Historically central bankers have been a taciturn lot, especially when it comes to the subject of the future direction of monetary policy. This reluctance to opine on monetary policy has changed dramatically over the past decade, to the point where some exasperated commentators exclaim they wish central bankers would just be quiet! An important aspect of this new openness is “forward guidance,” that is, central banks’ efforts to describe the likely future direction of monetary policy through words or policy projections. The Feroli et al. (2016) paper reexamines the roles and effects of Federal Reserve forward guidance and draws a number of conclusions and policy prescriptions for the use of forward guidance in the future. I should note that my comments reflect my own views and not necessarily those of anyone else in the Federal Reserve System.

Their paper evaluates the Fed’s use of forward guidance from a number of perspectives: economic theory, empirical evidence, and assessments from market participants. Although it is impossible to do justice to all aspects of a 90-plus page paper in a few sentences, a few key takeaways stand out.

First, they conclude that time-based forward guidance is generally a bad idea, especially when policy is not constrained by the lower bound on interest rates. They argue that it is inconsistent with the profession’s understanding that best-practice monetary policy reacts to changing economic conditions. It may also artificially reduce uncertainty about future policy, leading to excessive risk-taking and risks to financial stability. And it potentially locks in policy decisions in advance, restricting freedom to react to changing circumstances.

Second, they conclude that well-designed data-based forward guidance can be a useful tool to help guide the public’s understanding of the central bank’s reaction function. They make a number of suggestions of how the Federal Reserve—and, presumably, other central banks—could improve their communication toward that end by emphasizing the data dependency of policy decisions and the resulting uncertainty about the future path of policy.

Third, they present empirical evidence regarding the effects of various types of forward guidance and relate these findings to the desirable characteristics of monetary policy. This is where the rubber hits the road in terms of the debates about the costs and benefits of forward guidance in its various guises. I will devote the bulk of my comments to aspects of the evidence and present some new results of my own.

In considering the empirical evidence on the effects of forward guidance, one is immediately confronted by the quandary that, in our standard textbook theories, forward guidance is superfluous and should leave no imprint on the data. Under rational expectations and complete knowledge, the public already knows everything they need to about monetary policy and make decisions accordingly. They don’t need to read policy statements or listen to press conferences or speeches.

To think that policy guidance matters, you need to relax some assumptions about the public’s information set. For example, they may not possess a complete understanding of the policy regime, as in Rudebusch and Williams (2008), or there may be a break in the regime that the public is unaware of, or the central bank may be trying to reinforce commitment to a strategy, as in Woodford (2013). These issues are likely to be particularly salient when policy is constrained by the lower bound on interest rates and data dependency in policy actions is curtailed.1

