Why are the prices of stocks and other assets so volatile? Efficient capital markets theory implies that stock prices should be much less volatile than actually observed, reflecting an unrealistic assumption that investors are risk neutral. If instead investors are assumed to be risk averse, predicted volatility is higher. However, models that incorporate investor avoidance of risk can explain real-world stock price volatility only under levels of risk aversion that are unrealistically high. Thus, price volatility remains unexplained.

The global financial crisis forcefully reminded us of the important effects of financial markets on the real economy. But it also renewed our appreciation of how difficult it is to demonstrate these connections successfully. Economists have mathematically elegant models of financial markets with strong theoretical underpinnings. They also have models that connect successfully with the data. However, few, if any, models do both. In financial economics, this is a time of uncertainty and searching for new directions. This Economic Letter summarizes developments in one important area of this field: asset price volatility.

It is easiest to summarize financial markets research by focusing on the stock market, although the analysis can be applied to other financial markets with little modification. The earliest line of financial economics research that connects directly with current work is on efficient capital markets, developed in the 1960s and 1970s (Fama 1970). The defining claim of efficient capital markets theory was that, if investors process information efficiently and price stocks rationally, then future returns cannot be forecast. That’s because, if returns could reliably be forecast to be abnormally high in the future, investors would buy stocks now. That would cause stock prices to rise immediately, bringing future returns down to a normal level. The reverse would take place if returns could be forecast to be abnormally low. Empirical research appeared to confirm that financial market returns can’t be forecast.

An important piece of evidence appears to contradict stock market efficiency: the observed volatility of stock prices. In an efficient market, stock prices should be considerably less volatile than they actually are in the real world. The inability of efficient markets theory to explain price volatility stems at least partly from the fact that it doesn’t take into account investor risk aversion. Recent research has moved away from the efficient capital markets assumption of risk neutrality, postulating instead that investors are averse to risk.

Unfortunately, formal models incorporating risk aversion produce the degree of volatility seen in the real world only with levels of risk aversion that seem implausibly high. Thus, taking investor risk aversion into account does not satisfactorily explain the volatility of stock price movements.

To understand this better, a recap of financial economics theory is helpful. Early stock market gurus such as Benjamin Graham and David Dodd (1940) held that stocks should be traded based on the relationship between their prices and the discounted value of their expected future dividends. This present value model assumed that the discount rate could be held constant. At first glance, the efficient markets model appeared to conflict with this present value model. However, Samuelson (1965) showed that, far from being contradictory, the present value and efficient markets models were essentially equivalent. If stock prices equal expected future dividends discounted at a constant rate, returns in fact can’t be forecast.

Further, the assumption that stock prices equal expected future dividends independent of the volatility of dividends can be justified only if investor risk aversion is excluded. If investors are risk averse, stock prices will depend on how variable dividends are as well as on their expected levels. By ignoring this effect, market efficiency implicitly treats investors as being risk neutral.

In the 1970s and 1980s, empirical evidence that raised questions about the efficient markets model began to surface. Shiller (1981) and others showed that, under the efficient markets model, stock prices should exhibit the same low volatility as dividends themselves.

By “price volatility,” I mean the overall variability of stock prices over time. It is important to distinguish between this definition and a frequently used alternative definition of volatility as the average variability of stock returns, consisting of dividends plus price changes. To see the difference between price volatility and return volatility, assume unrealistically that investors have information that allows them to predict future dividends into the indefinite future with perfect accuracy. Then the present value model implies that stock returns are equal to the constant discount rate and have zero volatility. At the same time though, stock prices will still go up and down as dividends change, which means they will be volatile.

Shiller’s conclusion was based on the fact that the stock price volatility implied by a given dividends model depends on how much information investors are assumed to have about future dividends. If investors cannot predict future dividend growth at all, they will price stocks at a constant multiple of current dividends. The volatility of stock prices relative to dividends will be zero. On the other hand, if investors have information about future dividends, then stock prices relative to dividends will vary over time. The more information about dividend growth investors have, the greater the average price variation. The extreme case assumes that investors can forecast all future dividends. Therefore, the price volatility associated with complete information is the highest level of volatility that can actually occur. In exercises known as variance bounds tests, Shiller and others found that observed price volatility appeared to exceed this maximum level, contradicting the efficient markets model.

