Òscar Jordà, senior research advisor at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

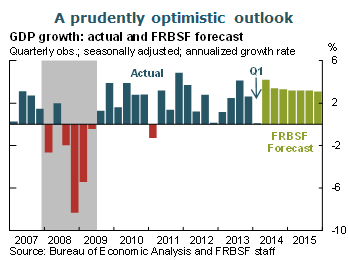

- Real GDP grew a disappointing 0.1% in the first quarter of 2014, according to initial data. Unusually severe weather in many parts of the country slowed residential and business fixed investment activity considerably. However, despite a slowdown in retail sales, overall growth in personal consumption expenditures remained solid in the first quarter, propelled by spending on a wide array of services. Moreover, employment growth picked up substantially over the past three months, largely offsetting the winter lull.

- We anticipate economic activity will recover strongly in the second quarter, with above-trend growth of around 4%, before settling down for the second half of the year. Three factors justify this optimism: Investment activity is expected to rebound from the effects of severe weather; accommodative monetary policy has improved access to credit; and greater stability in labor markets will continue to solidify gains in spending.

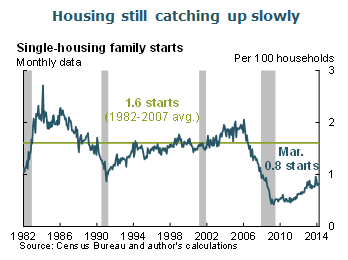

- It is sometimes said that the housing cycle is the business cycle. In other words, the overall economy tends to follow the ups and downs in the housing sector. Following previous recessions, housing had been a consistent tailwind boosting economic recovery. However, since the end of the most recent recession, housing has been recovering very gradually, especially over the past three quarters. Housing starts of new single-family homes, by far the largest category of residential construction, remain well below the historical norm.

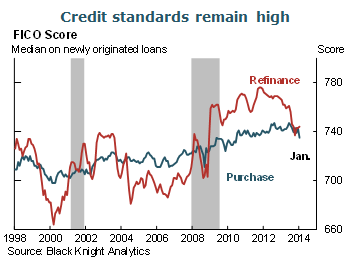

- In the aftermath of typical financial crises in the United States and other countries, credit tightens, asset prices fall, and households go through a rapid and painful period of deleveraging. In the current recovery, credit standards for new mortgages remain high, a trend that started as the house price boom began its slide. Credit standards for refinancing also shot up during the recession, but they have gradually loosened over the past year and a half. They are now on a par with standards for new loans. This improvement in credit market conditions is consistent with the recent bounceback in house prices, which has helped many borrowers regain positive equity and thus improved their opportunities to refinance.

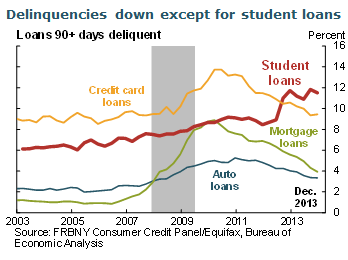

- Credit conditions have continued to improve across lending categories. Delinquency rates are gradually returning to pre-recession levels with one notable exception, student loans. After mortgages, student loans are the largest lending category, ahead of auto loans and credit cards. Delinquency rates for student loans jumped in 2013 and have remained elevated. This jump is likely an echo effect from the cohort of students that began college during the recession and recently began entering a still difficult job market. The student debt load may have contributed to the recent slow formation of new households, which in turn attenuates demand for housing.

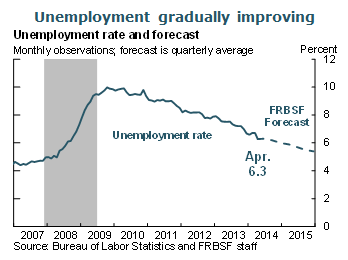

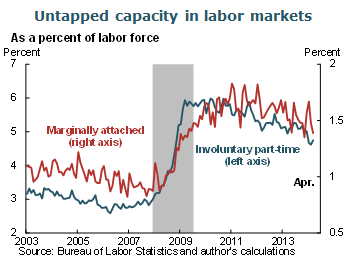

- Unemployment continues to improve gradually toward its natural rate. The unemployment rate declined from 6.7 to 6.3% in April, but this was mainly due to a large drop in labor force participation. Two indicators suggest there still is significant untapped capacity in the labor market. The share of labor force participants who are working part-time but would prefer a full-time job is about 3 percentage points higher than at the start of the recession. Similarly, the ratio of marginally attached persons, that is, those not in the labor force who want a job, has increased about 0.5 percentage point over the same period. These two measures of untapped capacity are consistent with significant labor market slack and restrained readings on labor compensation growth.

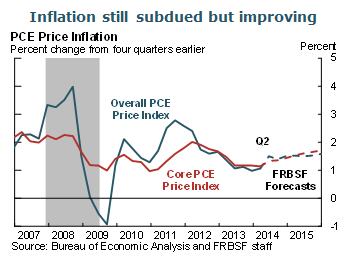

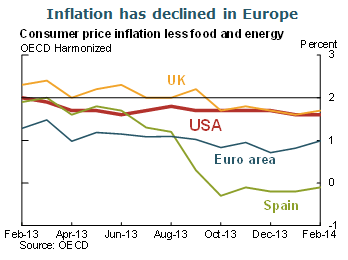

- As labor market slack continues to dissipate and consumer confidence grows, we expect that price inflation will gradually rise toward its mandate-consistent levels. Inflation has been running below the 2 percent rate that reflects the Federal Reserve’s notion of price stability for almost two years. This low inflation environment is not unique to the United States. Several other developed economies have been experiencing a similar bout of subdued inflation.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.