Rhys Bidder, economist at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of November 12, 2015.

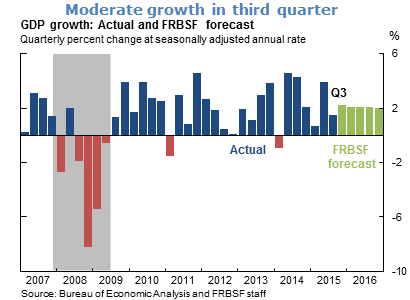

- The U.S. economy grew at an annual rate of 1.5% in the third quarter of 2015, easing back from a surge in the second quarter. Part of this pullback reflects a correction in the unsustainable pace of inventory investment earlier in the year as well as the ongoing effects of dollar appreciation and external weakness on net exports. Nevertheless, the underlying strength of the domestic economy seems to be intact, with consumer expenditures continuing to post solid growth rates.

- We forecast growth to pick back up going into 2016, to a trend rate of around 2%, underpinned by a continuation of recent strong consumer spending and boosted by an improved labor market, the ongoing recovery in housing, and recent gains in equity prices. In addition, the recent fiscal budget agreement in Washington has removed a degree of uncertainty. Possible downside risks remain, however, such as further appreciation of the dollar or deterioration of the international outlook.

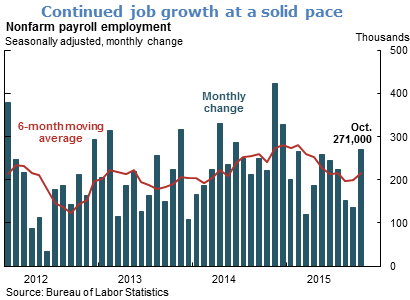

- The most recent employment report for October suggests that labor slack continues to be eliminated, with the economy approaching full employment. The strong headline number for the report—a 271,000 increase in jobs—was above expectations and reassuring after somewhat lower numbers in previous months, leaving the 6-month moving average at 214,833 jobs per month.

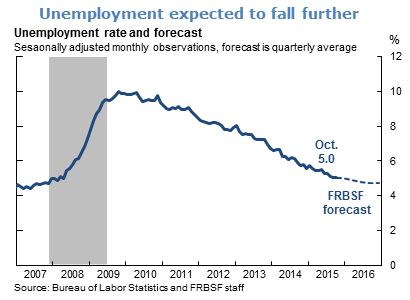

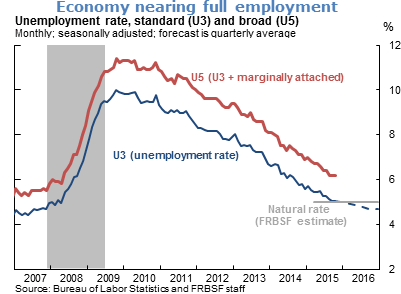

- Associated with the payroll gains, the unemployment rate declined to 5.0% in October. The labor force participation rate remained unchanged and the employment-to-population ratio remains low. Nevertheless, there were further improvements in broader indicators of slack, such as measures of unemployment that take into account the inability of some workers to find full-time jobs, requiring them instead to work part time.

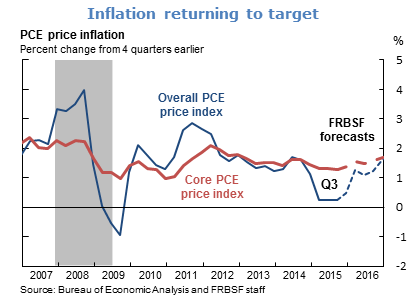

- Inflation, as measured by the change in the personal consumption expenditures (PCE) price index, was 0.16% in the twelve months ending in September, reflecting the substantial declines in energy prices recently.

- Excluding volatile energy and food prices, core PCE rose 1.3% over the year. Both overall and core inflation have been consistently below the Federal Open Market Committee’s 2% target over the past several years. Nevertheless, since inflation expectations apparently remain well anchored, we expect a gradual rise in inflation towards the 2% target as the transitory effects of energy price declines and dollar appreciation subside.

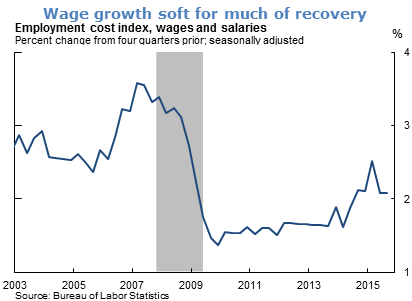

- Wage growth during the recovery has been disappointing. After declining dramatically during the Great Recession, the employment cost index (ECI) for wages and salaries has since averaged annual growth of approximately 1.7%, compared with average growth of 2.9% for 2003–2007. This slow wage growth reflects both disappointing productivity performance as well as substantial slack in the labor market during the recovery.

- Although there were some hints of wage pressures building in the first half of this year, the ECI numbers for the past couple of months came in softer than expected. Other wage indicators also do not indicate a dramatic pickup in wage growth.

- The lack of clear acceleration in wage growth suggests that some slack remains, as the labor market is not yet so tight that businesses need to increase compensation significantly to attract and retain qualified workers. Thus, even though unemployment has declined to a level that is near its long-run natural rate of around 5%, we expect it to continue its decline further in the coming quarters before eventually rising back up to the natural rate.

- This anticipated undershooting of the long-run natural rate reflects the fact that the rates of marginally attached and, in particular, involuntary part-time workers are still somewhat elevated. Thus, the standard unemployment rate slightly underestimates the amount of slack in the current labor market because it does not capture these factors.

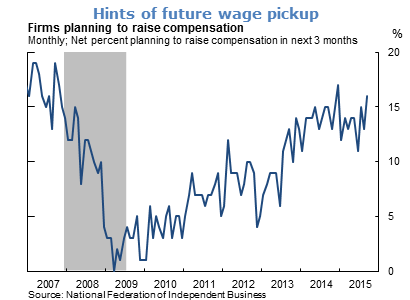

- Nevertheless, the amount of remaining slack seems limited. Consequently, we expect wage growth to pick up in the near future. Indeed, some surveys of firms’ plans for future compensation suggest that such an acceleration may be imminent.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.