Rob Valletta, vice president at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

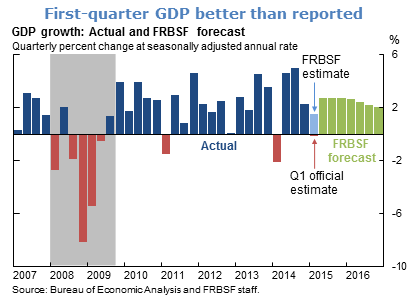

- Real GDP declined slightly in the first quarter of 2015, falling 0.2% at an annualized rate, according to the U.S. Bureau of Economic Analysis (BEA). However, recent San Francisco Fed staff research suggests that seasonal factors not accounted for in the official BEA figure held down that estimate. The staff’s alternative estimate of 1.5% growth in the first quarter is consistent with an ongoing moderate expansion for the U.S. economy.

- Favorable data on consumer spending and the housing market thus far in the second quarter reinforced expectations for continued growth. We expect a second-quarter rebound to be largely maintained in coming months, with growth converging back near its 2% long-run trend by late 2016. Recent fragile conditions overseas, most notably the financial and economic turmoil in Greece and the stock market decline in China, are unlikely to derail the U.S. expansion.

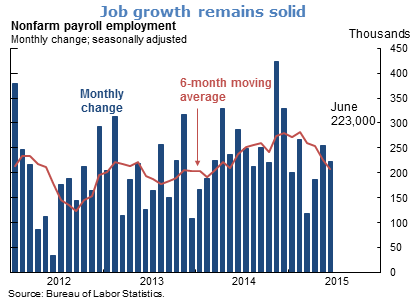

- Our expectation of a moderate expansion is also supported by continued solid employment growth. Job gains this year have slowed relative to last year’s torrid pace. Still, averaging slightly above 200,000 per month, they remain well above the minimum needed to sustain improvement in labor market conditions.

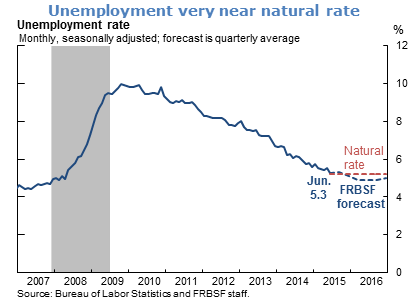

- Sustained employment growth has helped push down the unemployment rate further this year. The June level of 5.3% is closing in on the long-run normal or natural rate that is generally consistent with stable inflation, which we estimate at 5.2%. Our forecast calls for the unemployment rate to fall below the natural rate later this year and remain below it through next year.

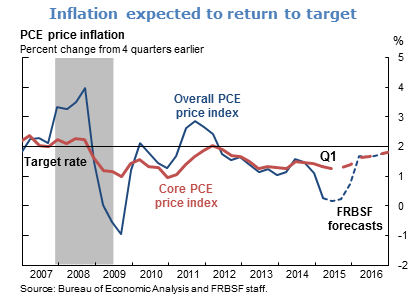

- Inflation remains well below the Federal Open Market Committee’s 2% objective. This largely reflects temporary factors, particularly the earlier fall in energy prices and appreciation of the dollar, that are already showing signs of stabilizing or reversing. Despite the strong influence of energy and food prices on overall inflation, the core inflation rate that strips out these volatile prices has shown only a slight decline. The dissipation of temporary factors combined with the elimination of labor market slack should pull the inflation rate back close to target by the end of next year.

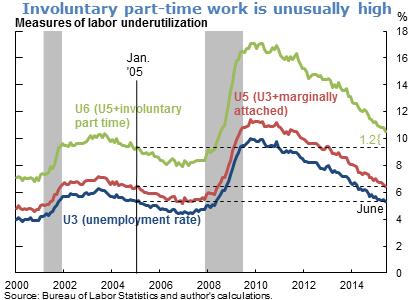

- Our inflation projection is based partially on the reliability of the unemployment rate as an indicator of labor market slack or underutilization. The Bureau of Labor Statistics provides alternative measures of labor underutilization. In their typology, the official unemployment rate is known as U3, with U4 through U6 capturing broader components of labor underutilization.

- U5 incorporates unemployed people who are “marginally attached” to the labor force, who want and are available to work but are not actively searching for a job. The June 2015 level of U5, 6.4%, is identical to its level in January 2005, the point in the prior economic expansion when the official unemployment rate (U3) also matched the June 2015 level of 5.3%. This relationship generally holds for all comparable months across business cycles dating back to the initial publication of underutilization series in 1994, which suggests that the unemployment rate is still a reliable measure of labor market slack relative to the broader U5 measure.

- The broadest measure of labor underutilization, U6 incorporates individuals who are working part-time for economic reasons, also known as involuntary part-time workers, who would like a full-time job but are unable to find one. In contrast to U5, U6 is currently high relative to its past relationship with the unemployment rate. Compared with its value in January 2005, the involuntary part-time employment rate is up about 1.2 percentage points. This may suggest significant labor market slack beyond that reflected in the unemployment rate.

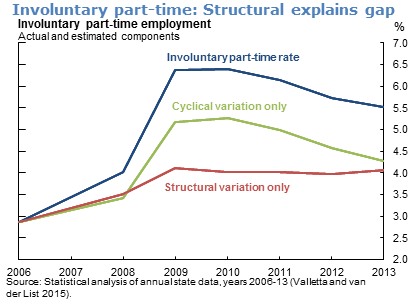

- The degree of slack associated with the unusual elevation of the U6 series depends on the evolution of the determinants of involuntary part-time work. It varies across industries and age or gender groups. It also may respond over time to changes in labor costs, such as employers’ health benefit costs. Such factors may reflect relatively persistent structural changes in the labor market that are independent of the business cycle and the Federal Reserve’s maximum employment goal.

- Separating the cyclical and structural components indicates that cyclical factors account for most of the overall movement in involuntary part-time work. However, persistent structural factors explain most of the additional 1.2 percentage point amount of involuntary part-time work that is present at this stage of the business cycle. This suggests that the U6 series does not reflect additional labor market slack beyond that reflected in the official unemployment rate (U3) series.

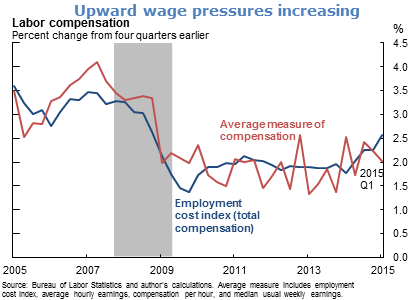

- One sign that the labor market is near maximum employment is an increase in upward wage pressures and observed wage growth. Our standard set of four compensation measures, which combines earnings and employment costs, are somewhat mixed. On balance, however, they show an acceleration beginning in mid-2014, most notably for the employment cost index.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.