When the housing boom of the past decade turned into a bust, falling house prices played a primary role in driving up delinquency and foreclosure rates. As housing values fell, distressed borrowers lost equity, which hindered their ability to escape delinquency by prepaying their mortgages by refinancing or selling their homes. Falling house prices may have especially impinged on subprime and adjustable-rate borrowers. These homeowners may have counted on being able eventually to refinance into loans with terms more affordable than those of their original mortgages.

Since their peak in mid-2006, house prices have experienced a fall without precedent in the post-World War II era, declining 32% nationwide and more than 45% in markets such as Las Vegas, Phoenix, and parts of Florida. Those declines have played a key role in the crisis of the mortgage market, which has been marked by surging delinquencies and foreclosures. An early study of the crisis by Doms, Furlong, and Krainer (2007) found a strong positive relationship between the rate of house-price depreciation in urban areas and the subsequent rate of subprime mortgage delinquency.

What are the mechanisms connecting falling house prices and rising delinquencies? One important link may be that, when home equity declines, distressed borrowers have few options except to stop paying their mortgages. Two alternatives might be to use the proceeds from selling the house or refinancing the mortgage to prepay the original loan. Of course, refinancing works only if the new terms are more affordable. However, if the borrower has little or no equity in the house, those options may be closed off. Doms et al. note that “homeowners with a greater equity stake would be in a better position either to sell their homes and pay back the remaining principal or to refinance existing mortgages to ones that would offer lower, more affordable payments.”

This Economic Letter explores the connections between house prices, prepayment, and delinquency during the 2001–2008 period. It draws on work reported in greater detail in Krainer and Laderman (2011), and complements Hedberg and Krainer (2010), which emphasizes how tighter underwriting standards restrained prepayments in the late 2000s.

How does delinquency occur?

Borrowers can become delinquent on their mortgages for several reasons. An obvious cause might be an unexpected life event that makes a borrower unable to pay, such as a major medical expense or job loss. However, life events cannot fully explain the sharp increase in mortgage delinquencies that began in 2007. For example, although unemployment has risen sharply, it hasn’t increased enough to explain the jump in delinquency rates.

The fall in house prices appears to be a key contributor to the run-up in mortgage delinquencies during this period. As prices dropped, it became more difficult for distressed borrowers to get out of their original mortgages, that is, to prepay them. Lower prices meant home sales might not raise enough funds to pay off the mortgages. In addition, lower equity meant less chance of being able to refinance.

Subprime borrowers may have been particularly vulnerable. Loans to borrowers with poor credit were originally intended as bridge financing to repair a borrower’s credit rating. Because of the risk involved in lending to such borrowers, interest rates were typically high. Those high rates made subprime loans burdensome in the long run.

But, as Gorton (2008) explains, subprime borrowers who regularly made timely payments were eventually rewarded with higher credit scores. In addition, they were building equity in their houses. When they had built up sufficient equity, meaning that the value of the loan relative to the value of the home was not too high, borrowers could refinance into more affordable loans. In fact, many subprime borrowers apparently counted on continually rising home prices to allow them to refinance. Of course, house prices didn’t keep rising indefinitely. They first slowed and then fell, leaving many subprime borrowers unable to refinance. As a result, many borrowers couldn’t keep making mortgage payments.

What role for prepayment?

To investigate the links between house prices, delinquency, and mortgage prepayment, Krainer and Laderman (2011) use loan level information on over 770,000 first-lien, owner-occupied, conventional mortgages originated between the first quarter of 2001 and the first quarter of 2008. We then look at those loans over the two years after they were originated to see what percentage was paid off and what percentage was delinquent at any time during that period. The data come from LPS Applied Analytics, which compiles reports from most of the nation’s major mortgage servicers.

