The 2007–08 financial crisis was the biggest shock to the banking system since the 1930s, raising fundamental questions about liquidity risk. The global financial system experienced urgent demands for cash from various sources, including counterparties, short-term creditors, and, especially, existing borrowers. Credit fell, with banks hit hardest by liquidity pressures cutting back most sharply. Central bank emergency lending programs probably mitigated the decline. Ongoing efforts to regulate bank liquidity may strengthen the financial system and make credit less vulnerable to liquidity shocks.

Financial institutions provide liquidity to depositors and creditors by standing ready to provide them cash on demand. In the traditional framework, liquidity risk stemmed from the possibility of bank runs. These are episodes in which depositors lose faith in their bank and withdraw their money, either because of concerns about the bank’s financial condition or because they worry that others might stage runs. Such runs could make banks insolvent by initiating a chain reaction that forced a fire sale of illiquid loans. In the past, such instability was partly checked by reserve requirements tied to deposits, deposit insurance, and the availability of liquidity from central banks, the lenders of last resort.

More recently, liquidity risk has come less from deposit outflows and more from exposure to a range of lending and interbank financial arrangements. These include undrawn loan commitments, obligations to repurchase securitized assets, margin calls in the derivatives markets, and withdrawal of funds from wholesale short-term financing arrangements.

For example, banks today often lend by extending credit lines that borrowers can tap on demand, or by making other kinds of loan commitments. Increases in borrower use of these commitments make this business risky. When the overall supply of liquidity falls, borrowers draw on funds from existing credit lines en masse. Thus, in the 2007–08 financial crisis, nonfinancial firms lost access to short-term funds when the commercial paper market dried up. Commercial paper issuers turned instead to prearranged backup lines at banks to refinance their paper as it came due. Banks were obligated to fund such loans. As a result, funds became less available for new lending.

Nonfinancial business demand for liquidity also increased during the crisis to meet high precautionary demands for cash. Many businesses drew funds from existing credit lines simply because they feared continued disturbances in the credit markets. To cite one example, American Electric Power drew down $2 billion from an existing credit line supplied by JP Morgan Chase and Barclays as lead arrangers. According to an SEC Filing, the utility “took this proactive step to increase its cash position while there are disruptions in the debt markets.” (See Ivashina and Scharfstein 2010.)

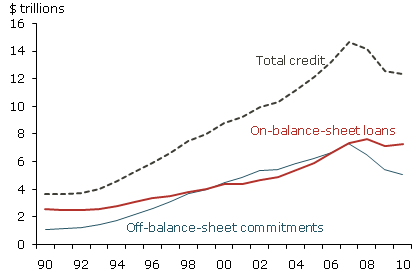

Figure 1

Total loans and unused commitments ($ trillions)

Source: Annual Call Reports for all U.S. banks.

Banks finance their balance sheets with more than just deposits and equity capital. Other liabilities include uninsured wholesale deposits, repurchase agreements, and other short-term unsecured debt instruments. These sources became scarce during the crisis. For example, repurchase agreements, known as repos, were often used to finance risky assets such as private-label mortgage-backed securities. Gorton and Metrick (2011) show that, in the middle of 2007, mortgage-backed securities could be almost completely financed with short-term borrowed funds in the repo market. However, by the fourth quarter of 2008, only about 55% of each dollar invested in such securities could be financed this way. Banks that used repos to finance purchases of mortgage-backed securities faced an unpleasant choice. They could sell their securities holdings into a falling market and take a big loss. Or they could find new, and presumably expensive, sources of credit.

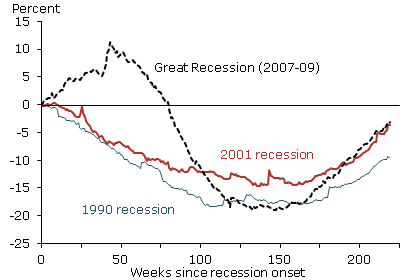

Figure 2

Cumulative business-loan growth since recession onset

Source: Federal Reserve, H.8 weekly C&I loans for large domestic banks.

