Aggregate state, local, and federal fiscal policy was expansionary during the Great Recession and the initial stages of recovery, providing a tailwind to economic growth. Federal fiscal policy in particular was more expansionary than usual, according to a historical analysis, even when the weakness of the economy is taken into account. However, during the past year, aggregate government budgetary policy has reversed course. Over the next few years, as federal fiscal policy shifts toward austerity, it is likely to be a headwind against economic growth.

State, local, and federal fiscal policy in the United States has historically been countercyclical. Government spending as a share of gross domestic product generally rises during economic downturns and falls during expansions, while tax revenue does the opposite. Thus, the difference between government spending and revenue&—the combined state, local, and federal deficit&—tends to lean against business cycle fluctuations. This countercyclical feature of government fiscal policy arises in part through automatic stabilizers, that is, previously enacted programs that are designed to increase outlays during downturns and contract in expansions without explicit policy changes. For example, when the economy enters a downturn, government spending on safety net programs, such as Medicaid and unemployment insurance, increases because more Americans need financial assistance. At the same time, tax revenue falls as incomes, sales, and property values decline.

In addition to these automatic stabilizers, stimulus policies are often put in place during recessions, such as the $800 billion federal spending and tax package enacted in 2009. Thanks in large part to that package, federal fiscal policy is generally considered to have been more expansionary than in any downturn since the Great Depression.

However, state and local governments contracted sharply over this period as they slashed spending to balance budgets. Some researchers (for example, see Aizenman and Pasricha, 2011) have argued that state and local contraction roughly canceled out federal expansion, so that overall government fiscal policy was neutral. Others point to the large and growing aggregate state, local, and federal budget deficit as evidence that overall fiscal policy has been expansionary.

This Economic Letter examines the pattern of state, local, and federal fiscal policy since the start of the Great Recession to consider whether government spending and taxation have been more expansionary or less expansionary than would be expected, given the depth and duration of the downturn. We then use Congressional Budget Office (CBO) projections for the federal budget and economic growth to explore whether fiscal policy over the next few years is likely to be a headwind or tailwind for the economy.

Characterizing recent fiscal policy

To investigate the extent to which recent fiscal policy has been countercyclical and expansionary, we created a statistical model by estimating how federal, state, and local budgets have moved through past business cycles. Our analysis uses quarterly data since 1949 from the National Income and Product Accounts of the U.S. Commerce Department Bureau of Economic Analysis. We use historical fiscal patterns to predict what budgetary policy would have been in recent years based solely on business cycle factors, and then compare that prediction to actual policy. We measure the business cycle based on the difference between actual GDP and the CBO’s estimate of potential GDP, which is known as the output gap. This allows us to determine how expansionary current policy has been compared with fiscal policy’s typical countercyclical response, given the severity of the recent downturn.

One pattern independent of the business cycle is worth noting. State, local, and federal spending and tax revenue have both trended up as a share of GDP since 1949. Spending has grown faster than revenue, so the aggregate government deficit has also trended up. Our statistical model incorporates these long-run trends.

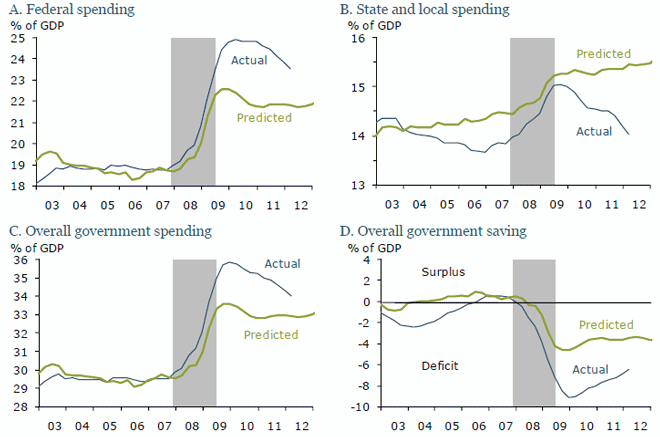

Figure 1

Analysis of fiscal policies

Bureau of Economic Analysis (BEA) and authors’ analysis. Shaded regions indicate NBER recessions.

Figure 1 summarizes the results of our analysis based on four measures of fiscal policy, calculated as a percentage of GDP. Figure 1, panel A plots federal spending against the level predicted based on historical patterns. It turns out that federal spending was highly stimulatory during the recession, rising well above the level predicted by normal cyclical factors. Our statistical model predicted a sharp rise in spending, based on the historical relationship between spending and the business cycle, and the unusually large output gap that developed during the Great Recession. But the actual rise in federal spending was even greater than our model predicted. By comparison, federal spending also rose during the severe recession of 1981–82 (not shown), but less than our statistical model would predict.

To understand the effect of fiscal policy on the economy, it is important to distinguish between the level of cyclically adjusted spending and taxes and their change. The rate of change is what affects economic growth, at least in the near-term. As noted, panel A shows that the level of federal spending as a share of GDP is higher than our model predicts. However, it has declined rapidly in the past year. The drop has been larger than would be expected based on historical patterns.

