policy Symposium.

This Economic Letter revises the recession odds calculated in 2010 to account for these international factors. Viewed through the domestic lens, the immediate risks of recession appear to be low, but gradually increasing. International risks, though less precisely measured, are the mirror image. Risks are highest in the very short run, but then fade. In combination, the data suggest vigilance. The U.S. economy is fragile with limited ability to withstand shocks. Yet, as the economy strengthens, recession risks will gradually abate beginning in the second half of 2012.

Updating the recession odds based on the leading indicators index

Why should anyone care about dating expansions and recessions? When millions of workers are unable to find a job during a period of expansion, it seems little more than an academic exercise. It would be more compelling to quantify the odds that the rate of GDP growth will exceed a level at which the jobs picture can reasonably be expected to improve, say, 2%.

However, identifying business cycle turning points is useful. From an operational viewpoint, predicting a binary outcome—recession or expansion—over a long forecast horizon is easier than predicting GDP. Moreover, certain variables, such as leading economic indicators, offer insight into recession odds in the distant future. If economic policy is to be preemptive rather than reactive, it is important to get ahead of the curve.

In Berge and Jordà (2010), we used the components of the Conference Board’s Leading Economic Index (LEI) (www.conference-board.org/data/bci.cfm) to forecast the odds of recession. We assembled different LEI indexes based on weighted averages of the components, tailored to reflect that different variables have predictive power at different horizons.

Historically, the interest spread between the federal funds rate and the yield on the 10-year U.S. Treasury bond had been one of the better predictors of turning points. But the extraordinary combination of the federal funds rate stuck near its zero lower bound and extremely low Treasury bond yields, reflecting uncertainty about European sovereign debt more than domestic fundamentals, have kept the spread unusually narrow. We continue to view this signal as misleading in the current environment and have chosen to drop it from the update, just as we did in 2010.

One way to assess the accuracy of predictions about turning points is to rely on a statistic that has a long tradition in biostatistics and medicine called the area under the curve (AUC). The AUC is a number between 0.5, a prediction no better than a coin toss, and 1, a perfect sorting of recessions and expansions. One interpretation of the AUC is as the average correct classification rates of observations as either expansions or recessions (for more on the AUC, see Berge and Jordà 2011).

At the short end of our 24-month forecasting exercise, the AUC is 0.99, which means we can almost perfectly determine whether we are in recession. At about a year out, the AUC is 0.75, which, loosely interpreted, means we can correctly sort expansions and recessions with 75% accuracy. At the two-year mark the AUC is 0.81, a surprising improvement in accuracy reflecting that the leading indicators are well suited for that horizon.

The American business cycle in international context

Fluctuations in U.S. economic activity sometimes have an international component. The oil crises after OPEC’s oil embargo in 1973 and the Iranian revolution in 1979 engulfed a large portion of the global economy. Although financial crises in advanced economies are rare, they can leap continents and borders with tremendous facility, as we learned in 2008. It is tempting to think that such contagion is a modern phenomenon. However, using a data set spanning 140 years, Jordà, Schularick, and Taylor (2011) have identified five such financial crises. In each case, 9 to 10 countries out of a sample of 14 advanced economies were dragged into the financial maelstrom. Will the European sovereign debt crisis evolve into one of these events? If so, what would be the risks to the U.S. economy?

The approach we use largely resembles that based on the domestic LEI data discussed earlier. The OECD prepares a composite leading indicators (CLI) index for each of its member countries to detect country-specific turning points (see www.oecd.org/std/cli). These differ for each country depending on data availability and each indicator’s ability to project country-specific turning points.

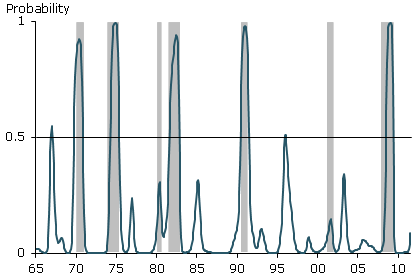

Figure 1

Probability of a U.S. recession using CLI data

We examine to what extent international data on leading indicators are able to detect U.S. turning points using combined CLI data for Canada, France, Germany, Japan, and the United Kingdom. We begin by separating any information that is correlated with the U.S. CLI, which is calculated by the OECD as well. This separation avoids double counting information that already appears in our domestic LEI analysis.

