Helping the public understand how monetary policy is conducted is an important goal for the Federal Reserve. One way to measure people’s understanding is through surveys that show household expectations for the economy. Responses from the Michigan survey show some groups of households appear to hold beliefs consistent with basic features of U.S. policy. In particular, households with higher incomes and more education appear to better grasp how interest rates relate to inflation and unemployment, particularly during times of labor market weakness.

The Federal Reserve often emphasizes the need to communicate to improve people’s understanding of monetary policy. Fed officials reach out to the public through speeches (Bernanke 2010 and Yellen 2013), lectures (Bernanke 2012), and educational programs for the general public (FRB San Francisco 2014). As the argument goes, greater communication and transparency about what the Fed is doing and why should help households and firms make better-informed decisions about setting prices and wages, which in turn should improve policy effectiveness.

The main challenge in evaluating the public’s understanding is that the Federal Reserve does not follow one formal rule in working toward its dual mandate of stable prices and maximum employment. However, some simple rules, such as the Taylor rule, mimic reasonably well how the Fed has conducted U.S. monetary policy at certain times. A simple version of this rule suggests that policy rates should correlate positively with inflation and negatively with unemployment.

This Economic Letter assesses whether the public understands the basic features of monetary policy according to how well people’s expectations match this simple rule. We combine households’ answers to survey questions about what they expect for future inflation, unemployment, and interest rates. We find that household awareness depends on both demographic characteristics and on the business cycle. Higher income and more educated households have a better grasp of relationships and changes in monetary policy. In addition, the negative relationship between unemployment and interest rates that is apparent in actual data only shows up in household answers during periods of labor market weakness.

The Taylor rule and the Michigan survey questions

Taylor (1993) showed that, although the Fed does not formally follow any specific rule, U.S. monetary policy since the mid-1980s can be approximated by a simple rule—a “Taylor rule”—that relates interest rates to inflation and unemployment rates. According to one version of this rule, policy interest rates should respond to deviations of inflation from its target and unemployment from its natural rate (Rudebusch 2010). This simple rule implies that the policy rate correlates positively with inflation and negatively with slack in economic activity, so that the policy rate rises as inflation rises and as the unemployment gap narrows.

While these relationships are well known among researchers, it’s difficult to determine whether the general public has the same basic understanding. To explore this, we turn to the Survey of Consumers conducted by Thompson Reuters and the University of Michigan, known as the Michigan survey. This survey interviews U.S. households about their personal finances and demographic characteristics, and also asks about their expectations for changes in interest rates, inflation, and unemployment over the next 12 months.

Since the Taylor rule appears to mimic how the Fed conducts monetary policy for some periods of time, we can use these household expectations to assess if their answers are consistent with the basic relationships implied by the Taylor rule.

As a basis for our study, suppose that the Fed’s target for the federal funds rate depends positively on current inflation and negatively on current unemployment, and changes only with these two variables. Then, if people in the survey predict that unemployment will go down and inflation will go up in one year, to be consistent with the Taylor rule, they would have to answer, more often than not, that the Fed will tighten monetary policy over the same period. We emphasize that our analysis does not classify answers as correct or incorrect, but only searches for relationships across households’ answers (see Carvalho and Nechio 2014).

Monetary policy and survey answers between 1987 and 2007

The sample for our initial analysis starts in August 1987; this coincides with the beginning of Alan Greenspan’s tenure as chairman of the Federal Reserve Board, since the Taylor rule came to be seen as a good approximation for U.S. monetary policy for much of this period. The Taylor rule does not allow for the federal funds rate to fall below zero. As such, and because the survey questions pertain to 12-month forecasts, we end the sample in December 2007, a year before short-term interest rates in the United States had essentially dropped to zero.

We pool survey answers across all households and estimate the relationships between expected changes in interest rates, inflation, and unemployment rates. We then compare our findings with results from actual changes using monthly data on the three-month Treasury bill rate, 12-month consumer price index (CPI) inflation, and the civilian unemployment rate.

