Small businesses have historically contributed more than their share to overall employment growth in the United States. But during the recent recession, the rate of net employment losses of small businesses exceeded that of larger businesses. Sharp cuts in the rate of gross job gains at small businesses appear to have been a major factor explaining the larger net employment losses for this group. The drop in the rate of job gains reflected slower business creation and a lower rate of hiring among expanding small businesses.

Small businesses have historically contributed disproportionately to employment growth. Research suggests that most of this modest advantage takes place during periods of relatively high unemployment (see Moscarini and Postel-Vinay 2012). However, during the recent recession and recovery, that small business advantage eroded. This Economic Letter explores some of the reasons for this relatively weak employment growth among small businesses.

How hard were small businesses hit during the Great Recession?

Before the recent recession, small businesses—those with less than 50 employees—generally contributed more than their share to employment growth (see Haltiwanger, Jarmin, and Miranda 2013 and Neumark, Wall, and Zhang 2011). Between 1992 and 2007, small businesses averaged 30% of total nonfarm private employment in the United States. However, they accounted for about 35% of total net employment growth over those years. Paradoxically, the small business share of total employment shrank slightly during this period. The reason is that some small businesses expanded enough to no longer be counted as small. When they grew to larger status, their workforces were no longer counted as small business employees.

During the recent recession and recovery, small businesses experienced disproportionate job losses (see Burgen and Aliprantis 2012, Tasci and Burgen 2012, and Sahin et al. 2011). Between 2007 and 2012, their share of total net job losses was nearly double their 30% share of total employment. From the employment peak immediately before the recession through March 2009, the recession low point for private nonfarm employment, jobs at small businesses declined about 11%, according to the Business Employment Dynamics (BED) database of the U.S. Bureau of Labor Statistics. By contrast, payrolls at businesses with 50 or more employees shrank about 7%.

What explains the disparity between job losses at small and large businesses? Financial factors appear to have played a part. The financial crisis that accompanied the 2007–09 recession restrained the supply of credit to businesses. Banks severely tightened lending standards and raised interest rates for business loans during the crisis, according to evidence from the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices. Survey participants reported that the degree of tightening was about the same for businesses of all sizes. However, large companies can more easily tap public credit markets, while smaller companies depend more on bank credit. Indeed, Duygan-Bump et al. (2011) found empirical evidence that financing constraints for small businesses were important in explaining unemployment during the Great Recession. Other potential sources of small business finance were similarly hard hit. Small business owners often rely on personal credit for financing, such as home equity loans, especially if they are just starting out. Thus, falling house prices may have restricted their access to financing. Research has found an especially low rate of business formation during the Great Recession (see Shane 2011). Another study found that the employment decline at newer small businesses was especially large in states with sharp house price declines (Fort et al. 2013).

Weak demand for small business products and services may also have played a role in the pace of job losses. During the recession, the most important small business concern was poor sales, not limited credit availability, according to survey data from the National Federation of Independent Business (NFIB). Although sales of small and large businesses both took hits early in the recession, sales of large businesses recovered more quickly (Sahin et al. 2011). Using state-level NFIB data, Atif Mian and Amir Sufi (2013) showed that the degree of concern about poor sales among a state’s small businesses was strongly correlated with the decline of employment in that state. Mian and Sufi’s result may help explain outsized job losses among small businesses. These businesses have relatively few opportunities to benefit from geographic diversification, which means that their fortunes tend to be closely tied to economic conditions in their home states. By contrast, larger businesses typically serve broader, more diverse geographic markets.

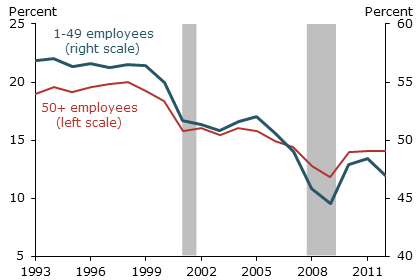

Figure 1

Gross employment gains

Source: Business Employment Dynamics and author’s calculations.

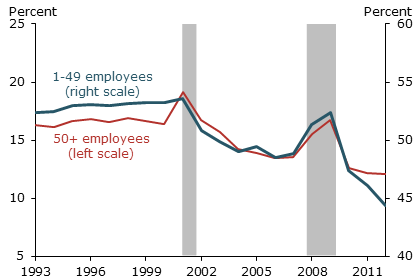

Figure 2

Gross employment losses

Source: Business Employment Dynamics and author’s calculations.

Weak gains or sharp losses?

Net employment growth equals gross employment gains minus gross losses. Figure 1 shows gross business employment gains and Figure 2 gross losses. The figures suggest that the difference between changes in small and large business employment growth in the most recent recession was mostly on the gains side. Just before the onset of the recession, the rate of job gains slowed more at small businesses than at larger businesses. By contrast, the rate of job losses at small and larger businesses followed roughly the same path before and during the recession.

The sharper slowdown in gross job gains at small businesses may also have contributed to the overall severity of the 2007–09 recession. Evidence for this comes from comparing the most recent recession with the recession of 2001. In that earlier recession, changes in job gains at small and large businesses were roughly equal. The paths for job losses at small and large businesses were also about the same in the 2001 recession, similar to the pattern in the 2007–09 downturn.

What factors might explain the sharp slowdown in gross employment gains at small businesses during the 2007–09 recession? One factor that may have played an important role was a decline in the rate of business formation. Most new businesses are small, so a decline in business formation would disproportionately affect their employment gains.

