Glenn Rudebusch, executive vice president and director of research at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

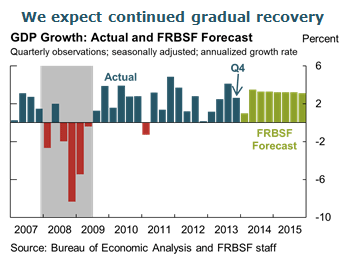

- Real GDP grew a solid 2½% over the four quarters of 2013, despite being held back by less accommodative fiscal policy. More recently, unusually severe winter weather in many parts of the country account for some but not all of the weakness in spending and employment. Starting this spring, we anticipate a return to above-trend growth of around 3 to 3½%. Improving financial conditions, increasing credit availability, accommodative monetary policy, and healthier labor and housing markets all support a faster pace of growth.

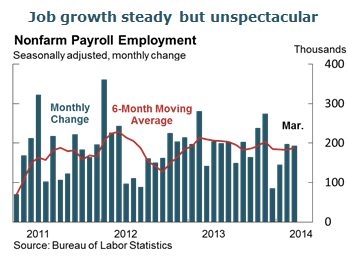

- A strengthening labor market is a crucial underpinning for developing a strong, self-sustaining economic recovery. The March jobs report posted a healthy payroll employment gain of 192,000. Clearly, the job market has shrugged off the adverse effects of the winter weather. Averaging over the past six months suggests continuing fairly solid gains in employment. Given the job gains over the past four years, the private sector has finally made up all the jobs lost during the recession. However, because the government is employing fewer workers now than at the start of the recession, total employment—private sector plus government workers—is still a half million jobs short of its peak. Of course, the population has been growing as well, so there is a long way to go to return to full employment.

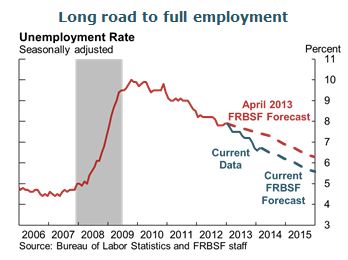

- The long road ahead is apparent in our unemployment rate projection. The data for the past year have been somewhat lower than we had expected. With solid future economic growth, we anticipate continued declines in unemployment.

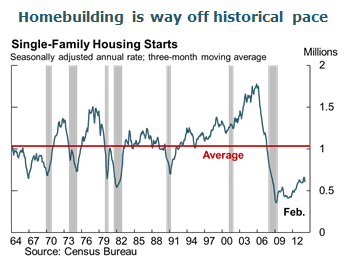

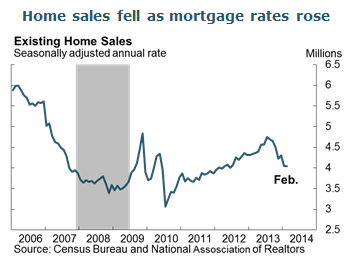

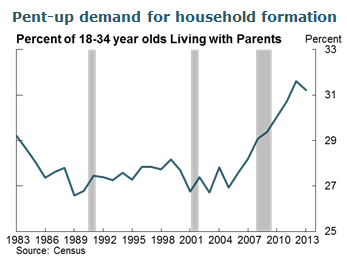

- Following most past recessions, a housing revival provided a significant boost to the early stages of recovery. In line with this, housing was expected to be much more of a tailwind for the recovery by now. Instead, housing demand has dropped off since the middle of last year. Slackening demand from institutional investors appears responsible for some of the decline in home sales, but much of the drop can be attributed to last year’s jump in mortgage interest rates. We remain optimistic about the eventual recovery of the housing market given the likely significant pent-up demand. The percentage of adult children living with their parents rose substantially during and after the Great Recession, and some should be setting out in starter homes and raising the pace of household formation.

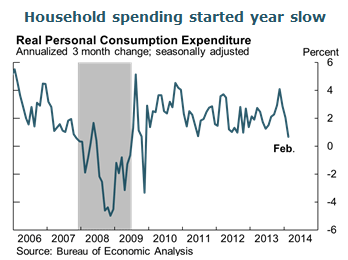

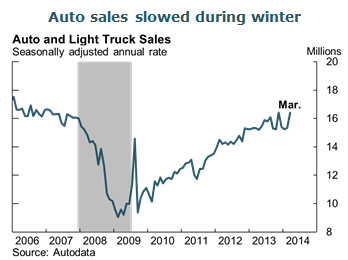

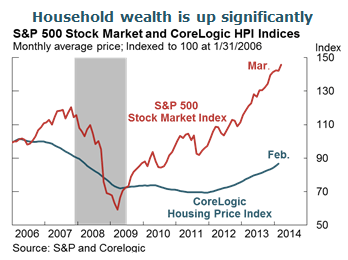

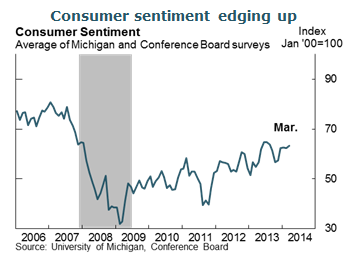

- Overall, household spending started the year a bit slow. Again, poor weather and other special factors make it difficult to get a good read on underlying demand. Auto and light truck sales also slowed around year-end. Looking ahead, the gains in household wealth produced by rising home and equity prices and improved consumer confidence should lead to stronger consumption.

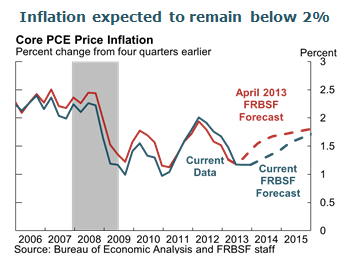

- Personal consumption expenditures price inflation has stubbornly remained little changed over the past year. Currently, on a year-over-year basis, headline inflation is 0.9% and core inflation, excluding food and energy prices, is 1.1%. We expect inflation will start to return toward the Federal Reserve’s 2% longer-run inflation target later this year.

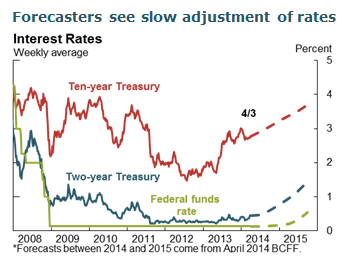

- A key factor supporting further growth is continued easy financial conditions—owing in part to accommodative monetary policy. The Fed has reinforced low interest rates with two key actions. First, the Federal Open Market Committee (FOMC) has provided forward guidance about future short-term rates. Second, the FOMC has purchased Treasury bonds and government-sponsored enterprise mortgage-backed securities to directly bid up bond prices and push down longer-term yields.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.