Commercial real estate construction faltered during the 2007 recession and has improved only slowly during the recovery. However, low interest rates have led to higher property valuations and are clearly benefiting the sector. The recovery of commercial property prices has been notable. Some measures suggest that, in some segments of the market, prices are close to their pre-recession highs. Valuation measures do not suggest that current prices are excessive.

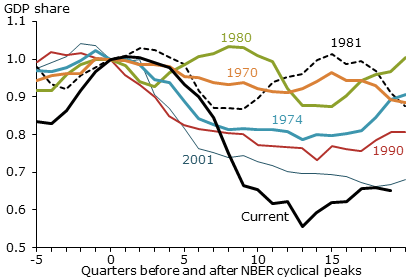

The recent downturn in nonresidential construction activity has been one of the most severe in memory. Even controlling for the depth of the recession, construction of nonresidential structures has dipped to a share of gross domestic product lower than that seen in any downturn since the 1960s. Figure 1 shows that the sharp drop in activity in the early part of the 2008–09 recession accounts for much of the recent weak relative performance in nonresidential construction.

Figure 1

Commercial real estate investment over business cycles

Note: Shares of real GDP indexed to 1 at cyclical peak.

The commercial property downturn in part reflects how the slump in the broader economy led to a deterioration of real estate fundamentals, such as rental price appreciation and vacancy rates. The magnitude of the collapse in new construction was probably also due to the extraordinary developments on the pricing and funding side of the commercial real estate sector. Commercial property prices fell about 40% from late 2007 to early 2010. This shock to real estate collateral values led to a sharp contraction in funding for commercial real estate projects. Commercial real estate loans outstanding fell 18%, and securitization of new commercial mortgages seized up.

Figure 1 could be read as indicating that the entire commercial real estate market is still seriously depressed. However, the reality is more nuanced. First, the commercial real estate market consists of both new and existing properties. It’s true that builders are not adding much new space. But there are signs of a rebound in the market for existing properties. Second, drilling down below the aggregate statistics, commercial real estate is performing differently both within and across geographical markets. Furthermore, owners of properties that are completed and fully leased have access to credit on very favorable terms. By contrast, conditions are different for more marginal properties that are not leased up or producing reliable cash flows.

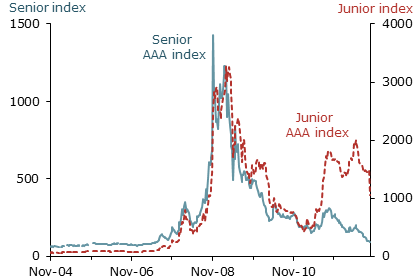

Figure 2

CMBS spreads

Let’s examine the first point, that conditions in the existing commercial property market are better than might be predicted based on the level of new nonresidential construction. One piece of evidence comes from the risk premiums that investors in commercial mortgage-backed securities (CMBS) require, which are reflected in the interest rate spreads over comparable risk-free rates. Figure 2 plots the path of the spreads of an index of AAA-rated CMBS yields over 10-year Treasury securities. Spreads on the senior CMBS tranche, which are the safest claims, are shown by the solid blue line. These spreads spiked in 2008 during the financial crisis, but have since moved back down to levels in effect before the crisis. All the same, concerns about risk are still evident in the CMBS market. The spreads on the riskier junior tranche of the AAA-rated CMBS index, indicated by the dashed red line, have not recovered as much as for senior bonds. Moreover, these spreads shot up again, along with all other risk spreads, in response to the European sovereign debt crisis.

Commercial real estate investments typically require a high proportion of borrowed funds. Access to and terms for credit figure importantly in how able and willing investors are to pay for properties. The easing of pricing for commercial real estate debt has helped fuel a mild lending recovery. Securitization of commercial real estate loans is nowhere near its level before the recession, but the pace of issuance has begun to revive. Likewise, commercial bank lenders have returned to the market, and the stock of bank nonresidential real estate loans has ticked up.

Valuation measures in commercial real estate

One common metric for valuing commercial real estate is the capitalization rate, or cap rate. It is defined as the ratio of the expected annual net operating income on a property to the price of the property. The concept is similar to the earnings yield on a stock. Net operating income changes slowly, so much of the variation in cap rates over time is due to changing property valuations.

As should be expected, interest rates, cap rates, and commercial real estate valuations move closely together. A basic principle of finance is that prices are the present value of future expected cash flows. Those prices depend critically on what discount rate is applied to these cash flows. As interest rates fall, the rate at which the cash flows on commercial properties are discounted also falls, pushing commercial real estate prices up.

Hobijn, Krainer, and Lang (2011) investigated the behavior of cap rates in different regional markets and different property categories, including offices, retail, industrial, and multifamily residential. Their goal was to explain what drives cap rates, that is, to what extent cap rates reflect discount rates and expected future cash flows respectively. They constructed a weighted index of cap rates from metropolitan markets across the country using a statistical technique called principal components analysis. They found that this weighted cap rate index moved closely with the level of interest rates. This suggests that changes in interest rates, which occur nationwide, lead to changes in commercial real estate discount rates across all local markets.

