Although the Federal Reserve does not target the dollar, its announcements about monetary policy changes can affect the dollar’s exchange value. Before the 2007-09 financial crisis, the dollar’s value generally fell when the Fed lowered its target for the federal funds rate. Since the crisis, the Fed’s announcements of monetary policy easing through unconventional means have had similar effects on the dollar’s exchange rate.

After the financial crisis began in 2007, the Federal Reserve reduced the federal funds rate, its main policy tool, close to zero, its lowest possible level. It has remained there since. Because the federal funds rate cannot be reduced further, the Fed has introduced unconventional policy measures to stimulate the economy. One of these unconventional measures is large-scale asset purchases, which are intended to lower long-term interest rates. Another measure is known as forward guidance, communication about the Fed’s expectations for future policy that is intended to guide market expectations and reduce policy uncertainty.

The effectiveness of these new policy tools is an open question. In particular, we don’t know whether the standard channel for transmitting monetary policy through financial markets works as well now as it did in the past. One way to measure the effectiveness of unconventional monetary policy tools is through the U.S. dollar exchange rate. Although the Fed does not target the exchange rate specifically, monetary policy decisions ultimately affect the dollar’s value, which can have important effects on the economy. For example, before the crisis, the dollar typically depreciated following declines in the target for the federal funds rate. The lower value of the dollar in turn helped raise U.S. net exports, boosting output and employment in the United States.

This Economic Letter examines how unconventional policy decisions have affected the value of the. dollar since the Fed lowered the federal funds rate close to zero in December 2008. We look at how the dollar’s value changed during the minutes immediately after Fed policy announcements. This helps isolate the response of the dollar to monetary announcements from other possible factors. In addition, because financial and currency markets may anticipate policy changes and build those expectations into prices, we account for those expectations and focus on the effects of surprise policy announcements.

Our analysis shows that unconventional monetary policy has affected the dollar exchange rate. In particular, surprise unconventional policy easing has pushed down the value of the dollar roughly as much as similar surprise downward moves in the federal funds rate did before the crisis.

Unconventional monetary policy

Identifying how unconventional monetary policy actions have affected the dollar since 2008 is challenging. Because the Fed’s recent actions are unprecedented, we have limited data to work with. To see how unconventional policy actions have affected the dollar’s value, we focus on the dates of monetary policy announcements. We broadly label these quantitative easing announcements, but they could contain news about both large-scale asset purchases and forward guidance. We look at what happened to the trade-weighted value of the dollar measured against a basket of currencies from major U.S. trading partners, including the Canadian dollar, the pound, the euro, and the yen, in a tight time window around these announcements.

The quantitative easing announcements in our sample include statements by the Fed’s policymaking board, the Federal Open Market Committee (FOMC), after scheduled meetings, and speeches and congressional testimony by Fed Chairman Ben Bernanke in which he signaled possible policy changes. Our sample includes all announcements regarding the Fed’s three rounds of quantitative easing.

- The first round began on November 25, 2008, when the Fed announced it intended to buy up to $500 billion in mortgage-backed securities and $100 billion in debt from Fannie Mae, Freddie Mac, and other government-sponsored enterprises.

- The second round started with two dates in August 2010: the August 10 FOMC statement announcing that the Fed would roll over its holdings of Treasury securities as they matured, keeping them on the Fed’s balance sheet, and Chairman Bernanke’s August 27 speech at the Economic Symposium in Jackson Hole, Wyoming.

- The third round began with the September 2012 FOMC statement announcing the decision to buy $40 billion in mortgage-backed securities in addition to the ongoing purchases of longer-term Treasuries of $45 billion per month. Another major event in this round was the December 2012 announcement that the Fed expected to wait at least until the economy reached numerical thresholds for unemployment and inflation before it would begin raising the federal funds rate. The FOMC specified these thresholds to help the public understand the Committee’s decisionmaking process and make its forward guidance more precise. (See Glick and Leduc 2013 for a list of announcements used in this study.)

We assume policy announcements immediately influence the views of market participants, and that these views are quickly reflected in the value of the dollar. To capture this effect, we look at movements in the trade-weighted value of the dollar in a 30-minute window around each policy announcement in our sample, from 10 minutes before the announcement to 20 minutes after. Using such a narrow time span allows us to isolate policy announcement effects from other possible influences on the dollar’s value. Other studies have used similar currency data (see Neely 2012 and Glick and Leduc 2012), but rely on less-frequent daily data or consider only the first round of quantitative easing.

Surprise policy announcements

How much an announcement affects the dollar’s value depends largely on whether market participants expect it or were surprised by it. If market participants anticipate the news, then no additional information is revealed and the exchange rate should not move. This makes determining market expectations crucial for our analysis.

Before the crisis, when the federal funds rate was the main monetary policy tool, researchers could easily determine the market’s policy expectations by looking at federal funds rate futures contracts. Those futures show the value of the federal funds rate that market participants expect at some future date (see, for instance, Kuttner 2001). But, the federal funds rate is now near zero and is no longer the main monetary policy tool. Thus, federal funds futures don’t tell us much now about the expectations of market participants for unconventional monetary policy.

Quantitative easing is designed to lower longer-term interest rates. That suggests that a potential way of measuring the extent to which market participants expected or were surprised by unconventional policy announcements is to look at long-term Treasury rate futures. Specifically, for any given quantitative easing announcement, we can measure changes in long-term Treasury rate futures over the same 30-minute window used to calculate the change in the dollar’s value. Big swings in futures prices at the time of the announcement suggest that the change in policy surprised participants (for more details, see Wright 2011).

