You asked a very interesting and important question for monetary policymakers.

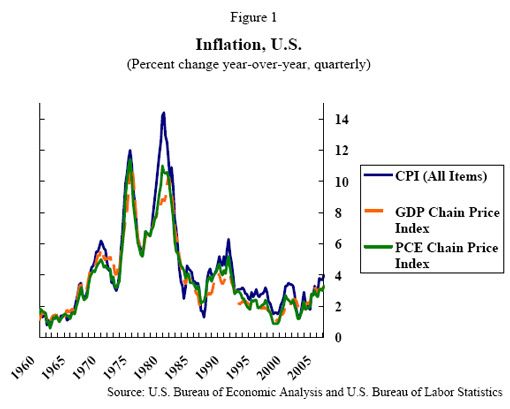

In October 2002, I discussed the definition of inflation. Also in that response I emphasized that there are as many measures of inflation as there are measures of overall price levels. Three popular measures of overall consumer prices are the consumer price index (CPI) published by the U.S. Bureau of Labor Statistics, the personal consumption expenditure (PCE) deflator published by the U.S. Bureau of Economic Analysis, and GDP deflator (published by the Bureau of Economic Analysis). Figure 1 shows that these inflation series (quarterly; year-over-year percent change; seasonally adjusted) tend to follow similar paths.

Finally, note that economists often focus on core inflation (which excludes volatile energy and food prices) rather than overall inflation. To read more about core inflation, please refer to my October 2004 response.

When trying to understand the debate about inflation or interpret an inflation number reported in the press, it is important to be clear on which measure of inflation is under consideration to avoid confusion. That said, one thing about inflation that is clear is how important it is to monetary policymakers.

Importance of Price Stability

Central banks around the world view stable and low inflation as a very important goal. Below are some concrete examples (italics added for emphasis):

U.S. Federal Reserve System: “Monetary policy has two basic goals: to promote “maximum” sustainable output and employment and to promote ‘stable’ prices. These goals are prescribed in a 1977 amendment to the Federal Reserve Act.“

NOTE: On January 25, 2012, the Federal Open Market Committee issued a “Statement of Longer-Term Goals and Policy Strategy.” One of important announced in the statement was a 2 percent numerical inflation target for the overall personal consumption expenditures price index. Key points from the statement are:

- A commitment to the Fed’s “statutory mandate from the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates.”

- A numerical longer-run goal for the personal consumption expenditure price index of 2 percent.

- An estimate of the longer-run normal rate of unemployment in the 5.2 to 6.0 percent range.

Bank of Japan: “The Bank of Japan, as the central bank of Japan, decides and implements monetary policy with the aim of maintaining price stability.”

European Central Bank: “To maintain price stability is the primary objective of the Eurosystem and of the single monetary policy for which it is responsible. This is laid down in the Treaty establishing the European Community, Article 105 (1).”

Bank of England: “The Bank sets interest rates to keep inflation low, issues banknotes and works to maintain a stable financial system.”

Bank of Canada: “The goal of Canadian monetary policy is to contribute to rising living standards for all Canadians through low and stable inflation.”

Central Bank of Chile: “The main purpose of the Central Bank of Chile’s monetary policy is to keep inflation low and stable, defined as a range of 2% to 4% per annum, centered on 3%.”

Policymakers and economists are not the only groups concerned with inflation and its consequences. The general public has a great distaste for inflation too. It has been noted that news about inflation can damage approval ratings of presidents and affect outcomes of elections. A look at public opinion polls reveals that inflation at times can be viewed as the most important national problem (Shiller 1996).

Costs of Inflation

Although I have given you all this evidence that many groups view inflation as a serious problem, I have not begun to discuss why. It is interesting to note that while both economists and non-economists tend to dislike inflation, they dislike it for different reasons. Non-economists would most likely argue that inflation erodes their purchasing power. In an international survey conducted in the 1990s by a prominent Yale economist Robert Shiller, other concerns with inflation expressed by non-economists were centered around issues of exploitation, political instability, loss of morale, and damage to national prestige (Shiller 1996).

The costs of inflation cited by economists tend to be different and fall into two categories: the costs of expected inflation and the costs of unexpected inflation. The remainder of this discussion will focus on these costs. This does not mean that the costs cited by non-economists are not important. However, there is quite enough to say about the costs of inflation without branching outside of economics!

Costs of Expected inflation:

- Shoe-leather costs. These costs reflect the inconvenience of a reduction in money holding that arises during periods of high inflation when individuals tend to make more frequent but smaller cash withdrawals. The name “shoe-leather” is metaphoric – walking to the bank wears out one’s shoes, but worn-out shoes is hardly the only inconvenience of going to the bank more often.1 Example 1 provides further intuition for this cost of inflation.

- Menu costs. These costs arise due to firms changing and posting their prices with higher frequency during times of high inflation. The name “menu” costs refers to restaurants having to change prices of dishes (and, therefore, print new menus) more often during high-inflation periods. Restaurants, of course, are not the only businesses that incur menu costs.2 While one might think of menu costs as costs that follow the decision about what the new price should be (such as reprinting catalogs, updating computer systems, reprinting price tags, etc.), it is useful to keep in mind the cost of the very decision of what the new price ought to be (such as gathering relevant information and processing it).

- Increase in relative price volatility. These costs arise because firms facing menu costs are not likely to change prices frequently. As a result, relative price volatility increases. This, in turn, leads to inefficiencies in resource allocation. For more details, please see Example 2.

