Unconventional monetary policies such as asset purchases and forward policy guidance have given the Federal Reserve much-needed tools when the traditional policy interest rate is near zero. Looking ahead to normal times, certain types of unconventional policies are best kept in reserve. If another situation arises where the Fed needs to call on these tools, it is ready and prepared to do so. The following is adapted from a presentation by the president and CEO of the Federal Reserve Bank of San Francisco to the UC San Diego Economic Roundtable in San Diego, California, on October 3, 2013.

It’s a real pleasure to be here in San Diego and I would like to thank the Economic Roundtable for inviting me. The subject of my talk today is the unconventional monetary policies pursued by the Federal Reserve over the past several years and how I see our resulting experiences shaping what will likely be the new normal for monetary policy in the future.

Why unconventional policy?

I’ll begin by describing why the Federal Reserve turned to so-called unconventional policies in the first place. As you will remember all too well, in late 2008 our country was facing the worst financial crisis and recession since the Great Depression. Congress has tasked the Federal Reserve with maintaining maximum employment and price stability. Therefore, in response to the sharp decline in employment and inflation, the Federal Reserve’s monetary policy body, the Federal Open Market Committee, or FOMC, cut the federal funds rate close to zero. The federal funds rate is the short-term interest rate that is our main conventional monetary policy tool.

Given the severity of the downturn, the FOMC would have liked to cut rates even further to provide support for the economy and avoid a damaging sustained period of price deflation. However, cutting rates further wasn’t feasible. That’s because nominal interest rates cannot fall much below zero. After all, people can hold cash, which of course pays no interest, rather than lend money out at a negative rate of return. Because of this zero lower bound on the federal funds rate, the Federal Reserve introduced alternative ways to ease financial conditions and thereby stimulate economic growth and job creation. In my talk, I’ll focus specifically on two types of unconventional monetary policy that the Fed and other central banks put in place in recent years. The first is large-scale asset purchases, referred to by most people outside the Federal Reserve as quantitative easing, or QE. The second is forward policy guidance; that is, communicating likely future Fed policy actions.

Large-scale asset purchases

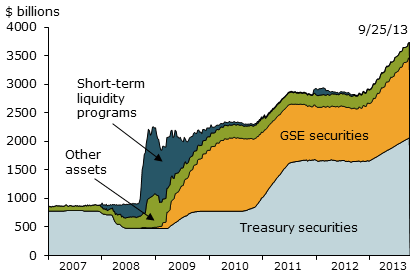

I’ll start by talking about our large-scale asset purchases, or what we at the Fed affectionately call LSAPs. The Federal Reserve has bought large quantities of longer-term Treasury securities and agency mortgage-backed securities that are guaranteed by the government. Currently, the Fed is buying $45 billion of Treasury securities and $40 billion of agency mortgage-backed securities each month. The Federal Reserve now owns an astounding $3.5 trillion of these assets in total (Figure 1).

Figure 1

Federal Reserve assets

Source: Federal Reserve Board of Governors.

What do these asset purchases accomplish? Well, no surprise here, theoretical economists are of two minds on this issue. In a textbook world of perfect-functioning financial markets, LSAPs would have essentially no effect, positive or negative. According to this theory, the price of an asset depends solely on its expected future returns, adjusted for risk. Investors bid prices up and down so that risk-adjusted returns of different kinds of assets are equal. If the price of a specific asset deviated from this level, arbitrageurs would swoop in to take advantage of the discrepancy, knowing that the price would inevitably return to its proper level. So, under these assumptions, since asset purchases by the Fed don’t fundamentally change the risk-adjusted returns to assets, they wouldn’t do anything to asset prices or the economy more broadly.

In reality, financial markets don’t work nearly so seamlessly, which creates a potential role for asset purchases to have meaningful effects on the economy. Long ago, future Nobel laureates James Tobin and Franco Modigliani argued that certain financial markets are segmented. Some investors, such as pension funds, have strong preferences or even legal restrictions on where they put their money. Such “preferred habitats” for certain types of investments can interfere with the equalization of risk-adjusted returns to different assets. For example, a pension fund might prefer to hold longer-term fixed income securities like bonds to hedge its longer-term liabilities, even if other investments offer better risk-adjusted returns. The supply and demand of assets in these habitats can affect prices because that pension fund is not going to start buying short-term securities just because the prices of longer-term securities rise.