Policy surprises and the dollar

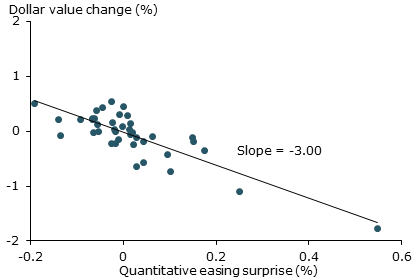

Figure 1

Dollar’s response to quantitative easing surprises

Figure 1 plots the relationship between quantitative easing policy surprises and the trade-weighted value of the U.S. dollar. The chart’s horizontal axis shows the extent of the policy surprise in percentage points. A higher value implies a larger degree of surprise easing in a policy announcement. The vertical axis shows the change in the dollar’s value, also in percentage points. For this measure, a higher value implies a greater dollar appreciation; a negative value implies depreciation.

The figure includes quantitative easing policy surprises with negative values, indicating unexpected policy tightening, and positive values, indicating unexpected policy easing. The largest positive surprises came on January 18, 2008, and March 18, 2009, during the first round of quantitative easing. The figure shows a clear negative relationship between the magnitude of surprise easing and the value of the dollar, as captured by the downward sloping line. In other words, the greater the surprise, the more the dollar depreciates. In fact, the line indicates that a 1 percentage point easing in long-term Treasury futures rates, suggesting a policy surprise, leads within 30 minutes to a roughly 3 percentage point decline in the trade-weighted value of the dollar.

How strong are these effects on the dollar’s value compared with the impact of conventional monetary policy? To gauge this, we compare these results with the effects of surprise changes in the federal funds rate before the financial crisis. This conventional policy sample period runs from January 1994, when the FOMC began issuing press releases whenever it met or changed monetary policy, until October 2008, just before the Committee lowered the federal funds rate close to zero.

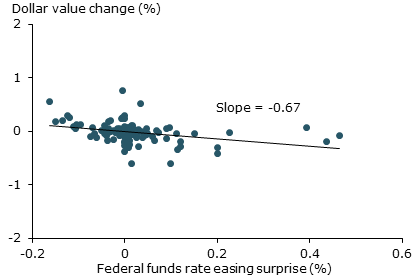

Figure 2

Dollar’s response to fed funds rate surprises

We identify surprise changes in monetary policy during this period by examining changes in federal funds rate futures in the same 30-minute window around monetary policy announcements. Figure 2 shows that the dollar tended to depreciate following surprise federal funds rate easing, measured along the horizontal axis. A 1 percentage point surprise in the federal funds rate causes the dollar to drop about 0.7 percentage point.

However, a surprise change in the Fed’s target for the federal funds rate is different from a surprise change in quantitative easing. The federal funds rate is an overnight interest rate, while quantitative easing involves longer-term securities. For instance, if the FOMC wanted to move the federal funds rate to engineer a quarter percentage point fall in the 10-year Treasury rate, it would typically have to target a decline in the federal funds much larger than a quarter percentage point.

To make an apples-to-apples comparison on how conventional and unconventional policy surprises affect the dollar, we need to develop a way of making the two types of policy announcements equivalent for measurement purposes. To do that, we look at how long-term interest rate futures changed on average following a surprise change in the federal funds rate during our pre-crisis sample period. We use this estimate to translate our quantitative easing surprises into an equivalent measure to compare with federal funds rate surprises (see Glick and Leduc 2013 for details).

We find that a quantitative easing surprise equivalent to a 1 percentage point decrease in federal funds rate futures leads to a 0.5 percentage point depreciation in the dollar. The size of this effect is comparable with the 0.7 percentage point depreciation following surprise movements in the federal funds rate before the financial crisis.

Conclusion

Our study shows that unconventional monetary policy has affected the value of the dollar. Moreover, changes in the dollar’s value immediately following surprise policy announcements are comparable before and after the crisis. This suggests that changes in unconventional monetary policy have affected the dollar about as much as changes in the federal funds rate did before the financial crisis.

It is more difficult to assess whether these changes in the dollar’s value stemming from unconventional monetary policy have similar effects on U.S. net exports as those stemming from conventional policy. The recent boost to net exports from a weaker dollar may have been obscured by other factors, such as reductions in foreign demand stemming from uncertainty about Europe’s economic recovery.

References

Glick, Reuven and Sylvain Leduc. 2013. “The Effects of Unconventional and Conventional U.S. Monetary Policy on the Dollar.” Manuscript, Federal Reserve Bank of San Francisco.

Glick, Reuven, and Sylvain Leduc. 2012. “Central Bank Announcements of Asset Purchases and the Impact on Global Financial and Commodity Markets.” Journal of International Money and Finance 31(8), pp. 2,078–2,101.

Kuttner, Kenneth. 2001. “Monetary Policy Surprises and Interest Rates: Evidence from the Fed Funds Futures Market.” Journal of Monetary Economics 47(3), pp. 523–544.

Neely, Christopher. 2012. “The Large-Scale Asset Purchases Had Large International Effects.” FRB St. Louis Working Paper 2010-018.

Wright, Jonathan. 2011. “What Does Monetary Policy Do to Long-Term Interest Rates at the Zero Lower Bound?” National Bureau of Economic Research Working Paper 17154.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org