Good afternoon and thank you. It’s a pleasure to be on this panel. The main theme of my remarks is the critical importance of research in designing and implementing unconventional monetary policies since the financial crisis. I hope this isn’t a controversial thesis. Nonetheless, I should note that, as always, my remarks represent my own views and do not necessarily reflect the views of others in the Federal Reserve System.

In response to the financial crisis, the Federal Open Market Committee (FOMC) lowered the federal funds rate to essentially zero in December 2008 and has kept it there ever since. The FOMC then turned to several “unconventional” monetary policies, such as large-scale asset purchases (LSAPs) and forward guidance. In my remarks today, I’d like to focus on the lessons we’ve learned about these unconventional policies and their prospective role going forward.

Before the financial crisis, almost everything we knew about unconventional monetary policy came from studies of the Japanese “lost decade” and a few scattered episodes in the U.S., such as Operation Twist in the 1960s. The conventional wisdom at the time seemed to be that longer-term bond purchases didn’t have much effect on longer-term yields. As the financial crisis unfolded, however, central banks became willing to give large-scale bond purchases a try. In late 2008, the Federal Reserve announced it would purchase a large quantity of agency debt and mortgage-backed securities, and the announcement of this program had a striking effect on longer-term yields and mortgage rates. In January 2009, the Bank of England followed suit and announced its own asset purchase program, which similarly had sizable effects.

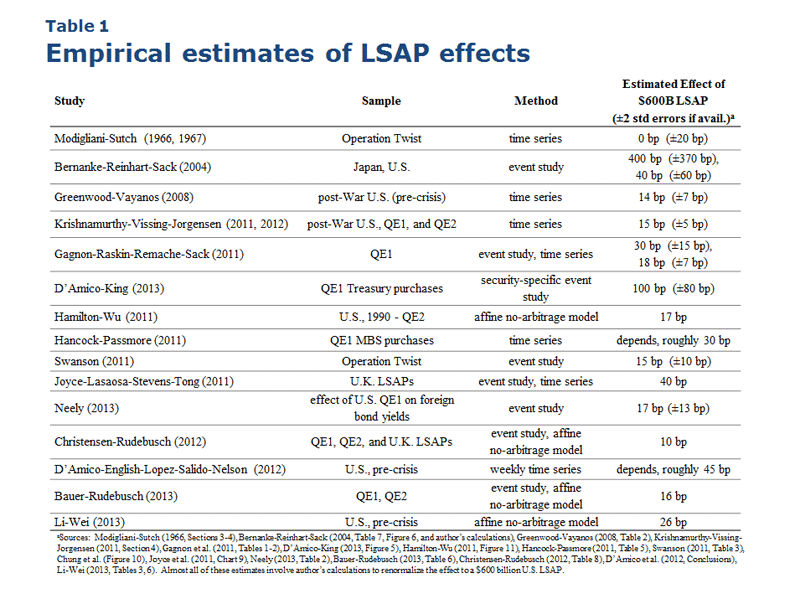

One of the early key lessons from the financial crisis is that asset purchases can be a very useful monetary policy tool at the zero lower bound. The success of these announcements led to a flurry of research on the efficacy of asset purchases at the Federal Reserve, at other central banks, and in academia. Table 1 summarizes the results from a number of research papers. Although individual estimates differ, this analysis typically suggests that $600 billion of Fed asset purchases lowers the yield on 10-year Treasury notes by around 15 to 25 basis points.1 To put that in perspective, that’s roughly the same size move in longer-term yields one would expect from a cut in the federal funds rate of ¾ to 1 percentage point.

Nevertheless, I don’t see LSAPs as being part of the FOMC’s toolkit once we leave the zero bound behind us. We’re still much less certain about their effects than we are about the effects of changes in the federal funds rate. According to Brainard’s classic analysis, the more uncertain you are about the effects of a policy tool, the more cautiously you should use it. Instead, you should rely more on other instruments in which you have greater confidence.2 We have decades of experience using the federal funds rate as the main tool of monetary policy and we have a reasonably good understanding of how it affects the economy. Given this understanding and the predictability of the effects of conventional policy, the short-term interest rate remains the best primary tool for future monetary policy.

