Good afternoon and thank you. I first want to say what a pleasure it is to be in Singapore for the first time, and how auspicious to be coming in the year of the 50th National Day. I’m particularly pleased to see the Federal Reserve Bank of San Francisco and the Monetary Authority of Singapore working together to organize this excellent symposium.

We’re here today to talk about the evolution of regulatory reform. For central bankers and financial regulators it’s virtually de rigueur to emphasize the importance of taking a macroprudential approach to maintaining financial stability. Given the events of the past decade, this renewed focus on fostering a robust, resilient financial system is entirely appropriate.1 But what does this mean in practice? The answer to this question differs across countries, depending on laws, institutions, and history. There are many countries with deep experience in this arena and many in the audience today have firsthand knowledge of implementing macroprudential policies. Given my own experience, I will take a decidedly U.S.-centric perspective, based on the unique legal, institutional, and market structures of my home country, where macroprudential policies are still relatively new and untested. Before I proceed any further, I should emphasize that my remarks reflect my own views and not necessarily those of anyone else in the Federal Reserve System.

Now that I have that out of the way, let me be clear what I mean by “financial stability.” I’ll quote the European Central Bank’s definition: “A condition in which the financial system—comprising financial intermediaries, markets and market infrastructures—is capable of withstanding shocks and the unravelling of financial imbalances, thereby mitigating the likelihood of disruptions in the financial intermediation process which are severe enough to significantly impair the allocation of savings to profitable investment opportunities.”2 It goes without saying that the global financial system did not meet this definition when confronted by the Lehman shock and subsequent events. The resulting near meltdown of the global financial system almost toppled economies around the world. Even with dramatic and, in many cases, unprecedented action by governments and central banks, the fallout from the financial crisis was devastating. I should note that the renewed concern for financial stability represents more a return to the roots of central banking than new-age thinking. The Federal Reserve itself was created from the ashes of the panics and depressions that plagued the U.S. economy in the late 19th and early 20th centuries.

In my remarks I will focus on policy options directed at improving financial stability in the United States. These include monetary policy and micro- and macroprudential policies. Lest I bury the lede: My main conclusions are: (1) monetary policy is poorly suited for dealing with financial stability concerns, even as a last resort; (2) a macroprudential, financial system-wide perspective is needed—but in the United States, explicitly macroprudential tools are hard to find; and (3) given (1) and (2), we need to rely primarily on microprudential regulations and supervision to achieve macroprudential goals. A final conclusion is that constant repetition of the words “macroprudential” and “microprudential” will render me unable to speak after about five minutes, so I’ll revert at times to “macro-pru” and “micro-pru” to spare us all.

The role of monetary policy in financial stability

Let me start with the least controversial topic first: the role of monetary policy in supporting financial stability goals. It has become a mantra in central banking that robust micro- and macroprudential regulatory policies should provide the main lines of defense for threats to financial stability. Nonetheless, there is some concern that these alone may be insufficient. Those who hold these worries conclude that there should be a financial stability goal in the monetary policy mandate. Central bankers themselves regularly refer to the connections between monetary policy and financial stability. At the Federal Reserve, the Bank of England, the Norges Bank, the Sveriges Riksbank, and elsewhere, policy discussions have frequently highlighted the tradeoffs between, and the appropriate balancing of, macroeconomic and financial stability goals.3

It is noteworthy that the recent heightened focus on the connections between monetary policy and financial stability is a sea change from the consensus before the global financial crisis. Central bankers were then nearly unanimous in their undying faith and fealty to a version of inflation targeting, whereby monetary policy is single-mindedly focused on price stability and, usually more quietly, other macroeconomic goals. Financial stability was viewed as a potentially dangerous distraction, risking the central bank’s attention to, and credibility in, achieving its price-stability mandate. This approach was codified in numerous central bank charters, which in some cases mandated consequences if the inflation goal was not met.4

Despite the clear need to consider all potential tools to avoid a financial crisis, I am unconvinced that monetary policy is one of them. Three observations lead me to this conclusion. First, monetary policy actions offer unfavorable and costly tradeoffs between macroeconomic and financial stability goals. Second, using monetary policy in pursuit of financial stability could undermine the credibility of the central bank’s commitment to its inflation target and unmoor inflation expectations. Third, the great uncertainty about, and long lags between, monetary policy actions and risks to the financial system argue against their playing a meaningful role.

