Download PDF (pdf, 712.36 kb)

The Federal Reserve conducted a follow-up Diary of Consumer Payment Choice in 2016. Read the FedNotes paper on Understanding Consumer Cash Use: Preliminary Findings from the 2016 Diary of Consumer Payment Choice.

Introduction

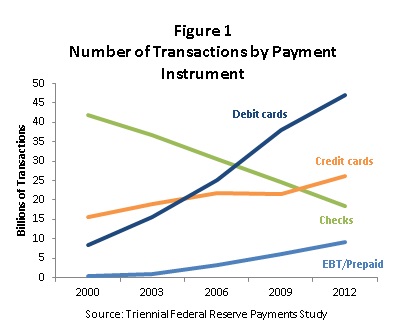

It’s commonplace these days to predict the demise of cash. After all, consumers’ use of the other major physical payment instrument, the check, has plummeted over the last decade in favor of payment cards, especially debit (Figure 1). And with rapid growth in online commerce, it may not be too far-fetched to assume that consumers won’t even be able to use a physical payment instrument in the future. However, evidence from the Diary of Consumer Payment Choice (DCPC), conducted in October 2012 by the Boston, Richmond, and San Francisco Federal Reserve Banks suggests otherwise. Not only is cash a very different payment instrument than checks, but consumers choose to use cash more frequently than any other payment instrument, including debit or credit cards. Cash plays a dominant role for small-value transactions, is the leading payment instrument for many types of purchases, and stands as the key alternative when other options are not available. In certain cases, including that of mostly lower-income consumers who lack access to alternative payment options or find them too costly or difficult to obtain, cash is also used for relatively larger-value transactions. Using the DCPC data, this paper explores where, how, and why people use the various payment options and highlights the key and enduring roles cash continues to play in consumer transactions.

The Federal Reserve conducted a follow-up Diary of Consumer Payment Choice. Read the FedNotes paper, The State of Cash: Preliminary Findings from the 2015 Diary of Consumer Payment Choice to see how current findings compare to the 2012 data.

Summary of Key Results

Cash is the most used retail payment instrument.

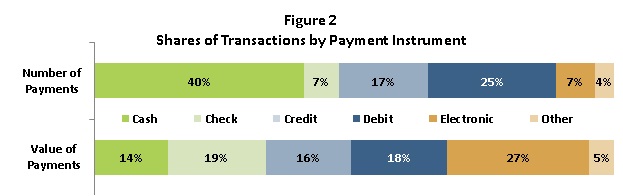

In October 2012, the average American consumer had 59 transactions, including purchases and bill payments, and 23 of these 59 payments involved cash. Figure 2 shows that, at 40 percent, cash makes up the single largest share of consumer transaction activity, followed by debit cards at 25 percent, and credit cards at 17 percent. Electronic methods (online banking bill pay and bank account number payments) account for 7 percent, while checks make up 7 percent. All other payments represent less than 5 percent of monthly transaction activity, with text and mobile payments barely registering at less than one half of one percent.

By value, cash accounts for a relatively small share of total consumer transaction activity at 14 percent, while electronic methods make up 27 percent and checks 19 percent. These findings suggest that although consumers don’t use electronic methods or checks very often, when they do, it tends to be for much higher-value transactions. In contrast, cash is used quite often, but primarily for low-value transactions. In fact, the average value of a cash transaction is only $21, compared with $168 for checks and $44 for debit cards.

Cash is the dominant instrument for low-value payments.

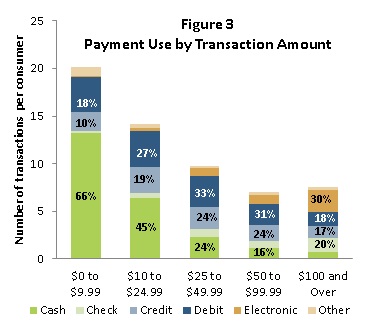

As Figure 3 shows, consumers have a lot of low-value transactions each month, and typically use cash for these payments. About one-third of the average consumer’s monthly payments involve transactions with a “ticket size” less than $10, and the average consumer uses cash for two-thirds of these transactions. In fact, consumers use cash for half of all of their transactions valued at less than $50. Interestingly, both the actual number of cash transactions and cash’s share of all transactions fall as the ticket size rises, while the number of card payments remains roughly the same regardless of ticket size.1 As ticket size rises above $100, the number and share of electronic payments and checks take a significant leap, in part due to the influence of bill payments.

Cash is widely used, even where other payment options are typically available.