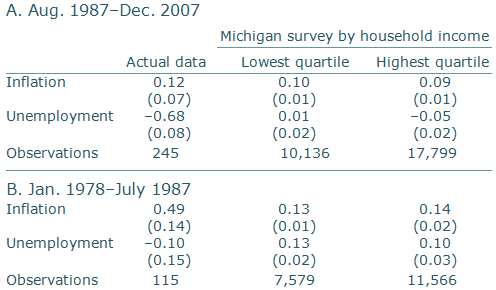

Table 1

Estimated relationships of interest rates with

inflation and unemployment

The top part of Table 1 shows our first set of results, along with their standard errors in parentheses. Survey results are split between households in the lowest and highest income groups, which generally resemble data for lower and higher education levels. For our analysis, we focus only on whether these estimated relationships have a positive or negative sign.

The actual data in the first column display the expected pattern. Changes in interest rates correlate positively with changes in inflation and negatively with changes in unemployment. The Michigan survey data show a strong positive relationship between answers regarding inflation and interest rates for both income groups. The unemployment relationship, however, is only negative for higher income households.

These findings suggest that higher income households better perceive the patterns found in the data. They also show that, regardless of the demographics, the relationship between interest rates and inflation in the Michigan survey answers is positive, but the negative relationship between interest rates and unemployment is weaker.

Deviations from the Taylor rule in the mid-2000s

While the Taylor rule usually provides a good description of how U.S. monetary policy is conducted, there can be sizable deviations at times. During the mid-2000s, in particular, Fed policy arguably deviated from the Taylor rule. From August 2003 to May 2004, the Fed kept a constant target of 1% for the federal funds rate and resorted to “forward guidance,” communicating that the target rate was expected to be maintained at this level for a “considerable period.” In June 2004, the Fed began to remove monetary policy accommodation at a pace it said was “likely to be measured,” and raised its target for the federal funds rate by 25 basis points (Federal Reserve Board 2003, 2004). The indication that the pace of monetary tightening would likely be measured and the 25-basis-point increases in its policy target continued until the end of 2005.

To test whether households perceived any change in the conduct of monetary policy at that time, we check whether our estimated relationships using the Michigan survey data also changed. For this, we focus on higher income households and pool results by year of the interview. If household answers reflect their perceptions of monetary policy, their responses should change during periods of deviation from a Taylor rule.

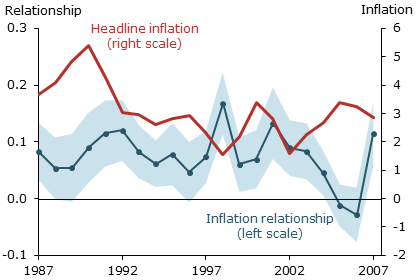

Figure 1

Relationship between interest rates and inflation

Source: Michigan survey, authors’ calculations, and Bureau of Labor

Statistics.

Note: Headline inflation=CPI inflation.

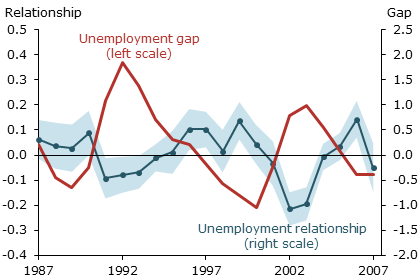

Figure 2

Relationship between interest rates and unemployment

Source: Michigan survey, authors’ calculations, and Congressional

Budget Office (CBO).

Note: Unemployment gap=Unemployment rate–natural rate (from CBO).

Figure 1 reports the estimated relationships between Michigan survey answers about interest rates and inflation (blue line) and the actual yearly average inflation rate (red line). Figure 2 reports the survey’s estimated relationships between interest rates and unemployment (blue line) and the actual yearly average unemployment gap (red line). The gap is defined as the difference between the measured unemployment rate and the natural rate, that is, the unemployment rate that would cause inflation to neither rise nor fall. The shaded areas around the blue lines correspond to the most likely range of variability of the estimated relationships. Hence, shaded areas that include zero, meaning no relationship, are less informative.

