Reuven Glick, group vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 12, 2017.

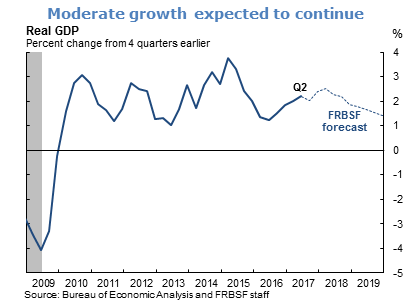

- Gross Domestic Product (GDP) continues to grow at a moderate pace. Estimated second quarter growth, revised up to 3.1% at an annualized rate, was very strong though it partially represents a bounceback from weak first quarter growth of 1.2%. Going forward, we expect GDP growth will be disrupted in the third quarter by the hurricanes, but will rebound in the fourth quarter due to offsetting recovery spending. Recent indicators, including factory orders, vehicle sales, and business sentiment, point to continued momentum in the economy. We expect output growth to average somewhat above 2% for 2017, and transition back gradually over the next two years to our estimate for potential growth of 1½ to 1¾% as more monetary policy accommodation is removed.

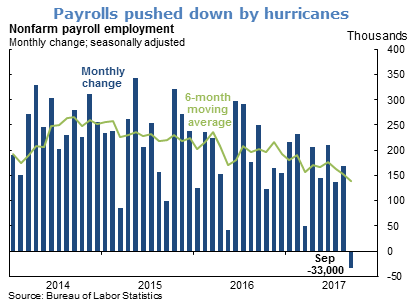

- The recent hurricanes have pushed down nonfarm payrolls. The September report indicated a loss of 33,000 jobs, mostly in the leisure and hospitality sector as workers there tend not to be paid when conditions temporarily shut down businesses. However, these effects are expected to be transitory. The job market looks strong over the longer run.

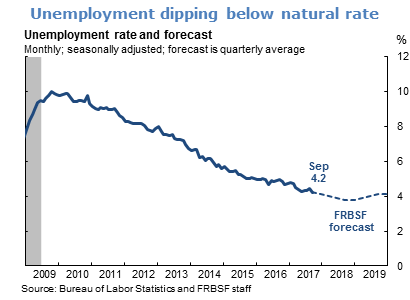

- The unemployment rate has been hovering around 4.3 to 4.4% for the last few months, but fell lower in September to 4.2%. This data reading is less likely to be affected by the hurricanes for methodological reasons since it is based on surveys asking if people have a job, not whether they were actually paid. These recent numbers are all below 4.8%, our estimate of the natural rate of unemployment. In the year ahead, we expect unemployment to fall further as the economy grows above potential, and then rise in 2019 toward the natural rate as monetary policy normalizes more and the economy slows.

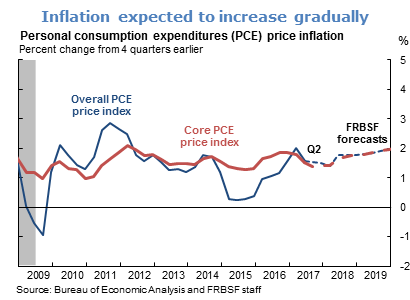

- Inflation continues to run below the Federal Open Market Committee’s (FOMC) target of 2% annual inflation. The September data indicate that the headline price index of personal consumption expenditures (PCE) over the past 12 months was up 1.4%, while the core PCE price index, which excludes volatile energy and food components, was up 1.3%. We expect that a tightening labor market will push inflation higher in the future.

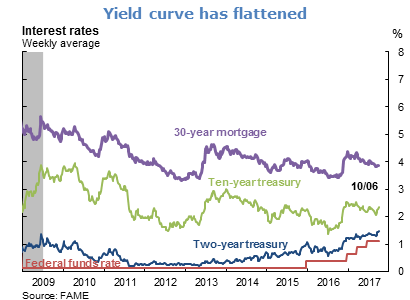

- Financial conditions continue to be accommodative. The yield curve has flattened since the beginning of the year, as long-term rates have fallen, even though short-term rates have been rising. At its September meeting, the FOMC kept the target range for the federal funds rate unchanged at 1 to 1-1/4%. The FOMC also announced its intention to begin reducing its $4.5 trillion balance sheet by decreasing the reinvestment of maturing assets at a steadily increasing rate.

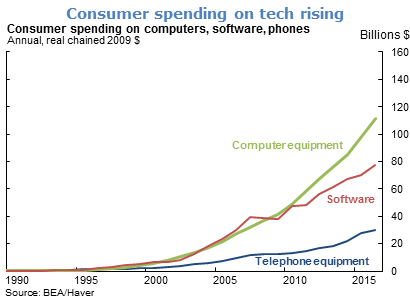

- Technological change, particularly digital innovation, has transformed the nature of the products and services used by consumers. According to surveys by the Pew Research Center, more than 95% of people now own a cell phone, most of which are smartphones, 80% own a computer, and almost 70% own a tablet device. Though still small—less than two percent—purchases of computer equipment, software, and telephone devices is a growing portion of total consumer spending.

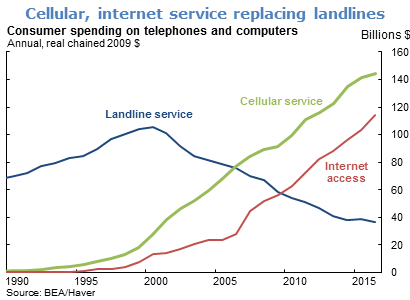

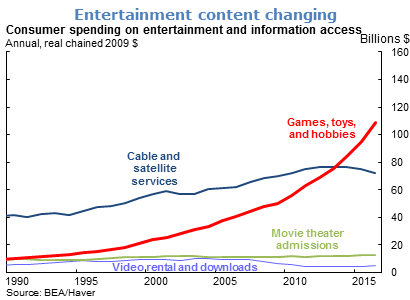

- The increased use of digital devices has affected the composition of the services used to exchange information, as cellular and internet service usage steadily displaces telephone landline use. In addition, digital innovation has affected the sources of the entertainment that is viewed. In particular, spending on entertainment supplied by cable and satellite has declined recently as more people have “cut the cord” and are spending more instead on internet access and computer games. Spending on video disc rentals have also declined as consumers have turned to greater use of internet downloads and streaming.

- The U.S. Bureau of Economic Analysis, which calculates GDP data, faces several ongoing challenges in measuring spending on digital devices and related services. First, it must keep up with changing spending patterns as new devices replace older products. Second, it must properly adjust price data for quality changes in digital products. To the extent price increases reflect quality improvement, measured prices overstate true inflation. Using true lower prices raises the estimated quantity of spending adjusted for inflation. This issue also affects the measurement of business investment in computers and software. A third concern relates to whether or not communications services provided by, for example, social media, web searching, and mapping applications should be included in the GDP accounts. Current methodology practice excludes such services because households are not directly charged for these activities, even though they provide benefits to consumers. Since most providers of such “free” services charge advertisers, advertising-supported content is indirectly included in GDP to the extent that advertising costs are reflected in the prices paid by consumers for the items being advertised. Some debate exists about how much each of these considerations might contribute to possible under-measurement of GDP and productivity growth. However, most estimates of the estimated magnitudes of these effects tend to be relatively small.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.