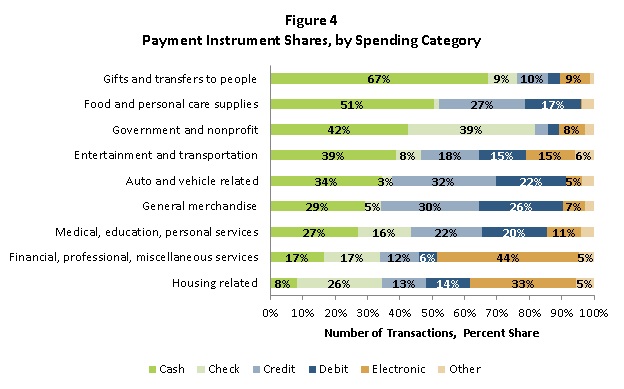

As shown in Figure 4, cash is the leading payment instrument for several expenditure categories, including gifts and other transfers between people (P2P); food and personal care supplies; entertainment and transportation; medical, educational, and personal services; and government and nonprofit expenditures. It is the second most frequently used payment instrument for all other categories except housing (and a distant second for financial and professional services). The average ticket size (see Appendix 1) for many of these expenditure categories is relatively low, suggesting that the reason cash is the most or second-most frequently used payment instrument is because small value transactions tend to dominate these categories. Moreover, the fact that debit cards tend to be used frequently for these expenditures as well indicates that cash usage likely is not the result of a lack of access to alternative payment options.

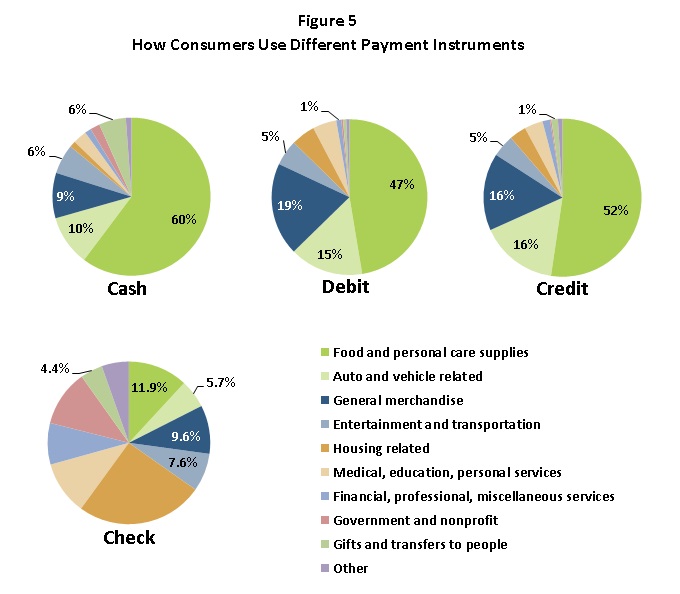

Figure 5 provides more evidence that consumers do not use cash as a niche payment instrument, but actually use it in similar ways to debit and credit cards. Specifically, food and personal care supplies make up 60 percent of all cash transactions, with entertainment and transportation, general merchandise, and auto and vehicle related expenditures collectively accounting for an additional 26 percent of cash transactions. The breakdowns by expenditure category for credit and debit cards look similar to that of cash, with food and personal care items making up the largest share of consumers’ use of these instruments, as well. In contrast, consumers seldom use checks for these sorts of day-to-day expenditures.

P2P transactions appear to be a special use case for cash, where they behave more like checks than cards, most likely because other payment options are less readily available for these transactions. However, while cash is used for more than two-thirds of P2P transactions (Figure 4), P2P transactions make up a relatively small share (6 percent) of all cash transactions (Figure 5). The call out box provides more insight on P2P transactions and cash.

Cash usage patterns look different when other options may not be as readily available.

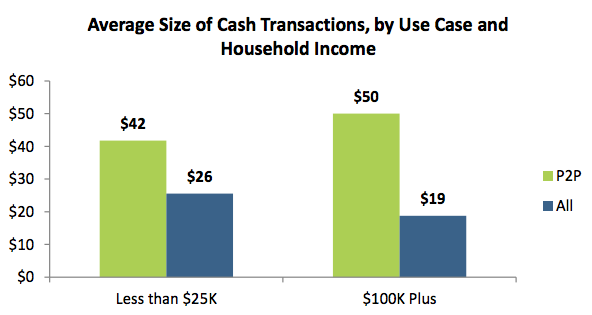

In this Box, we take a closer look at P2P transactions as an example of a “use case” for which other options are generally viewed as less available than cash (and even checks). As the figure shows, for these transactions, consumers use cash differently than they do for all their other transactions. Specifically, consumers’ average cash transaction values are 66 percent higher for P2P than for other types of expenditures ($35 vs. $21)2. This is particularly true for more affluent consumers (i.e., those with family incomes greater than $100,000 a year) who typically use cash only for small ticket purchases. However, when they make P2P payments, they not only use cash more frequently, but they also use it for much higher average value payments. The least affluent consumers (those making less than $25,000), in contrast, use cash for higher valued transactions in general, and the difference between P2P expenditures and all other expenditures is therefore less dramatic.