Now, if the Fed buys significant quantities of longer-term Treasury or mortgage-backed securities, then the supply of those securities available to the public declines. As supply falls, the prices of those securities rise, and the yields on these assets decline. The effects extend to yields on other longer-term securities. Mortgage rates and corporate bond yields fall as investors who sold securities to the Fed invest that money elsewhere. Hence, our asset purchases drive down a broad range of longer-term borrowing rates. And those lower long-term interest rates stimulate the auto market, the housing market, business investment, and other types of economic activity.

Before the Federal Reserve introduced our first asset purchase program back at the end of 2008, it was hard to know which theory was right and what the effects of these purchases would be. We had no firsthand experience with such policies, and the evidence we did have was based on foreign experiences or case studies of changes in the demand or supply of Treasury securities (see Bernanke, Reinhart, and Sack 2004). That void was filled once we and other central banks introduced asset purchase programs and economists were able to carefully study their effects.

The evidence to date provides support for the view that financial markets are segmented and that asset purchase programs affect interest rates and other asset prices. There have been numerous studies of the effects of our asset purchases on longer-term interest rates (see, for example, Williams 2011, Krishnamurthy and Vissing-Jorgensen 2011, Hamilton and Wu 2012, Swanson 2011, Gagnon et al. 2011, Li and Wei 2013, and Chen, Cúrdia, and Ferrero 2011). This analysis suggests that each $100 billion of asset purchases lowers the yield on 10-year Treasury notes by around 3 to 4 basis points, that is, between 0.03 to 0.04 percentage point. That might not sound like much. But consider the Fed’s so-called QE2 program in 2010–11 that totaled $600 billion of purchases. According to estimates, that program lowered 10-year yields by about 20 basis points. That’s about the same amount that the 10-year Treasury yield typically falls in response to a cut in the federal funds rate of ¾ to 1 percentage point, which is a big change (see Chung et al. 2012 and Gürkaynak, Sack, and Swanson 2005, Table 5). Applying the same logic to the current, much larger, asset purchase program, the implied reduction in longer-term interest rates is roughly 40 to 50 basis points.

We just saw a case study of how changes in expectations of the Fed’s asset purchases affect longer-term interest rates and financial conditions more broadly. The FOMC’s announcement on September 18 that it would not change the pace of asset purchases appeared to cause financial market participants to expect that the Fed would purchase more assets in the future than they had previously believed. As a result, in the minutes following the announcement, the yield on the 10-year Treasury note fell by 18 basis points. The effects didn’t stop there. The stock market rose about 1¼% and the value of the dollar against the euro fell by around 1%.

Estimating the effects of LSAPs on the economy—as opposed to financial markets—is inherently harder to do and subject to greater uncertainty. The effects of lower interest rates take place over the course of many months and even years, and over those longer horizons it’s hard to know how much of the change in economic activity was due to the effects of monetary policy or other factors. In some of my own research with colleagues at the Federal Reserve Board, we used the Board’s large-scale macroeconomic model to try to separate the effects of LSAPs from other factors (Chung et al. 2012). We estimated that the Fed’s $600 billion QE2 program lowered the unemployment rate by about ¼ percentage point compared with what it would have been without the program.

We also found that, for asset purchases to have such sizable effects, it’s critical that short-term interest rates remain low for a significant period of time (see Chen, Cúrdia, and Ferrero 2012, and Chung et al. 2012). That is, asset purchases are most effective at stimulating the economy when they work in concert with expectations of sustained easy conventional monetary policy. This brings me to the topic of forward guidance.

Forward policy guidance

The second main way the Fed has affected longer-term interest rates and the economy is through forward policy guidance. With the federal funds rate close to zero, we can’t ease policy by moving the funds rate lower. Instead, we have looked for ways to communicate our expectation that interest rates will remain low for quite some time, through our policy statements, meeting minutes, FOMC forecasts, press conferences, and speeches.