Consistent with the idea that households’ responses reflect their perceptions of monetary policy, Figure 1 shows a strong positive relationship between interest rates and inflation for most of the sample, except during the mid-2000s when it falls substantially and becomes not much different from zero.

The estimates for the relationship between unemployment and interest rates also yield an interesting pattern, varying systematically over the business cycle. The negative relationship is much stronger during periods of labor market weakness. This could show that households believe policy varies depending on the economy, or it could simply show that households become more attentive to how the policy rate and unemployment are related during economic downturns.

Monetary policy and survey answers between 1978 and 1986

Another way to judge if households are aware of how monetary policy is conducted is to view Michigan survey data from before 1987, that is, before the relationships described by the Taylor rule came to be seen as a good proxy for U.S. monetary policy.

Actual data from 1978 to 1986 in the bottom panel of Table 1 show a positive relationship between interest rates, but a much weaker relationship not significantly different from zero between interest rates and unemployment. Comparing the relationships from the two periods in the top and bottom panels indicates that the role of unemployment changed. While the relationship between interest rates and inflation is positive in both periods, the relationship between interest rates and unemployment only turns strongly negative after 1987. Turning to the Michigan survey data, the estimated results in the bottom of Table 1 show a positive relationship of interest rates with both inflation and unemployment for lower and for higher income households.

The survey results suggest that higher income households seem to have perceived the changes in the actual data. Comparing data from before and after 1987 indicates that these households may have grasped how monetary policy changed between these two periods. In particular, higher income households seem to have perceived the change in the role of unemployment in monetary policy.

Conclusion

Some households appear to hold beliefs consistent with basic features of U.S. monetary policy. In particular, during times of economic slack households with higher incomes seem to form expectations in accordance with a Taylor rule.

Does this mean that they understand monetary policy? The answer is not entirely clear. Households may simply base their expectations on patterns from their own experiences, rather than attempting to predict future policy decisions. In that case they might respond as if they understand monetary policy. Alternatively, while some groups of households understand monetary policy, they may find forecasting time-consuming and costly; thus, they only think about economic policy when doing so is particularly important, such as at times when the labor market is weak and unemployment makes headlines.

Regardless of what drives the business cycle variation in Michigan survey responses, we can conclude that some people’s beliefs have changed as U.S. monetary policy has evolved. This suggests some households, particularly those with higher income and more education, understand how inflation, unemployment, and interest rates are related as if they had some basic understanding of U.S. monetary policy.

Carlos Carvalho is an Associate Professor of Economics at Pontifical Catholic University of Rio de Janeiro.

Fernanda Nechio is an economist in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Bernanke, Ben. 2010. “Monetary Policy Objectives and Tools in a Low-Inflation Environment.” Speech at FRB Boston conference, “Revisiting Monetary Policy in a Low-Inflation Environment Conference,” October 15.

Bernanke, Ben. 2012. “The Federal Reserve and the Financial Crisis.” Lecture 3, Chairman Bernanke’s College Lecture Series, March 27.

Carvalho, Carlos, and Fernanda Nechio. 2014. “Do People Understand Monetary Policy?” Forthcoming, Journal of Monetary Economics. FRB San Francisco Working Paper 2012-01.

Federal Reserve Bank of San Francisco. 2014. Fed Chairman Game

Federal Reserve Board. 2003. “Minutes of Federal Open Market Committee,” August 12.

Federal Reserve Board. 2004. “Minutes of Federal Open Market Committee,” May 4.

Rudebusch, Glenn. 2010. “The Fed’s Exit Strategy for Monetary Policy.” FRBSF Economic Letter 2010-18 (June 14).

Taylor, John. 1993. “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Conference Series on Public Policy 39, pp. 195–214.

Yellen, Janet. 2013. “Confirmation Hearing before the Committee on Banking, Housing, and Urban Affairs.” U.S. Senate, Washington, DC., November 14.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org