Financial market prices contain valuable information about investors’ views regarding future interest rates, inflation, and other economic variables. However, such market-based expectations can be hard to interpret because changes in risk and liquidity premiums also affect asset prices. In practice, policymakers should be cautious in relying on the expectations information in market prices.

People’s expectations for future income, interest rates, and inflation are important determinants of financial and economic outcomes. But these expectations are not observable. Surveys of the public or economic forecasters can provide some guidance, but they are published only monthly at best. Statistical estimates based on historical data are also useful but are subject to considerable model uncertainty.

A popular alternative is to use financial market prices to infer investors’ expectations. For example, the breakeven inflation (BEI) rate, which is the difference between nominal and inflation-adjusted bond yields, provides a measure of market-based expectations of future inflation. However, market-based expectations do not correspond exactly to real-world expectations because asset prices also reflect the compensation that investors require for making risky and somewhat illiquid investments.

Fluctuations in risk and liquidity premiums and in other market forces complicate how market-based expectations are interpreted and used by policymakers—including central bankers. For example, over the second half of 2014, BEI rates fell dramatically. Does this reflect a drop in the public’s expectations of future inflation or does it reflect other market forces? This Economic Letter describes what policymakers can and cannot learn from financial market prices about expectations of future economic outcomes and how best to interpret and use that information.

Real-world and market-based expectations

When interpreting market prices, it’s useful to distinguish between two types of expectations for future events, which we call “real-world” and “market-based” expectations.

Real-world expectations are based on the standard “true” probabilities of everyday interpretation, for example, the probability that it will rain tomorrow. These probabilities are associated with the underlying process that actually generates the observed data. However, they are generally not known and must be inferred by using a statistical model, by individual introspection, or by surveying households or professional forecasters. In any case, such estimates often include a substantial amount of uncertainty.

Market-based expectations draw directly from the probabilities implied by prices in financial markets. Indeed, by definition, market-based probabilities set expectations of discounted future payoffs equal to current market prices. Therefore, an asset with a high price tends to imply high market-based probabilities for outcomes that have a high payoff. Market-based probabilities are altered versions of real-world probabilities that account for the risk compensation required by investors. Intuitively, the market-based probability of a certain outcome can be high either because the real-world probability is high or because investors worry a lot about their financial position in that circumstance. These are also called “risk-neutral” or “risk-adjusted” probabilities and expectations.

Market-based expectations are easily measured from asset prices and are available without the need to rely on statistical models, surveys, or the judgment of forecasters. Therefore, they are sometimes used in place of real-world expectations—especially at short forecast horizons. For example, market-based expectations of future short-term interest rates can be observed from interest rates on government bonds or money market futures (Bauer and Rudebusch 2013, Bauer 2014). Market-based expectations of inflation and probabilities for different inflation scenarios in the near future can be obtained from prices on inflation swaps (Bauer and Christensen 2014). Similarly, to assess the future fiscal implications of central bank policies, Hilscher, Ravis, and Reis (2014) use market-based probabilities of future inflation outcomes, while Christensen, Lopez, and Rudebusch (2013) use model-based real-world probabilities.

Using market-based expectations for policy decisions

In theory, choosing an optimal policy under uncertainty involves two steps: (1) assigning probabilities to uncertain future outcomes depending on the choice of the current setting of policy, and (2) ranking the relative desirability of different policy choices by evaluating their expected benefits and losses. Normally, a policymaker would use real-world probabilities to calculate the expected net benefits of a variety of possible policy actions, and then choose the policy action that maximizes that net benefit. Using market-based probabilities instead is generally viewed as potentially misleading because they combine investors’ views about real-world probabilities with investors’ views and preferences regarding risk. While each of these components is of interest, the standard approach to policy treats them differently.

As an alternative, Minneapolis Fed President Kocherlakota (2013) and staff (Feldman et al. 2014) recently advocated using market-based probabilities to choose optimal policy, both in theory and in practice. Their reasoning is straightforward: If the goal of a policy is to maximize the expected net benefit, then in theory, calculating that net benefit using market-based rather that real-world probabilities puts more weight on outcomes that investors care strongly about. That is, the market-based probabilities through their embedded risk adjustment contain the correct weighting of benefits and losses for policy—assuming the policymaker has the same preferences as investors. In their simple theoretical model, choosing a policy that maximizes social welfare leads to the exact same policy that maximizes the expected net benefit using market-based probabilities.

If we take this argument literally, policymakers would not need to estimate real-world expectations, but could instead simply use readily available market-based expectations. For example, consider a central bank that cares only about inflation and aims to minimize deviations from a target inflation level. In general, this central bank will want to keep expected inflation—measured with real-world expectations—close to its target, and would therefore need to carefully estimate the real-world expectations of future inflation. But if the central bank had the same preferences as financial investors, the optimal strategy would be to adjust monetary policy so that market-based expectations of future inflation—measured, say, by BEI rates—are equal to the inflation target, adjusted perhaps for a constant risk premium. Accordingly, there would be no need to use any other information in setting policy than the market-based expectations.

Forces that distort market-based expectations

Although there is a theoretical argument for using market-based expectations in setting policy, in practice, a variety of factors can distort the information in financial market prices and thus make market-based expectations misleading for policymakers. For one, participation in financial markets is limited: Many people do not invest in stocks and bond markets, let alone derivatives markets. Since many households are effectively shut out from these key asset markets, the investors who determine asset prices and market-based probabilities may not be representative of all U.S. households. Accordingly, market prices may not reflect the views and preferences of the average U.S. household, and policies that respond strictly to market-based probabilities may reflect the views of only a small set of people. Another issue related to participation is that asset prices are often driven by the behavior of foreign investors, including, for example, sovereign wealth funds or foreign central banks. These investors affect market prices but are outside the mandate of U.S. policymakers.