Taking these in turn: The first issue is the high cost, in terms of macroeconomic goals such as price stability and full employment, of using monetary policy to address potential risks to financial stability. Under normal circumstances, macroeconomic and financial stability goals are likely to be in harmony. However, in some circumstances, such as when the economy is weak but risks to financial stability appear to be growing, they may come into conflict. In such a case, the concern over financial stability may suggest raising interest rates higher than would be appropriate for macroeconomic goals, resulting in higher unemployment and lower inflation.

This problem is starkly illustrated by the real-world tradeoff that Sweden’s central bank, the Sveriges Riksbank, faced in trying to mitigate risks to financial stability using monetary policy. Let me set the stage. In recent years, Sweden’s economy has been in the throes of persistently high unemployment and low inflation. At the same time, household debt has grown rapidly. In response, the Riksbank undertook a tighter monetary policy stance than purely macroeconomic considerations would have called for. In effect, inflation and unemployment goals were subordinated to reduce the risks to financial stability that stemmed from Sweden’s high level of household debt. Lars Svensson has argued that the Riksbank’s monetary policy actions induced a significantly higher rate of unemployment and a sustained shortfall of inflation relative to its target.5 Sweden’s dilemma is not an isolated example; a similar set of issues has faced Norway’s central bank, the Norges Bank.6

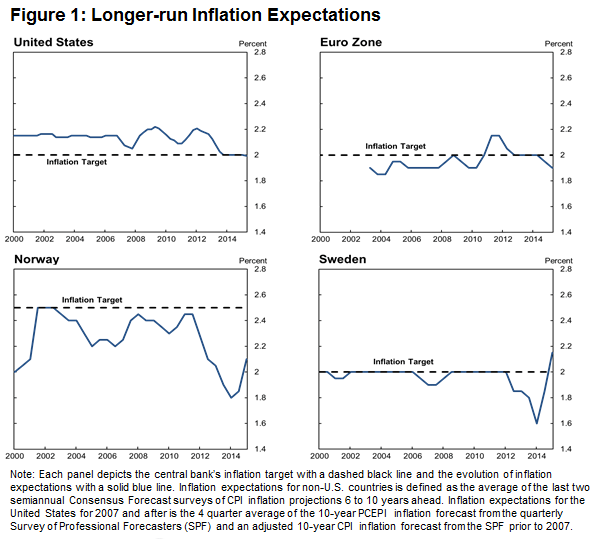

The second, related, observation is that policy actions aimed at addressing financial stability could drive inflation far from its target for many years. This could undermine faith in the central bank’s commitment to its inflation target and affect inflation expectations, which have been known to slip when central banks emphasize the role of financial stability when deliberating monetary policy. Figure 1 shows survey data on longer-run measures of inflation expectations for the United States, the euro area, Norway, and Sweden.7 These have remained stable in the United States and the euro area throughout the tumult of the global financial and euro crises, as well as the aggressive monetary policy undertaken by the Federal Reserve and the ECB. In contrast, long-run inflation expectations in Norway and Sweden fell below target when their central banks were highlighting financial stability worries.8 This followed long periods of inflation averaging below target levels and central bank communication that financial stability concerns had been affecting policy decisions.

After the Riksbank reversed course in July 2014, inflation expectations rebounded, providing additional evidence to suggest a link between adherence to a financial stability mandate and inflation expectations. The Norges Bank, on the other hand, stayed the course and inflation expectations have remained depressed. So far, it’s unclear how durable this slippage will be. Nonetheless, it is an apt reminder of the potential long-run costs of losing sight of the price stability mandate. The steadfastness of the nominal anchor in most advanced economies has been, and continues to be, a key factor in many central banks’ ability to maintain low and stable inflation during and after the global financial crisis. If the anchor were to permanently slip, it would wreak lasting damage to central banks’ control over both inflation and economic activity, at considerable cost to the economy.

