Robert G. Valletta, associate director and senior vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 7, 2021.

- The U.S. economy is continuing to recover from the severe impact of the coronavirus pandemic. Though the recent surge of the Delta variant appears to have put a dent in the domestic growth path, the outbreak has started to subside. Overall growth prospects remain favorable, albeit with unusually high uncertainty.

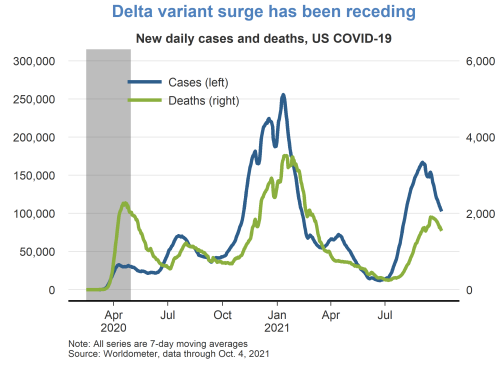

- The Delta variant raised COVID-19 case counts and deaths well above the early-summer lows, to levels not seen since February. Nationwide, these virus indicators have been on the wane for several weeks, although they remain elevated in some states, primarily those with low vaccination rates.

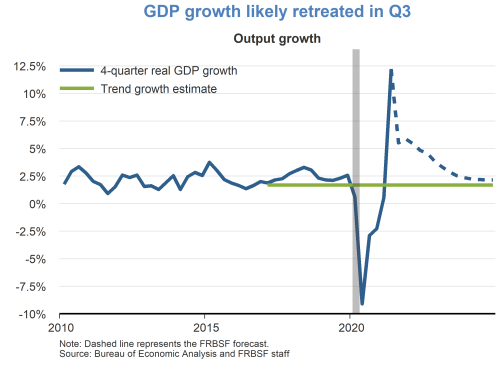

- The U.S. economy grew at a robust pace during the first half of 2021, over 6% at an annual rate, continuing the strong bounceback from the severe downturn in early 2020. The growth during the first half of the year was propelled by increased consumer spending focused on nondurable goods and leisure and hospitality services, as local economies reopened, and travel picked back up.

- As the Delta variant continued to spread, consumer spending growth slowed in July and August, mainly for the high-contact services that were the locus of growth earlier in the year. As a result, the August employment report showed that jobs were flat to down in the retail and leisure and hospitality sectors.

- GDP data for the third quarter will be released on October 28, and it is widely expected to show a substantial slowdown in the pace of growth from the first half of the year. We expect that growth will pick back up substantially over the next few quarters as more people receive COVID vaccinations and the virus is further contained, leading to above-trend performance overall for 2021 and 2022.

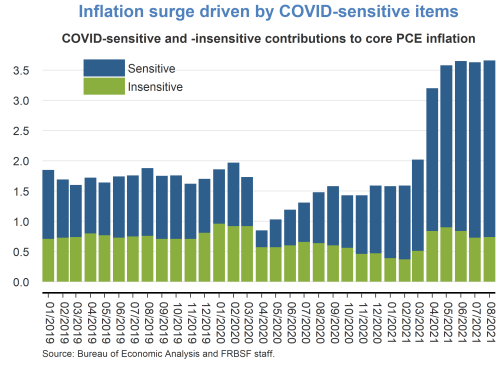

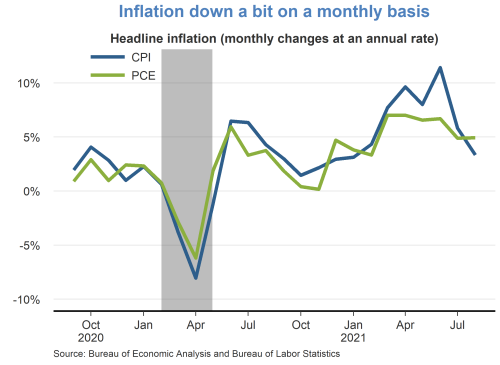

- Inflation has been running at unusually high rates most of this year. In August, the headline and core PCE inflation indices registered 4.3% and 3.6%, respectively. Our analysis shows that most of the inflation surge this year has been caused by price increases for items in “COVID-sensitive” sectors that are highly responsive to the economic disruptions caused by the pandemic.

- Although underlying market imbalances and supply chain disruptions leading to higher prices have persisted longer than anticipated, we expect that they will subside in coming quarters. Measured on a month-to-month basis, both the PCE and CPI inflation indices have fallen a bit from their highs in the spring, providing tentative signs that inflation pressures are starting to ease. We expect inflation this year to come in well above the FOMC’s 2% average goal before receding back to that level in 2022.

