Productivity growth has been quite strong over the past 2½ years, despite a drop in the second quarter of 2010. Many analysts believe that productivity growth must slow sharply in order for the labor market to recover robustly. However, looking at the observable factors underlying recent productivity growth and the patterns of productivity over past recessions and recoveries, a sharp slowdown appears unlikely.

Labor productivity, defined as output per hour of labor, unexpectedly stalled in the second quarter of 2010, falling by a 1.1% annual rate in the total business sector based on data available through the end of August. This follows 2½ years of generally strong productivity growth, which started when the recession began at the end of 2007. In fact, the annualized 2.5% pace of labor productivity growth during the latest recession, which appears to have ended in mid-2009, was the fourth strongest of the 11 recessions since World War II. Post-recession, from the third quarter of 2009 to the second quarter of 2010, productivity grew at an even faster annual pace of 2.8%, even with the second-quarter drop. This strong growth is one reason for the scant downward movement in the unemployment rate despite moderate GDP gains. Businesses have been able to meet demand for their products and services without hiring new workers or increasing the hours of current staff because they are managing to get more from each hour of labor.

Recent rapid gains in productivity beg the questions of where the growth is coming from and whether it is sustainable. They also raise the question of whether the second-quarter drop was just a temporary blip in an otherwise strong productivity trend or the start of a significant productivity slowdown. The strength of the labor market recovery hinges on the answers to these questions. Many forecasters have predicted moderate GDP growth and a reasonably strong recovery in employment over the next year or two. Such a scenario would require a sharp slowdown in productivity growth to about 1% or less.

This Economic Letter examines the risks to this forecast, first looking at how productivity growth has fared in past recessions and recoveries. Then it considers where recent gains have come from. For example, do they reflect more physical capital relative to labor hours, increases in labor quality, or efficiency gains? The findings suggest that productivity growth for the next year or so might very well exceed forecaster expectations, which would put a damper on employment gains.

Productivity growth in past recessions and recoveries

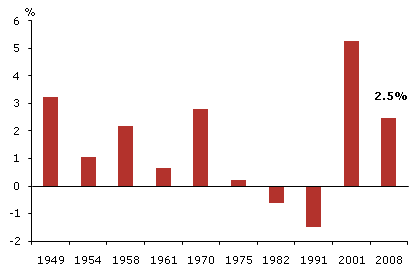

Figure 1

Productivity growth in recessions (peak to trough)

Percent change in business output per hour, annual rate

Source: Bureau of Labor Statistics (BLS) and author’s calculations.

Productivity growth was strong in the latest recession compared with that registered in past recessions. Figure 1 shows these comparisons using Bureau of Labor Statistics (BLS) seasonally-adjusted quarterly data on real output per labor hour for the nonfarm business sector. Growth rates are annualized to facilitate comparisons among recessions of different durations. The National Bureau of Economic Research Business Cycle Dating Committee, the standard source for recession dates, has determined that the previous expansion peaked, and the recession began, in December 2007. The committee has not yet determined when, or even if, the latest recession ended. Many analysts believe the business cycle trough occurred sometime around the middle of 2009. Here I assume the third quarter of 2009 was the last quarter of the recession. Using the second quarter for the analysis yields qualitatively similar conclusions. Including third-quarter data, productivity grew at an annualized 2.5% rate during the latest recession. Adjusting for changes over time in the underlying trend rate of productivity growth, which is generally thought to have slowed around 1973 and accelerated after 1995, does not change this conclusion.

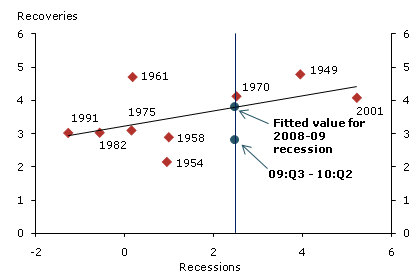

Figure 2

Labor productivity growth, recession vs. recovery

Growth from peak to trough (x-axis) vs. growth over 8 quarterssince trough (y-axis), annual rate

Source: BLS and author’s calculations.

Does strong productivity growth in a recession predict strong productivity growth in the subsequent recovery? Figure 2 is a scatter plot characterizing the relationship between productivity growth in past recessions and productivity growth in the subsequent recoveries. Each point represents a particular recession-recovery episode. All post-World War II episodes are shown except that of the very short 1980 recession, whose recovery overlapped with the 1982 recession. The value of the point on the x-axis indicates annualized productivity growth during the recession. The value of the point on the y-axis gives the productivity growth rate during the subsequent recovery, which is defined as the eight quarters following recession.

There is a clear positive correlation, as indicated by the fact that those points with high x-axis values, indicating fast productivity growth during the recession, tend also to have high y-axis values, indicating fast productivity growth during the subsequent recovery. The positively sloping line running through the data points is what is known in statistics as a regression fit line, showing the relationship between productivity growth in recessions and productivity growth in subsequent recoveries in the post-World War II data. The vertical line at the value of 2.5% on the x-axis shows productivity growth in the recent recession. The historical relationship between productivity growth in recessions and recoveries, traced by the regression fit line, predicts that productivity growth for the current recovery will be about 3.8%. Because of the sharp productivity drop in the second quarter, the 2.8% productivity growth from the third quarter of 2009 through the second quarter of 2010 is somewhat below this predicted level. Still, this recovery rate of productivity growth is above the rate during the recession and is well over the roughly 1% pace that many private forecasters have predicted. Adjusting the data for estimates of underlying trend productivity growth dampens the positive relationship somewhat, but the correlation remains positive.