Let me turn to our second main unconventional monetary policy tool: forward guidance. Before the crisis, we knew that a large majority of the effects of FOMC announcements could be attributed directly to FOMC statements, rather than to changes in the federal funds rate.3 In 2003 and 2004, the FOMC experimented with forward guidance in the FOMC statement, using phrases such as, “The Committee believes that policy accommodation can be maintained for a considerable period.” In December 2008, this qualitative forward guidance was dusted off and used again, when the FOMC stated that it expected to keep the funds rate low “for some time.”

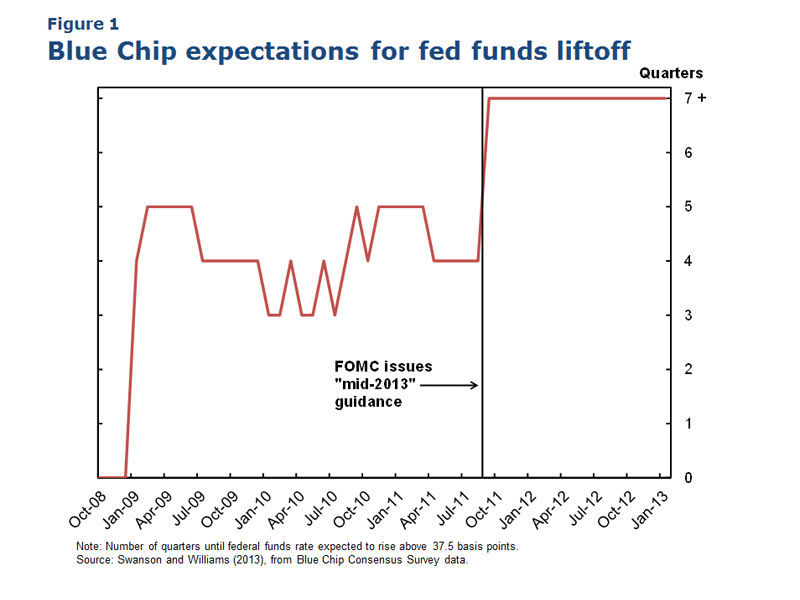

Despite this qualitative forward guidance, however, financial market participants’ policy expectations were consistently much tighter than the FOMC’s own outlook. From 2009 to mid-2011, expectations from financial markets and surveys such as Blue Chip consistently showed the fed funds rate lifting off from the zero bound within just a few quarters, as can be seen in Figure 1. This bias persisted despite the efforts of many FOMC members to communicate the severity of the downturn and the resulting need for highly accommodative monetary policy for quite some time.

