The short response is, “Yes!” As you know, U.S. monetary policy has two goals: maximum sustainable output and inflation (for more on monetary policy goals see “U.S. Monetary Policy: An Introduction”). As you probably also know, the conventional tool of monetary policy is the federal funds rate (the interest rate for overnight interbank lending). Given the high rate of unemployment and low rate of inflation in the U.S. economy in 2009, easing the federal funds rate (even all the way to zero) did not provide nearly enough stimulus to the ailing economy.

So, yes, the financial crisis (for more on the financial crisis, please see FRBSF website, The Economy: Crisis & Response and Dr. Econ for June 2009) had a major impact on the way the Federal Reserve has implemented monetary policy since 2008. The most dramatic moment occurred Dec. 16, 2008 when the Fed’s primary monetary policy making body, the Federal Open Market Committee (FOMC), lowered its target for the fed funds rate to a 0 to ¼ percent range. With the fed funds rate essentially up against its zero lower bound, the Fed could not lower the target rate any further, even though conditions in the economy warranted additional stimulus.

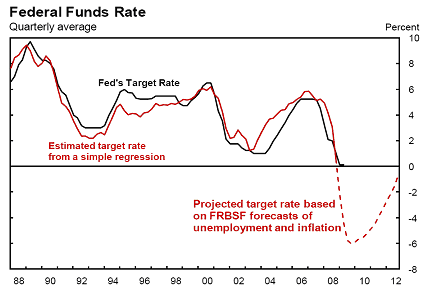

Let me share an important example that illustrates how the zero bound may have limited policy in 2009. It is taken from the Oct. 13, 2009 FedViews; a national economic forecast that is available from the Economic Research Department at the Federal Reserve Bank of San Francisco.

In the October 2009 FedViews, Rudebusch notes that:

…a rough benchmark for calibrating the stance of monetary policy explains the level of the funds rate in terms of inflation and unemployment. Currently, this simple rule of thumb, which has captured the broad contours of policy over the past two decades, suggests that the funds rate will be near its zero lower bound for several years.

You can see this most dramatically in the chart below. It shows the Estimated Target Rate (red line) – often referred to by economists as a Taylor rule – that is a close approximation of the Fed’s actual Target Rate (black line) up until the zero bound was reached at the end of 2008. However, based on the forecasts for unemployment and inflation that were available in October 2009, the Projected Target Rate (dashed red line) falls well below zero and is expected to remain there for an extended period of time.

This FedViews analysis shows that the conventional monetary policy tool alone could not be lowered enough, given the high level of unemployment and the low rate of inflation. As a result, the Fed expanded the use of unconventional policy tools.

Chart: Projected Target Rate in 2009-2012

(information as of October 13, 2009)

For more information on the financial crisis and the Fed’s monetary policy response, including its unconventional monetary policy actions, please see the Federal Reserve Bank of San Francisco’s website, The Economy: Crisis & Response. Rudebusch (2009), Yellen (2009), and the Board of Governors of the Federal Reserve System website, Credit and Liquidity Programs and the Balance Sheet provide information on the Fed’s unconventional monetary policy tools.

For current information on the monetary policy outlook, please check our FedViews publication.

References

Rudebusch, Glenn D. (2009). “The Fed’s Monetary Policy Response to the Current Crisis,” FRBSF Economic Letter 2009-17.

What is the Taylor Rule? Ask Dr. Econ, FRBSF Website, March 1998.

Yellen, Janet L. (2009). “Economic Turmoil and Policy Response” speech delivered to the Financial Women’s Association, San Francisco, California, January 15.