Of course, one should not make too much of a correlation based on nine data points. All the same, since World War II, only in the recovery following the 2001 downturn was productivity growth slower than it was in the recession itself. And that episode may be an exception that proves the rule. Productivity growth in the recovery following the 2001 recession was a strong annualized 3.9%, far above estimates of the underlying structural productivity trend. Many economists point to this strong growth as a key factor in the so-called “jobless recovery” that took place after the 2001 recession. This bodes poorly for employment in the current recovery. Today’s forecasts of a sharp productivity slowdown, necessary for robust employment growth, imply a serious departure from history, in which productivity growth in recoveries has generally exceeded growth in recessions.

Where are recent productivity gains coming from?

To better understand why labor productivity growth has been so strong over the past few years, it is useful to break down this growth into measurable components. To assess the sources of productivity gains, economists separate growth in output per hour into observable factors related to capital investment and the average skill level of the workforce. In addition, economists consider unobserved residual factors which are collectively called total- or multi-factor productivity growth (MFP). In other words, a portion of labor productivity growth can be attributed to additions to the quantity of capital in the form of equipment or buildings for each hour of work, a process known as capital deepening. Another portion can be attributed to changes in the “quality” of workers, typically defined as the average education level of the workforce. What’s left over—the difference between total measured labor productivity growth and the sum of the contributions from capital deepening and labor quality—are the unmeasured or difficult-to-measure factors that make up multi-factor productivity growth. These may include changes in the intensity of capital and labor utilization, measurement errors in labor hours, and productivity gains due to technological change, improvements in management techniques, greater efficiency of distribution systems, and the like.

Although Bureau of Labor Statistics data on labor productivity are available quarterly, BLS data on capital deepening, labor quality, and multi-factor productivity are only available annually and with a considerable lag. Fernald (2009), however, constructs quarterly data on these factors, which have been updated through the second quarter of 2010 (see https://www.frbsf.org/wp-content/uploads/quarterly_tfp.xlsx).

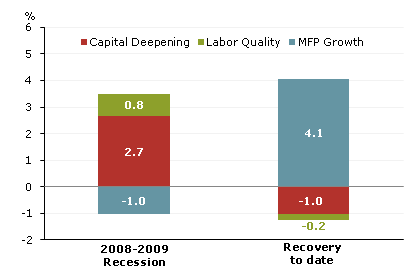

Figure 3

Labor productivity growth decomposition

Percent point contributions, annual rate

Source: Author’s calculations based on data from Fernald 2009.

Using these data, it is possible to analyze labor productivity growth for the recent recession and the recovery through the second quarter of 2010. The results are shown in Figure 3. During the recession, capital deepening was the main factor, contributing 2.7 percentage points to total annualized labor productivity growth. This strong capital deepening was not because capital investment was particularly robust during the recession. Rather, it reflected a calamitous drop in labor hours combined with weak but positive growth in capital services, a measure of flows coming from physical assets and software.

That is, investment more than kept up with depreciation of existing capital while businesses reduced labor input severely. Labor quality also contributed positively to productivity growth, as businesses disproportionately laid off or didn’t hire less-educated workers. Such “up-skilling” is common in recessions. Together, capital deepening and the increase in labor quality accounted for more than 100% of observed labor productivity growth in the recession. The residual multi-factor productivity growth was actually slightly negative.

However, in the recovery, the roles of capital deepening and multi-factor productivity reversed. Growth in employment and hours worked returned to positive territory in late 2009. Capital services, however, were essentially flat during the recovery through the second quarter of 2010. As a result, capital deepening-or shallowing in this case-contributed negatively to productivity. Yet, labor productivity growth accelerated, thanks to 4.1% multi-factor productivity growth.

Where did all this multi-factor productivity growth come from? As noted, the factors behind multi-factor productivity growth-measurement error in hours worked, changes in capital utilization, changes in labor effort, and efficiency gains due to technological or organizational changes-are, by definition, unmeasurable, or at least very difficult to measure, especially in real time. For example, measurement error in hours worked can contribute to measured productivity growth because productivity is typically defined in terms of hours paid, based on data collected quarterly in large-scale BLS surveys. The surveys miss hours actually worked because of such factors as “off-the-books” employment. BLS does report annual survey data on the ratio of hours worked to hours paid, with a substantial lag. The latest year currently is 2008. The magnitude of past year-to-year changes in this ratio suggests that its movements are not likely to explain much of the 4.1% multi-factor productivity growth in the recovery to date. The largest year-over-year change in this ratio from 1976 to 2008 was 0.5%.

Capital utilization, on the other hand, appears to have much more promise as an explanation for the recent multi-factor productivity growth. The Federal Reserve Board’s industrial capacity utilization rate, often used as a proxy for capital utilization, has increased 10% since mid-2009. Capital accounts for about one-third of production, with labor accounting for the rest. Hence, capital utilization potentially contributes over 3 percentage points to multi-factor productivity and, by extension, to overall labor productivity growth. Separate data on the capital workweek in the manufacturing sector also suggest a large potential contribution from capital utilization.

Evidence that capital utilization is an important and possibly the primary factor behind the recent strength in productivity growth has important implications for the sustainability of that growth going forward. Although measures of capital utilization have grown rapidly during the recovery to date, they are still well below their historical averages. That suggests there is plenty of room for further increases in capital utilization over the next several quarters. Such increases could lead to continued strong productivity growth for the next year or so, posing an important risk to the strength of the labor market recovery.

References

Fernald, John. “A Quarterly Utilization-Adjusted Series on Total Factor Productivity.” Unpublished manuscript, August 2009.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org