After each monetary policy meeting, the FOMC releases a statement describing the current state of the economy, monetary policy, and the outlook for both. By varying the forward-looking language in this statement, the FOMC can alter business and investor views about where monetary policy, and in particular, the federal funds rate, is likely headed. This in turn affects longer-term interest rates, as investors adjust their views of what they will earn on short-term securities in the future. Thus, the Federal Reserve’s forward policy guidance can affect longer-term interest rates by changing people’s expectations about the future path of monetary policy.

Here’s a real-world example that illustrates the power of forward guidance. In the summer of 2011, many private-sector economists thought that the FOMC would start raising the federal funds rate in the next year. The FOMC, however, viewed liftoff from zero as likely to occur further in the future. The Fed was able to shift expectations of future policy and bring it in closer alignment with its own views by changing the forward-looking language in its August 2011 statement. Specifically, the FOMC said that economic conditions were “likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.” The statement communicated that the FOMC would probably keep the federal funds rate near zero for at least two more years, much longer than many had been expecting. As a result, longer-term interest rates fell by 10 to 20 basis points, similar in size to the response to the QE2 program I mentioned earlier (see Gürkaynak, Sack, and Swanson 2005 and Chung et al. 2012).

Since August 2011, the FOMC has extended and modified its forward guidance a number of times. Last December, we introduced a new form of forward guidance that explicitly tied our future policy decisions to specific economic events. That is, instead of describing our forward guidance in terms of dates on the calendar, we began to describe the future path of monetary policy in terms of economic variables such as the unemployment rate. Specifically, the FOMC said that it “currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6½%.”

Note that this 6½% threshold for the unemployment rate is not an automatic trigger. The FOMC statement says “at least as long as” the unemployment rate remains above 6½%. Once unemployment falls below that threshold, we will evaluate how the recovery is progressing and decide on the appropriate course for the federal funds rate then. In my own projection, even though I expect the unemployment rate to fall below 6½% early in 2015, I don’t currently expect that it will be appropriate to raise the federal funds rate until well after that, sometime in the second half of 2015.

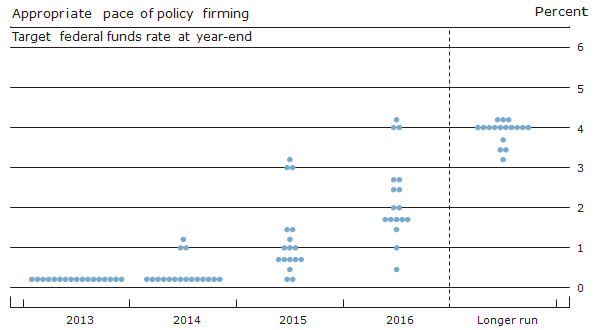

Figure 2

FOMC interest rate projections

Source: Federal Reserve Board of Governors (2013).

A second form of forward guidance is the FOMC’s projections of the federal funds rate for the next few years. Four times a year, the FOMC participants submit their views on the appropriate future path for the federal funds rate, along with the associated projections for economic growth, unemployment, and inflation. The FOMC projections for the federal funds rate from our September meeting are shown in Figure 2. A large majority of FOMC participants—14 out of 17—expect the first federal funds rate hike to take place in 2015 or later. And after the first rate hike, most FOMC participants expect the funds rate to increase only gradually, with the median projection showing it rising to just 2% by the end of 2016.

The FOMC policy projections help the public see what the Fed is thinking in concrete numbers. This serves two purposes. First, it can help the public better understand and predict the Fed’s policy intentions and plans. In the parlance of economics, it can help the public understand the Fed’s reaction function; that is, how policy changes as economic conditions evolve (Rudebusch and Williams 2008). This can reduce uncertainty and confusion from public misperceptions of Federal Reserve monetary policy. Second, the fact that there is a range of projections illustrates the fact that the future path of policy is uncertain and depends on how the economy progresses. In other words, policy is not locked on a preset course.

