John Fernald, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 14, 2016.

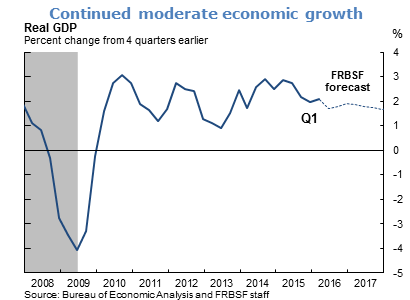

- We expect continued moderate GDP growth in the 1½% to 2% range. In recent months, growth has been supported by healthy consumer spending which, in turn, reflects rising incomes, elevated household net worth, and low gas prices. The strong consumer spending has offset sluggish investment spending by businesses.

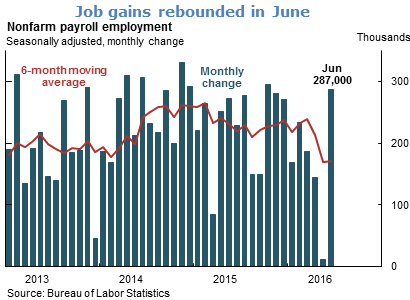

- The June employment report showed a sharp rebound in job gains following anemic gains in May. The May figure was held down by transitory factors, including a major strike, and the June rebound was consistent with continuing momentum for the U.S. economy. Looking past the month-to-month volatility, the six-month moving average shows a gradual slowdown in employment gains as the economy approaches full employment.

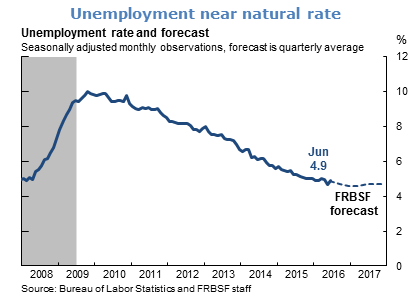

- June’s unemployment rate was close to our estimate of the natural rate of unemployment of 5%. We anticipate that modestly above-trend GDP growth will push the unemployment rate down a bit further over the next year.

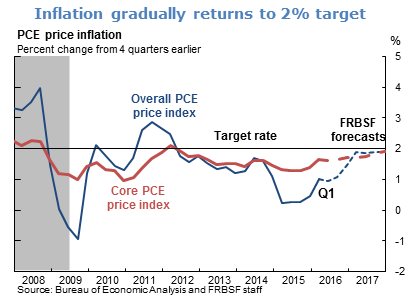

- Inflation has been running below the Federal Reserve’s 2% target. We expect that inflation will gradually rise towards 2% in response to further improvement in the labor market as well as the fading effects of the appreciation of the dollar and declines in oil prices.

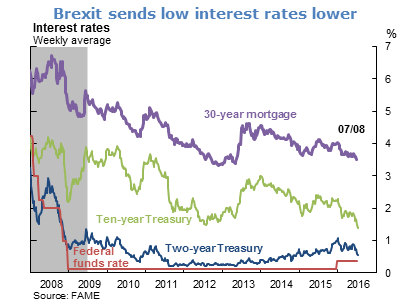

- Following the United Kingdom’s “Brexit” vote to leave the European Union, already low interest rates have moved even lower. In the United States, 10-year Treasury rates reached all-time lows in early July. The decline in rates reflects several factors including views that U.S. monetary policy likely will be more accommodative than previously expected as well as increasing flows into the relative safety of U.S. Treasuries.

- Since the recovery began seven years ago, GDP growth has averaged only about 2% per year. Going forward, the “new normal” for growth may be even lower. Assessments of normal growth reflect assessments of productivity (most broadly, GDP per hour worked) and the labor force (which determines potential hours worked). Expected growth for both are likely to be modest.

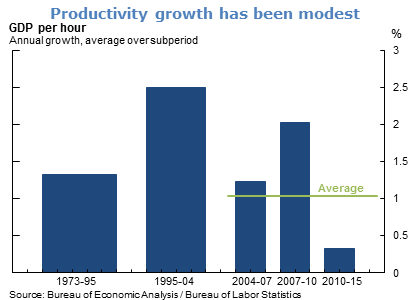

- GDP per hour has grown at varying rates over time. From 1973 to 1995, GDP per hour grew at an average pace of 1¼% per year. From 1995 to 2004, productivity accelerated to a 2½% pace, reflecting the broad-based and transformative role of information technology (IT), including the Internet. During this period IT-producing firms rapidly improved their equipment and software, and the use of IT transformed the operations of firms and industries throughout the economy. After 2004, however, this exceptional pace disappeared. GDP per hour grew at only a 1% pace from 2004-2015, with an even lower pace since 2010.

- The slowdown in productivity growth after 2004 does not simply reflect the effects of the Great Recession, since productivity growth slowed prior to 2007. Nor does the slowdown appear to reflect a rising problem in the mismeasurement of growth. Mismeasurement is not new; it has always been a challenge to capture the effects of new goods and the improving quality of existing goods. Recent research, however, finds little evidence that measurement problems have gotten worse. Rather, the post-2004 slowdown appears to reflect a “return to normal” after an exceptional period of IT-related innovation and reorganization. Overall, the effects of IT on businesses have been more incremental over this period, rather than transformative.

- Going forward, the most likely case is that GDP per hour will grow in the 1% to 1¼% range, similar to the range over the past forty years (with the exception of the 1995-2004 period). Of course, even attaining 1% productivity growth would require a pickup from its subdued pace over the past five years. Though productivity might surprise and accelerate beyond that pace, history suggests that such accelerations do not occur frequently.

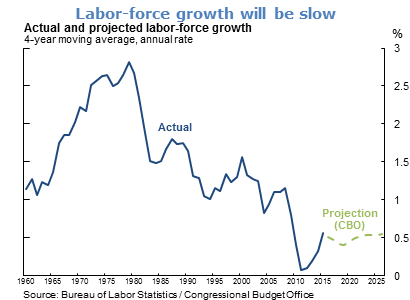

- Reflecting demographic factors, the labor force will grow slowly relative to its historical pace. In the 1970s and 1980s, the labor force grew quickly as baby boomers hit working age and female labor-force participation rose. However, baby boomers are now retiring and labor force growth is slowing. Going forward, the Congressional Budget Office projects that the U.S. labor force will grow at about a 0.5% pace.

- GDP-per-hour growth of 1% to 1¼%, combined with labor-force growth of around 0.5%, implies that the “new normal” for GDP growth is plausibly 1½% to 1¾%. By historical standards, such a pace would be unusually low.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.