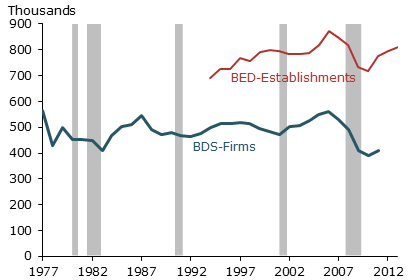

The BED database distinguishes between firms, which are defined as corporate or other legal entities, and establishments, which are units that produce goods or services, usually at a single physical location. A firm may consist of one or a number of establishments. The data presented in Figures 1, 2, and 4 are for firms. BED data do not include the formation of new firms, but they do include establishment births, which are shown in Figure 3. For example, when a manufacturer opens a new plant, it is counted as an establishment birth. Figure 3 does show firm formation using a different data series, the U.S. Census Bureau’s Business Dynamics Statistics. As the figure shows, the BED establishment birth path and the Census Bureau’s firm birth path both show steep drops in business creation just before and during the 2007–09 recession. By contrast, both the establishment and firm birth rates changed little during the 2001 recession.

Figure 3

Firm and establishment births

Sources: Business Employment Dynamics, Business Dynamics Statistics, and author’s calculations.

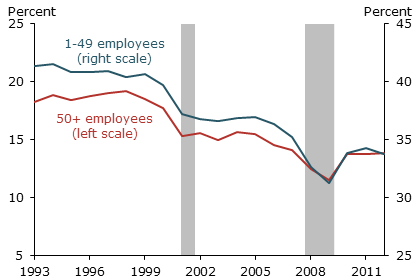

Figure 4

Gross employment gains at expanding businesses

Source: Business Employment Dynamics and author’s calculations.

A second factor explaining the sharper slowdown in employment gains at small businesses during the recession may have been relatively weak job growth at existing enterprises that were expanding employment. The drop in the rate of job growth among expanding small businesses was more pronounced than among expanding larger businesses. As Figure 4 shows, the rate of employment gains at expanding small businesses has been notably higher than the rate of gains at expanding larger businesses for many years. However, the downward trend in the job growth rate at expanding small businesses has been steeper than that for expanding large businesses, narrowing the gap between them. That gap between the employment growth paths at expanding small and large companies tightened especially quickly right before the recession.

What about the recovery? Since 2009, net employment growth at small businesses has accelerated at roughly the same pace as net employment growth at large businesses. Figures 1 and 2 show that, in the early part of the recovery, small and larger businesses followed roughly parallel paths for both job gains and losses. More recently, a deceleration in job losses at small businesses has offset a deceleration in gains. During the recovery from the 2001 recession, net employment growth at small and larger businesses also accelerated at roughly the same pace.

It appears that net employment growth trends at small businesses during the recovery have little to do with the slow pace of overall net employment growth, at least relative to the recovery from the 2001 recession. However, the impact of the severe recession on small businesses may have had a lingering effect on the recovery. Employment growth at larger businesses is typically fed by expansion of recently formed small businesses. Thus, small business retrenchment during the recession could be dampening large business expansion during the recovery. Haltiwanger, Jarmin, and Miranda (2013) found that, although most new businesses fail in their first five years, survivors tend to grow relatively quickly. This suggests that contractions in the small business pipeline could affect future overall growth.

Conclusion

During the Great Recession, net employment losses at small businesses exceeded those at large businesses. It appears that a sharper slowdown in the rate of gross job gains at small businesses than at larger businesses was the most important factor contributing to this differential. By contrast, differences in gross job loss rates among small and larger businesses were slight. Slowdowns in business formation and in the expansion of existing small businesses contributed to disproportionate small business net employment losses during the recession. Whether these developments also weakened growth among larger businesses during the recovery is an issue for further research.

References

Burgen, Emily, and Dionissi Aliprantis. 2012. “Measuring Small Business Employment over the Business Cycle.” FRB Cleveland Economic Trends, May 22.

Duygan-Bump, Burcu, Alexey Levkov, and Judit Montoriol-Garriga. 2011. “Financing Constraints and Unemployment: Evidence from the Great Recession.” FRB Boston Quantitative Analysis Unit Working Paper QAU10-6.

Fort, Teresa, John Haltiwanger, Ron Jarmin, and Javier Miranda. 2013. “How Firms Respond to Business Cycles: The Role of Firm Age and Firm Size.” NBER Working Paper 19134 (June).

Haltiwanger, John, Ron Jarmin, and Javier Miranda. 2013. “Who Creates Jobs? Small versus Large versus Young.” The Review of Economics and Statistics 95(2), pp. 347–361.

Mian, Atif, and Amir Sufi. 2013. “Aggregate Demand and State-Level Employment.” FRBSF Economic Letter 2013-04 (February 11).

Moscarini, Giuseppe, and Fabien Postel-Vinay. 2012. “The Contribution of Large and Small Employers to Job Creation in Times of High and Low Unemployment.” American Economic Review 102(6) pp. 2,509–2,539.

Neumark, David, Brandon Wall, and Junfu Zhang. 2011. “Do Small Businesses Create More Jobs? New Evidence for the United States from the National Establishment Time Series.” The Review of Economics and Statistics 93(1), pp. 16–29.

Sahin, Aysegul, Sagiri Kitao, Anna Cororaton, and Sergiu Laiu. “Why Small Businesses Were Hit Harder by the Recent Recession.” FRB New York Current Issues in Economics and Finance 17(4).

Shane, Scott. 2011. “The Great Recession’s Effect on Entrepreneurship.” FRB Cleveland Economic Commentary, March 24.

Tasci, Murat, and Emily Burgen. 2012. “Job Creation by Small and Large Firms over the Business Cycle.” FRB Cleveland Economic Trends, February 6.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org