Nicolas Petrosky-Nadeau, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of June 9, 2016.

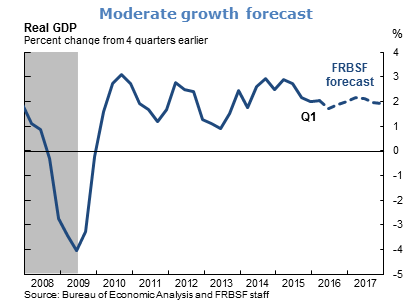

- The U.S. Bureau of Economic Analysis (BEA) recently bumped up its estimate of real GDP growth in the first quarter of 2016 to 0.8%, at an annual pace, from the initial estimate of 0.5%. Even with this upward adjustment, San Francisco Fed research suggests that inadequate accounting for first-quarter seasonal factors indicates the BEA estimate significantly understates the economy’s underlying growth momentum. Smoothing through such seasonal fluctuations, we see GDP growth hovering around 2% on a four-quarter basis. This pace is consistent with an ongoing moderate expansion, which we expect to continue over the next few years.

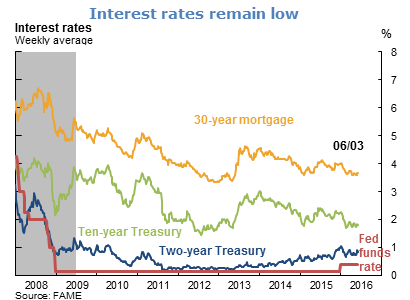

- Financial conditions remain supportive of growth. Rates on a broad class of financial instruments have declined over the last year, such as the rate on conventional 30-year mortgages, which remains near its historic low. In addition, the U.S. dollar has continued to unwind some of its earlier appreciation, which helps to reduce the relative price of domestically made products.

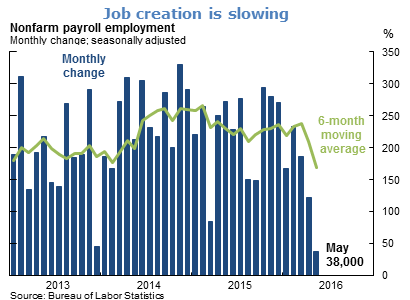

- The Bureau of Labor Statistics reported weak job creation in May, with the U.S. economy adding only 38,000 jobs. Along with the March and April job growth numbers, which were revised down to 186,000 and 123,000, the pattern in recent months suggests a marked slowdown in hiring.

- However, additional San Francisco Fed research suggests that the pattern of job growth in recent months reflects weather effects such as unusually warm temperatures in March, which pulled some springtime job gains forward. After accounting for the unusual weather pattern as well as the Verizon employee strike, our revised employment numbers imply relatively consistent job gains over the past three months. And while the average gain of 152,000 jobs per month represents a slowdown relative to the robust pace of the past few years, it is well above the level needed to support further improvement in overall labor market conditions, estimated to be in the range of 60,000 to 100,000 new jobs per month.

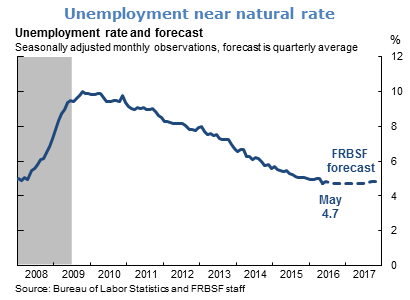

- In contrast to the sluggish job creation, the unemployment rate declined by 0.3 percentage point to 4.7% in May. As with the reported limited job gains, we take little signal from this sharp drop in unemployment, which largely reflects a drop in the labor force. However, unemployment is now significantly below our estimate of its normal or natural rate, which we judge to be 5.0%. Other measures of labor market activity remain strong, including job openings and voluntary quits. Combined, these indicators are consistent with an economy that has reached maximum employment, and we expect additional strengthening in labor market conditions going forward.

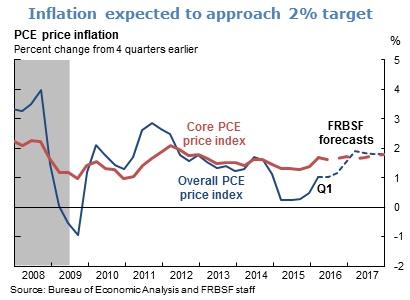

- Inflation continues to move towards the Federal Open Market Committee’s stated 2% target. Overall personal consumption expenditures (PCE) price inflation is projected to register 2.1% at an annual pace in the second quarter, and 1.5% for 2016 as a whole, compared with 0.5% in 2015. Core inflation, which strips out movements in food and energy prices, has also firmed early this year and is expected to come in at 1.7% for the year as a whole, versus 1.4% last year.

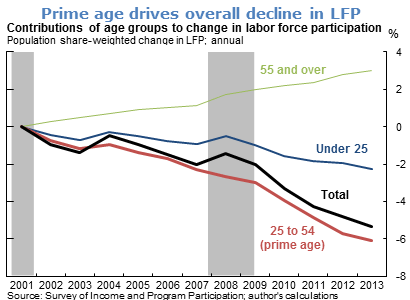

- Over the past few months, the labor force participation (LFP) rate has largely reversed the gains observed since the middle of last year. This decline in the participation rate since the recession ended is likely driven by the longer-term changes in the U.S. labor market rather than any cyclical factors.

- Individuals over the age of 55 have lower participation, and their rising population share will tend to pull down the overall participation rate. However, this group went through a period of increasing labor force participation during the first decade of the 21st century, which has muted their downward pull on the overall rate.

- Our research into the changing labor force participation rate has focused more on the so-called “prime-age workers,” who are between the ages of 25 and 54. The behavior of this group accounts for the bulk of the decline seen in the overall participation rate since 2001.

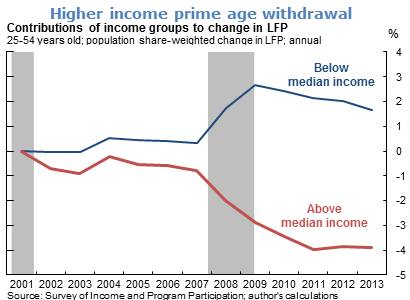

- Most of the participation decline among prime-age workers occurred for those living in middle- to high-income households, with little change in the bottom half of the household income distribution. In part, this is a response to the stronger wage gains in the upper portion of the distribution. Lower-income households often need multiple earners to make ends meet, while higher-income households often have more flexibility. The data show that the percentage of households with multiple earners has been declining; this suggests that higher-income groups may be shifting toward the “life” part of the work-life balance. If so, their participation rates may continue to stay low.

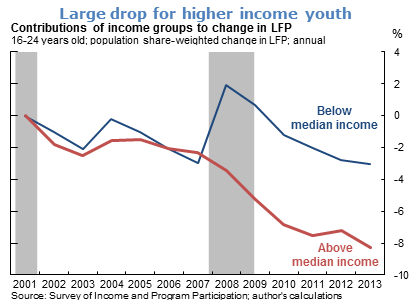

- A similar pattern of strong declines in the labor force participation rate emerges among young workers. For people between the ages of 16 and 24, those living in households with above median incomes contributed 8 points of the 11 percentage point decline for the age group. As with prime-age workers, the decline in participation among young workers is following a trend set in motion before the most recent recession, and it is not likely to be responsive to the business cycle.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.