Inflation as measured by the personal consumption expenditures price index is near historical low levels, below the Federal Reserve’s 2% longer-run goal. Another common inflation measure, the consumer price index, is also historically low, but remains closer to 2%. The recent gap between these two measures is due largely to the cost of shelter, which makes up a larger proportion of the CPI consumption basket. Based on history, the gap between the two inflation measures should close at a rate of 0.05 percentage point per month.

In January 2012, the Federal Reserve’s policymaking body, the Federal Open Market Committee (FOMC), announced it judged “that inflation at the rate of 2%, as measured by the annual change in the price index for personal consumption expenditures (PCEPI), is most consistent over the longer run with the Federal Reserve’s statutory mandate” (Board of Governors 2012). The consumer price index (CPI) is an alternative inflation measure with a longer history. Like the PCEPI, the CPI is closely monitored by the FOMC and numerous private-sector firms and government agencies to track price movements. These two inflation measures tend to move closely together, though the CPI has tended to increase a bit faster in the past. Currently, annual CPI inflation excluding volatile food and energy prices is 0.5 percentage point higher than the comparable PCEPI core inflation measure.

This Economic Letter examines the principal differences between the PCEPI and the CPI, and why their rates of inflation do not always align with one another. Their recent divergence can be explained largely by differences in how each measure accounts for consumer shelter costs. However, historical data imply that the two inflation measures should close much of this gap. Furthermore, when CPI inflation exceeds PCEPI inflation, it tends to slow towards the latter to close the gap.

A tale of two measures

The Bureau of Labor Statistics (BLS) first developed the CPI in 1913. The index is based on reports from retailers and tracks the price level for a basket of goods and services purchased by a typical urban consumer. The PCEPI is produced by the U.S. Commerce Department’s Bureau of Economic Analysis (BEA) based on the same national accounts data used to estimate gross domestic product. For most of its history, the Federal Reserve used the CPI to set policy and forecast inflation. However, in February 2000, the FOMC began using the PCEPI to frame its inflation forecasts.

The PCEPI and CPI share many of the same features. For example, the PCEPI, like the CPI, is designed to track the prices of goods and services consumed by households, and it includes much of the same data. However, the PCEPI differs from the CPI on many dimensions. The FOMC cited three of these as reasons for switching its focus from the CPI to the PCEPI (Board of Governors 2000). First, the PCEPI’s formula adjusts to changing consumption patterns, while the CPI is based on a basket of goods and services that is largely fixed. Second, the PCEPI is revised over time, allowing for inflation to be tracked as a more consistent series. Third, the PCEPI’s larger scope of goods and services provides a more comprehensive picture of the nation’s consumer spending than the CPI.

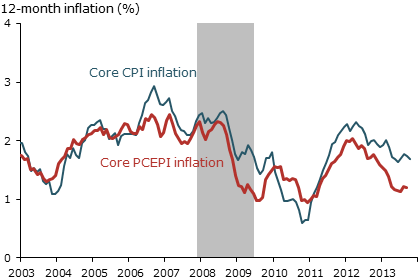

Figure 1

Core CPI and PCEPI inflation, 2003 to present

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics.

Figure 1 shows the year-over-year change in core CPI and PCEPI inflation over the past 10 years. These core measures exclude food and energy prices, reducing volatile short-run movements in the indexes. Core measures are better able to capture the underlying longer-term trends in inflation. The figure shows that core CPI and core PCEPI inflation measures are highly correlated, but that gaps frequently arise between them. Since August 2011, annual core CPI inflation has outpaced annual core PCEPI inflation by a minimum of 0.20 percentage point and an average of 0.34 percentage point. This is the longest sustained gap between these measures in the past 10 years.

What explains the gap between CPI and PCEPI inflation?

There are many reasons for the discrepancy between the CPI and PCEPI, but the differences can be summarized into questions of scope and weight. Differences in scope refer to goods and services included in one index basket but not the other. For example, in addition to direct spending by consumers, the PCEPI includes purchases by nonprofit organizations and those made on behalf of consumers by employers. By contrast, the CPI includes only direct, out-of-pocket consumer expenditures.

The PCEPI also fluctuates differently than the CPI because of variances in the weight of specific goods and services in each consumption basket. In other words, specific goods and services may make up different proportions of each basket. This weighting is meant to capture the consumption habits of individual households and determines the importance of a specific good or service in the index. For example, because the CPI only measures out-of-pocket consumer expenditures, it places a lower weight on health expenditures, which are often partially paid for by employers.

