Kevin J. Lansing, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of September 10, 2015.

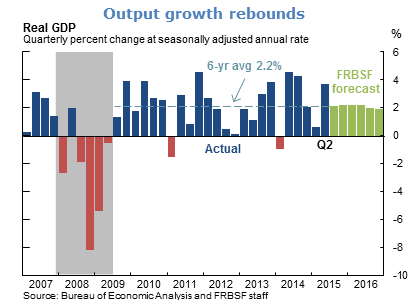

- Real GDP growth in the second quarter of 2015 was revised up to 3.7% at an annual rate, a substantial pickup from first-quarter growth of 0.6%. Personal consumption expenditures, residential investment, and state and local government spending all posted solid gains during the second quarter. In the six years since the Great Recession ended, real GDP growth has averaged 2.2% at an annual rate.

- We expect the U.S. economy to grow slightly above its 2% long-term trend for the next four quarters, and then return to trend by the end of 2016. Downside risks to the growth outlook include possible spillovers from economic slowdowns in China and other foreign markets and a continued strengthening of the U.S. dollar, which would pose a headwind for net exports.

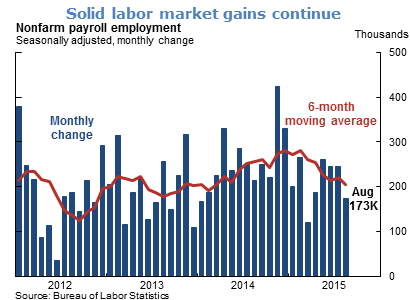

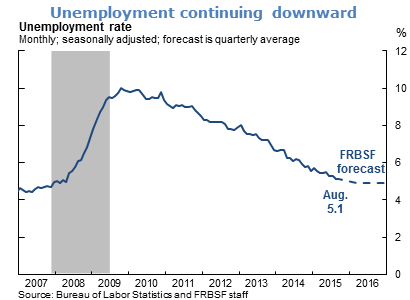

- Payroll employment increased by 173,000 in August, resulting in a year-to-date gain of 1.7 million new jobs. Since bottoming out in February 2010, payroll employment has increased by 12.6 million. The continued strong job growth pushed down the unemployment rate to 5.1% in August, which is close to the level that we judge to be the natural rate of unemployment. It should be noted, however, that other measures of labor market slack, such as the employment-to-population ratio, have yet to fully recover.

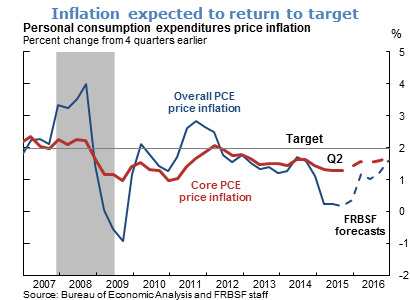

- Inflation, as measured by the four-quarter change in the personal consumption expenditures (PCE) price index, has remained below the Federal Open Market Committee’s 2% target since mid-2012. Absent further declines in energy prices or a further strengthening of the U.S. dollar, we would expect PCE inflation to rise gradually towards 2% as economic slack continues to dissipate.

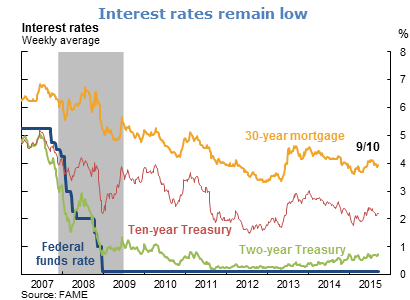

- Long-term nominal interest rates have declined recently after rising during the first half of 2015. Recent movements reflect a “flight-to-safety” in response to investor concerns about economic slowdowns in foreign economies and the prospect that such events could have negative spillovers for U.S. economic growth. At the short end of the yield curve, the two-year Treasury rate continues to trend upward as investors anticipate that the liftoff date of the federal funds rate from zero is drawing closer.

