Zheng Liu, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of December 14, 2017.

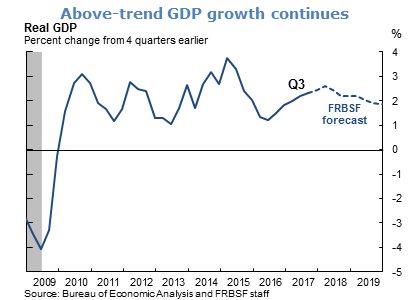

- Real GDP grew at an annual rate of 3.3% in the third quarter, according to the most recent estimate of the Bureau of Economic Analysis. Over the first three quarters of this year, real GDP has expanded at an average annual rate of about 2.5%. This growth reflects solid gains in personal income and improved consumer confidence, supported by a strong labor market and boom in the stock market. Dollar depreciation this year also has contributed to net export growth.

- If Congress passes the tax reform legislation by the end of this year or early next year, we expect a modest boost to GDP growth in 2018 and 2019. We expect real GDP to grow at an average annual rate of about 2¼% through 2018, before slowing to 1¾% in 2019. This forecast reflects the expected gradual tightening of monetary policy, as well as the longer term effects of population aging and slower productivity growth.

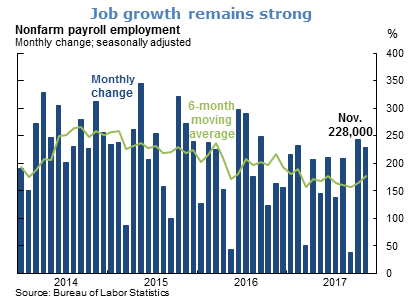

- Labor market conditions continued to strengthen. Nonfarm payroll employment increased by 228,000 jobs in November, following 224,000 in October. Despite the hurricane-related employment slowdown in September, the recent job growth brought the six-month average to about 178,000 per month, putting the U.S. economy on track of gaining over 2 million jobs this year.

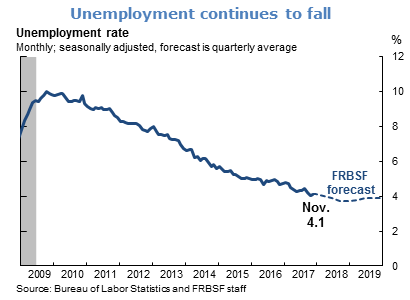

- The unemployment rate was unchanged in November from its October value of 4.1%. We expect the unemployment rate to decline further to slightly below 4.0% by the middle of 2018 as the economy continues to strengthen. With gradual removals of monetary policy accommodation, we expect the unemployment rate to return gradually to our estimate of the natural rate of 4¾%.

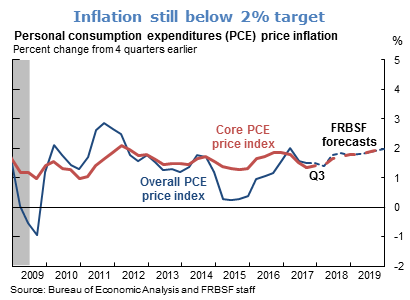

- Inflation remains below the FOMC’s target of 2%. In October, the personal consumption expenditure (PCE) price index rose 1.6% over the past 12 months, and the core PCE price index, which removes volatile food and energy prices, rose only 1.4%. This low inflation partly reflects declining costs of health-care and telecommunication services, which are likely to be transitory and are less sensitive to changes in overall economic conditions than prices such as housing, restaurants, and recreation services.

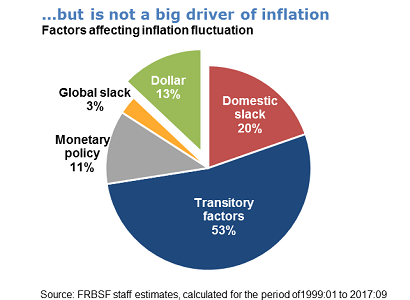

- Inflation dynamics are driven by several factors. These include domestic economic slack such as the unemployment gap and wage growth; monetary policy, which affects inflation expectations; transitory factors such as health-care and telecommunication services; global economic slack, which drives foreign demand for U.S. exports; and the dollar exchange rate.

- The dollar exchange rate measured by the trade-weighted broad dollar index has depreciated about 6% since the beginning of this year. A weaker dollar can boost U.S. inflation directly by raising import prices and indirectly by passing through to other prices. It can also raise inflation by increasing global demand for U.S. exports.

- Staff statistical analysis suggests that fluctuations in the dollar value are not a big driver of inflation. Over the period from January 1999 to September 2017, the dollar exchange rate is estimated to account for about 13% of inflation fluctuations on average.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.