My third observation is that while the costs of using monetary policy to address financial stability risks are clear and sizable, the potential benefits of such actions are much harder to pin down. In part, this uncertainty is due to the difficulty inherent in analyzing and measuring tail risks that could develop in the future. But it also reflects the shortcomings of available economic models, which do not provide much guidance on how monetary policy may affect such risks.9 Moreover, monetary policy is likely to affect financial stability in myriad ways and even the direction of these effects may depend on the circumstances at hand. For example, Svensson argues that the Riksbank’s policies may have actually increased the already high household debt-to-income ratio, potentially exacerbating financial stability risks rather than mitigating them.10 More generally, once perceived risks to the financial system have begun to emerge, the implications for monetary policy are unclear. Take the current example of the purported effect of low interest rates on excessive risk-taking in financial markets. Does this argue for more rapid policy actions to discourage further risk accumulation? Or does it imply a more gradual course of action to minimize the risk of a sudden adverse market reaction? It’s not at all obvious. Based on the standard principle that highly uncertain policy actions should be used with caution, the ambiguous effects of monetary policy on financial stability are another argument for limiting use of this tool.11

Micro- and macroprudential policy and financial stability

I am convinced that monetary policy should not be used to address risks to financial stability given the very real and sizable costs, not to mention that the potential benefits are anything but certain. This brings me to micro- and macroprudential regulatory and supervisory policies, which better address financial stability at less cost to other economic goals. One of the key lessons of the recent crisis (and, for that matter, earlier crises) is the need to move beyond a standard microprudential framework. We should instead supplant the focus on individual institutions’ financial soundness, based on traditional measures of regulatory capital, with a more systemic view of the financial system’s overall health.

Of course, strong microprudential regulation is a prerequisite for a robust and resilient financial system. The regulatory reforms in the Dodd-Frank Act and Basel III—including larger capital and liquidity-cushion requirements—strengthen the resilience of financial institutions from a microprudential perspective.12 This not only decreases the odds of an idiosyncratic failure, but reduces the contagion risks posed by outside events. However, experience teaches us that this alone may not be sufficient. The macro-pru approach extends the regulatory lens to include the interconnectedness of institutions and markets; correlations in strategies and risks across the financial system; risks of contagion across institutions during panics; and financial markets’ performance under stress.13 As I said earlier, countries around the globe have embraced this macroprudential approach in their various regulatory reforms in different ways.

The development of a more macroprudential approach in the United States has been shaped by its particular legal and regulatory constraints, and in large part continues to be built on microprudential foundations. In fact, there are few explicitly macro-pru tools available in the United States of the kind found in many other countries. In addition, the sizable share of finance and credit that occurs outside of banks, in the so-called shadow banking sector, severely limits the ability of regulators to impose macroprudential restrictions like loan-to-value limits. Hence the title of this talk: Macroprudential policy in a microprudential world.

Despite these limitations, there are important ways in which a macroprudential perspective is being integrated into the regulatory and supervisory framework in the United States. I’ll list three examples. Of course, this list is far from complete, and it ignores important issues such as resolution of failed institutions and regulation of nonbank financial institutions. But it highlights some of the key successes and challenges in executing macroprudential policies in the United States.14

The first is a detailed examination of the goings-on throughout the financial system—that is, looking beyond just the regulated depository institutions—to identify emerging threats to financial stability before it’s too late. The second is strengthening market structures to reduce the danger of credit markets freezing up during a crisis. And third is the use of stress tests as an indirect, but nonetheless powerful, method to bring a macroprudential outlook to an otherwise microprudential tool.

One obvious lesson from the crisis is the need to have a full understanding of the complex interrelationships that permeate the financial ecosystem. Risks in one part of the system can easily and rapidly spill over to other parts, as was seen in 2007-2008, when problems in the shadow banking sector—including investment banks and insurers—threatened to overturn the entire system. Such monitoring and analysis of developments throughout the financial system has become a regular practice at the Fed.15 It has already helped identify latent or emerging risks to financial stability. One example is the rapid growth of leveraged lending that led to the supervisory guidance to banks issued by U.S. regulators in 2013.16

The second macroprudential effort is the strengthening of market structures critical to the provision of credit.17 These include the recent regulatory reforms regarding money market mutual funds, designed to reduce the risk of flight from these markets during a panic, as we saw in 2008. Other efforts include reforms to the institutional structure around clearing of derivatives, and repurchase agreements aimed at minimizing contagion and market breakdowns during stress. In fact, this is one area where monetary policy does intersect with financial stability.18 In particular, the central bank can play the role of a ready, ultrasafe, short-term borrower, which may reduce the incentive in the financial sector to create risky money-like financial instruments.19 On the other hand, it may increase risks of a run on short-term funding markets during a panic.20 This is an important issue that requires more study.