Figure 1 displays the U.S. recession probabilities calculated with these data. The AUC hovers around 0.7 over the entire 24-month forecast range. Thus, the foreign CLI data provide a surprisingly reasonable signal of U.S. recessions. In normal times, this signal is lower quality than the LEI-based signal and would be superseded. But what if these are not normal times?

Calculating recession odds due to domestic and external factors

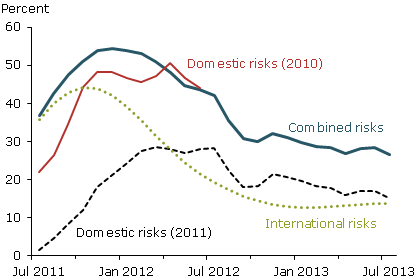

Figure 2 shows our updated recession probability forecasts. The thin red line shows the LEI-based predictions we calculated in 2010, which run until 2012. The black dashed line shows the LEI-based predictions using data through August 2011 and extends until mid-2013. The dotted green line shows the predictions based on international CLI data released through July 2011. The thick blue line displays the odds of recession based on combining the lines based on domestic and international factors.

To interpret these predictions, think about an experiment in which two coins are flipped, with heads representing recession and tails expansion. One coin represents the recession odds from domestic factors, the other coin from international factors. Figure 2 shows the probabilities of flipping heads with the domestic and international coins. The overall probability of recession is reflected in the thick blue line.

In the next few months, the odds of recession due to domestic factors appear reasonably contained. Those odds increase gradually and reach about 30% in the second half of 2012, after which they decline. However, the curve reflecting the international odds suggests more imminent danger to the economy, although this threat is harder to calibrate using historical data and only indirectly reflects the health of the European financial system. Recession odds based on international factors peak at about 45% toward the end of 2011, but decline rapidly thereafter.

Figure 2

Recession probability forecasts

The combination of these two recession coins, shown in the combined risks line of Figure 2, is quite disconcerting. It indicates that the odds are greater than 50% that we will experience a recession sometime early in 2012. Because the international odds of recession are more imprecisely estimated, one must be careful with a strict interpretation of this result. But the message is clear. Prudence suggests that the fragile state of the U.S. economy would not easily withstand turbulence coming across the Atlantic. A European sovereign debt default may well sink the United States back into recession. However, if we navigate the storm through the second half of 2012, it appears that danger will recede rapidly in 2013.

Travis J. Berge is an economist in the Research Department of the Federal Reserve Bank of Kansas City.

Early Elias is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Òscar Jordà is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Balduzzi, Pierluigi, Edwin J. Elton, and T. Clifton Green. 2001. “Economic News and Bond Prices: Evidence from the U.S. Treasury Market.” Journal of Financial and Quantitative Analysis 36(4), pp. 523–544.

Berge, Travis J., and Òscar Jordà. 2010. “Future Recession Risks.” FRBSF Economic Letter 2010-24. /economic-research/letter/2010/el2010-24.html

Berge, Travis J., and Òscar Jordà. 2011. “Evaluating the Classification of Economic Activity into Recessions and Expansions.” American Economic Journal: Macroeconomics 3(2, April), pp. 246–277.

International Monetary Fund. 2011a. “Global Financial Stability Report: Grappling with Crisis Legacies.” World Economic and Financial Surveys, September 2011. http://www.imf.org/external/pubs/ft/gfsr/2011/02/index.htm

International Monetary Fund. 2011b. “World Economic Outlook: Slowing Growth, Rising Risks.” World Economic and Financial Surveys, September 2011. http://www.imf.org/external/pubs/ft/weo/2011/02/index.htm

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2011. “Financial Crises, Credit Booms, and External Imbalances: 140 Years of Lessons.” IMF Economic Review 59(2), pp. 340–378.

Organisation for Economic Co-operation and Development. 2011. Economic Outlook 89 (September 8). www.oecd.org/oecdEconomicOutlook

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org