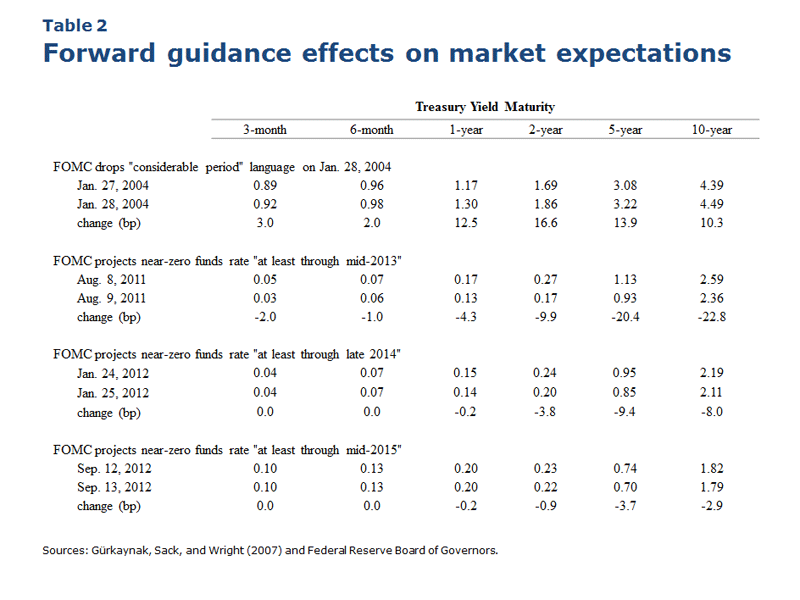

To push back against these excessively tight expectations, the FOMC made its forward guidance more explicit. In August 2011, we announced that economic conditions were “likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.” As can be seen in Table 2 and Figure 1, this announcement had a dramatic effect on financial market expectations. It caused an immediate 20 basis point drop in longer-term yields and a jump in the number of quarters the public expected the funds rate to remain at the zero bound. This quantitative forward guidance was extended further in January 2012 to “late 2014” and again in September 2012 to “mid-2015,” also with significant effects (Table 2).

This leads me to a second lesson from the financial crisis for monetary policy, which is the importance of clear communication. To add transparency and clarity to our communication of the likely future path of policy, the FOMC also began reporting participants’ projections of the “appropriate path” of the federal funds rate, as well as their projections for output, unemployment, and inflation. These projections are released four times a year. These projections should make it easier for the public to understand both the likely future path of policy and the underlying factors driving our decisions.

This past December, the FOMC took another step toward greater transparency by clearly tying its forward guidance to the state of the economy. We said we were likely to keep the funds rate near zero “at least as long as the unemployment rate remains above 6½ percent,” and as long as inflation is not expected to exceed 2½ percent over the next year or two and inflation expectations remain anchored. This should help the public understand that monetary policy depends primarily on the performance of macroeconomic variables such as unemployment and inflation, rather than on some preset course. This “state-based” forward guidance is still a relatively new experiment in FOMC transparency, but it has already proven to be an effective communication tool, focusing public attention on economic milestones in contemplating future policy decisions.

That said, I expect that the explicit link between future policy actions and specific numerical thresholds, as in the recent FOMC statements, will not be a regular aspect of forward guidance, at least when the federal funds rate is not constrained by the zero lower bound. This guidance has proven to be a powerful tool in current circumstances, when conventional policy stimulus has been limited by the zero lower bound. But such communication is difficult to get right and comes with the risk of oversimplifying and confusing rather than adding clarity. Therefore, in normal times, a more nuanced approach to policy communication will likely be warranted. I see forward guidance typically being of a more qualitative nature, highlighting the key economic factors that will affect future policy actions. Of course, if we again find ourselves in a situation where conventional policy has reached its limits, then we will have the ability to return to more explicit forward policy guidance to provide additional monetary stimulus.

Let me conclude by saying that the experience with unconventional policies illustrates the critical importance of research in guiding the design and implementation of monetary policy. Before the financial crisis and recession, unconventional policies were still mostly theoretical concepts on the drawing board, untested on the battlefield. Once they were deployed, researchers from across the globe mobilized, quickly filling the vacuum regarding what works and what doesn’t work. This knowledge has been essential for central banks in shaping policies to maximize their effectiveness. Thank you.

End Notes

1. See, for example, Gagnon et al. (2011), Joyce et al. (2011), Krishnamurthy and Vissing-Jorgensen (2011, 2012), Vayanos and Vila (2009), Hamilton and Wu (2011), Christensen and Rudebusch (2012), Swanson (2011), Li and Wei (2013), and D’Amico and King (2013).

2. See Brainard (1967).

3. See Gürkaynak, Sack, and Swanson (2005).

References

Bauer, Michael, and Glenn Rudebusch. 2013. “The Signaling Channel for Federal Reserve Bond Purchases.” International Journal of Central Banking, forthcoming.

Bernanke, Ben, Vincent Reinhart, and Brian Sack. 2004. “Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment.” Brookings Papers on Economic Activity 2004-2, pp. 1–78.

Brainard, William. 1967. “Uncertainty and the Effectiveness of Policy.” American Economic Review 57, pp. 411–425.

