You are right, I have written on the topic of transparency before, although it has been a while—the last time I touched on this issue was in June and September of 2006.

The financial crisis of 2007 and the global recession that followed have brought the issue of central bank transparency front and center. Indeed, heightened economic uncertainty and the complexity of the Fed’s unconventional monetary policy actions (such as special lending facilities used during the crisis, and large-scale asset purchases and the maturity extension program that were implemented more recently) have made communication and transparency even more critical—and more challenging.

The Fed’s Journey toward Transparency: A Brief Background

Since 1978, under what is commonly known as the Humphrey-Hawkins Act, the Fed has sent written reports twice a year to Congress and the Fed Chairman has also testified before Congress on economic conditions and monetary policy twice a year. However, the Fed took its first “recent” step towards transparency in February 1994, when the Federal Open Market Committee (FOMC) began issuing statements describing monetary policy decisions following an FOMC meeting. At first the FOMC only communicated changes in the stance of monetary policy to the public. Not until 2000 did the Committee begin issuing a statement following each regularly scheduled meeting, regardless of whether the stance of monetary policy had changed. Here are other notable steps the Board of Governors and the FOMC have taken towards greater transparency:

- Early 1994: Announced a target for the federal funds interest rate.

- Late 1994: Added descriptions of the state of the economy and the rationale for the policy actions to the FOMC statement.

- 2000: Added “balance of risks” for the outlook to the FOMC statement.

- 2002: Reported votes of individual members in the FOMC statement.

- 2003: Added forward-looking guidance on policy to the FOMC statement.

- 2005: Shortened the schedule to release FOMC minutes three weeks after each meeting.

- November 2007: Added numerical forecasts to the FOMC minutes four times per year, with a three-year horizon.

- February 23, 2009: Board of Governors launched a new website to provide information on the Fed’s policy actions during the financial crisis.

- April 27, 2011: Added Chairman’s press conference to the release of projections.

- January 25, 2012:

- Provided a statement of longer-run goals and monetary policy strategyincluding a 2% inflation target.

- Fed policymakers began reporting their short-term interest rate projections over the next few years.

Since I discussed the evolution of the FOMC statement in my September 2006 response, I will focus on the most recent developments.

Expanded economic projections

In November 2007, the FOMC announced it would release more frequent, expanded economic projections to the public. Instead of reporting to Congress only twice a year, as it had since 1979 in its Monetary Policy Report, the FOMC began posting projections four times a year with a three-year instead of two-year forecast horizon. In addition, the projections included not only the meeting participants’ views on the most likely outcome but also discussed the risks to the economic outlook and the dispersion of views among policymakers.

Websites on crisis response

To improve public understanding of the Fed’s actions in response to the crisis, the Board of Governors launched a new section of its website, called “Credit and Liquidity Programs and the Balance Sheet.” The section describes policy tools the Fed employed to address the financial crisis that first emerged in the summer of 2007. Regional Federal Reserve Banks also have included information about the Fed’s actions on their websites. For instance, the Federal Reserve Bank of San Francisco created a site entitled, “The Economy: Crisis and Response”.

More media access

Chairman Bernanke gave the first formal press conference by a Fed Chairman following the release of the April 2011 FOMC projections. One reporter noted the historical significance of speaking to the press and answering questions after an FOMC meeting, saying that this was the rare news conference that actually made news before it happened. Videos of press conferences and transcripts can be found on the Board of Governors’ website.

Steps in 2012: Insight into Fed goals and policymaker views

The Fed took two significant steps further along the path to transparency on January 25, 2012.

The first step was announcing longer-run goals and monetary policy strategy. The FOMC provided its interpretation of the dual mandate Congress assigned to the Fed—maximum sustainable employment and price stability. Importantly, the FOMC’s announcement specified an inflation goal of 2% and an estimated longer-run normal unemployment rate around 5.2% to 6%.

The second step was reporting FOMC meeting participants’ projections of the federal funds rate, which will now be released quarterly along with the projections of GDP growth, unemployment, and inflation. The interest rate projections show the federal funds rate that FOMC participants judge to be consistent with appropriate monetary policy for the next three years given expected economic conditions. Providing the public with interest rate projections along with the other projections should improve the public’s understanding of the future course of monetary policy and what factors might change the policy outlook. Ultimately, greater clarity about the monetary policy outlook should improve the effectiveness of monetary policy.

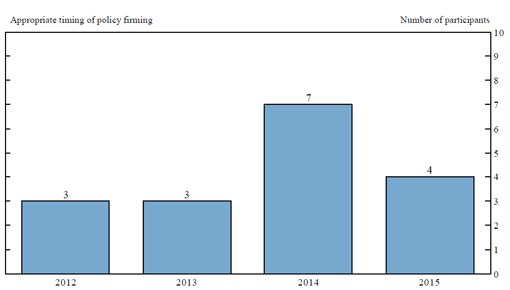

Figure 1 shows the distribution of the seventeen (there were two vacancies at this time) meeting participants’ views from the April 2012 FOMC meeting about the appropriate timing of removing some of the monetary policy accommodation. For example, the figure shows that three participants thought it would be appropriate to have the first increase in the target federal funds rate from its current range of 0 to ¼% occur in 2012. The chart illustrates that “most participants judged that highly accommodative monetary policy was likely to be warranted over coming years to promote a stronger economic recovery in the context of price stability. In particular, with inflation generally projected to be subdued over the projection period and the unemployment rate elevated, 11 participants thought that it would be appropriate for the first increase in the target federal funds rate to occur during 2014 or later” (please see FOMC minutes from the meeting).