In the case of nonbank brokerage firms, the collapse of the repo market was a calamity. However, it was less of a disaster for commercial banks because they could use increases in deposits to bridge the financing gap.

Figure 1 shows how these sources of liquidity risk affected overall bank credit during the crisis. Off-balance-sheet loan commitments rose steadily from 1990 to 2007. Overall bank credit production, including both on- and off-balance-sheet credit commitments, started to fall in the middle of 2007. The decline accelerated sharply in the last quarter of 2008. By contrast, loans held on bank balance sheets continued to rise until the end of 2008. That rise in on-balance-sheet loans during the crisis was due to borrowers drawing down preexisting credit lines. Banks began cutting back new lending in the middle of 2007. This illustrates how bank obligations to existing borrowers crowded out new borrowers.

Figure 2 uses weekly Federal Reserve data to show the cumulative growth of business loans on bank balance sheets. Unlike earlier recessions, loan balances continued to rise until almost 50 weeks into the Great Recession. This reflects movement of loans onto bank balance sheets from preexisting off-balance-sheet commitments, either credit lines or other guarantees (Acharya, Schnabl, and Suarez, forthcoming).

How did banks manage liquidity during the crisis?

How did banks manage the liquidity shock of the 2007–2008 crisis? To what degree did banks boost their holdings of cash and other liquid assets as a buffer? More importantly, did bank efforts to raise liquidity reduce the availability of credit?

The Federal Reserve sets aggregate liquidity in the banking system. Hence, focusing on aggregate liquidity merely tells us what the Fed is doing (see Keister and McAndrews 2009). By contrast, Cornett et al. (2011) look at how cash, other liquid assets, and provision of credit vary across banks. These variations help explain differences in bank behavior during the crisis.

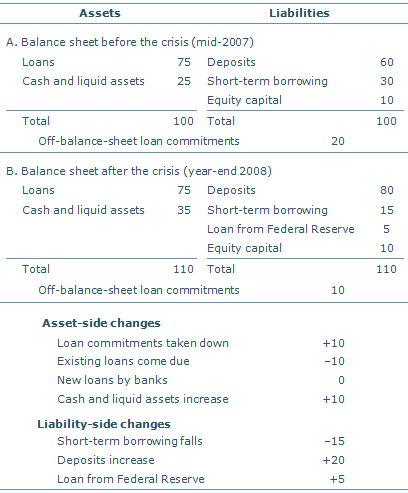

Table 1

Example of adjustments to bank balance sheet ($ billions)

Note: This example ignores loan losses and provisions for simplicity.

Banks more exposed to liquidity risk increased their holdings of liquid assets most. They also reduced new lending most. Liquidity exposure affected behavior along several dimensions. On the asset side, banks holding securities with low liquidity, such as mortgage-backed securities, expanded their cash buffers during the crisis and decreased new lending. Such banks were worried about their ability to finance securitized assets. They protected themselves by hoarding liquidity, to the detriment of borrowers. On the liability side, banks that relied more on wholesale sources of funding cut new lending significantly more than banks that relied predominantly on traditional deposits and equity capital for funding.

Cornett and coauthors also test how banks managed sudden rises in loan demand during the crisis stemming from off-balance-sheet loan commitments. Banks with higher levels of preexisting commitments increased their holdings of liquid assets and simultaneously cut back on new credit origination. Thus, loan commitment drawdowns displaced new credit origination during the crisis.

Table 1 illustrates how the balance sheet of a hypothetical bank might have adjusted to these liquidity pressures. It compares the bank’s balance sheet at the beginning of 2007 and the end of 2008. Prior to the crisis, the bank holds $75 billion in loans on its balance sheet, with an additional $20 billion in off-balance-sheet loan commitments and credit lines, a total credit supply of $95 billion. The bank also holds $25 billion in cash and other liquid assets. On the liability side, the bank finances these investments 60% with traditional deposits, 30% with wholesale short-term debt, and 10% with equity.