Another complication of basing policy only on market-based probabilities is that markets are not complete, meaning that existing financial contracts do not cover all possible contingencies. For example, there are no futures markets, and thus no market-based expectations, for the unemployment rate. For a monetary policymaker with a dual mandate for both price stability and maximum employment—like the Federal Reserve—monetary policy cannot rely only on market-based expectations, since none exist for a key macroeconomic variable.

In addition, the liquidity of certain securities—that is, the ability to easily buy and sell them—also affects market prices. Indeed, market-based expectations often appear distorted by substantial liquidity premiums that fluctuate over time. For example, the liquidity premium incorporated in the price of nominal Treasury securities rises during times of crisis when investors are searching for a safe haven.

Finally, there is a widespread view that some movements in asset prices represent shifts in market sentiment rather than in fundamentals. Indeed, asset prices appear to be more volatile than can be explained by economic determinants such as dividend payouts, profit projections, or default risk. Large flows out of equities and into bonds during “risk-off” phases—when flight-to-safety demand pushes up the prices of safer assets—seem to alternate with flows in the opposite direction during “risk-on” phases when investors’ appetite for risk improves. These changes in market sentiment, which can be viewed as exaggerated or even potentially irrational, are a key source of volatility in financial markets that policymakers may wish to avoid reacting to.

Example: The recent drop in BEI rates

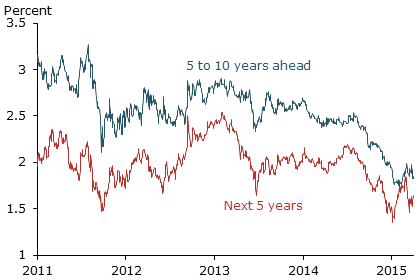

As an example of making policy with market-based expectations, consider U.S. monetary policymakers, who closely follow inflation expectations obtained from financial markets (Christensen, Lopez, and Rudebusch 2010). Figure 1 shows the past four years of BEI rates, calculated as the difference between nominal Treasury yields and Treasury inflation-protected securities (TIPS) yields, measuring inflation over the next five years and the subsequent five years. These BEI rates are the most commonly used measures of market-based inflation expectations.

Figure 1

Breakeven inflation (BEI) rates

Since the middle of 2014, market-based inflation expectations for 5 to 10 years ahead have plummeted from 2.5% to 1.8%. At face value, these changes would indicate a drop in long-term inflation expectations, which would be worrisome given the Fed’s explicit longer-run inflation objective of 2%. Indeed, a strict market-based approach to making policy would argue that the Fed should take immediate action toward more accommodative policy to push the BEI rate back to the inflation target.

But can the recent decline in BEI rates be taken at face value? Note that a similar decline occurred in the fall of 2011 when 5- to 10-year-ahead BEI rates suddenly dropped over a percentage point despite increases in actual inflation and steady long-run inflation expectations from surveys. A key factor then was the European sovereign debt crisis, which triggered massive flight-to-safety purchases of nominal Treasury bonds but not the less liquid TIPS. These inflows pushed down nominal yields much more than inflation-adjusted yields, hence BEI rates dropped. This is a striking example of substantial changes in market-based expectations that were largely driven by market forces that the Fed would likely want to avoid reacting to.

More recently, as expectations of an impending quantitative easing program by the European Central Bank steadily increased over the second half of 2014, European sovereign bond yields declined and capital outflows from Europe to the United States surged. Hence, international financial developments were probably an important factor in driving down U.S. BEI rates over the past year as well. Again, a strict, mechanical reliance on these changes in BEI rates to set U.S. monetary policy would seem unwise.

Conclusion

Financial market prices can be a valuable source of information for policymakers, including central bankers. However, it is important to recognize the limitations of market-based expectations. Market prices may vary for a number of reasons that are unrelated to the fundamental factors of interest to policymakers. Therefore, it appears that policy cannot be formulated exclusively using information in market-based expectations.

Michael D. Bauer is an economist in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Glenn D. Rudebusch is director of research and executive vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Bauer, Michael. 2014. “Options-Based Expectations of Future Policy Rates.” FRBSF Economic Letter 2014-29 (September 29).

Bauer, Michael, and Jens Christensen. 2014. “Financial Market Outlook for Inflation.” FRBSF Economic Letter 2014-14 (May 12).

Bauer, Michael, and Glenn Rudebusch. 2013. “Expectations for Monetary Policy Liftoff.” FRBSF Economic Letter 2013-34 (November 18).

Christensen, Jens, Jose Lopez, and Glenn Rudebusch. 2010. “Inflation Expectations and Risk Premiums in an Arbitrage-Free Model of Nominal and Real Bond Yields.” Journal of Money, Credit, and Banking 42(6), pp. 143–178.

Christensen, Jens, Jose Lopez, and Glenn Rudebusch. 2013. “A Probability-Based Stress Test of Federal Reserve Assets and Income.” FRB San Francisco Working Paper 2013-38.

Feldman, Ron, Ken Heinecke, Narayana Kocherlakota, Sam Schulhofer-Wohl, and Tom Tallarini. 2015. “Market-Based Probabilities: A Tool for Policymakers,” January, manuscript.

Hilscher, Jens, Alon Raviv, and Ricardo Reis. 2014. “Inflating Away the Public Debt? An Empirical Assessment.” NBER Working Paper 20339.

Kocherlakota, Narayana. 2013. “Optimal Outlooks.’’ Speech, “Conference on Extracting and Understanding the Risk Neutral Probability Density from Options Prices,” NYU Stern School of Business, September 20.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org