Introduction

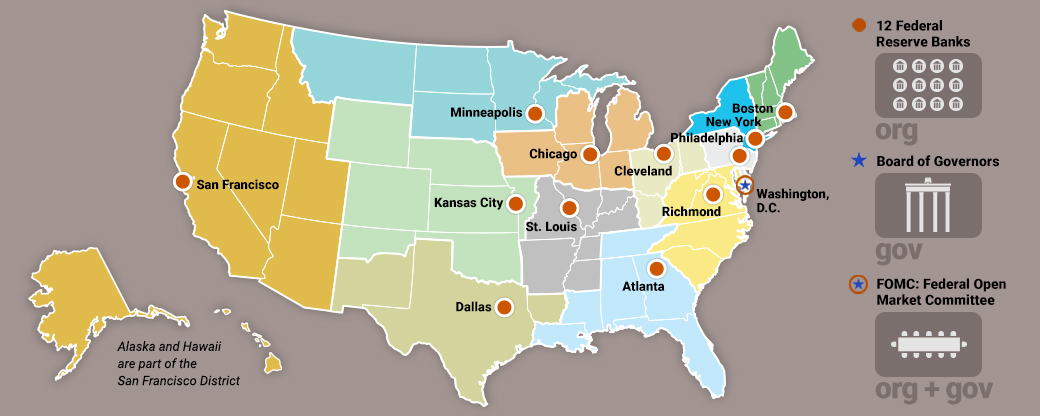

The Federal Reserve System has a two-part structure: a central authority

called the Board of Governors located in Washington, D.C., and a

decentralized network of 12 Federal Reserve Banks located throughout the

U.S. One of the most visible functions of the Fed plays out at the meetings

of the Federal Open Market Committee (FOMC), which bring together members of

the Board of Governors and presidents of the Reserve Banks to set monetary

policy.

The Fed’s structure has been set up by Congress to ensure that monetary

policy is insulated from political pressure. The Fed’s decisions are also

protected from interference from other arms of the federal government.

Specifically, policy and operational decisions do not require approval from

Congress or the President. Also, the Fed’s operations are not financed by

appropriations from Congress. The Fed is able to self-fund its budget

through interest earned on U.S. government securities it holds, interest on

loans to financial firms, and fees charged to banks. While the Fed’s

structure shields it from political pressure, Congress still has the power

to change the laws governing the Fed and its structure. In addition, the Fed

regularly reports to Congress on monetary policy and other matters, and

undergoes an audit process each year. As such, the Fed is commonly described

as “independent within the government,” or as a “quasi-governmental” agency.

Board of Governors

The Board operates as an independent government agency.

At the center of the Federal Reserve structure is the Board of Governors in

Washington, D.C. The Board is charged with overseeing the entire Federal

Reserve System and operates as an independent government agency. The Board

is made up of seven members who are nominated by the President and confirmed

by the Senate. Members serve staggered 14-year terms that expire in

even-numbered years. The long, 14-year terms are another feature of the

Fed’s structure designed to shield Board members from political pressures.

From these members, the President also designates a Chair and two Vice

Chairs of the Board to serve four-year terms. These leadership roles must be

approved by the Senate and may be renewed.

Federal Reserve Banks

Twelve regional Federal Reserve Banks carry out much of the System’s

day-to-day operations.

The Fed includes 12 regional Federal Reserve Banks that carry out much of

the System’s day-to-day operations. These Reserve Banks, also known as

district banks, are organized as a special type of not-for profit

organization operating in the public interest. The 12 districts are

headquartered in Boston, New York, Philadelphia, Cleveland, Richmond,

Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San

Francisco. Branches of the Reserve Banks are located in 24 other cities.

Each Reserve Bank and each of their branches has a board of directors. The

local boards include individuals from different sectors of their

communities. Some individuals represent commercial banks that are members of

the Federal Reserve System. Other board directors represent local businesses

and labor, consumer, and nonprofit areas of their communities. Each Reserve

Bank has a president who is appointed by its board of directors, excluding

directors representing commercial banks. The Board of Governors must approve

these appointments.

Federal Open Market Committee

The FOMC is the Fed’s monetary policy-making body.

The Federal Open Market Committee (FOMC) is the Fed’s monetary policy-making

body. The FOMC has 12 voting members, including all seven members of the

Board of Governors and a rotating group of five Reserve Bank presidents. The

Chair of the Board of Governors also serves as Chair of the FOMC. The

president of the Federal Reserve Bank of New York serves as Vice Chair of

the FOMC. The NY Fed is directly involved in carrying out monetary policy

operations, so its president has a permanent vote on the FOMC. The other 11

Reserve Bank presidents serve one-year terms as voting members on a rotating

basis. All 12 Reserve Bank presidents participate in FOMC meetings, whether

or not they are current voting members.

The FOMC holds eight regularly scheduled meetings a year in Washington, D.C.

For each session, economists at the Board of Governors and the Reserve Banks

analyze regional, national, and international economic and financial

conditions. On the final day of each FOMC meeting, monetary policy actions

are put to a vote. Following the meeting, the FOMC issues a written

statement. Each statement describes how the committee views economic

conditions, policy actions, and guidance on the possible future course of

policy. Three weeks following each FOMC meeting, detailed minutes are

released. The minutes include descriptions of the Committee’s views on

economic conditions and the reasons for policy decisions. Following a

five-year holding period, the actual transcripts of each FOMC meeting are

also released.

FOMC Communications

The FOMC has taken several steps to be more open about monetary policy. The

Chair of the Federal Reserve holds regular press conferences after every

FOMC meeting. In addition, the Committee regularly updates and releases a

document called the “Statement on Longer-Run Goals and Monetary Policy

Strategy.” This document outlines how Fed policymakers interpret the Fed’s

dual mandate from Congress to promote full employment and stable prices.

FOMC members also provide their views on the likely direction of future

monetary policy in a document called the “Summary of Economic Projections.”

The Committee releases these projections four times each year.

Recent Changes

There are also two additional entities within the Fed that were established

in 2010 as a result of the Dodd-Frank Act. The Consumer Financial Protection

Bureau is an autonomous agency operating within the Fed that protects

consumers in financial matters. The Office of Minority and Women Inclusion

is charged with stepping up the Fed’s involvement with minority- and

women-owned businesses and reviewing the diversity and inclusion policies of

the financial institutions the Fed oversees.

Sources:

Crisis & Response: Regulatory Reform, Federal Reserve Bank of San Francisco.

FAQs: How is the Federal Reserve System structured?, Federal Reserve Board of Governors, April 17, 2016.

FAQs: What is the FOMC and when does it meet?, Federal Reserve Board of Governors, January 30, 2019.

FAQs: What is the purpose of the Federal Reserve System?, Federal Reserve Board of Governors, November 3, 2016.

The Federal Reserve System Purposes & Functions, Federal Reserve Board of Governors, Tenth Edition, October 2016.

Statement on Longer-Run Goals and Monetary Policy Strategy, Federal Reserve Board of Governors, January 29, 2019.

Summary of Economic Projections, Federal Reserve Board of Governors, December 11, 2019.