As policies are proposed to expand health insurance coverage in the United States, it is useful to focus on the experience of Hawaii, where employers are required to offer such insurance to their full-time employees. Our findings suggest that Hawaii’s law has substantially increased health insurance coverage in the state, although the impact has been partially offset by employers’ increased reliance on the exempt class of employees who work fewer than 20 hours per week.

Over the past half century, employer-sponsored insurance (ESI) has dominated the U.S. health insurance landscape. Despite its primacy, signs of strain have emerged in recent years. As health insurance costs have grown, the percentage of the population covered by ESI has declined. This raises important questions about the role of ESI just as Congress is debating how to reform the nation’s system for financing and delivering health care (Buchmueller and Monheit 2009, Gruber 2008).

In this Economic Letter, we discuss the role of ESI in the context of proposed policies aimed at expanding health insurance coverage in the United States. We focus in particular on the experience of Hawaii, which has had an employer health insurance mandate for many years. Hawaii’s experience offers useful lessons as plans are considered to expand health insurance coverage through the existing ESI system.

A brief history of ESI

Although some U.S. employers and labor unions began providing employment-based health benefits beginning in the late 19th century, strong links between employment and private health insurance were not established until World War II, when the War Labor Board ruled that wartime wage and price controls did not apply to fringe benefits such as health insurance (Buchmueller and Monheit 2009). In response to this ruling, many employers began using health insurance benefits to attract and retain scarce labor. The use of health benefits was reinforced in the late 1940s when the National Labor Relations Board ruled that health insurance and other employee benefit plans were subject to collective bargaining. The close link between employment and health insurance was cemented in 1954 when the Internal Revenue Service declared that ESI benefits were exempt from income taxation. ESI subsequently became the most common source of health insurance in the United States.

Although ESI remains the nation’s primary source of health insurance, its prevalence has waned over the past decade. The percentage of Americans receiving health insurance coverage through their own employer or that of a family member peaked at 64.2% in the year 2000 and has fallen slowly since then, reaching 59.3% in 2007. Despite this decline, the percentage of the population covered through ESI is still more than double the percentage that receive health insurance through government sources (DeNavas-Walt, Proctor, and Smith 2008). The declining incidence of ESI coverage in recent years likely reflects pressures on both employers and employees related to rising health insurance costs and shifts towards shorter-term, more tenuous employment relationships (Buchmueller and Monheit 2009). Nevertheless, sustained reliance on ESI in the United States, combined with significant political and institutional challenges that would have to be overcome to replace the country’s private insurer network with a publicly provided “single payer” system, suggest that ESI will continue to play a central role in the U.S. health insurance system.

One option for increasing health insurance coverage in the United States is to leverage the existing ESI system by requiring employers to offer such insurance to all or most of their employees. While this may be a straightforward means for expanding coverage, it has the potential to cause unwanted distortions in the labor market. In particular, if employers are required to provide an employment benefit to at least some workers who would not receive the benefit in a voluntary market, employment costs will rise. These costs may be offset by lower wages, but complete offset is not guaranteed, especially for low-skill workers near the minimum wage. To the extent that wage reductions do not fully “neutralize” the higher employment costs, employers may adjust by reducing overall employment or altering the employment mix in favor of worker groups or employment arrangements that are exempt from the mandate.

Assessment of the effects of an ESI mandate requires comparisons between mandate and no-mandate environments. As the only state that has long-term experience with mandated ESI, Hawaii provides the sole basis for such direct comparisons in the United States. Assessing the impact of Hawaii’s mandate is made difficult by the state’s small size and its somewhat unique economy. But recent research suggests that informative comparisons can be made between Hawaii and other states (see Buchmueller, DiNardo, and Valletta 2009).

Hawaii’s mandate

Hawaii’s employer mandate legislation, the Prepaid Health Care Act (PHCA), was passed in 1974. It requires private-sector employers in Hawaii to provide health insurance coverage to most employees working 20 or more hours per week. Other than low-hour employees, who constitute only about 3 to 6% of the overall Hawaiian workforce, exemptions are limited to new hires, seasonal employees, and those working on commission. After its passage, Hawaii’s law was subject to an almost immediate court challenge based on potential conflicts with national guidelines for private-sector employee benefit programs established by the federal Employee Retirement Income Security Act (ERISA). Following years of uncertain enforcement and litigation at escalating judicial levels, Congress granted a permanent ERISA exemption to the PHCA in 1983.

We analyze the PHCA’s impact by focusing on detailed differences in ESI coverage rates and changes over time in Hawaii’s labor market, using annual data on ESI and related variables from the March Annual Demographic supplement and monthly Current Population Survey (CPS) data files compiled for the Bureau of Labor Statistics by the U.S. Census Bureau. ESI data only became available in the CPS in 1979, so the sample covers the years 1979 through 2005 (see Buchmueller, DiNardo, and Valletta 2009 for a detailed discussion of the data and statistical methodology). In assessing the impact of the law, it’s important to distinguish between workers who probably would receive insurance anyway and those who are insured as a direct result of the law. Because U.S. private-sector employers voluntarily provide ESI to most of their employees, most Hawaiian workers would receive ESI in the absence of the law and as such are unaffected by it. The affected groups are workers who would be unlikely to receive ESI in the absence of the mandate.