In general, borrowers with adjustable-rate mortgages prepay at a higher rate than borrowers with fixed-rate mortgages. Indeed, some borrowers may choose adjustable-rate mortgages precisely because they expect to sell their houses before their interest rates reset upward. Others may expect fixed mortgage rates to fall. They take advantage of low initial adjustable rates, expecting to refinance into a lower fixed-rate mortgage than was available when their adjustable loans originated. Krainer and Laderman consider the fixed and adjustable-rate borrowers separately. Here the focus is on the adjustable group. It’s important to stress though that fixed-rate borrowers also find it hard to prepay when house prices drop sharply.

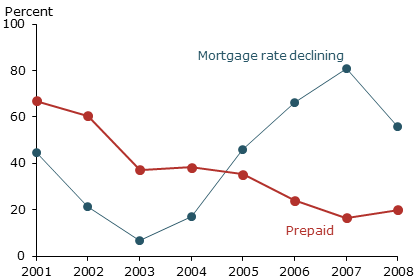

Figure 1

Mortgage prepayment and refinance incentive

Note: Rates shown for adjustable-rate mortgages only. Mortgage ratedeclining is percent of mortgages with higher current rate than market rateany time within 24 months.

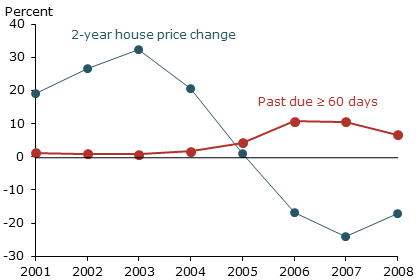

Figure 2

Mortgage delinquencies and house price changes

Note: Rates shown for adjustable-rate mortgages only.

In Figure 1, the red line shows the percentage of loans that were prepaid within two years of origination for loans made from 2001 to 2008. Similarly, the red line in Figure 2 shows the percentage of loans that became at least 60 days past due within two years. For example, nearly 70% of borrowers who took out adjustable-rate loans in 2001 prepaid within two years of loan origination, while only about 1% became delinquent.

The prepayment and delinquency trends appear to be associated, with prepayment falling as delinquencies rise. Except for a tiny increase in the prepayment rate for loans originated in 2004, the prepayment rate declines steadily for 2001 to 2007 loans. The delinquency rate increases beginning with the 2004 loan group, then declines for 2008 borrowers, accompanied by a slight increase in the prepayment rate.

Of course a decrease in the prepayment rate does not automatically mean that fewer borrowers are able to prepay. Borrowers often may be able to prepay but choose not to do so. And many borrowers who do prepay have reasons other than avoiding foreclosure. Some borrowers who prepay may be selling their homes because they are moving. Others may be refinancing to lower their mortgage payments, even if they’re not distressed. Still others may wish to capitalize on rising home values by extracting cash to finance large expenses, such as education or home improvements. On the other side, borrowers may avoid prepayment because they think that conditions will be more advantageous in the future.

To assess whether a declining ability to qualify is causing the fall in prepayment rates, Krainer and Laderman identify a group of borrowers who could have gotten lower interest rates if they refinanced and paid off their mortgages. If at any time within two years after a loan has originated, the market rate on fixed-rate mortgages was at least one-half percentage point below the borrower’s current interest rate, then that individual is identified as a prepayment candidate. In Figure 1, the blue line plots the proportion of borrowers in that category for the 2001 to 2008 origination groups.

In aggregate data, prepayment appears to be negatively correlated with market interest rates. The higher the interest rate, the lower the prepayment rate, because fewer people are refinancing to get lower mortgage rates. Thus, if the interest rate incentive to prepay increases, but the incidence of prepayment decreases, a decline in the ability of borrowers to prepay is more likely.

This interest rate incentive is probably more important for fixed-rate borrowers than for adjustable-rate borrowers. Fixed-rate borrowers face a certain payoff if they refinance at a lower fixed rate. By contrast, adjustable-rate borrowers who move into fixed-rate loans lose out if market rates decline in the future.