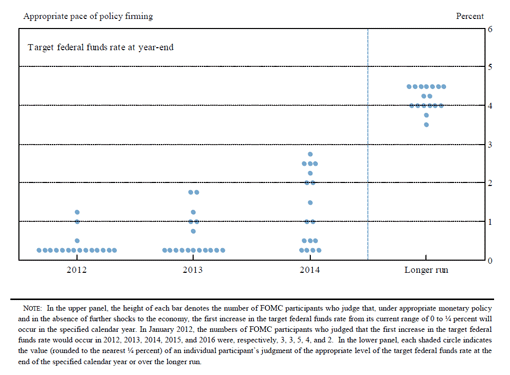

Figure 2 shows the value (rounded to the nearest ¼%) of each meeting participants’ judgment of the appropriate level of the target federal funds rate at the end of the specified calendar year and over the longer run. The additional information provided by this figure is, therefore, the projected pace of increase for the target federal funds rate (that is, the pace of policy firming). For example, while we know from Figure 1 that those three participants advocated increasing the fed funds rate beginning in 2012, Figure 2 shows that their views of the pace of policy firming differed, calling for a range from 0.5% to 1.25% by the end of 2012. You can see that the distribution of the projections widens considerably for later years.

Figure 1. Overview of FOMC participants’ assessment of appropriate monetary policy, April 2012

Source: Minutes from the FOMC April 24-25, 2012, meeting

Figure 2. Individual FOMC participants’ assessment of appropriate

monetary policy, April 2012

Figure 2 presents the same information about individual participants’ judgments from Figure 1. The median value for each year remains far below the longer-run median 4.25%. This is consistent with the language in the FOMC statement from the April 24-25, 2012, meeting that communicates that the federal funds rate is likely to stay low at least through late 2014:

“In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions—including low rates of resource utilization and a subdued outlook for inflation over the medium run—are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.”

It is important to keep in mind that “the 17 funds rate projections are obviously not promises, but represent projections based on information available at the time. In addition, they are forecasts not necessarily of what the funds rate is likely to be, but what each individual FOMC participant believes it should be given current conditions and the Fed’s statutory mandate” (Rudebusch 2012). The minutes of the FOMC meetings give insight into the factors that inform the policymakers’ decision on the appropriate monetary policy actions:

“Several key factors informed participants’ individual expectations about the appropriate setting for monetary policy, including their assessments of the maximum level of employment, the Committee’s longer-run inflation objective, the extent to which current conditions had deviated from these mandate-consistent levels and why the deviations had arisen, and their projections of the likely time periods required to return employment and inflation to levels they judge to be most consistent with the Committee’s mandate. Several participants commented that their assessments took into account the risks and uncertainties associated with their outlooks for economic activity and inflation, and one pointed specifically to the potential effects of a protracted period of very low interest rates on financial stability. Participants also noted that because the appropriate stance of monetary policy depends importantly on the evolution of real activity and inflation over time, their assessments of the appropriate future path of the federal funds rate would change if economic conditions were to evolve in an unexpected manner.”

I encourage you to read the minutes for more information on the monetary policy decision making.

How the FOMC Communicates with the Public

Beyond the formal FOMC meeting statements and minutes, the Fed is focusing more attention on other ways monetary policymakers can communicate with the public. Here is a brief summary of the types of FOMC communications available; most of them are accessible from the Board of Governors’ website.

- FOMC Statement.

- FOMC Minutes.

- Quarterly Summary of Economic Projections.

- Transcripts of FOMC meetings published with a 5-year lag and other historical materials.

- Speeches by the chairman and other FOMC members; speeches by regional Federal Reserve Bank presidents are accessible on each regional Reserve Bank’s website.

- Chairman’s quarterly press conference following the Quarterly Summary of Economic Projections

Note that Chairman Bernanke also delivered a four-part lecture series to George Washington University School of Business about the Federal Reserve and the financial crisis that you can watch on video. In the lectures, he discussed the Federal Reserve in general, as well as the causes of and the Fed’s response to the recent financial crisis. You can also access transcripts and presentation slides for each lecture.

Conclusion

The Fed has taken important steps toward increased transparency. The Fed has come to rely heavily on new unconventional tools and communications/forward guidance. Improving communications is at the top of the Fed’s priorities, as illustrated by San Francisco Fed President John Williams’s essay from the Bank’s 2011 Annual Report, “Opening the Temple.” The Fed’s desire to be more open is genuine and plays an important part in making monetary policy effective in a challenging environment. That, in my view, is a good direction to be moving.

Date of publication: Second Quarter 2012

Additional Resources

Anderson, Richard G. 2012. “The FOMC: Transparency Achieved?” Federal Reserve Bank of St. Louis, Economic Synopses 9.

Bullard, James B. 2012. “Recent Actions Increase the Fed’s Transparency.” Federal Reserve Bank of St. Louis, The Regional Economist (April).

Plosser, Charles. 2012. “Transparent Communication: The Journey Continues.” Speech at the National Economists Club, Washington, DC, April 12, 2012.

Rudebusch, Glenn. 2012. “Recent FOMC Communications Initiatives.” Federal Reserve Bank of San Francisco.

Rudebusch, Glenn. 2008. “Publishing FOMC Economic Forecasts.” FRBSF Economic Letter 2008-01.

Williams, John. 2012. “Opening the Temple.” Federal Reserve Bank of San Francisco 2011 Annual Report.