Risk aversion

It is easy to see why the efficient markets model implies low price volatility. The rate of return on stock is defined as the dividend yield plus the rate of capital gain. This relation can be shown to imply that price volatility relative to current dividends is due entirely to the degree that future dividend growth and future returns can be forecast. If investors can forecast variations in dividend growth, they will price stocks at a high or low multiple of current dividends depending on whether dividend growth is expected to be high or low. In fact, dividend growth empirically is nearly impossible to forecast, implying that price volatility can be attributed to it only to a very minor extent.

The efficient markets model implies that future returns can’t be forecast. It follows that the efficient markets model combined with the empirical fact that dividend growth is nearly impossible to forecast implies low stock price volatility. Thus, the degree of stock price volatility seen empirically can only occur if we reject market efficiency and hold that future returns contain a large predictable component. In view of the association of market efficiency with risk neutrality, it follows that the market efficiency assumption of risk neutrality must be rejected to allow for risk aversion.

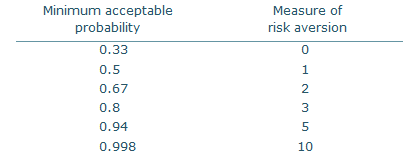

Economists have a measure of risk aversion. Suppose an investor were offered the prospect of either doubling his wealth or halving it, depending on the outcome of a random event. The higher the probability of success, the more prone the investor would be to accept such a gamble. The investor’s risk aversion can be defined to depend on the minimum probability of success that would induce him to accept the bet. The higher the minimum probability he demands, the higher his risk aversion.

An investor with no risk aversion would accept the gamble if the probability of success exceeded one-third because the gain under success is double the loss under failure. But risk-averse investors would require a higher probability of success. An investor who requires a probability of 0.5 is defined as having risk aversion of one. Table 1 shows other probabilities. A reasonable guess for the average investor’s minimum probability is around 0.67, implying a risk aversion of about 2.

Table 1

Probability of success and investors’ risk aversion

In a theoretical model, Lansing and LeRoy (2011) computed the stock price volatility implied by different levels of risk aversion. Like Shiller, they found that, under risk neutrality, predicted maximum stock price volatility is much lower than what is actually seen in the market. They also found that the higher the level of risk aversion, the higher the maximum stock price volatility. To generate a price volatility level near that seen in the real world, the model needs an implausibly high level of risk aversion around 4 or 5, implying a probability of success around 0.94 in the gamble described above. Most investors would not need such a high probability of success to accept the risk.

What’s more, risk aversion must be even higher if the stock price volatility implied by formal models is to be reconciled with actually observed volatility. Maximum volatility in the models is based on the implausible presumption that investors can predict dividends with perfect accuracy into the indefinite future. If investor ability to predict future dividends is more limited, then predicted price volatility will be lower under a given degree of risk aversion. Accordingly, still-higher levels of risk aversion are required to account for real-world price volatility.

To summarize, allowing for risk aversion can in principle generate stock price volatility similar to that seen in real-world financial markets. However, that assumes either that investors are implausibly risk averse or that they can predict dividends into the distant future, or both. Otherwise, price volatility surpasses levels that can be explained by fundamentals. It follows that assuming that investors have reasonable levels of risk aversion is not enough to explain why stock prices are so volatile.

Conclusion

The finance models summarized in this Letter are at odds with empirical data. Economists have been experimenting with innovative models that might help explain why asset prices are so volatile. Some have been looking at behavioral models that don’t assume full rationality, but these have problems of their own. So far, these investigations have not led to convincing explanations. It is far from clear where we go from here.

References

Fama, Eugene F. 1970. “Efficient Capital Markets: A Review of Theory and Empirical Work.” Journal of Finance 25(3), pp. 383–417.

Graham, Benjamin, and David Dodd. 1940. Security Analysis. New York: McGraw-Hill.

Lansing, Kevin J., and Stephen F. LeRoy. 2011. “Risk Aversion, Investor Information, and Stock Price Volatility.” FRB San Francisco Working Paper 2010-24.

Samuelson, Paul A. 1965. “Proof that Properly Anticipated Prices Fluctuate Randomly.” Industrial Management Review 6, pp. 41–50.

Shiller, Robert J. 1981. “Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?” American Economic Review 71(3), pp. 421–436.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org