Proper assessment of the effects of the law on ESI coverage and labor market outcomes requires identifying and focusing on these affected groups. To do so, we partitioned the data into worker groups based on the patterns of ESI coverage in the no-mandate environment of states other than Hawaii, proceeding in two steps. First, we estimated the probability that workers receive ESI in states other than Hawaii based on personal and job characteristics such as education, age, marital status, race/ethnicity, and industry and occupation affiliation. We then placed all workers in our data, including those from Hawaii, into five groups (quintiles) based on their probabilities of receiving health insurance. Because placement into the quintile groups was based on the relationship between ESI coverage and worker characteristics in states other than Hawaii, the distribution of the sample of Hawaiian workers was approximately uniform across the five quintile groups.

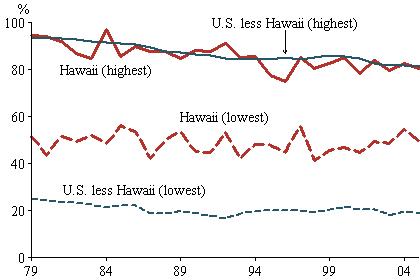

Figure 1

ESI coverage for lowest and highest probability groups, 1979-2005

Note: Authors’ calculations using March CPS data.

Figure 1 displays the ESI coverage rates over time for the quintile groups with the lowest and highest probabilities of receiving ESI for Hawaii and for the rest of the United States. These plots provide compelling eviden

ce that, relative to an unconstrained market outcome, Hawaii’s mandate raises ESI coverage rates for workers with low coverage probabilities. On average, Hawaii’s coverage rate for this group is more than double the rate in other states. But the mandate has little impact on workers with high coverage probabilities.

Although not displayed in the figure, our detailed statistical tests show that coverage rates for the lower quintiles were not significantly higher in Hawaii than in other states in the early years of the sample period, probably reflecting the legal uncertainties surrounding the law that existed until 1983. But Hawaii is a large statistical outlier for these groups in the later years. This pattern, combined with large increases in health insurance costs over the past few decades, points to substantial increases in the costs of the mandate over time, which are concentrated among workers with low probabilities of receiving ESI in an unconstrained market. In particular, for Hawaiian workers in the two lowest ESI quintiles, employers’ average per-worker cost of the mandate rose from about 8 cents per hour in 1979 to about 43 cents per hour in 2005 (measured in inflation-adjusted terms, in 2006 dollars).

What were the effects of Hawaii’s mandate on the state’s labor market? To answer that question, we compared trends in Hawaii to those in each of the other 49 states and the District of Columbia. Because enforcement in the law’s early years was uncertain and costs to employers were small, we examined the increase in mandate costs over our complete sample period. To properly account for wide cross-state variation in wage and employment trends and consequent random statistical variation between Hawaii and other states, we utilized a statistical methodology that identifies the impact of the mandate based on whether the estimated trends in Hawaii are large relative to the trends in other jurisdictions.

The analyses revealed that wage and employment trends in Hawaii were not substantially different than in the typical state over our sample period. However, we did uncover a shift in favor of workers employed fewer than 20 hours per week, who are exempt from the mandate. As expected, this effect is concentrated on workers who face low probabilities of receiving ESI in the absence of a mandate. This apparent effect of Hawaii’s law passes our stringent test for statistical significance, and its estimated magnitude is economically meaningful: for the quintile group with the lowest probability of receiving ESI, the shift towards low-hour jobs in Hawaii over our sample period was approximately equal to the estimated increase in relative ESI coverage (6 percentage points), suggesting that the increase in ESI coverage would have been about twice as large for this group had employers not increased their reliance on exempt, low-hour employees.

Implications

We find that Hawaii’s ESI mandate has substantially increased health insurance coverage in the state. Our evidence also suggests that employers’ primary response to the mandate was increased reliance on the exempt class of workers who are employed for fewer than 20 hours per week. We did not find reliable statistical evidence for corresponding reductions in wages or overall employment probabilities. This may indicate that the shift to low-hour employment was the mandate’s primary labor market effect, although it may simply be that any adverse effects on wages and employment are too small to detect using our data and methodology. In addition to such labor market distortions, the results of our research imply that an employer mandate is not an effective means for achieving universal coverage. Although overall insurance coverage rates are unusually high in Hawaii, a substantial number of people remain uninsured, suggesting a need for alternative approaches if universal coverage is the ultimate goal.

Buchmueller, Thomas C., John DiNardo, and Robert G. Valletta. 2009. “The Effect of an Employer Health Insurance Mandate on Health Insurance Coverage and the Demand for Labor: Evidence from Hawaii.” FRBSF Working Paper 2009-08, April.

Buchmueller, Thomas C., and Alan C. Monheit. 2009. “Employer-Sponsored Health Insurance and the Promise of Health Insurance Reform.” NBER Working Paper 14839, April.

DeNavas-Walt, Carmen, Bernadette D. Proctor, and Jessica C. Smith. 2008. “Income, Poverty, and Health Insurance Coverage in the United States: 2007.” U.S. Census Bureau, Current Population Reports P60-235. Washington, DC: U.S. Government Printing Office.

Gruber, Jonathan. 2008. “Incremental Universalism for the United States: The States Move First?” Journal of Economic Perspectives 22(4, Fall), pp. 51-68.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org