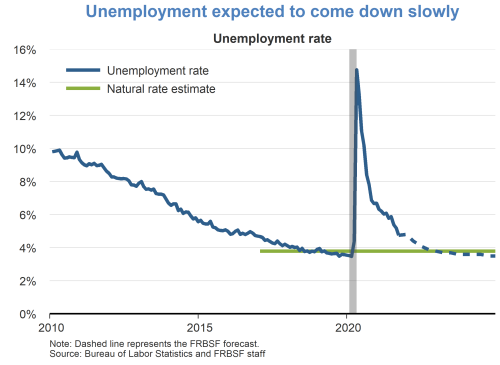

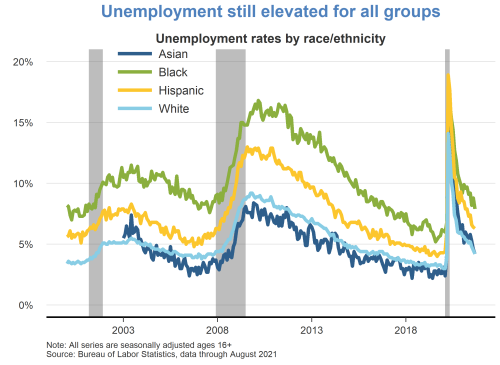

- The unemployment rate generally has continued to decline in recent months. Its most recent reading of 5.2% in August is consistent with a labor market that is slowly healing from the severe impact of the pandemic downturn last year. We expect the unemployment rate to fall gradually over the next few years to slightly below its long-term natural level sometime in 2023. Despite its decline, the unemployment rate is still well above its pre-pandemic low, and unemployment remains elevated for all racial and ethnic groups.

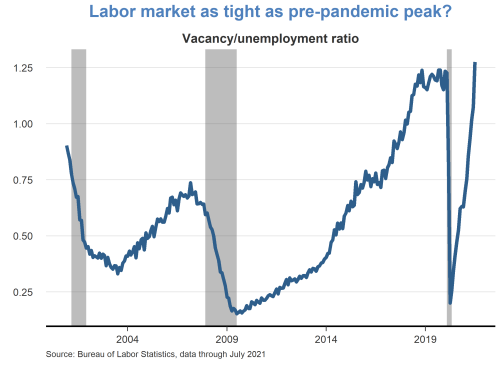

- The unemployment rate alone suggests that significant slack remains in the labor market. However, this conflicts with widespread perceptions and reports of severe hiring challenges for employers in many sectors and areas. A more precise measure of labor market tightness, the ratio of the count of job openings to the number of unemployed individuals, suggests that the labor market is as tight as its pre-pandemic peak.

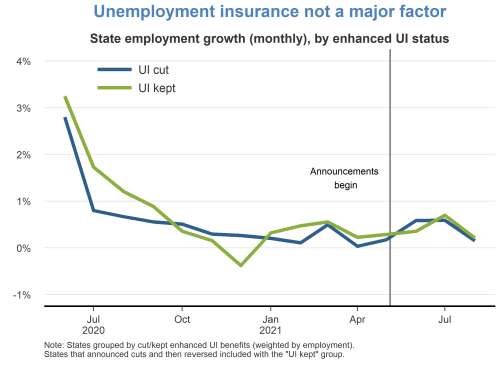

- Various explanations have been offered to reconcile elevated unemployment with tight labor markets. One argument is that the availability of extended and enhanced unemployment insurance (UI) benefits provided by the federal government caused many potential workers to choose to remain jobless. This view was put to the test when some states eliminated the UI enhancements before the federal programs expired in early September. Employment growth rates over the summer were similar between states that eliminated or maintained the UI provisions, suggesting that UI availability did not substantially impede the job creation and matching process. This is consistent with our earlier research and other sources suggesting that the UI expansions exerted minimal influence on job search and acceptance decisions.

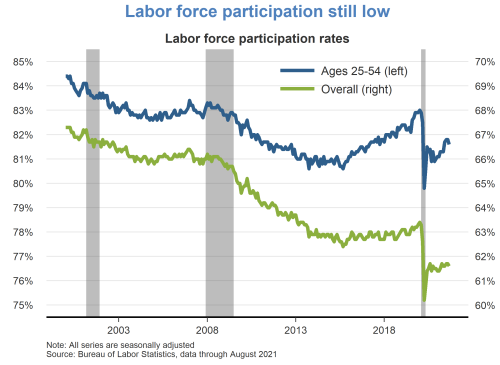

- A more compelling explanation is that high job openings and slow matching reflect ongoing post-pandemic adjustments by employers and potential workers. On the worker side, reports suggest that many are hesitant to return to jobs due to health concerns, instability in available jobs and hours, and childcare challenges. This view is supported by continued low labor force participation rates for prime-age workers and the overall workforce.

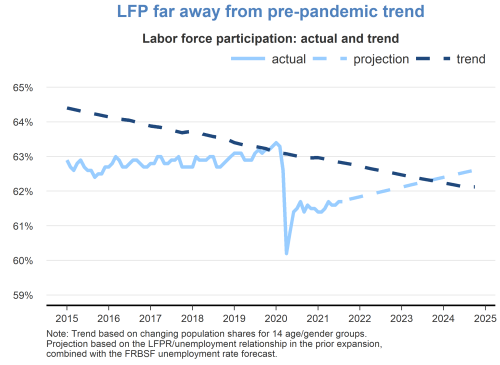

- Some of the current worker shortages are likely to ease as more potential employees return to the labor force. It should be noted that overall labor force participation is trending downward due to the aging of the U.S. population and the consequent increasing share of retired people. However, based on the patterns observed in the long pre-pandemic expansion, overall participation is now so far below trend that it is likely to require at least a few more years before it is back at its trend level.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.