Although I see many benefits to greater transparency and the use of forward guidance, it is important to recognize both the limitations and some potential drawbacks of forward policy guidance. First, for it to be effective, it must be viewed as credible. In severe downturns such as we have just experienced, appropriate forward guidance may stretch years into the future. The public may not give much credence to statements about distant events, especially when the decisionmakers may be different than today. Second, clearly communicating monetary policy and the associated data dependence is simply hard to do well. Swings in asset prices in response to Fed communications over the past several months demonstrate how hard it is to convey the FOMC’s policy plans in an evolving economic environment. Just as good communication can reduce confusion and enhance the effectiveness of monetary policy, poor communication can do the opposite. Relatedly, there is the danger that Fed communication takes on too great a role in the public’s thinking about monetary policy. We want to avoid people spending too much time trying to divine Fed utterances and not enough thinking for themselves.

The future of unconventional monetary policy

So far, I’ve talked about the types of unconventional policies the Fed has followed since the federal funds rate was brought close to zero and presented evidence that shows how those policies have helped ease financial conditions and supported the economic recovery. Let me now turn to what I see as the lessons we’ve learned that can inform the use of unconventional policies in the future.

But before I do that, it’s important to emphasize that unconventional policies will continue to play an important role in providing needed stimulus to the economy for the next few years. The U.S. economy has been gradually improving for over four years now. The unemployment rate, which hit a high of 10% back in 2009, has fallen to 7.3%. This is considerable progress, but still significantly above the long-term natural rate of unemployment, which I estimate to be about 5½%. Thus, despite the improvement in the economy these past four years, we are still falling short of our mandate for maximum employment. In addition, the rate of inflation has been running well below the Fed’s preferred 2% goal for some time.

We are therefore in a situation where U.S. unemployment is still too high and inflation is too low. The appropriate stance of monetary policy is very accommodative and that will continue to be the case for quite some time. As the U.S. economy continues to improve, it will be appropriate for the Fed to start trimming its asset purchases and eventually stop them altogether. And as the economy further strengthens, and unemployment and inflation get closer to levels in line with the Fed’s mandate, the stance of monetary policy will need to be normalized. When this eventually happens, what will become of our unconventional monetary policies? Are asset purchases and forward guidance here to stay? Or were these policies only appropriate in the exceptional circumstances that ran us up against the zero lower bound?

Looking to what will constitute the new normal for future monetary policy, one must weigh the costs and benefits of conventional and unconventional policy tools in different circumstances. The experience of the past several years has taught us that unconventional policies can play a vital role in complementing conventional monetary policy, especially when short-term interest rates are near zero. But it has also revealed some limitations and drawbacks. One important consideration in choosing the appropriate mix of policy tools in the future is the degree of uncertainty associated with their effects on the economy.

A basic principle of optimal policy articulated by William Brainard (1967) over 40 years ago is: the more uncertain you are about the effects of a policy tool, the more cautiously you should use it, relying more on other instruments in which you have greater confidence. We have decades of experience using the short-term interest rate as the main conventional tool of monetary policy and have a reasonably good understanding of how it affects the economy. Given this understanding and the predictability of the effects of conventional policy actions, the short-term interest rate remains the best primary tool for future monetary policy.

I also see a continuing role for some aspects of forward guidance. The FOMC policy projections that I discussed earlier represent a shift toward greater transparency by the Fed about the likely future path of the federal funds rate. This should in turn reduce households’ and businesses’ uncertainty about where the economy and monetary policy are heading. More clarity should help households and firms make better borrowing and investment decisions and help make monetary policy more effective.

The FOMC’s emphasis on providing an economic basis for forward guidance can also improve transparency. It can help the public understand what we’re doing and why. It’s important for the public to recognize that monetary policy is not set on some fixed schedule, but rather is data-dependent. If the unemployment rate or the outlook for the labor market evolve in a certain way, then monetary policy should respond appropriately. Helping the public to understand this should help make monetary policy more transparent and effective.

That said, I expect that the explicit link between future policy actions and specific numerical thresholds, as in the recent FOMC statements, will not be a regular aspect of forward guidance, at least when the federal funds rate is not constrained by the zero lower bound. This guidance has proven to be a powerful tool in current circumstances, when conventional policy stimulus has been limited by the zero lower bound. But such communication is difficult to get right and comes with the risk of oversimplifying and confusing rather than adding clarity. Therefore, in normal times, a more nuanced approach to policy communication will likely be warranted. I see forward guidance typically being of a more qualitative nature, highlighting the key economic factors that affect future policy actions. Of course, if we again find ourselves in a situation where conventional policy has been fully utilized, then we will have the ability to return to more explicit forward policy guidance to provide additional monetary stimulus.