For the earlier years of the adjustable-rate sample, the relationship between incentive to prepay and actual prepayment rates is what would be expected if it were easy for borrowers to pay off their loans. The incentive to prepay declines for 2002 and 2003 borrowers compared with 2001 borrowers, as do prepayment rates. However, the relationship begins to break down starting in with the 2004 group. The prepayment incentive increases for 2004 borrowers, but the prepayment rate barely budges. For 2005 borrowers, prepayment incentives are even higher, but the proportion of prepayments drops. This pattern continues for 2006 and 2007 borrowers.

This pattern of weak prepayment in the face of strong incentives suggests borrowers were unable—as opposed to unwilling—to prepay. To test this, Krainer and Laderman perform a statistical exercise to control for other loan features and characteristics of borrowers. The exercise shows that increases in loan-to-value ratios significantly reduce the incidence of prepayment in our data. These increases in loan-to-value ratios may be driven by decreases in house prices. This provides statistical evidence that falling house prices may have been associated with the decline in prepayments.

To further test the correlation between house prices, prepayment, and delinquency, Krainer and Laderman examine the trend in house prices. The blue line in Figure 2 plots house price appreciation in the two years following mortgage origination. Appreciation is measured by looking at house prices in the same zip code as the mortgages in our data base, using home value indexes constructed by Zillow.com, an online housing data service. For example, borrowers who took out mortgages in 2003 saw the value of houses in their zip codes increase by about 32% on average over the next two years.

House price appreciation slowed for 2004 borrowers, which may have been the first group facing constraints on their ability to prepay and thereby avoid delinquency. The delinquency rate does not begin to tick up until the 2004 group, even though prepayment rates fell for the 2002 and 2003 groups. Of course, slower house price appreciation may have reduced borrower incentives to extract cash from home equity by prepaying. But the increase in delinquency suggests that financial distress was also a factor. Some borrowers who could have avoided delinquency if they sold or refinanced may not have been able to do so.

Subprime borrowers’ prepayment

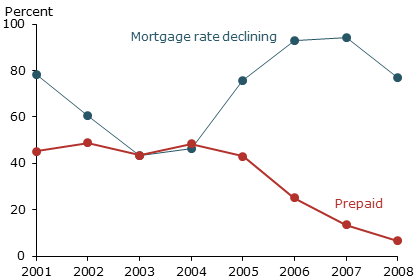

Figure 3

Subprime prepayment and refinance incentive

Note: Rates shown for subprime adjustable-rate mortgages only.

Borrowers with lower credit scores may have been especially dependent on prepayment to refinance into more affordable mortgages. Figure 3 shows that subprime borrowers in the 2002 and 2003 origination groups maintained high prepayment rates in the face of weakening interest rate incentives. High prepayment rates continued among 2004 and 2005 subprime borrowers. House price appreciation slowed for these borrowers. Those still able to prepay may have been eager to do so quickly before house prices actually began falling. But high prepayment rates were not enough to keep overall subprime borrower delinquency rates from rising sharply. By 2007, those rates were more than twice those of adjustable-rate borrowers.

Conclusion

While many factors contributed to the mortgage crisis, most analysts agree that house prices played a primary role. Even with attractive mortgage rates, the drop in loan-to-value ratios severely limited the ability of borrowers to avoid delinquency by selling their homes or refinancing their loans. This was especially true for subprime borrowers and homeowners with adjustable-rate mortgages. But the decline in house prices appears to have dampened the opportunity for all mortgage borrowers to pay off the principal balance of their loans as an alternative to delinquency.

References

Doms, Mark, Fred Furlong, and John Krainer. 2007. “Subprime Mortgage Delinquency Rates.” FRBSF Working Paper 2007-33.

Gorton, Gary. 2008. “The Panic of 2007.” In Maintaining Stability in a Changing Financial System, proceedings of the 2008 Jackson Hole Economic Policy Symposium, sponsored by FRB Kansas City.

Hedberg, William, and John Krainer. 2010. “Mortgage Prepayments and Changing Underwriting Standards.” FRBSF Economic Letter 2010-22, July 19.

Krainer, John, and Elizabeth Laderman. 2011. “Prepayment and Delinquency in the Mortgage Crisis Period.” FRBSF Working Paper 2011-25.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org