In response to job losses associated with the Great Recession, a number of states adopted hiring credits to encourage employers to create jobs. These credits provide tax breaks to employers that create jobs or expand payrolls, with the aim of increasing hiring by reducing labor costs. The evidence on their effects is mixed, although some of these credits appear to have succeeded in boosting job growth.

In response to the Great Recession, state and federal policymakers adopted hiring credits to encourage employers to create jobs. However, there is virtually no evidence on the effects of such counter-recessionary hiring credits. This Economic Letter examines the effects of hiring credits adopted by states during and after the Great Recession. It draws on extensive research cataloguing and coding the features of state hiring credits, and performs statistical analysis of their effects (see Neumark and Grijalva 2013). Some types of hiring credits appear to have successfully boosted job growth. These include those targeting the unemployed and those that allow states to recapture credits when job creation goals are not met. At the same time, other credits did not work, and some appear to generate hiring without increasing employment or generate more total hiring than net employment growth.

The potential effects of hiring credits

Hiring credits subsidize wages for eligible workers and businesses, and therefore should boost labor demand and employment by reducing the effective wage employers pay. However, several factors can substantially reduce their effects. First, if hiring credits do not reward net new job creation, they can reward hiring that would have occurred anyway, generating windfalls for employers. Second, hiring credits may pay more for newly hired workers, creating incentives for employers to hire some workers and fire others. Third, credits usually impose administrative requirements whose costs can deter their use. Fourth, credits targeted at specific groups, such as the disadvantaged, can stigmatize such workers, with eligibility for the credit signaling their low productivity to employers.

Existing research generally argues that hiring credits are ineffective (Neumark 2013). However, most evidence supporting this comes from credits targeting the disadvantaged, in contrast with more broadly targeted programs, or credits designed to create incentives for job creation during recessions. The only evidence on a more broadly targeted countercyclical hiring credit comes from the federal New Jobs Tax Credit of the late 1970s. This evidence is more positive, suggesting that such a hiring credit can help create jobs. However, the lessons of the New Jobs Tax Credit are limited because it is dated and it is difficult to identify the effects of national policy given other changes that occurred at the same time (see Neumark 2013).

Over recent decades, states have adopted nearly 150 different types of credits. Many of these were enacted during and after the Great Recession, providing evidence on whether these credits helped counter recessionary effects. (Chirinko and Wilson, 2010, examine some earlier state hiring credits.) Moreover, the variety of state credits allows a test of whether particular credit features made them more effective as countercyclical measures. These features include targeting the unemployed or allowing claw-backs requiring businesses to repay credits if they fail to create jobs.

State hiring credits

To analyze the impact of these programs, we constructed a state hiring tax credit database. From 2007 to 2011, 31 state hiring credits were established. We focus on these because their adoption during our sample period lets us distinguish their effects from other state-level differences that could affect the labor market outcomes we examine.

Hiring credits are a subset of the many incentives states offer to promote economic activity. We define state hiring credits as policies explicitly intended to create or retain jobs statewide, based on several criteria: requiring creation or retention of jobs or increases in payroll; coverage of the whole state and a large portion of businesses or workers; and direct incentives for creating jobs rather than for other purposes, such as building infrastructure.

State hiring credits differ along many dimensions. We focus on three:

- Credits may be limited to the value of a business’s tax liability or they can be worth more by being refundable or by allowing businesses to carry them forward to future years.

- Credits can target different types of workers. In response to the Great Recession, credits targeting the unemployed are of particular interest.

- Many credits try to ensure that they pay for job creation by allowing recapture of some of the credit if net job creation is lower than required.

Effects on employment growth and hiring

We study monthly employment growth from the U.S. Bureau of Labor Statistics Quarterly Census of Employment and Wages (QCEW), and employment and hiring by state and quarter from the U.S. Census Bureau Quarterly Workforce Indicators (QWI). The QCEW data, based on unemployment insurance records, tally the number of employed workers by quarter. The QWI data use these records to track individual workers over time and measure movements of workers into and out of businesses.

We isolate the effects of state credits by examining job growth and hiring in states as the Great Recession unfolded. We compare states that did or did not implement particular types of hiring credits, and adjust for other differences. Given the great variety of state hiring credits, it is impractical to study all their dimensions. Instead, we estimate separately the effects of the three types of hiring credits noted above: refundable credits; credits targeting the unemployed; and credits that can be recaptured if job creation goals are not met.

One important control is a state business cycle measure, based on a state’s industry composition, intended to capture the recession’s impact in a state absent a hiring credit. We also control for other state policies that could affect employment and hiring, including unemployment insurance benefits, minimum wages, and federal stimulus spending.

It is possible that states with particularly anemic job growth were the ones that adopted hiring credits. Thus, we could be measuring underlying weak job growth rather than the effects of hiring credits, which would make us less likely to find positive effects of credits. To rule this out, we verified that states with greater employment losses were not systematically more likely to adopt hiring credits.