We should, however, only resort to asset purchases as a policy tool in special circumstances, such as when the federal funds rate is near zero and we have fully utilized forward policy guidance. Despite all that we’ve learned, the effects of asset purchases are much less well understood and are much more uncertain and harder to predict than for conventional monetary policy. Indeed, the recent outsize movements in bond rates in response to Fed communications about our current asset purchase program illustrate the difficulty in gauging the effects of asset purchases. Moreover, given our limited experience, we can’t be sure of all their consequences, which may play out over many years. When the federal funds rate was at zero and we were still facing a severe recession, it was the right call to turn to asset purchases. But, once the federal funds rate is back to a more normal level, we should relegate asset purchases to a backup role, employing it only when conventional policy and forward guidance fall short.

Conclusion

Let me offer a final thought. Before the financial crisis and recession, unconventional monetary policies were still mostly theoretical concepts on the drawing board, untested on the battlefield. In practice, they have given central banks such as the Federal Reserve much-needed tools when the traditional policy interest rate is near zero. We have learned a great deal over the past few years about their effectiveness, but also about some of their limitations. As I have discussed, in normal times, certain types of unconventional policies are best mothballed and kept in reserve in case needed. But, more importantly, the experience with these policies means that if another situation arises where we need to call on these tools, we are ready and prepared to do so.

John C. Williams is president and chief executive officer of the Federal Reserve Bank of San Francisco.

References

Bernanke, Ben S., Vincent R. Reinhart, and Brian P. Sack. 2004. “Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment.” Brookings Papers on Economic Activity 2004(2, Fall), pp. 1–78.

Brainard, William. 1967. “Uncertainty and the Effectiveness of Policy.” American Economic Review 57, pp. 411–425.

Chen, Han, Vasco Cúrdia, and Andrea Ferrero. 2012. “The Macroeconomic Effects of Large-Scale Asset Purchase Programmes.” The Economic Journal 122(564), pp. F289–F315.

Chung, Hess, Jean-Philippe Laforte, David Reifschneider, and John Williams. 2012. “Have We Underestimated the Likelihood and Severity of Zero Lower Bound Events?” Journal of Money, Credit, and Banking 44, pp. 47–82.

Federal Reserve Board of Governors. 2013. “Federal Open Market Committee: Projections Materials.” September 17–18 meeting, Figure 2.

Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2011. “The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases.” International Journal of Central Banking 7, pp. 3–43.

Gürkaynak, Refet, Brian Sack, and Eric Swanson. 2005. “Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Actions and Statements.” International Journal of Central Banking 1, pp. 55–93.

Hamilton, James, and Jing Cynthia Wu. 2012. “The Effectiveness of Alternative Monetary Policy Tools in a Zero Lower Bound Environment.” Journal of Money, Credit, and Banking 44, pp. 3–46.

Krishnamurthy, Arvind, and Annette Vissing-Jorgensen. 2011. “The Effects of Quantitative Easing on Interest Rates.” Brookings Papers on Economic Activity 43(2), pp. 215–287.

Li, Canlin, and Min Wei. 2013. “Term Structure Modeling with Supply Factors and the Federal Reserve’s Large-Scale Asset Purchase Programs.” International Journal of Central Banking 9(1), pp. 3–39.

Rudebusch, Glenn D., and John C. Williams. 2008. “Revealing the Secrets of the Temple: The Value of Publishing Central Bank Interest Rate Projections.” In Asset Prices and Monetary Policy, ed. J.Y. Campbell. Chicago: University of Chicago Press, pp. 247–284.

Swanson, Eric. 2011. “Let’s Twist Again: A High-Frequency Event-Study Analysis of Operation Twist and Its Implications for QE2.” Brookings Papers on Economic Activity 42(1), pp. 151–207.

Williams, John C. 2011. “Unconventional Monetary Policy: Lessons from the Past Three Years.” FRBSF Economic Letter 2011-31 (October 3).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org