Consumers’ payment preferences influence how they pay.

While ticket size plays a role in consumers’ decisions about when to use cash, it is not the only factor that influences their choices about which payment instrument to use. Indeed, a consumer’s preferences play a key role.

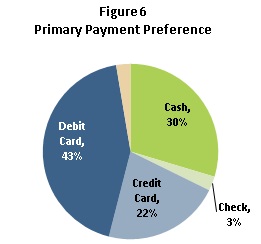

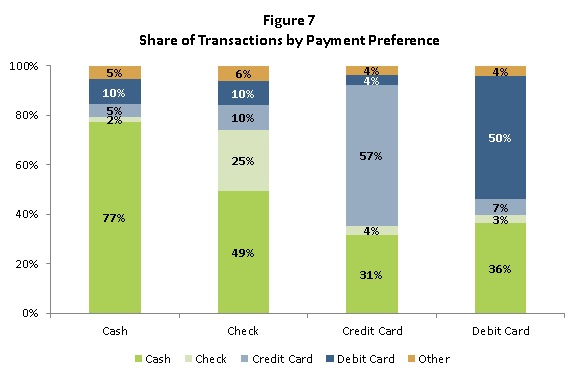

About 43 percent of consumers say that the debit card is their payment instrument of choice (Figure 6), and consistent with this stated preference, they do, in fact, use their debit card for the largest share of all their transactions (Figure 7). Similarly, 30 percent of consumers say they prefer cash and 22 percent say credit cards; in both cases, they use their preferred payment instrument for at least half of their transactions. Checks, however, are an anomaly: the 3 percent of consumers who prefer checks actually use cash twice as often as they use checks. This may reflect subtle (and not so subtle) social pressures to use a faster alternative to the check for the point of sale transactions that make up a large share of consumers’ everyday expenditures.

Figure 7 also shows that when they do not use their preferred instrument, consumers who prefer debit and credit cards use cash more frequently than any other payment instrument. While one might expect consumers to treat debit and credit cards somewhat interchangeably, that does not appear to be the case. Consumers who prefer debit cards, for example, use cash 36 percent of the time, while the same group uses credit cards for only 7 percent of their transactions.

Consumers who prefer cash are a diverse group.

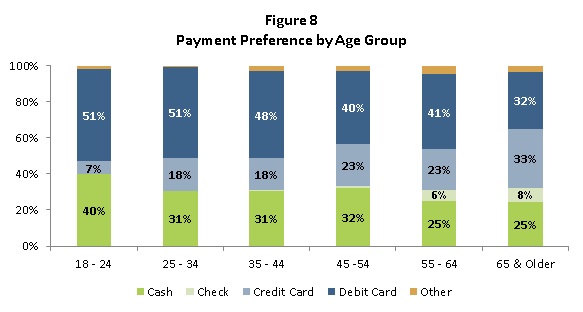

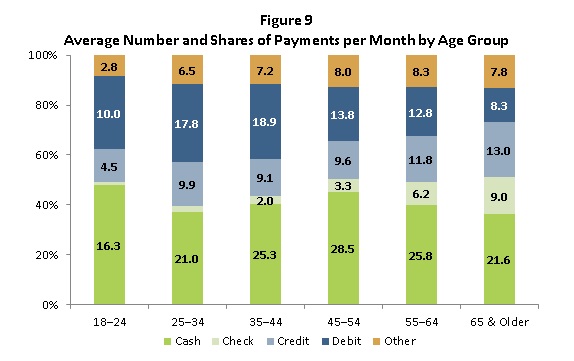

As shown in Figures 8 and 9, consumers of all age groups list cash as their preferred payment instrument. Contrary to conventional wisdom, 40 percent of 18 – 24 year olds actually prefer cash, the highest percentage of any age group. At the same time, this age group also has the highest preference for debit cards. It is possible that a segment of younger consumers prefer cash because they have limited access to banking and other financial products and services, in part due to typically lower incomes in early adulthood. Older consumers are more likely to prefer credit cards and checks than younger adults – and are less likely to prefer cash than younger adults. The much higher percentage of adults over 65 who prefer credit cards relative to other age groups, particularly the youngest adults, is also likely correlated with income (see Figure 10). However, the fact that virtually no consumers younger than 35 prefer checks, compared to nearly 8 percent of those older than 65, seems less correlated with income and may instead be the result of other age-related factors, such as payment habits that were established in early and mid-adulthood.3

Given these stated preferences, it is not surprising that all ages use cash. However, as Figure 9 shows, young adults actually use it far more frequently than they do debit cards, which is their most frequently preferred payment instrument. Indeed, all age groups use cash more frequently than one might expect based solely on stated payment preferences.

