Bharat Trehan, research advisor at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

- The latest GDP report contained a comprehensive data revision going all the way back to 1929. The Bureau of Economic Analysis makes these revisions about every five years to incorporate new data and new methodology. The most important change this time was the introduction of a new category of capital called intellectual property investment. This new component capitalizes expenditures on research and development and on entertainment, literary, and artistic originals. Software, which was previously grouped with equipment, has also been moved into this category. This is a significant conceptual change, meant to better account for innovation and intangible assets.

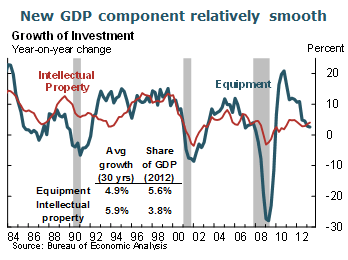

- The new component is less volatile than business equipment expenditures, which is another key component of investment. Both intellectual property and business equipment investment grow faster than real GDP, which grew at an average rate of 2¾% over the past three decades. But intellectual property investment is a relatively small share of the economy, so its inclusion had only a small effect on real GDP growth since 1929.

- The expanded definition of GDP, along with new source data and other minor statistical and definitional changes, raised the level of nominal GDP $560 billion in 2012. These factors have boosted the real GDP growth rate since the most recent recession began by two-tenths of a percentage point.

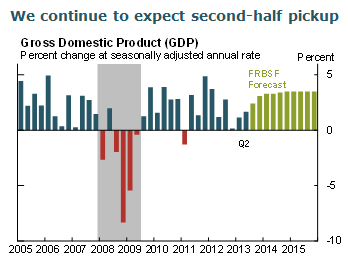

- GDP growth in the second quarter of 2013 was better than we were expecting. However, this was roughly offset by first-quarter growth, which was revised down. Trade data released after the GDP report suggest that output growth in the second quarter could be revised up as much as one percentage point.

- Overall, recent data support our forecast that growth will pick up in the second half of the year. Fiscal drag is likely to fade going forward, and the economy will be helped by rising equity and home prices. We expect real GDP growth to average close to 3.5% over 2014 and 2015.

- We continue to see risks associated with this forecast. Contentious debate in Washington could act as a negative shock, and the lingering effects of tax increases could restrain consumption longer than we are expecting. On the other hand, risks associated with Europe have diminished somewhat.

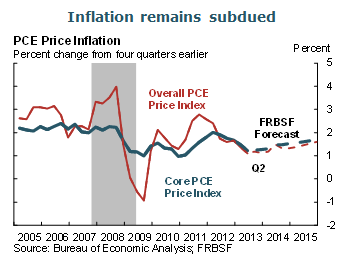

- The comprehensive data revision did not significantly change historical inflation rates. Core personal consumption expenditures (PCE) price inflation in June came in slightly above expectations, while headline PCE inflation, which includes food and energy, was boosted by rising oil prices. These data did not affect our inflation forecast beyond the current quarter. We’re still calling for a gradual rise in the inflation rate to levels consistent with the Fed’s mandate.

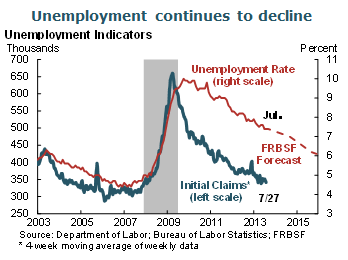

- Turning to the labor market, the July employment report was mixed. Payroll employment went up by 162,000, which is not bad. But it was noticeably below the 197,000 average over the previous six months. While the unemployment rate fell from 7.6% in June to 7.4% in July, part of this reflected a decline in the labor force participation rate. Even so, recent data on initial unemployment claims look quite good and are consistent with our forecast of gradual improvement in the labor market.

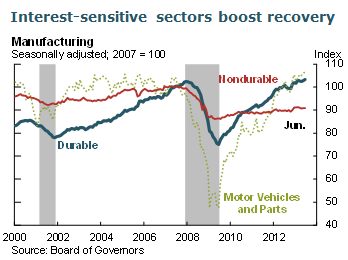

- Both home and auto sales have benefited from low interest rates. Looking at key components of manufacturing provides another take on the same issue. Both durable and nondurable goods production fell noticeably during the recession. Durables fell much more sharply, but have recovered more strongly as well. Motor vehicles and parts follow the general path of durable goods but with more exaggerated changes. Following a decline of more than 50%, the sector rebounded to levels higher than those that prevailed before the past recession.

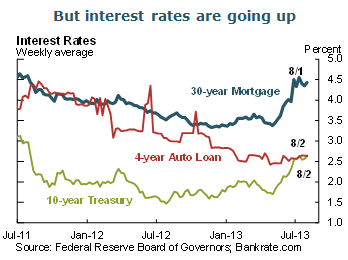

- Interest rates have risen in recent months. The conventional mortgage rate is up roughly one percentage point from its lows, and other long-term rates have risen significantly as well. However, rates on auto loans have not gone up very much. Some of the increase in long-term rates reflects an improving economy, but other factors have also played a role. One risk is that rising rates might slow the economy more than we expect.

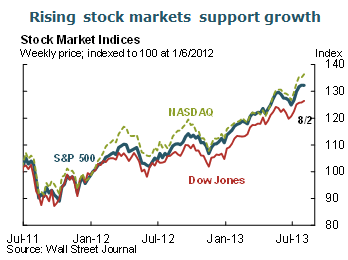

- Of course, interest rates are not the only things that have gone up. Major stock indexes are up between 18 and 20% since the beginning of the year. And home prices continue to rise. Over the first six months of the year, home prices have climbed faster than at any point since the recession began. Rising asset prices should help boost consumption and output growth.

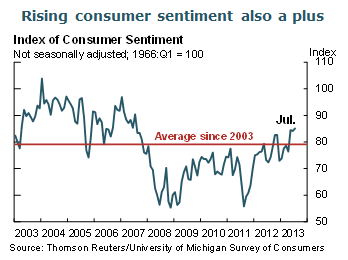

- Developments outside the financial markets should reinforce this momentum. The Thomson Reuters/University of Michigan Consumer Sentiment Index shows consumers continue to be more optimistic about the economy. Other major consumer surveys show the same thing. And the recent improvement is not confined to consumer surveys. In the manufacturing sector, the Institute for Supply Management (ISM) index rose higher than expected in July, with increases in both orders and production. The ISM survey of nonmanufacturing firms showed similar results.

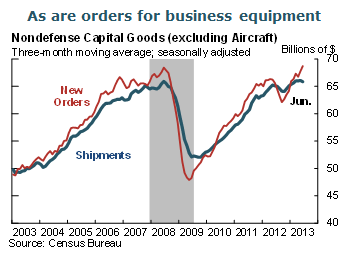

- Recent data on orders for nondefense capital goods excluding aircraft point in the same direction. While shipments have leveled off, orders have resumed their upward climb. This suggests healthy growth in business investment in coming months.

- To conclude, recent data from both inside and outside financial markets are consistent with our forecast that the pace of growth will pick up in the second half.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.