Rhys Bidder, economist at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of May 11, 2017.

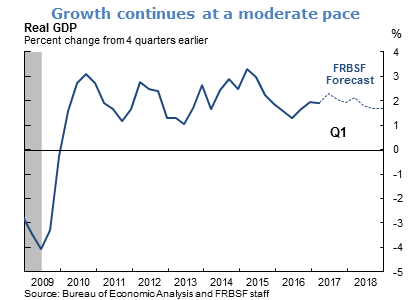

- Real GDP grew at an annualized rate of 0.7% in the first quarter, down significantly from the 2.1% pace of the previous quarter. Much of this weakness reflected transitory factors such as declines in inventories and reductions in spending on utilities owing to unseasonably warm weather. We expect a substantial bounceback in the coming quarters, with growth averaging around 1¾% in 2017 and 2018.

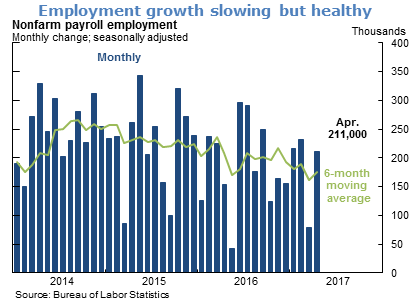

- The April labor market report featured strong employment growth, as non-farm payrolls expanded by 211,000 jobs, making the six-month moving average 176,000. This growth is substantially above the rate that the economy needs to create in the longer run in order to absorb new entrants into the labor force, which we estimate to be somewhere between 50,000 and 100,000.

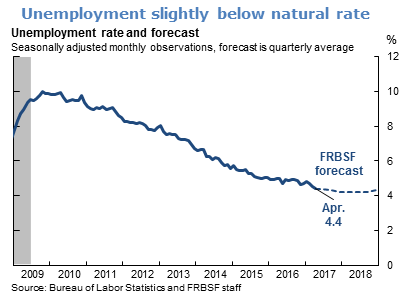

- The unemployment rate fell in April to 4.4%, somewhat below our estimate of the natural rate of unemployment of between 4.8% and 5.0%, reflecting continued strong, though gradually slowing, payroll growth. We expect unemployment to fall further, reaching 4.2% towards the end of the year, before rising towards its natural rate in the coming two to three years.

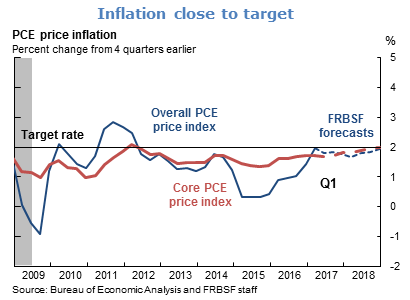

- Inflation data for March were somewhat soft. The 12-month percentage change in the personal consumption expenditure (PCE) price index was 1.8%, down from 2.1% in the prior month. Excluding volatile food and energy components, the core PCE price index increased by 1.6%, below the February pace of 1.8%. While these data imply a pause in the upward path in price inflation over the last two years, we expect inflation to resume gradually converging to the Fed’s 2% target.

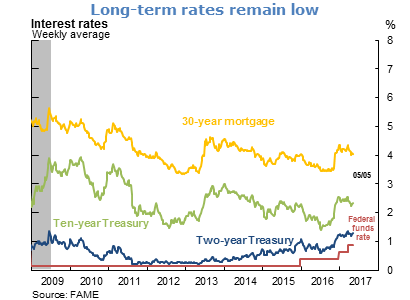

- Long-term interest rates have subsided somewhat since the increases observed following the U.S. presidential election last November. With the Federal Reserve maintaining its target rate between ¾% and 1% at its meeting in May, futures data imply that financial markets expect a further rate increase in June and again later in the year.

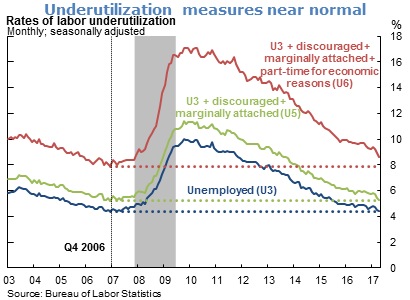

- While the unemployment rate (formally referred to as U3) is traditionally taken to be the most reliable indicator of labor underutilization, it is useful to consider alternative measures. The U3 measure only takes into account people who are unemployed if they have looked for a job in the past month.

- The U5 measure of labor underutilization augments U3 by considering people who may not have looked for a job recently, but are regarded as still marginally attached to the labor force, having looked for a job in the past year. The U6 measure in turn augments U5 by also including those working part-time, but who would prefer to work full-time.

- During the great recession, all three unemployment measures increased dramatically, though U5 and especially U6 increased by relatively large amounts—indicating a greater degree of slack than captured by U3. All of these measures have since declined during the recovery, with U5 as well U3 now at their pre-recession levels, suggesting that labor market slack has been eliminated.

- U6, however, has not quite returned to its pre-recession level, implying perhaps that some slack still remains. While this is possible, research suggests that structural changes in the labor market over the past decade can account for much of the remaining gap between the current and pre-recession levels of U6. These changes include a shift towards sectors where part-time work is more prevalent, and a reduction in the share of young people in the work force who might voluntarily chose to work part-time.

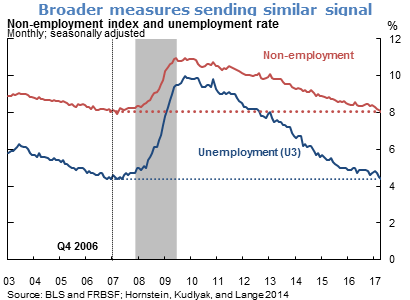

- The definition of unemployment can be extended further by taking into account other categories of labor-force non-participants, such as students or retirees who may still enter the labor force, though with low probability. A “Non-Employment Index” that weights different categories of non-participants by their probability of transitioning into the labor force indicates that this measure of labor market slack also has returned to its pre-crisis level, thus conveying essentially the same message about labor market conditions as U3.

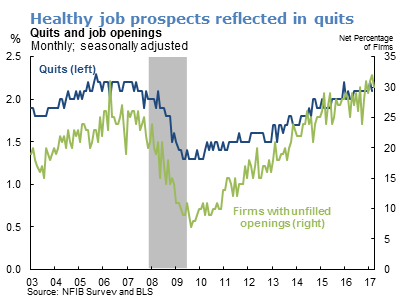

- Quit rates among employed workers have recovered to pre-recession levels, indicating that workers are more confident in their ability to leave a job and find another. This accords with data indicating that firms are experiencing increasing difficulty in filling open positions.

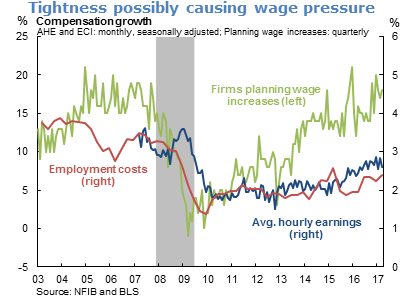

- For most of the recovery period, wage increases have been limited, averaging around 2% annually. Some wage measures, such as average hourly earnings and employment costs, have been picking up recently, perhaps reflecting the fact that the economy has reached and perhaps moved beyond full employment. For example, earnings rose 2.5% in the year through April. Nevertheless, wage pressures still are not surging, likely reflecting limited productivity growth and the generally low inflation environment of recent times that may have dampened wage demands. However, a more forward-looking indicator, such as the fraction of small businesses planning wage increases, has been rising for some time. This is consistent with the view that sustained labor market tightness will result in increased wage pressures.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.