Figure 9 also shows that there is a significant substitution between check and debit, with older age groups tending to use checks much more frequently than debit cards and vice versa for younger age groups. This finding is not surprising given that check preference is highly correlated with age.

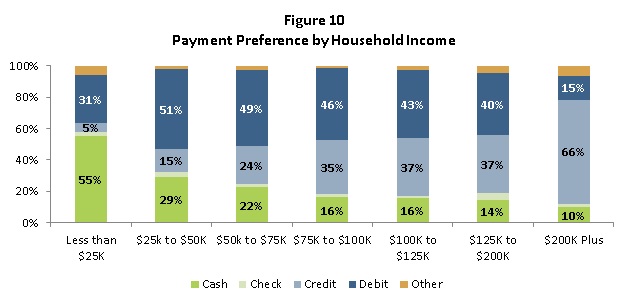

Income exerts a strong influence on payment preference.

As Figure 10 shows, 55 percent of consumers with household incomes less than $25,000 per year prefer cash over non-cash payment instruments, while those households making more than $200,000 per year exhibit a very strong preference for credit cards.4 The preference for cash declines sharply once household income exceeds $25,000 per year, with debit cards cited as the preferred payment instrument for all those in household income groups between the two extremes.

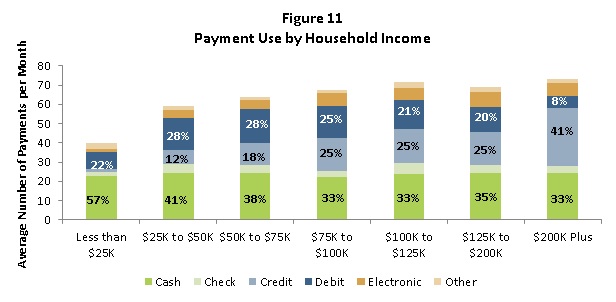

Consistent with payment preference, Figure 11 shows that the highest income group uses credit cards for more than 40 percent of their monthly transactions – much more frequently than any other payment option. This likely is due to the fact that more affluent consumers tend to have better access to credit and financial services and can take advantage of the incentives card issuers offer for using credit cards. At the same time, the lowest income group uses cash far more frequently than all other options combined. What is surprising, however, is that, despite the declining preference for cash as income rises, all income groups use cash for around 22 transactions per month.

Low income consumers use cash differently.

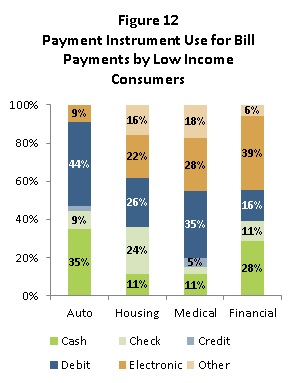

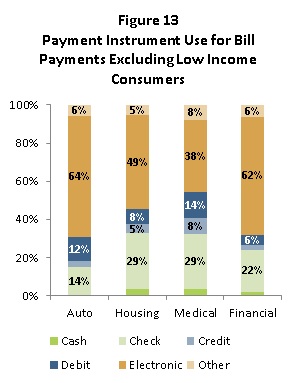

Although all consumers use cash approximately the same number of times a month regardless of income, those making less than $25,000 annually use cash for a much wider variety of transactions than do those with higher household incomes. These consumers typically have a higher number of monthly cash transactions with a ticket size valued at $25 or more than does any other household income group. Specifically, those making less than $25,000 annually have an average of 5.1 such transactions a month versus 3.2 for households earning more than $25,000. Consistent with this, the total value of low-income consumers’ cash spending, at $558 per month, is much higher than any other income group’s cash spending. Moreover, as Figures 12 and 13 show, low income consumers use cash much more frequently for bill payments like housing than the average consumer. This likely is due, at least in part, to a lack of access to banking and financial products. This finding is not surprising in light of various studies of “unbanked and underbanked” U.S. consumers, many of whom also fall into the lower-income category. For example, as a study by the FDIC found, low income consumers use cash because they view most mainstream banking and financial products as too expensive or too difficult to obtain.5

Cash is the preferred back-up payment instrument.