By contrast, after accounting for the interest rate component in the statistical analysis, other measures of real estate fundamentals, such as regional unemployment rates, have weak relationships with metropolitan cap rates. This is not to say that cap rates have no relationship to any economic variable except interest rates. Cap rate levels still vary over time with idiosyncratic features of local economies or individual properties. It is simply that most of the common variation of cap rates across markets can be attributed to the movement of interest rates over time.

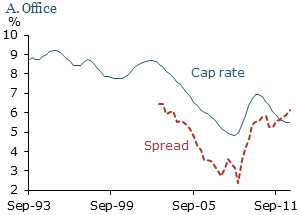

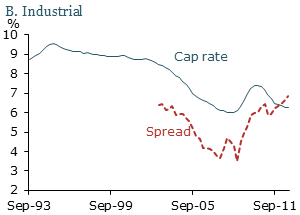

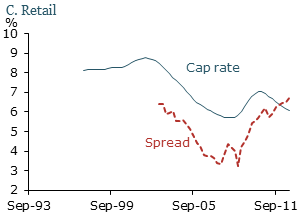

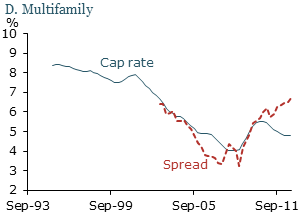

Figure 3

Cap rate comparisons for commercial real estate

Source: CBRE.

Note: Spread=Cap rate – 10-year Treasury inflation-protected securities yield.

A close look at commercial real estate fundamentals underscores the critical role interest rates play in determining cap rates. For most classes of commercial real estate, vacancies and rents have yet to recover significantly from the effects of the recession. But, as Figure 3 shows, for office, industrial, retail, and multifamily housing properties, cap rates, like interest rates, are at historical low points. This suggests that low interest rates are one of the only things currently supporting commercial real estate prices. The main exception is multifamily housing, which is seeing rising rents as well as historically low cap rates. Multifamily housing has undoubtedly benefited from the depressed demand for owner-occupied housing.

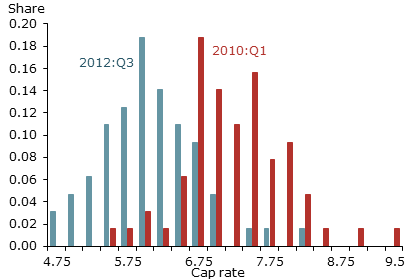

The improvements in cap rates have also been pervasive across different regional markets. Figure 4 shows that cap rates in primary metropolitan markets fell significantly from the first quarter of 2010 to the third quarter of 2012. This makes sense given the importance of interest rates for commercial real estate valuations. Of course, interest rates are determined in global financial markets. Borrowers with commercial property in different regional markets compete for funding in the broad financial market. Changes in interest rates should filter down to property markets everywhere. However, despite the nationwide improvement in commercial real estate, significant regional variation exists.

Figure 4

Distribution of regional office cap rates

Source: Metropolitan statistical area data from CBRE.

Figure 4 shows the geographic dispersion in cap rates. For example, average cap rates in San Francisco are currently close to 4%, while cap rates in Detroit are closer to 7%. In other words, investors value a dollar of earnings on commercial property in San Francisco at a multiple of 25. But they are only willing to pay about 14 times earnings for property in Detroit. Similarly, within markets, cap rates vary based on property classification. Cap rates on both Class A and Class B properties have generally come down over the last two years. But, even within the same metropolitan area, significant gaps in value are found between higher- and lower-quality properties. This undoubtedly reflects different local economic conditions and different expectations for future earnings growth even for properties within the same geographic market. These valuation disparities suggest that there still are very large differences in opportunities for different kinds of projects to get funding.

Conclusion

The improvement in commercial real estate cap rates appears to be largely the result of the recovery in credit markets. Cap rates are close to their historic lows for most property classes. At the same time, other commercial real estate fundamentals are still weak. This apparent disconnect—low cap rates and weak fundamentals—has prompted some observers to question the Federal Reserve’s low interest rate policy. The concern is that low rates may be boosting commercial real estate prices excessively. At this point, this concern does not appear to be warranted. It’s true that cap rates are at historic low levels. But it’s important to compare cap rates with other financial market yields rather than with cap rates during other periods. Many market interest rates are at or near historic lows, so low cap rates are not anomalies.

To elaborate, the red dashed lines in Figure 3 show the spread between cap rates and the yield on inflation-protected Treasury securities (TIPS). TIPS yields represent a real interest rate since they adjust to inflation. Thus, they are an appropriate benchmark for cap rates, which are based on cash flows that also adjust to inflation. Based on current cap rates, commercial real estate yields are very low. However, other benchmark bond market yields are even lower, including nominal yields that don’t adjust to inflation, such as the 10-year Treasury note or risky corporate bonds. This suggests that low cap rates are natural in a low interest rate environment. In itself, that does not tell us whether low interest rates are leading to excessive commercial real estate pricing. However, it does support the notion that improvements in commercial real estate are part of a broader healing process taking place throughout the economy.

References

Hobijn, Bart, John Krainer, and David Lang. 2011. “Cap Rates and Commercial Property Prices.” FRBSF Economic Letter 2011-29 (September 19).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org