Figure 1

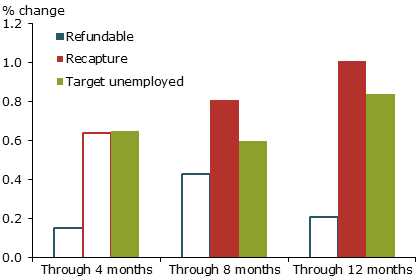

Effects of state credits on employment growth, 2007–11

Notes: Estimates are based on QCEW data.The heights of the bars measure the cumulative effects through these periods.The solid boxes indicate estimates that are statistically significant at the 5% or 10% level.

Figure 1 shows the effects of three types of state hiring credits on percentage employment change based on the QCEW data. Our analysis allows hiring credit effects to evolve slowly, so the figure reports credit effects over four months, eight months, and one year. The shaded bars indicate estimates that are statistically significant, meaning it is unlikely that we are incorrectly detecting an effect of hiring credits because of random data movements. The estimates indicate that hiring credit effects largely appear in the first four months after adoption, but persist beyond that.

The evidence suggests that a few specific types of hiring credits enacted during and after the Great Recession successfully boosted employment. Relatively weak evidence indicates that refundable hiring credits boosted employment by up to 0.43% after eight months. Stronger evidence indicates that credits allowing recapture of payments if hiring goals are not met and credits targeting the unemployed substantially increased employment. For example, the estimate for credits targeting the unemployed implies that such a credit boosts employment by 0.84% after 12 months. We do not have cost information on such credits, but it is highly unlikely that states spent anything close to 0.84% of payrolls within their borders on these credits. Thus, the benefits are likely to have outweighed the costs, although this might not hold if the jobs created were extremely low wage.

At the same time, many types of state hiring credits do not appear to have been effective. Interestingly, we did not find evidence that temporary hiring credits were effective, even though theory suggests they should be because such credits reduce near-term labor costs the most compared with the future. However, this finding may reflect the difficulty of knowing whether employers perceived the credits as temporary. Moreover, it is important to emphasize that, in some cases, only one or two states initiated a particular kind of hiring credit in the period we studied, making it hard to draw firm conclusions.

When we look at hiring using the QWI data, the results to some extent reflect the employment results from the QCEW data. In particular, credits allowing recapture and those targeting the unemployed have large and significant positive effects. However, in both cases, the positive estimates are about 10 times as large as the effects on employment overall, suggesting that these credits may generate considerable job churning. It is common to have a lot more hiring than net job growth. In general, gross job creation rates are larger than net employment growth, frequently by a factor of around 10 (Davis and Haltiwanger 1999). The result for recapture provisions also indicates that, despite the intention of providing incentives for net job creation, these provisions may not prevent businesses from claiming credits for some hiring that does not create new jobs on net.

Conclusion

Specific types of state hiring credits succeeded in boosting employment, although many types of credits did not spur job growth. Weak evidence supports the effectiveness of refundable credits, while stronger evidence indicates that credits targeting the unemployed or allowing for recapture of payments if required goals are not met are effective. Because there are not many new hiring credits, what can be learned about the effects of credits enacted in this period is limited. Hence, the findings must be interpreted cautiously. Nonetheless, the positive results we find make sense in light of existing work. Credits that target narrow groups, such as the disadvantaged, can stigmatize workers, sending negative signals to employers. But credits targeting the unemployed would probably not have this effect because many workers are out of work during and after a severe recession, making it unlikely that joblessness would reflect badly on them. Refundable credits are worth more to employers than nonrefundable credits. Moreover, many credits have failed to create jobs, in part because putting in place just the right incentives is difficult. Recapture provisions can help overcome this problem. In addition, evidence suggests that hiring credits can potentially have unproductive effects that can lead to churning of workers without increasing employment. Nonetheless, it appears that well-designed hiring credits—in particular those that broadly targeted the unemployed to avoid stigmatizing eligible workers and those that allowed states to recover credits if job growth did not take place—did help states boost job growth during and after the Great Recession.

David Neumark is Chancellor’s Professor of Economics and Director of the Center for Economics & Public Policy at the University of California, Irvine, and a visiting scholar at the Federal Reserve Bank of San Francisco.

Diego Grijalva is an Assistant Professor of Economics at Universidad San Francisco de Quito.

References

Chirinko, Robert S., and Daniel J. Wilson. 2010. “Job Creation Tax Credits and Job Growth: Whether, When, and Where?” FRB San Francisco Working Paper 2010-25.

Davis, Steven J., and John Haltiwanger. 1999. “Gross Job Flows.” In Handbook of Labor Economics, volume 3, part B, eds. Orley Ashenfelter and David Card. Amsterdam: North Holland, pp. 2,711–2,805.

Neumark, David. 2013. “Spurring Job Creation in Response to Severe Recessions: Reconsidering Hiring Credits.” Journal of Policy Analysis & Management 32(1), pp. 142–171.

Neumark, David, and Diego Grijalva. 2013. “The Employment Effects of State Hiring Credits During and After the Great Recession.” NBER Working Paper 18928.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org