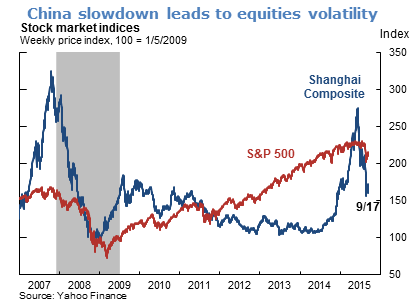

- Stock market gains have been an important feature of the U.S. economic expansion. Since bottoming out in early 2009, the Standard & Poor’s (S&P) 500 stock market index has trended upward for more than six years with occasional brief corrections. The most recent correction took the form of an approximate 10% drop in the index, reflecting investor concerns about China and foreign markets. Stock prices in China, as measured by the Shanghai Composite Index, underwent an enormous boom during the first half of 2015, but have since retraced most of the prior gains. This pattern is reminiscent of the boom-bust episode that occurred in the Shanghai index during 2007 and 2008. Nevertheless, the Shanghai index remains above the level that prevailed at the beginning of 2015.

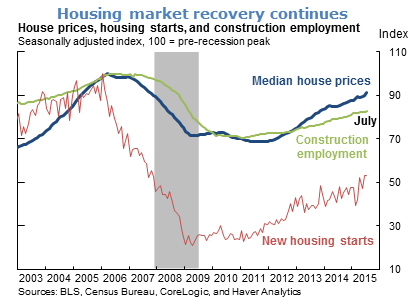

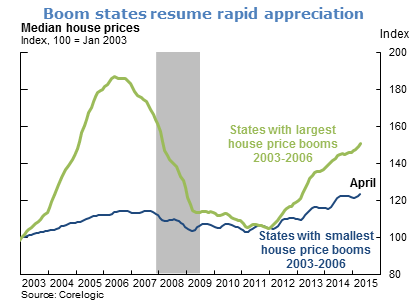

- The median U.S. house price has nearly recovered to its pre-recession peak. In some parts of the country, house prices have reached all-time highs. Movements in construction employment have tended to track movements in the median house price with a lag. Consequently, continued increases in house prices should contribute to more homebuilding activity and construction jobs. However, new housing starts are still about 50% below their prior peak, suggesting that homebuilders are exercising caution in light of the substantial overbuilding that occurred during the bubble years of the mid-2000s.

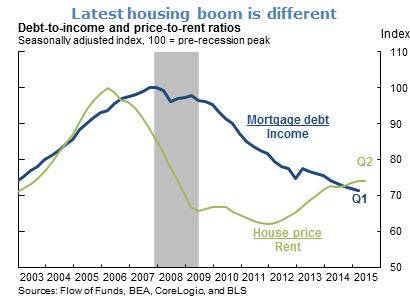

- When viewing any substantial run-up in asset prices, history tells us that the phrase “this time is different” should be met with a healthy degree of skepticism. Still, the increase in U.S. house prices since 2011 differs in significant ways from the housing boom experienced during the mid-2000s. The prior episode can be described as a credit-fueled bubble in which housing valuation (as measured by the house price-to-rent ratio) and household leverage (as measured by the mortgage debt-to-income ratio) rose together in a self-reinforcing feedback loop. In contrast, the more recent episode exhibits a less-pronounced increase in housing valuation together with an outright decline in household leverage—a pattern that is not suggestive of a credit-fueled bubble.

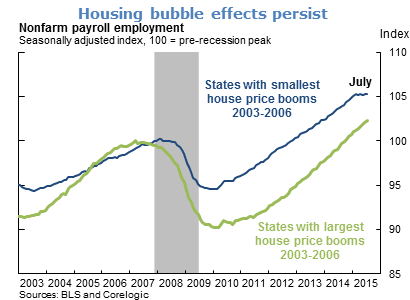

- Advocates of leaning against bubbles point out that bubbles can distort economic decisions, including employee hiring, contributing to imbalances that may take many years to unwind. States with the largest house price booms from 2003 to 2006 experienced faster employment growth during the boom years and more severe employment drops during the bust years in comparison to states with the smallest house price booms. While employment in both groups has rebounded, the additional jobs lost in states with the largest prior housing booms have yet to be fully recovered.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.