- Tax distortions. These costs arise because many tax laws do not take inflation into account. That is, they focus on one’s nominal rather than real income.3 Inflation can result in an arbitrary change in a person’s tax liability. For more details, please see Example 3.

Costs of Unexpected Inflation

- Arbitrary redistribution of wealth from lenders to borrowers. When inflation turns out to be different from expectations, some groups can be made better off, while others can be made worse off. For instance, when inflation turns out to be higher than expected, lenders can realize losses, while borrowers can gain. For more details, please see Example 4.

- Costs to individuals on fixed nominal contracts. Many long-term contracts build in an adjustment for inflation. People whose contract payments are fixed will suffer a loss in real terms (that is, in terms of purchasing power) if inflation turns out higher than they expected. For example, if pension payments are fixed for many periods and inflation ends up being higher than expected, then real pension payments end up being lower than expected.

How Large Are These Costs?

It is natural to wonder which of the cited costs of inflation is the largest or most important. The answer to this question truly depends on the time period considered, the country under consideration, and the severity of inflation or deflation (for instance, it matters whether it is moderate, high, or hyperinflation).

Though it is hard to quantify the costs of price volatility, it is a critical issue, especially for a central bank. What may surprise some people is that, although inflation is costly, policymakers generally do not wish for zero inflation. This is because reducing inflation from some low positive rate to zero might come at the expense of higher unemployment (and lower output). Thus, the costs of going from low to zero inflation are thought to exceed the benefits. This is further complicated by the difficulty of measuring inflation precisely enough to be certain exactly how close you are to zero inflation. Of course, that is why economists keep a close eye on several measures of inflation!

References:

Bernanke, Ben. 2002. “Deflation: Making Sure ‘It’ Doesn’t Happen Here” Remarks Before the National Economists Club, Washington, DC.

English, William. 1996. “Inflation and Financial Sector Size.” Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series. 96-1.

Fuhrer, Jeffrey, and Geoffrey M.B. Tootell. “Issues in economics: what is the cost of deflation?” 2004. Federal Reserve Bank of Boston. Regional Review. Q 4 2003 / Q1 2004, 2004 pp. 2-5.

Mankiw, Gregory. 2003. Macroeconomics, 5th edition. New York, NY: Worth Publishers.

Pakko, Michael. 1998. “Shoe-Leather Costs of Inflation and Policy Credibility.” The Federal Reserve Bank of St. Louis Review. November/December 1998.

Shiller, Robert. 1996. “Why Do People Dislike Inflation?” NBER Working Paper No. 5539.

Zbarski, Mark J. Mark Ritson, Daniel Levy, Shantanu Dutta, and Mark Bergen. 2004. ”Managerial and Customer Costs of Price Adjustment: Direct Evidence from Industrial Markets.” The Review of Economics and Statistics, vol. 86(2), pp.514–533.

Examples

Example 1 – Shoe-leather costs of inflation

The intuition behind the shoe-leather cost of inflation is that during times of high inflation, households make smaller cash withdrawals with higher frequency. That is, instead of withdrawing $200 once a week, they might withdraw $50 four times a week, thereby, “protecting” their assets from inflation by keeping them in an interest-bearing account longer.

Example 2 – Increase in relative price volatility

Suppose firm X produces one good and changes its price once a year (menu costs prevent this firm from changing its prices more often). In the case of no inflation in the economy (that is, the case when prices of other goods and services do not change), then the relative price of firm X’s good is constant throughout the year. Suppose, however, that inflation is 0.5% per month. In this case, prices of other goods and services increase by 0.5% every month, while the price of the good produced by firm X remains constant. Thus, the good produced by this firm becomes increasingly cheaper relative to other goods. In this scenario, sales of firm X might be relatively low at the beginning of the year (when the price of its good is relatively high) and increase towards the end of the year (as the relative price of its good falls). Economists believe that inefficiencies in resource allocation will result from this scenario.

Example 3 – Tax distortions

Suppose that you bought some asset for $100 in period 1 and sold it for $110 in period 2. You made a profit of $10 (10%). You have a nominal gain of $10, but whether you made a gain in real terms or not depends on inflation. If there is no inflation between periods 1 and 2, then your real gain is 10%. You can buy 10% more goods and services with $110 in period 2 than you could with $100 in period 1. Now suppose that inflation between periods 1 and 2 was 10%. In this case, you can buy as many goods and services with $110 in period 2 as you could with $100 in period 1—you made no real gains. Yet, regardless of whether you made any real gains or not, you may still have to pay taxes on the nominal gain.

Example 4 – Redistribution of wealth from lenders to borrowers

Suppose that you lend someone $100 at an interest rate of 10% for one year. Suppose also that both you and the person you are lending to expect inflation to be 3% per year, but that in reality inflation ends up being 10% per year. Regardless of the inflation rate, your nominal gain and the borrower’s nominal cost is $10. However, because of unexpectedly high inflation, you received less in real terms than anticipated (because prices of goods and services rose faster than you expected, you can buy less with your $110 than you could otherwise). On the other hand, the borrower paid you less than expected in real terms (thus giving up less in terms of goods and services than they thought they would at a time of entering into this agreement with you). Thus, you (the lender) suffered an unexpected real loss, while the borrower made an unexpected real gain.

Footnotes

1. For further discussion of shoe-leather costs, please see English (1996) and Pakko (1998).

2. For further discussion of menu costs see Zbarski et al. (2004).

3. For a discussion of nominal vs. real variables, see Mankiw (2003).