The third incorporation of macro-pru perspectives is the annual stress tests (officially called the Comprehensive Capital Analysis and Review, or CCAR) undergone by large banks.21 The stress tests appear at first glance to be purely micro-pru exercises: They evaluate each firm’s balance sheet in isolation, subject to a set of common aggregate economic shocks—the so-called “severely adverse scenario.” The results, in terms of approving capital plans, are determined on a firm-by-firm basis, rather than by looking at the health of the overall financial system.

But that takes far too narrow a view of the endeavor. In fact, the stress tests sit right at the intersection of the micro- and macroprudential worlds. First, the tests provide a huge amount of information regarding the intricate and numerous connections between financial institutions, along with the correlations in their strategies and exposures. This feeds into the macroprudential monitoring and analysis discussed earlier. Second, the design of the severely adverse scenarios can incorporate aspects of the potential risks to the economy and the financial system that this macro-pru observation has uncovered. These could include overvaluation of asset prices, duration risk at banks, lack of liquidity in bond markets, rapid growth in household debt, excessive risk-taking in shadow banks, foreign shocks…the list goes on. The point is that the stress tests place a penalty—and thereby an implicit shadow cost—on activities that would incur large losses in the test scenario. This creates a disincentive for banks to undertake such pursuits, which should reduce the very activity that threatens financial stability.

Despite the macroprudential features already present in the current iterations of stress tests, it’s clear that this is still a work in progress and there is further potential for bringing macroprudential perspectives into the tests. This includes more explicit treatment of the interconnectedness of institutions and the endogeneity of financial and economic conditions. In addition, the tests can be used as a way to measure the overall susceptibility of the financial system to a crisis or panic, rather than a singular focus on individual firms’ capital plans.

Conclusion

There is a broad consensus that strong and effective micro- and macroprudential policies are needed to assure a robust and resilient financial system. As always, the devil is in the details. For the United States, the situation is somewhat more nuanced owing to the legal, institutional, and regulatory landscape. Microprudential regulation and supervision will for the foreseeable future be the bulwark against systemic risks. Nonetheless, macroprudential approaches are increasingly being integrated into the regulatory framework and this process is sure to continue, albeit in a manner reflecting the unique aspects of the United States. Thank you.

End Notes

1. See, for example, Group of Thirty (2010).

2. This is taken from the European Central Bank (ECB) website.

3. See, for example, Bank of England (2013), Norges Bank (2014), Sveriges Riksbank (2014a).

4. Even at the Federal Reserve, where inflation targeting was never formally adopted, financial stability was rarely discussed at monetary policy meetings during the run-up to the financial crisis. See Fligstein et al. (2014) for a textual analysis of Federal Open Market Committee transcripts in the years before the global financial crisis

5. Svensson (2013).

6. For example, in the Norges Bank’s Monetary Policy Report (2014), they frame their policy decision as follows: “Both the objective of keeping consumer price inflation close to 2.5% and the objective of sustaining capacity utilization in the years ahead could in isolation imply a somewhat lower key policy rate forecast…. On the other hand, a lower key policy rate may increase the risk of a further buildup of financial imbalances.”

7. Figure 1 is based on a chart in Levin (2014).

8. Other surveys show smaller downward movements in long-run inflation expectations. See Norges Bank (2014) and Sveriges Riksbank (2014b).

9. See Adrian and Shin (2008) for a model of the interaction of monetary policy and financial stability.

10. Svensson (2013).

11. See Williams (2013) for a recent treatment of the implications of policy uncertainty on optimal policy choice of monetary policy.

12. See Shin (2011) and Yellen (2015).

13. See Bank of England (2009) and Group of Thirty (2010).

14. See Fischer (2015) for a more complete discussion.

15. See Bernanke (2013) and Adrian et al. (2014).

16. See Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency (2013).

17. See Fischer (2015).

18. See Williams (2014), Sheedy (2014), and Koenig (2013) for further discussion of ways in which monetary policy frameworks can affect financial stability.

19. See Stein (2012), Kashyap and Stein (2012), and Cochrane (2014),

20. Frost et al. (2015).

21. Board of Governors of the Federal Reserve System (2015). Note that the CCAR process is for the largest banks. In addition, the Dodd-Frank Act requires a separate set of tests for medium- to large-sized banks.

20. Frost et al. (2015).

21. Board of Governors of the Federal Reserve System (2015). Note that the CCAR process is for the largest banks. In addition, the Dodd-Frank Act requires a separate set of tests for medium- to large-sized banks.

References

Adrian, Tobias, Daniel Covitz, and Nellie Liang. 2014. “Financial Stability Monitoring.” Federal Reserve Bank of New York Staff Report 601 (February 2013, revised June 2014).