Figure 1, panel B shows state and local spending, which also rose markedly during the recession. However, the level of state and local outlays remains below what would be expected based on economic conditions and the long-run upward trend in spending. Before the recent recession, from 2003 to 2006, state and local spending fell significantly. As a result, such spending entered the recession at levels below those predicted by our model. Since 2009, state and local spending has fallen sharply as states have cut back to close budget shortfalls. This has widened the gap between actual state and local spending and the level consistent with historical movements over the business cycle.

Figure 1, panel C shows the combined effect of federal and of state and local spending. Both increased during the recession, leading to a sharp rise in overall government spending. In other words, from 2007 to 2009, state, local, and federal spending on net provided significant stimulus to the economy. As the recession ended, high federal spending continued, helping offset declining state and local spending. Thus, the overall level of government spending was higher during the early stages of recovery than would be expected based on history. However, over the past year, both state and local and federal spending have declined faster than predicted, creating a headwind for economic growth.

The story is much the same for the aggregate government primary deficit, defined as expenditures excluding interest payments minus revenue. Figure 1, panel D shows overall state, local, and federal saving as a share of GDP, a measure of the size of the aggregate government primary deficit. Positive values represent surpluses, while negative values represent deficits. The aggregate government deficit increased substantially during the recession because revenue fell and spending rose. State governments are generally required to balance their budgets. Thus, the fall in saving was due primarily to an increasing federal deficit.

The drop in government saving both at the federal and aggregate levels was greater than would be expected based on typical cyclical factors. In other words, the current aggregate government deficit is larger than would be predicted given the output gap. However, the deficit has recently been shrinking faster than our statistical model would predict. Thus, the contribution to economic growth from state, local, and federal fiscal policy is less than would be expected given the weakness of the recovery.

Looking ahead

Federal fiscal policy will increasingly weigh on economic growth in coming years, according to CBO projections. The CBO projects two possible paths for federal outlays and revenue, both of which would damp GDP growth. The more severe is its baseline scenario which assumes that federal fiscal policy in coming years will follow current law. This includes automatic spending cuts enacted in August 2011, and the expiration of the 2001 and 2003 tax cuts and several other tax provisions. These changes are generally scheduled to take effect at the end of 2012. They constitute what has been called a “fiscal cliff,” meaning that they represent a large and sudden contraction of the government budget.

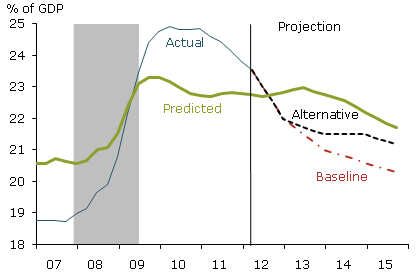

Figure 2

CBO projections

A. Federal government spending

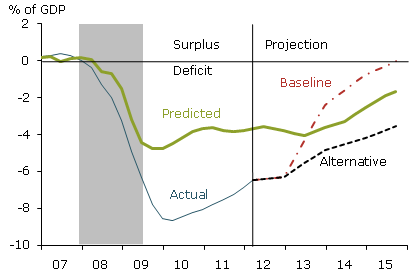

B. Federal government saving

Sources: BEA, CBO, and authors’ analysis. Shaded regions indicate NBER recessions.

The CBO’s second scenario is milder, though still not benign for near-term economic growth. This alternative assumes current tax policies continue and that Congress will undo the sharp automatic spending cuts set to take place at the end of the year, but that discretionary spending caps passed in 2011 will stay in effect.

Figure 2, panel A compares both CBO projections of federal spending with the level predicted by our statistical model. Under either CBO scenario, spending over the remainder of 2012 is projected to fall faster than would be expected based on the pace of economic recovery. Beyond 2012, the CBO projects that under either scenario government spending will contract at least for the next decade roughly in line with our statistical model. The retrenchment in 2013 would be much sharper under the current-law baseline projection than under the CBO’s second scenario, in which automatic spending cuts are avoided.

Figure 2, panel B shows that, as spending falls and tax revenue rises, the federal deficit is expected to shrink over the next one to two years under either scenario, faster than would be predicted based on its historical pattern through the business cycle. In a continuation of the subpar pace of recovery from the Great Recession, the gap between actual GDP and potential output is expected to close very slowly over the next couple of years. The typical countercyclical pattern of federal fiscal policy would predict that the deficit would remain large longer than the CBO projects. Just how fast fiscal tightening occurs and how large the headwind to economic growth will be depend on future policy decisions. The deficit is projected to shrink much more quickly under the CBO’s baseline scenario. However, even under the milder alternative scenario, the shrinking deficit implies a headwind for GDP growth in the near term.

Conclusion

In aggregate, state, local, and federal fiscal policy was unusually expansionary during the Great Recession, but has since reversed course. Overall government spending and the combined state, local, and federal deficit have been declining over the past year more rapidly than would be expected given the slow pace of recovery and the typical countercyclical pattern of fiscal policy. Moreover, CBO projections suggest that fiscal policy, at least at the federal level, will become increasingly contractionary over the next couple of years compared with normal cyclical patterns. This suggests that the tailwinds fiscal policy provided to economic growth during the Great Recession and the first few years of recovery have shifted direction. Going forward, the forecast calls for fiscal headwinds.

References

Aizenman, Joshua, and Gurnain Kaur Pasricha. 2011. “Net Fiscal Stimulus during the Great Recession.” NBER Working Paper 16779.

Congressional Budget Office. 2012. “The 2012 Long-Term Budget Outlook.” June.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org