Christensen, Jens, and Glenn Rudebusch. 2012. “The Response of Interest Rates to US and UK Quantitative Easing.” Economic Journal 122, pp. F385–F414.

Chung, Hess, Jean-Philippe Laforte, David Reifschneider, and John Williams. 2012. “Have We Underestimated the Likelihood and Severity of Zero Lower Bound Events?” Journal of Money, Credit and Banking 44, pp. 47–82.

D’Amico, Stefania, William English, David López-Salido, and Edward Nelson. 2012. “The Federal Reserve’s Large-Scale Asset Purchase Programmes: Rationale And Effects.” Economic Journal 122, pp. F415–F446.

D’Amico, Stefania, and Thomas King. 2013. “Flow and Stock Effects of Large-Scale Treasury Purchases: Evidence on the Importance of Local Supply.” Journal of Financial Economics 108(2), pp. 425–448.

Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2011. “The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases.” International Journal of Central Banking 7, pp. 3–43.

Greenwood, Robin, and Dimitri Vayanos. 2008. “Bond Supply and Excess Bond Returns.” NBER Working Paper 13806.

Gürkaynak, Refet, Brian Sack, and Eric Swanson. 2005. “Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Actions and Statements.” International Journal of Central Banking 1, pp. 55–93.

Gürkaynak, Refet S., Brian Sack, and Jonathan H. Wright. 2007. “The U.S. Treasury Yield Curve: 1961 to the Present.” Journal of Monetary Economics 54(8), pp. 2291–2304.

Hamilton, James, and Jing Cynthia Wu. 2011. “The Effectiveness of Alternative Monetary Policy Tools in a Zero Lower Bound Environment.” Journal of Money, Credit, and Banking44, pp. 3–46.

Hancock, Diana, and Wayne Passmore. 2011. “Did the Federal Reserve’s MBS Purchase Program Lower Mortgage Rates?” Journal of Monetary Economics 58(5), pp. 498–514.

Joyce, Michael, Ana Lasaosa, Ibrahim Stevens, and Matthew Tong. 2011. “The Financial Market Impact of Quantitative Easing.” International Journal of Central Banking 7(3), pp. 113–161.

Krishnamurthy, Arvind, and Annette Vissing-Jorgensen. 2011. “The Effects of Quantitative Easing on Interest Rates.” Brookings Papers on Economic Activity, Fall, pp. 215–265.

Krishnamurthy, Arvind, and Annette Vissing-Jorgensen. 2012. “The Aggregate Demand for Treasury Debt.” Journal of Political Economy 120(2), pp. 233–267.

Li, Canlin, and Min Wei. 2013. “Term Structure Modeling with Supply Factors and the Federal Reserve’s Large-Scale Asset Purchase Programs.” International Journal of Central Banking 9(1), pp. 3–39.

Modigliani, Franco, and Richard Sutch. 1966. “Innovations in Interest Rate Policy.” American Economic Review 56, pp. 178–197.

Modigliani, Franco, and Richard Sutch. 1967. “Debt Management and the Term Structure of Interest Rates: An Empirical Analysis of Recent Experience.” Journal of Political Economy 75, pp. 569–589.

Neely, Christopher. 2013. “Unconventional Monetary Policy Had Large International Effects.” Federal Reserve Bank of St. Louis Working Paper 2010-018D.

Swanson, Eric. 2011. “Let’s Twist Again: A High-Frequency Event-Study Analysis of Operation Twist and Its Implications for QE2.” Brookings Papers on Economic Activity, Spring, pp. 151–188.

Swanson, Eric, and John C. Williams. 2013. “Measuring the Effect of the Zero Lower Bound on Medium- and Longer-Term Interest Rates.” Federal Reserve Bank of San Francisco Working Paper 2012-02.

Vayanos, Dimitri, and Jean-Luc Vila. 2009. “A Preferred-Habitat Model of the Term Structure of Interest Rates.” NBER Working Paper 15487.