Adrian, Tobias, and Hyun Song Shin. 2008. “Financial Intermediaries, Financial Stability, and Monetary Policy.” In Maintaining Stability in a Changing Financial System. Kansas City: Federal Reserve Bank of Kansas City, pp. 287–334.

Bank of England. 2009. “The Role of Macroprudential Policy: A Discussion Paper.” November.

Bank of England. 2013. “Forward Guidance.” Monetary Policy Committee statement, August 7.

Bernanke, Ben S. 2013. “Monitoring the Financial System.” Speech at the 49th Annual Conference on Bank Structure and Competition sponsored by the Federal Reserve Bank of Chicago, Chicago, Illinois, May 10.

Board of Governors of the Federal Reserve System. 2015. Comprehensive Capital Analysis and Review 2015: Assessment Framework and Results. March.

Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency. 2013. “Agencies Issue Updated Leveraged Lending Guidance.” Joint press release, March 21.

Cochrane, John H. 2014. “Monetary Policy with Interest on Reserves.” Journal of Economic Dynamics and Control 49 (December), pp. 74–108.

Fischer, Stanley. 2015. “Nonbank Financial Intermediation, Financial Stability, and the Road Forward,” Speech at the “Central Banking in the Shadows: Monetary Policy and Financial Stability Postcrisis,” 20th Annual Financial Markets Conference sponsored by the Federal Reserve Bank of Atlanta, Stone Mountain, Georgia, March 30.

Fligstein, Neil, Jonah Stuart Brundage, and Michael Schultz. 2014. “Why the Federal Reserve Failed to See the Financial Crisis of 2008: The Role of ‘Macroeconomics’ as a Sense-Making and Cultural Frame.” University of California-Berkeley Institute for Research on Labor and Employment (IRLE) Working Paper 111-14 (September).

Frost, Josh, Lorie Logan, Antoine Martin, Patrick McCabe, Fabio Natalucci, and Julie Remache. 2015. “Overnight RRP Operations as a Monetary Policy Tool: Some Design Considerations.” Finance and Economics Discussion Series 2015-010. Washington, DC: Board of Governors of the Federal Reserve System.

Group of Thirty. 2010. Enhancing Financial Stability and Resilience: Macroprudential Policy, Tools, and Systems for the Future. New York: The Group of Thirty.

Kashyap, Anil K., and Jeremy C. Stein. 2012. “The Optimal Conduct of Monetary Policy with Interest on Reserves.” American Economic Journal: Macroeconomics, 4(1), pp. 266–282.

Koenig, Evan F. 2013. “Like a Good Neighbor: Monetary Policy, Financial Stability, and the Distribution of Risk.” International Journal of Central Banking 9(2, June), pp. 57–82.

Levin, Andrew T. 2014. “The Design and Communication of Systematic Monetary Policy Strategies.” Journal of Economic Dynamics and Control 49 (December), pp. 52–69.

Norges Bank. 2014. “Monetary Policy Report with Financial Stability Assessment.” March.

Sheedy, Kevin D. 2014. “Debt and Incomplete Financial Markets: A Case for Nominal GDP Targeting.” Brookings Papers on Economic Activity, Spring, pp. 301–361.

Shin, Hyun Song. 2011. “Macroprudential Policies beyond Basel III.” Bank for International Settlements Papers 60, December.

Stein, Jeremy C. 2012. “Monetary Policy as Financial Stability Regulation.” The Quarterly Journal of Economics 127, pp. 57–95.

Svensson, Lars E.O. 2013. “Some Lessons from Six Years of Practical Inflation Targeting.” Sveriges Riksbank Economic Review 2013(3), pp. 29–80.

Sveriges Riksbank. 2014a. “Monetary Policy Report, February 2014.”

Sveriges Riksbank. 2014b. “Repo Rate Cut by Half a Percentage Point to 0.25 Per Cent.” Press release, July 3.

Williams, John C. 2013. “A Defense of Moderation in Monetary Policy.” Journal of Macroeconomics 38 (December), pp. 137–150.

Williams, John C. 2014. “Financial Stability and Monetary Policy: Happy Marriage or Untenable Union?” FRBSF Economic Letter 2014-17 (June 9).

Yellen, Janet L. 2015. “Improving the Oversight of Large Financial Institutions.” Speech at the Citizens Budget Commission, New York, New York, March 3.