Daniel Wilson, research adviser at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of March 10, 2016.

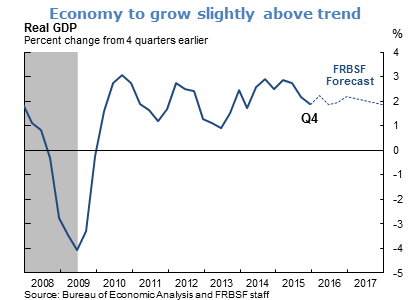

- Despite volatile financial conditions since the start of the year, incoming economic data in recent weeks have been fairly positive and point to healthy economic growth. While real GDP growth in 2015 was around 2%, we expect real GDP to grow slightly faster this year and slow slightly to just below 2% next year.

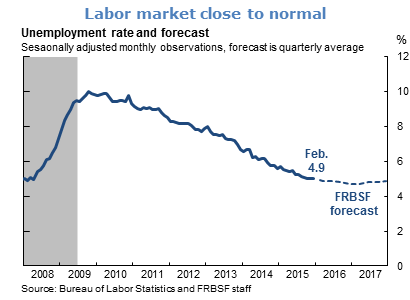

- Similarly, in the labor market, we expect the unemployment rate to fall a bit further this year before gradually rising back toward our estimate of the natural rate of unemployment, around 5%.

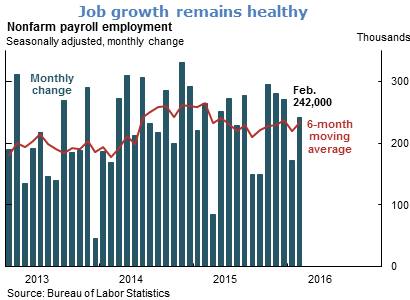

- Our expectation that the unemployment rate will continue its decline a bit longer also is bolstered by the solid gains we have been seeing in nonfarm payroll employment. February saw net gains of 242,000 jobs, which is just slightly above the six-month moving average.

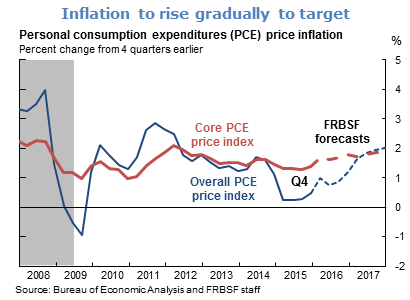

- On the inflation front, recent data point to some firming, consistent with our outlook that inflation will gradually rise toward the Federal Open Market Committee’s stated objective of 2% over the next two years. This outlook assumes that the negative pressures stemming from the earlier declines in energy prices and the appreciation of the dollar will gradually dissipate.

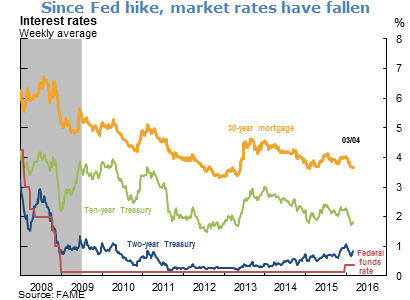

- Despite the generally positive recent data on economic conditions and inflation, market interest rates such as yields on 2-year and 10-year Treasuries and 30-year mortgages are down from the start of the year. These declines are likely to reflect a couple of factors. First, demand for U.S. assets has increased due to a weakening of economic conditions abroad and lower yields on foreign sovereign bonds. Second, financial market participants in the United States appear to have become more pessimistic about economic conditions and inflation or more concerned about downside risks.

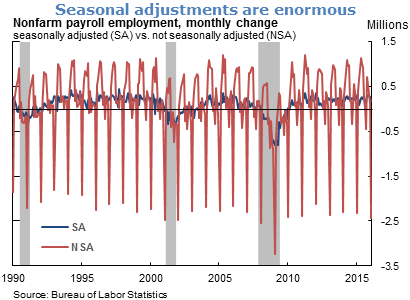

- Many economic variables, such as monthly employment growth, exhibit large fluctuations due to seasonal factors. A comparison of seasonally adjusted (SA) and not seasonally adjusted (NSA) data on the monthly change in nonfarm employment shows that the magnitude of seasonal adjustment can be enormous. For instance, a typical January sees a net decline of over 2 million jobs. By comparison, the worst month of job losses in the Great Recession, March 2009, saw a net decline of just a little over 800,000 jobs, according to the seasonally adjusted data. The large magnitude and variability of these seasonal fluctuations poses a daunting challenge for government statistical agencies seeking to adjust such data for seasonality.

- While factors like holidays and school-year schedules explain much of the seasonal fluctuations in employment growth, typical weather patterns also play an important role. Similarly, atypical weather fluctuations from month to month can have a large impact on employment growth, even after adjusting for seasonality.

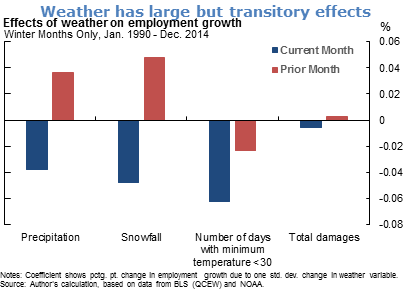

- By combining comprehensive local weather data from the National Oceanic and Atmospheric Administration with local employment data from the Bureau of Labor Statistics, one can estimate exactly how different types of weather affect employment growth. Specifically, one can measure how much monthly employment growth at the county level varies with weather in that county in the current and prior months. The analysis reveals that, in general, weather tends to have large but transitory effects. For example, winter rainfall, snow, and reported storm damages depress employment growth on impact, but the effects reverse in the following month. A higher frequency of especially cold days, on the other hand, depresses employment growth in both the current and subsequent month.

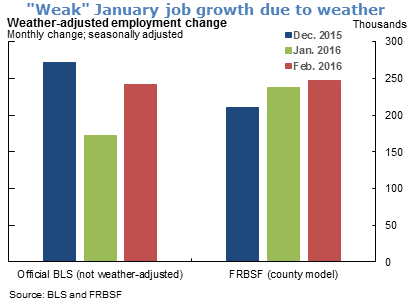

- This estimated county-level model can be used to predict how much employment growth in each county in any given month was boosted or damped by atypical weather, such as colder temperatures or more snow than normal. Aggregating these weather adjustments across counties gives an estimate of how much national employment growth was boosted or damped by atypical weather across the country.

- Applying this methodology to the current winter pattern indicates that the strong employment growth in December 2015 was boosted by weather, while the relatively weaker employment growth in January 2016 was damped by weather.

- This empirical model of local employment growth as a function of weather can be refined in several ways. For instance, one way is to allow the effects of certain weather variables to be different for counties in different regions of the country. The key point, however, is that by exploiting the rich granular data available on local weather, such models hold much promise for helping policymakers better discern how much the movements in incoming economic data are due to changes in the true underlying strength of the economy rather than to fluctuations in the weather.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.