Rhys Bidder, economist at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of November 10, 2016.

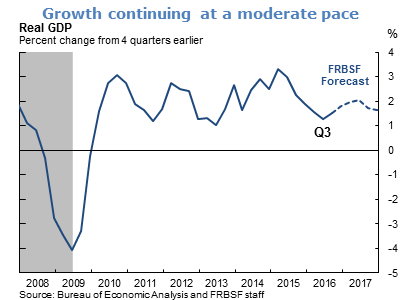

- Real GDP grew at an annualized rate of 2.9% in the third quarter, a significant improvement over the average growth of 1.1 % during the first half of the year. Even though consumption growth has eased from its earlier rapid pace, strong net exports and a turnaround in inventory accumulation have boosted real GDP growth.

- As some of the recent strength in net exports is likely to be transitory and investment and manufacturing performance continues to be sluggish, we expect real GDP growth to soften somewhat in the fourth quarter. However, annualized growth in the second half of the year should exceed 2% based on solid consumption growth in the near-to-medium term underpinned by strong fundamentals, such as continued strength in the labor market. Going into 2017 and beyond, we expect the pace of growth to slow somewhat to its long-run trend of a little over 1 ½%.

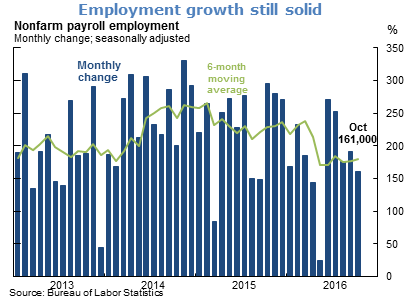

- The October labor market report indicated a still solid labor market with nonfarm payroll employment increasing by 161,000 jobs in October, while previous months’ data were revised upwards. Monthly payroll gains have averaged 179,000 per month over the past six months.

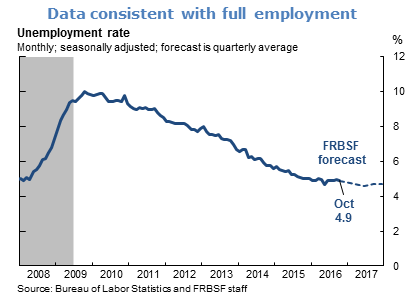

- The unemployment rate declined slightly, from 5.0% to 4.9% in October, and remains close to our estimate of the natural rate of unemployment, currently 5.0%. This decline was accompanied by falls in broader measures of labor market slack that include marginally attached workers and those who work part-time but would prefer to have full-time jobs. With the economy growing somewhat above trend and employment growth remaining healthy, we expect the unemployment rate to decline modestly in the near-term, before returning to its natural level.

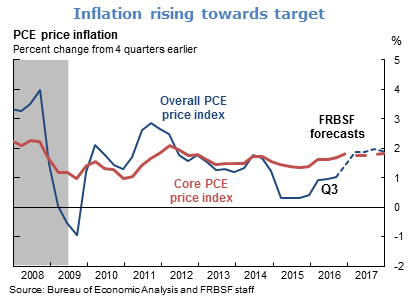

- Inflation remains below the Fed’s 2% target, although it has picked up somewhat. Headline inflation, captured by the 12-month percent change in the personal consumption expenditures (PCE) price index was 1.2% in September which is the highest reading reported since late 2014, partly reflecting a rebound in energy prices. Core inflation, which removes the direct influence of the volatile energy and food price components of inflation, remained at 1.7% in September, the same rate reported for August. As the labor market tightens further and the lingering effects of past dollar appreciation and oil price declines subside, we expect both core and headline inflation to rise gradually towards 2%.

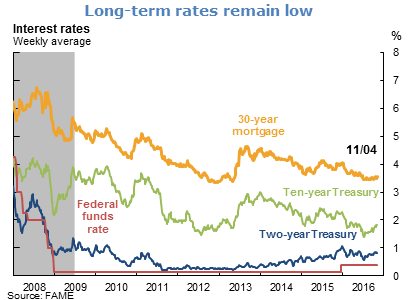

- Treasury yields and other long-term rates have remained low since the Fed raised its funds rate target range at the end of 2015. These low rates appear to reflect market expectations that the pace of any further policy tightening will be gradual and that the natural rate of interest is lower as a result of lower trend GDP growth, which in turn partly reflects lower expectations for productivity growth and slower trend growth in the labor force.

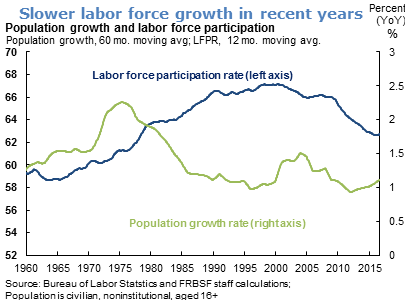

- Labor force growth depends on growth in the working age population as well as the labor market participation rate, which measures the fraction of the working aged who are working or seeking work. The growth rate in the population has slowed over the post-war period and in recent decades the labor force participation rate has declined substantially.

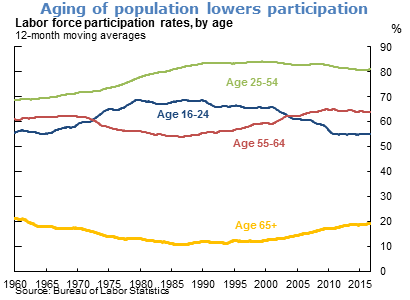

- The recent decline in the labor force participation rate partly reflects cyclical factors associated with the recent recession. However, the principal driver of its trend decline is the effect of an aging population. Since participation is relatively high among the young and prime-aged and substantially lower among older groups, the overall participation rate declines as the older groups represent a larger share of the population. This process will continue in coming years as more baby boomers reach retirement age.

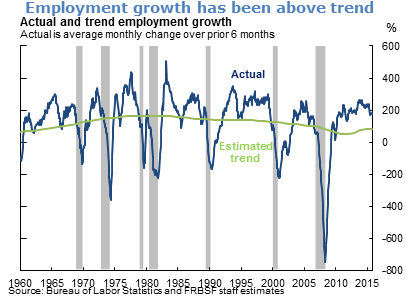

- The growth of the labor force determines how many jobs need to be created to maintain full employment. Intuitively, the more people there are who want to work, the more jobs are needed to absorb them into the ranks of the employed. Calculations of trend labor force growth allow an estimate of the pace of employment growth consistent with a healthy labor market at full employment. In the 1990s, this number appears to have been of the order of 150,000 job gains per month. However, due to the aforementioned demographic changes, the “new normal” or “trend” employment growth is now estimated to be approximately 80,000. Alternative assumptions about future participation rates imply estimates varying between 50,000 and 100,000 jobs per month.

- These estimates suggest that even if employment growth declines substantially from its current pace of 161,000 jobs to less than 100,000 per month, such a decline is still consistent with a healthy labor market where unemployment is close to its natural rate.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.