Mark Spiegel, vice president at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

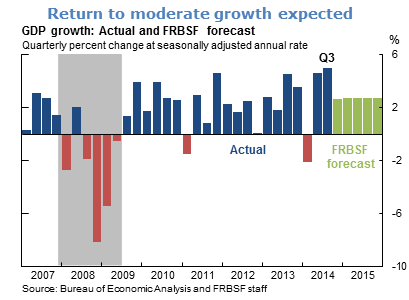

- Real GDP growth was revised upwards to 5.0% for the third quarter of 2014, 1.1 percentage points above the previous estimate. The U.S. economy showed strong growth across the board, including healthy increases in real personal consumption, business fixed investment, and net exports. Consumer sentiment also neared post-recession highs according to the Thomson Reuters/University of Michigan index and Conference Board surveys.

- Despite this strength, we expect the pending GDP data to show moderate growth for the fourth quarter of 2014 and continuing into 2015. There should be some payback from inventory buildups that occurred during the exceptional growth experienced in the second and third quarters of last year. We have already seen some signs of moderation, including modest declines in durable goods and orders for core capital equipment in November.

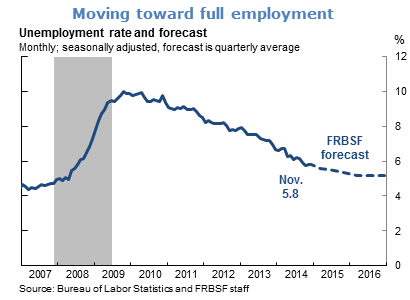

- Job growth has accelerated in recent months. This has brought unemployment closer to our estimate of full employment levels, although the labor force still exhibits considerable slack. We expect this slack to continue to diminish over the coming year.

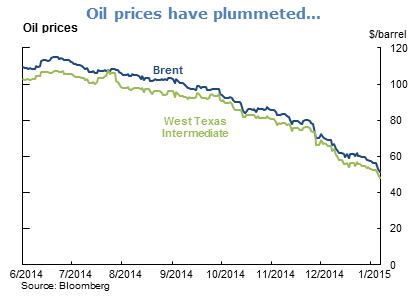

- Oil prices have plunged dramatically over the past six months, with West Texas Intermediate crude prices falling by more than half to less than $50 a barrel. Declines in Brent crude prices were similar. Other energy prices have also declined sharply, although not as much as oil. For example, natural gas prices have fallen by nearly a third over the same period.

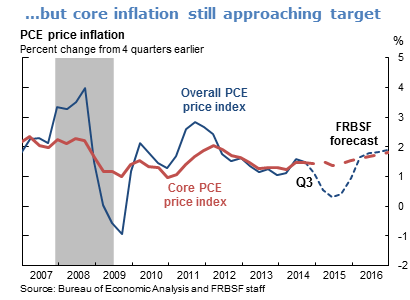

- These falling energy prices, as well as reduced import costs due to recent strengthening of the U.S. dollar, have contributed to keeping inflation low. Based on the headline PCE inflation measure, overall prices fell 2% at an annual rate in November. The core inflation measure, which excludes the volatile food and energy prices, indicates that prices were essentially flat. We expect future headline inflation to dip as recent energy price declines work their way through the rest of the economy, although they should have only a modest impact on core inflation. We continue to anticipate that core inflation will move upwards over time towards the Federal Open Market Committee’s 2% target.

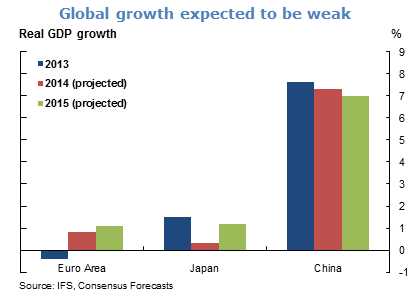

- Expectations of weak growth abroad are a primary source of weakness in our current outlook for the United States. We anticipate limited growth in the advanced economies, particularly the euro area and Japan. There is considerable uncertainty about the euro area, particularly with respect to future European Central Bank asset purchases. Japanese growth appears to have stalled in 2014 following the country’s consumption tax hike. Among emerging market economies, China’s ongoing slowdown is also a source of considerable concern.

- Expectations for global growth are so low, however, that a positive surprise may emerge. First, policy responses to economic difficulties abroad are likely to be accommodative. Second, the aforementioned energy price declines and the strength of the dollar are both likely to boost growth in the euro area and Japan in 2015.

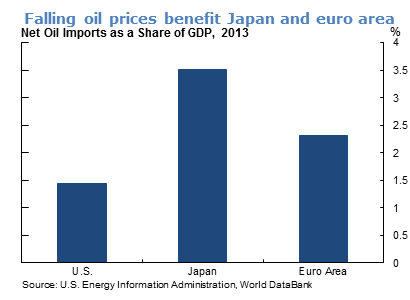

- Because the United States produces a substantial and growing amount of oil domestically, it is less dependent on imported oil than Japan or the euro area. This is especially true for Japan since its cessation of nuclear energy production after the 2011 Fukushima disaster. This discrepancy implies that the recent decline in oil prices should have an even stronger positive impact on the Japanese and euro-area economies than it is expected to have on the United States.

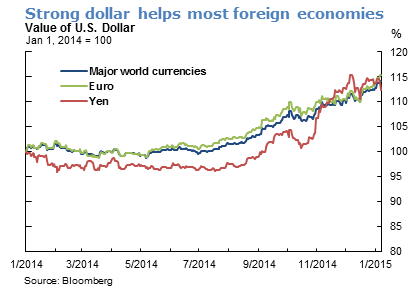

- The dollar has appreciated quite dramatically over the past six months relative to the world’s other major currencies, in particular the euro and the yen. Over that period, the dollar increased 11.3% against the euro and 17.8% against the yen. The strength of the dollar should make Japanese and euro-area exports, as well as domestic industries that compete against U.S. exports in those countries, more competitive and help stimulate growth.

- Positive news about growth prospects in the euro area and Japan is likely to be welcome because of their importance as trading partners for the United States. However, the conditions expected to be beneficial abroad may each affect the U.S. economy quite differently. In the case of energy price declines, the United States is still a net oil importer, even if it is not as dependent as the euro area and Japan. Thus, it is also likely to benefit from lower energy prices. In the case of the strong dollar, however, the enhanced competitiveness of goods from the euro area and Japan must come at the expense of goods produced elsewhere, including the United States. The adverse impact of the stronger dollar on U.S. exports is likely to more than offset the positive effects from stronger growth in the euro area and Japan.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.