Mary C. Daly, executive vice president and director of research at the Federal Reserve Bank of San Francisco, stated her views on the current economy and the outlook as of April 13, 2017.

- Recent data confirm that economic activity has continued to expand at a moderate pace, bolstered by supportive financial conditions, a strong labor market, and solid gains in consumer spending. Over the next few years, we expect real GDP growth to remain moderate, averaging around 1¾%.

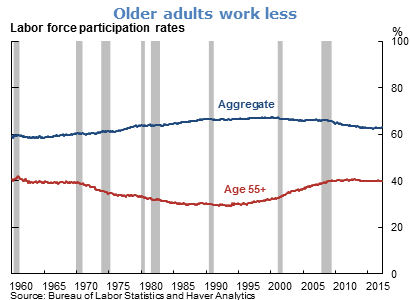

- The April jobs report left little doubt that the economy has reached full employment. Unemployment fell to 4.5% in March, below most estimates of its sustainable level in a healthy economy, or the natural rate. Other indicators also point to stronger conditions. For example, the number of workers who reported being involuntarily part time employed continued to tick down, and despite considerable downward pressures associated with the aging of the baby boomers, the share of adults working or looking for work has held steady. We expect labor market conditions to remain robust in the coming years, putting additional upward pressure on wages and prices.

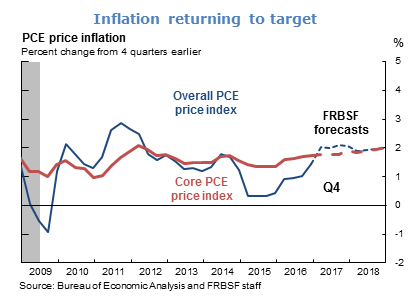

- Turning to inflation, the latest data show that headline and core prices have risen a bit faster than expected. Boosted by energy prices, overall inflation, as measured by the price index for personal consumption expenditures, was up 2.1% in February, from 12 months earlier. The index for core prices, which excludes food and energy, was up 1.8%. We expect inflation to moderate in the coming months but to move back to the Federal Reserve’s 2% goal on a sustained basis by the middle of next year.

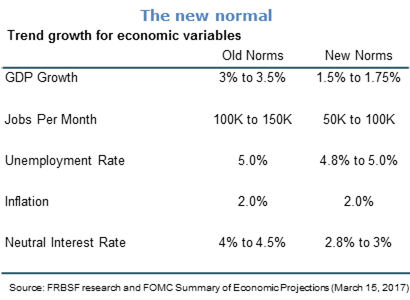

- With the cyclical effects of the Great Recession mostly behind us and monetary policy normalizing, the economy is moving towards its sustainable steady state. But the “new normal” is expected to look a lot different than the old. Assessments show that a sustained expansion will be characterized by real GDP growth of 1½% to 1¾%, job growth of 50,000 to 100,000 per month, and a neutral federal funds rate of around 3%.

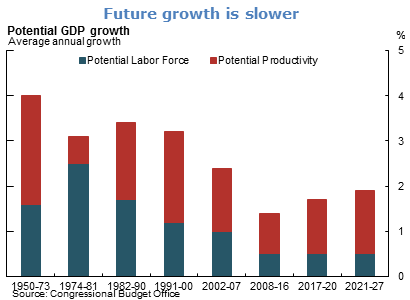

- Projections of normal GDP growth reflect assessments of labor force and productivity growth. Expectations for these elements, especially for labor force growth, are much more modest than in the past.

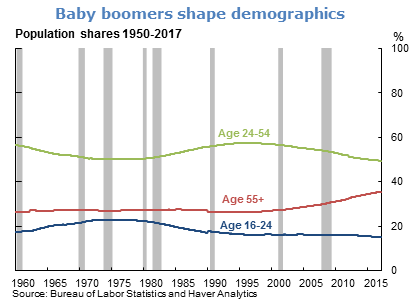

- Labor force growth is largely determined by population demographics, which in the U.S. has been shaped largely by the baby boom generation. In the 1970s and 1980s, the labor force grew quickly as baby boomers hit working age and greater numbers of women entered the labor market. Baby boomer retirements have already started to curb labor force growth and will continue to do so for the next decade. The Congressional Budget Office projects that the U.S. labor force will grow at about a 0.5% annual pace through 2027.

- Importantly, productivity growth is unlikely to make up the gap. With the exception of the years from 1995-2004, productivity growth has averaged 1% to 1¼% over the past 40 years, and lately has been far slower. But even if productivity growth picks back up to its historical pace, combined with the expected labor force growth, it implies a new normal for GDP growth of around 1½% to 1¾%, far slower than the 3% to 3½% growth from previous decades.

- Of course, slower labor force growth also reduces the number of jobs the economy must create to keep the labor market at full employment. Going forward, a growth rate of 100,000 jobs per month will be considered a normal pace rather than a disappointing number.

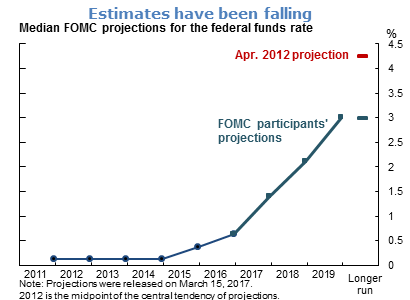

- Slower economic growth and an aging population is likely to put downward pressure on the longer run fed funds rate (FFR*). Since April 2012, the median projection among FOMC participants for the long-run level of FFR* has been marked down by 1¼ percentage points, from 4¼% to 3% as of March 2017.

- The decline in FFR* reflects an evolution of views on the equilibrium real funds rate, r*, or the real rate of interest in the economy that balances the supply and demand of funds when the economy is in steady state. Secular forces have been pushing the supply of savings up and the demand for business investment spending down.

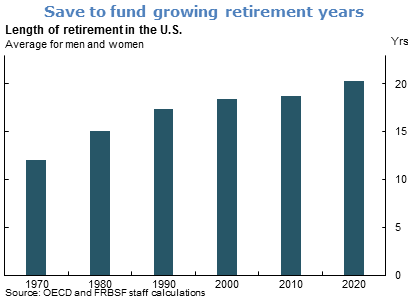

- Improved life expectancy combined with a largely stable average retirement age suggest that aging baby boomers will need to fund longer periods of time out of the workforce, implying an expected pattern of less spending and more saving. Slower GDP growth going forward implies that investment spending will also slow down. Taken together, these two forces will work to reduce the equilibrium real funds rate in the economy.

- The implications of a low r* are important. With less room to reduce rates in a downturn, there is a greater chance that the Federal Reserve will run into the zero lower bound on the federal funds rate. Discussions of unconventional monetary policy including balance sheet policy and forward guidance will be brought more regularly to the forefront.

- In sum, while the economy has largely healed from the aftermath of the Great Recession, we face new challenges associated with an aging population and slower economic growth. Slower growth and a lower neutral rate of interest are likely to be with us for some time.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.