During the crisis, borrowers take down funds from existing commitments, lowering the off-balance-sheet account from $20 to $10 billion and increasing loans on the balance sheet by $10 billion. Meanwhile, the bank loses half its short-term funds as markets dry up. At the same time, $20 billion of traditional deposits flow in and the bank is able to borrow an additional $5 billion from the Federal Reserve. However, under pressure on both the asset and liability sides of its balance sheet, the bank seeks to increase its cash holdings from $25 to $35 billion as protection against further disruptions. The bank has no choice but to scale back its overall provision of credit. In this example, new lending ceases, with total credit falling from $95 billion to $85 billion as some loans reach maturity.

Avoiding another credit collapse

Liquidity crises may be inherently hard to avoid, but can we minimize their adverse effects on credit supply? Cornett and coauthors consider this question by using a statistical model of changes in credit production. The model estimates how much bank efforts to strengthen balance sheets displaced lending during the fourth quarter of 2008.

The model also simulates the total credit production that would have occurred if all banks had entered the crisis with low liquidity-risk exposure. Since banks heavily exposed to off-balance-sheet commitments cut credit sharply, the model allows us to compute how much such a bank would have changed its credit production had it entered the crisis with low levels of commitments. Cornett and coauthors estimate similar adjustments across the other dimensions of liquidity-risk exposure. Each of these changes are calculated across the banking system to measure how loans and total credit would have changed. To be sure, this simulation is uncertain because of potential changes in regulation, technology, and banking industry structure. Nevertheless, the results suggest ways to make the banking system better able to withstand future liquidity shocks.

The model’s estimates of total adjustments to liquidity accumulation and credit production during the crisis are striking. For example, after these adjustments, bank accumulation of liquid assets during the fourth quarter of 2008 falls to almost zero. In other words, the model suggests there would have been no liquidity buildup had banks entered the crisis with low levels of liquidity-risk exposure. Similarly, the drop in credit production during the fall of 2008 would have been nearly 90% lower if banks had been less exposed going in.

Conclusion

The simulation highlights the importance of traditional deposits as a stabilizing source of funds and undrawn commitments as a potentially destabilizing source of asset-side liquidity exposure. These two effects are dominant, in contrast with other dimensions of liquidity exposure, such as investments in securitized assets. Moreover, this simulation suggests how to insulate credit provision from future liquidity shocks. The traditional banking framework managed liquidity risk through required reserves on deposits. As we have seen, deposits no longer bring liquidity risk. In fact, they insulate banks from such risk because deposits flow into banks when markets dry up. Thus, moving away from required reserves makes sense. What doesn’t make sense is not replacing required reserves with another form of protection. Liquidity risk has not disappeared. It has simply changed form.

These changes are recognized under the proposed Basel III regulatory framework, which would require banks to meet two liquidity-ratio tests. One, based on liquidity coverage ratio, focuses on the possibility that a bank would face cash demands over a 30-day period under conditions of market stress. For example, increases in repo margins or systemic increases in loans taken down from existing credit lines would play an important role in these scenarios. Results from Cornett and coauthors suggest that such a requirement makes sense. Arrangements, such as off-balance-sheet commitments, that can rapidly ramp up cash demands on banks were a major reason why credit fell during the crisis. Similarly, these results support use of the net stable funding ratio, a test focusing on a bank’s ability to finance illiquid assets, such as loans, with stable sources of debt finance, such as traditional deposits.

References

Acharya, Viral, Philipp Schnabl, and Gustavo Suarez. Forthcoming. “Securitization without Risk Transfer.” Journal of Financial Economics.

Cornett, Marcia, Jamie McNutt, Philip Strahan, and Hassan Tehranian. 2011. “Liquidity Risk Management and Credit Supply in the Financial Crisis.” Journal of Financial Economics 101(2), pp. 297–312.

Gorton, Gary, and Andrew Metrick. 2011. “Securitized Banking and the Run on the Repo.” Journal of Financial Economics 104(3), pp. 425–451.

Ivashina, Victoria, and David Scharfstein. 2010. “Bank Lending during the Financial Crisis of 2008.” Journal of Financial Economics 97(3), pp. 319–338.

Keister, Todd, and James McAndrews. 2009. “Why Are Banks Holding So Many Excess Reserves?” FRB New York Current Issues in Economics and Finance 15(8).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org