Two primary reasons explain why weights differ in the CPI and PCEPI: first, how often the weights are updated; second, the relative size of the weights in each basket. The CPI updates weights every two years, while the PCEPI updates them quarterly. The BLS method for the CPI is called a “fixed basket” approach, while the BEA method for the PCEPI is known as a “chained” approach. Broadly, this means that the CPI assumes that consumers change their purchasing habits every two years, while the PCEPI assumes that consumption habits change quarterly. Since 2000, the BLS has also produced a chained CPI to address this issue. The discrepancy in using a fixed versus a chained basket is actually small. The BEA estimates that since 2011 this difference has generated an average variation of only 0.14 percentage point between annualized CPI and PCEPI inflation.

By contrast, the difference in the size and distribution of the weights in the indexes has a more significant impact on the gap. The BEA judges that since 2011 the difference in weights caused on average a 0.56 percentage point difference between CPI and PCEPI inflation (CPS 2012 and BLS 2012). To put this in perspective, the average difference between overall CPI and overall PCEPI inflation over this period was 0.58 percentage point.

One way to see how the difference in the weights has affected the gap between CPI and PCEPI inflation is by looking at shelter prices. Importantly, neither index uses actual house prices to determine owner-occupied shelter prices. Rather, these prices are based on the rental value of owned homes. Shelter currently takes up 32% of the CPI consumption basket, but only 15% of the PCEPI basket. This difference reflects the larger scope of goods in the PCEPI, which dilutes the weight of shelter in its consumption basket. Overall, the CPI’s larger weight on shelter means that it is more sensitive to shelter price movements than the PCEPI. The BEA estimates that, since 2011, the difference in these shelter weights has caused a 0.31 percentage point difference between CPI and PCEPI inflation. This accounts for more than half of the 0.56 percentage point weight-based effect over the recent period.

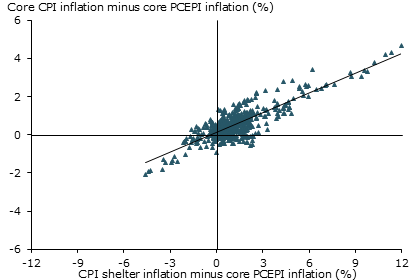

Figure 2

Role of shelter prices in overall inflation gap since 1963

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics.

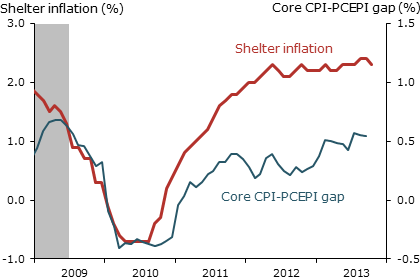

Figure 3

Shelter inflation and inflation gap, 2009 to present

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics.

Figure 2 illustrates the role of shelter prices in the overall inflation gap between the two indexes. The horizontal axis measures the gap in percentage between CPI shelter price inflation and core PCEPI inflation, based on 12-month changes. The vertical axis measures the gap between core CPI and core PCEPI inflation. The upward-sloping line shows a positive relationship between the two gap measures. The slope is approximately 0.5, indicating that, on average, when shelter price growth exceeds core PCEPI inflation by 1 percentage point, CPI inflation exceeds core PCEPI inflation by 0.5 percentage point.

Figure 3 compares recent shelter price inflation with the gap between annual core CPI inflation and core PCEPI inflation. The inflation gap falls and then rises in tandem with shelter price inflation. Thus, the recent steady increase in shelter prices relative to other prices is a major factor driving the sustained increase in CPI inflation relative to PCEPI inflation.

How does the gap usually close?

Given that gaps between these inflation measures widen and narrow over time, we can assess how the gap has closed on average historically. To do this, we construct an error-correction model to answer two questions. First, if CPI inflation and PCEPI inflation are different, do they typically converge at some point? Second, which of these two inflation measures typically moves most to close the gap?

We estimate that on average, when the two measures have diverged in the past, core CPI inflation has generally moved more to close the gap. This convergence is generally quite slow. For every 1 percentage point gap between the two measures, core CPI inflation typically moves 0.05 percentage point per month towards core PCE inflation. This suggests the current 0.5 percentage point gap will probably disappear in approximately 10 months.

Conclusion

Core CPI inflation is currently 0.5 percentage point higher than core PCEPI inflation. Historically, gaps of this size are not unusual and have primarily been driven by the differences of the weights the two indexes put on various items in their consumption baskets. For the most recent gap, the CPI’s larger weight on shelter is a major reason why that index has exceeded PCEPI inflation. Based on historical patterns, we expect core CPI inflation to move back gradually toward PCEPI inflation.

Yifan Cao is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Adam Hale Shapiro is a senior economist in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Board of Governors of the Federal Reserve System. 2000. “Monetary Policy Report to the Congress (Humphrey-Hawkins Report),” February 17.

Board of Governors of the Federal Reserve System. 2012. “Longer-Run Goals and Policy Strategy.” Press release, Federal Open Market Committee, January 25.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org