Rob Valletta, research advisor at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

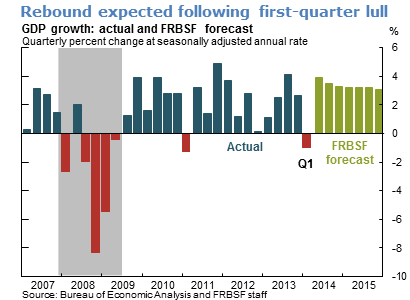

- Real gross domestic product (GDP) fell in the first quarter of 2014. However, the decline mainly reflected transitory factors, especially a sharp slowdown in the pace of inventory accumulation by businesses and a decline in U.S. exports. With these factors excluded, real final sales to domestic purchasers rose 1.6%, suggesting modest growth in underlying demand. Harsh winter weather in much of the country likely held demand down to some degree. Given these considerations, we expect solid growth for the remainder of this year through the end of next year, averaging just under a 3% pace for the two years combined.

- Data over the past few months show that the expected rebound is under way. Overall retail sales bounced back after February, and automobile sales in May came close to their pre-recession peak rate of 17 million on an annual basis. Moreover, employment gains from February through May generally made up for the early winter lull. The six-month average of monthly payroll job growth is back near the solid pace of approximately 200,000 per month that has largely prevailed since early 2013.

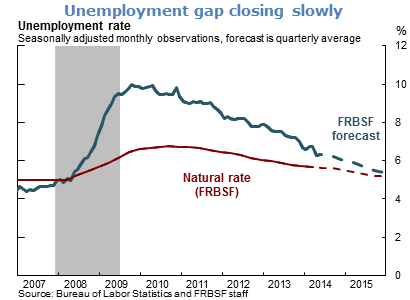

- Sustained employment gains have helped to lower the unemployment rate. It has fallen about 1¼ percentage points over the past 12 months and held steady at 6.3% in May. Nonetheless, it remains well above our estimate of the natural rate of unemployment, which is the lowest sustainable level in a healthy labor market.

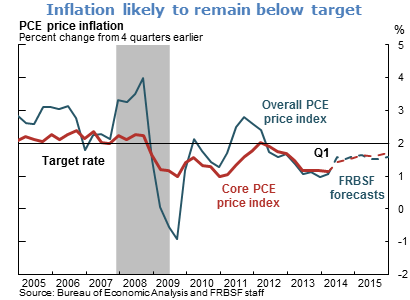

- Unemployment above the natural rate is an indicator of the overall economic slack that has been a key factor holding inflation at low levels. Our primary measure of inflation has been running below the Federal Open Market Committee’s stated target of 2% for two full years. The San Francisco Fed’s forecast projects that it will return to that target gradually over the next few years.

- The combination of elevated unemployment and persistent low inflation underlies the current very accommodative stance of monetary policy. At the same time, a recovering economy has prompted a steady reduction this year in the pace of monthly asset purchases by the Federal Reserve.

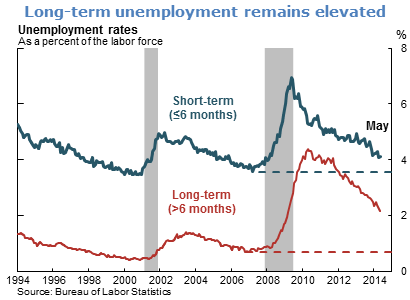

- The long-term unemployment rate—that is, the percentage of the labor force that has been unemployed continuously for more than six months—has fallen slowly and remains quite elevated. In contrast, the short-term unemployment rate, defined as those unemployed six months or less, has dropped nearly to its pre-recession low.

- The unique role played by long-term unemployment in the ongoing labor market recovery raises an inflation risk. In particular, recent research has emphasized the possibility that the long-term unemployed put little or no downward pressure on wage and price inflation. This in turn implies less labor market slack than is suggested by the overall unemployment rate. If this characterization is correct, inflation may reach the 2% target a bit faster than we currently forecast.

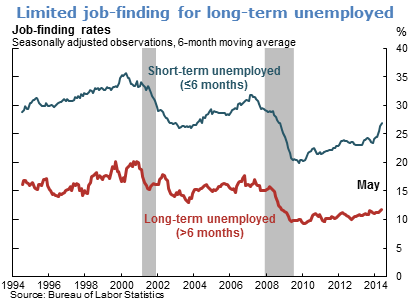

- Concerns about the limited impact of the long-term unemployed on wage and price inflation partly revolve around their unfavorable employment prospects. Job-finding rates fell significantly for both the long-term and short-term unemployed during the most recent recession. The subsequent improvement in job-finding rates has been more evident for the short-term unemployed.

- It is difficult to know whether the depressed job-finding rates of the long-term unemployed reflect a persistent structural problem or simply a slow recovery from the severe recession. Recent research suggests that employers place more emphasis on the short-term than the long-term unemployed in their recruiting, but the long-term unemployed may become more attractive candidates as the overall unemployment rate continues to fall.

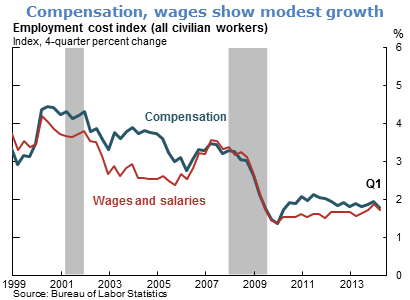

- One way to assess whether the long-term unemployed are contributing to labor market imbalances is to examine wage and compensation growth. In particular, if there is limited labor market slack, wage growth should pick up. Comprehensive measures of compensation and wage growth provide no evidence of such labor market tightness. Instead, they show that compensation and wage growth has been stable around a modest 2% pace.

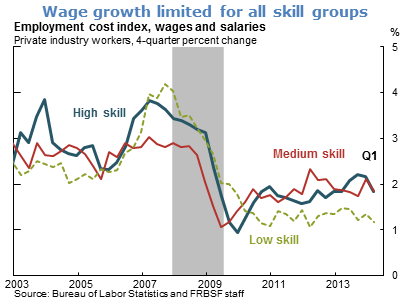

- Available data and anecdotal evidence indicate that selected worker groups with advanced, specialized technical skills have been seeing relatively rapid wage gains. However, for skilled workers overall, there is little evidence of a pickup in wage inflation. More generally, wage inflation has been especially limited for low-skilled workers.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.