Adam Shapiro, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of November 9, 2017.

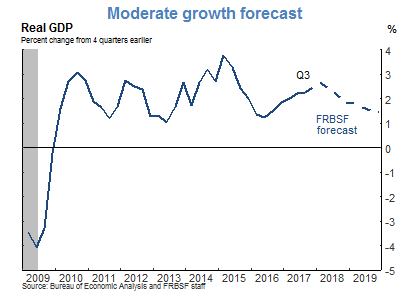

- Despite disruptions from the recent hurricanes, real gross domestic product (GDP) has continued to grow at a moderate pace. After a strong second quarter, real GDP grew at an annual rate of 3% in the third quarter, according to the “advance” estimate by the Bureau of Economic Analysis. We forecast that GDP will grow in the fourth quarter at an annual rate of 2.6% and average 2.5% for 2017. As monetary policy continues to normalize over the next two to three years, we expect growth to gradually fall back to our long-trend growth estimate of 1.5%.

- The recent fires in Northern California were the most devastating in the state’s history, causing billions of dollars in property damage, thousands of displaced residents, and tragic loss of life. While the full effect of the fires on the local economy is still being determined, the economic impact on the entire United States is likely to be modest as the affected areas are not sizable business or population centers.

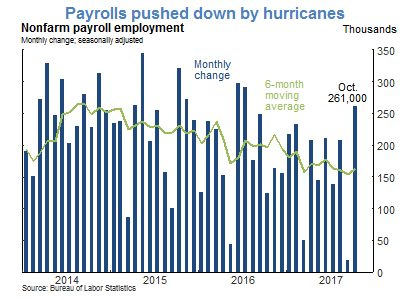

- The U.S. economy added 261,000 jobs in October, reflecting not only individuals returning to work who had been kept home by the hurricanes, but also the strong labor market. Job gains have averaged close to 160,000 over the past six months, well above the amount needed to absorb the flow of new workers into the labor force.

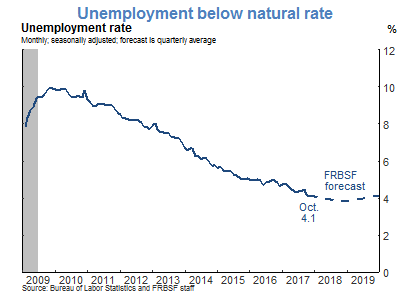

- The unemployment rate stands at 4.1% as of October. We expect the unemployment rate to decline below 4.0% by the middle of 2018 as the economy continues to strengthen. Monetary policy accommodation will ease over the longer run, and we expect the unemployment rate to gradually return back to our estimate of the natural rate of 4.8%.

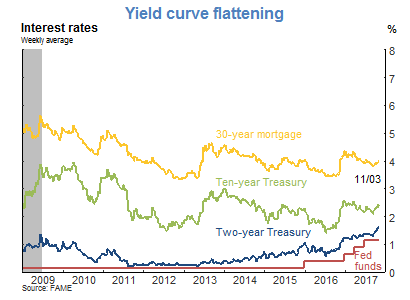

- The yield curve continues to flatten as short-term rates rise while longer-term rates remain relatively steady. At the November meeting, the Federal Open Market Committee (FOMC) kept the target range for the federal funds rate unchanged at 1 to 1.25% and announced it is proceeding with the balance sheet normalization process initiated in October.

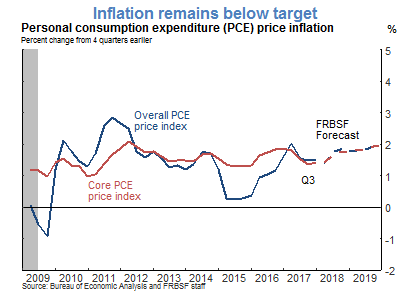

- Inflation continues to remain below the FOMC’s target of 2%. The personal consumption expenditures (PCE) price index rose 1.6% over the past 12 months, while the core PCE index, which removes volatile food and energy prices, rose 1.3%. As the labor market continues to tighten, we expect inflation to gradually reach the FOMC’s target of 2% by 2019.

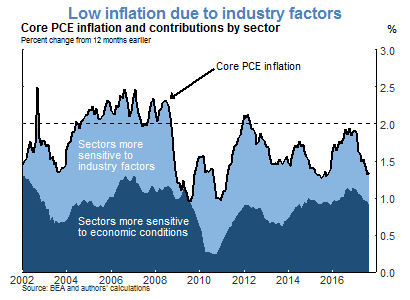

- Inflation fluctuates with the overall economy but also in response to factors that are more industry specific. The degree of price sensitivity to overall economic conditions and other factors varies across sectors. Prices in some sectors, such as housing, restaurants, and recreation services and goods, are relatively more sensitive to overall economic conditions, while prices in other sectors, such as health-care, financial, and communications services, are relatively more sensitive to industry-specific factors.

- The inflation rate for prices in sectors that tend to be sensitive to the overall state of the economy have moved back up to pre-recession levels, in line with the improvement in economic conditions. By contrast, the inflation rate has fallen for sectors that tend to be more sensitive to industry-specific factors and is currently holding down inflation.

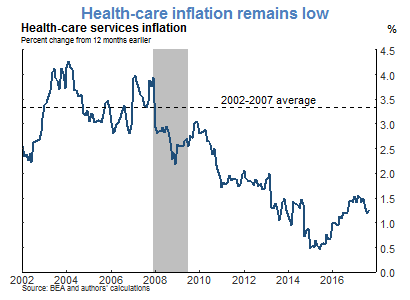

- A major contributor to low inflation is the health-care services sector, which currently makes up about one-fifth of core personal consumption expenditures and tends to be relatively insensitive to economy-wide conditions. Health-care services inflation has declined steadily, falling from an average above 3.0% in the mid-2000s to close to 1.0% over the past five years.

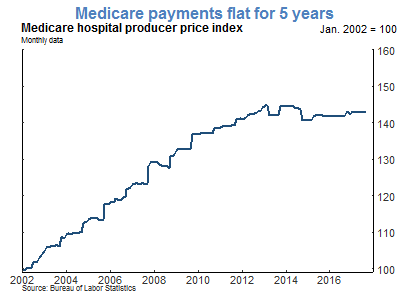

- The decline in health-care services inflation is mainly attributable to ongoing mandated cuts to Medicare payment growth, which also tend to affect payments in the private health-care market. Medicare payments to hospitals, for example, have been flat for the past five years. Some of the payment growth cuts are permanent, which are likely to cause some continued drag on inflation in the future, despite a strengthening economy.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.