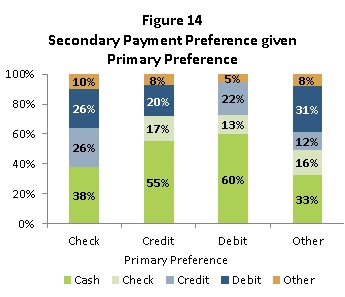

Not only does cash play an important role in small value transactions and as the primary payment instrument for low-income consumers, it also plays a significant role as the fallback payment instrument for most consumers. As Figure 6 above shows, cash was second to debit cards as consumers’ payment instrument of choice. When asked about their backup payment instrument, however, most consumers who preferred a non-cash payment instrument declared cash as their second choice. Sixty percent of consumers who prefer the debit card, for example, picked cash as their second choice (see Figure 14). A similar observation holds true for other payment instruments.

Additional evidence that cash may function as the primary back-up payment instrument for consumers is provided in the above Box, entitled “Cash usage patterns look different when other options may not be as readily available.” In particular, the Box shows that the consumers who typically do not use cash for higher ticket transactions (i.e., those with relatively high household incomes) tend to use cash differently (i.e., for higher values) in use cases where other options are not as readily available.

Conclusion

In summary, the Diary offers transaction-based evidence that cash is the most commonly used payment instrument and that it plays several key roles in consumer spending. All income and age groups use cash in roughly equal frequency, and particularly for transactions valued at less than $10, making cash the dominant payment instrument for very low-value transactions. Moreover, consumers use cash especially heavily for certain types of everyday expenditures, like food and personal care items. They also rely heavily on cash as their primary back-up payment instrument in situations where their first choice may not be available – P2P transactions are a good example. Finally, low-income consumers are much heavier cash users – even for bill payments – than other consumers who may also have a stated preference for cash but who tend to choose other options for bill payments and other high-value transactions.

Thus, while debit and credit cards are growing strongly, and cash’s share of total consumer transactions may well be declining, the 2012 Diary results suggest that cash still plays a very significant role in the consumer payments landscape. Looking to future potential changes in cash usage relative to other payment instruments, the Federal Reserve will continue its work to understand how the continued growth of debit cards, the expansion of prepaid cards among the unbanked, and novel P2P solutions may influence how consumers use cash, and the potential effects on the Fed’s cash business.

Download Appendix 1: Table 1: Average Purchases per Month, by Spending Category (pdf, 127 kb)

Download Appendix 2: Methodology (pdf, 209 kb)

About the Cash Product Office

As the nation’s central bank, the Federal Reserve ensures that cash is available when and where it is needed, including in times of crisis and business disruption, by providing FedCash® Services to depository institutions and, through them, to the general public. In fulfilling this role, the Fed’s primary responsibility is to maintain public confidence in the integrity and availability of U.S. currency.

The Federal Reserve System’s Cash Product Office (CPO) provides strategic leadership for this key function by formulating and implementing service level policies, operational guidance, and technology strategies for U.S. currency and coin services provided by Federal Reserve Banks nationally and internationally. In addition to guiding policies and procedures, the CPO establishes budget guidance for FedCash® Services, provides support for Federal Reserve currency and coin inventory management, and supports business continuity planning at the supply chain level. It also conducts market research and works directly with financial institutions and retailers to analyze trends in cash usage.

References

1. Note that while the numbers of card payments stays the same, their shares rise as the total number of transactions within each value category falls.

2. The average value for person to person (P2P) payments is slightly different than the average value for the spending category “Gifts and transfers to people” from Table 1, which includes a sub spending category called “People who provided goods and service.” Since this sub category is a payment for goods or services rather than a P2P transfer to another person, it is excluded in the average P2P calculation.

3. While the preliminary results show distinct patterns in preference across age groups, it should be emphasized that the study has been done only once thus far and, as a consequence, the data cannot discern the effect of age on a person’s preferences as he or she grows older. Recurring studies that follow the same or similar pool of survey participants would allow for analysis of how a person’s choice can change as he or she gets older and, as a corollary, how the stated preference across age groups translates to the actual instrument used in making payments over time.

4. It is important to note that household income, and not individual income, is used in this analysis. There are inherent limitations in using households as a proxy for individual consumer income, most obvious of which is that households often have dual income and can skew the results.

5. FDIC National Survey of Unbanked and Underbanked Households – December 2009.