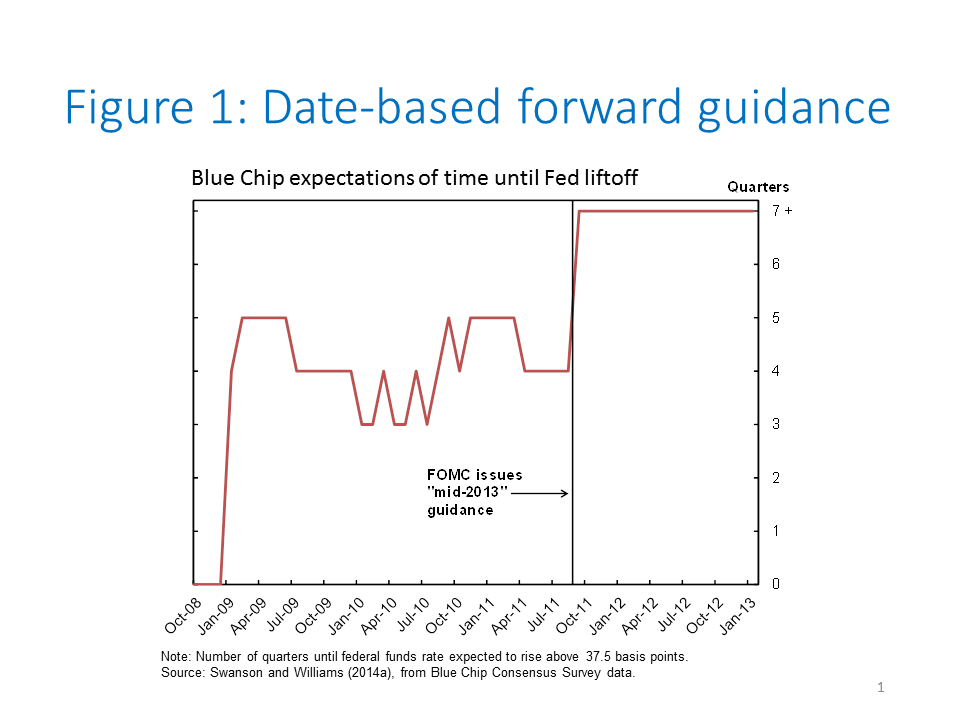

Thus, any discussion about the costs and benefits of forward guidance must take place in the context of the situation in which it is being used. This brings me to my first case study, the Fed’s use of explicit time-based guidance starting on August 9, 2011. Despite extraordinary monetary stimulus—over 2½ years of near-zero short-term interest rates and QE1 and QE2—the unemployment rate had come down only 1 percentage point from its recession peak, to 9 percent, and the economic recovery remained tepid. Given the weakness in the economy, the Federal Open Market Committee (FOMC) repeatedly stated that it intended to keep rates exceptionally low “for an extended period.” Nonetheless, public expectations were glued to the idea that the Fed would start to raise rates in about a year (Figure 1).

It was against that backdrop that the FOMC decided to take dramatic action to shift public expectations using time-based forward guidance. The August 2011 FOMC statement said “The Committee currently anticipates that economic conditions—including low rates of resource utilization and a subdued outlook for inflation over the medium run—are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.”2 Three comments are in order. First, this statement, as well as subsequent FOMC statements that used forward guidance, clearly put the economic outlook front and center as the determinant of policy. The outlook defines the guidance. Second, it was the lower bound that tied the hands of policymakers, not the introduction of date-based guidance. Third, this action was taken after weighing the concerns around the costs of time-based guidance discussed in Feroli et al. (2016); the conclusion then was that the benefits from stimulating the economy outweighed the potential cost.

The evidence bears out this judgment. The issuance of the statement dramatically shifted public expectations of future Fed policy. This is seen in private economists’ forecasts of the length of time until the Fed would raise rates, which jumped following the statement (Figure 1). Compared to the gentle taps of the hammer of previous FOMC verbal guidance that appeared to have little effect on expectations, the time-based guidance was like a sledgehammer.

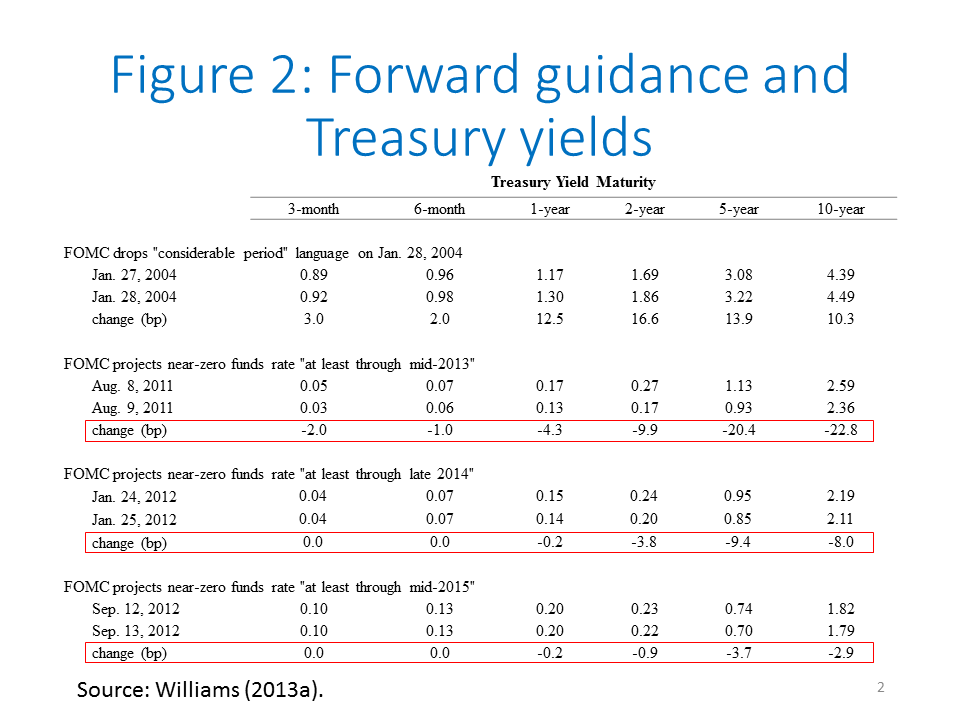

The impact of the introduction of time-based guidance is also seen in the Treasury market, where the yield on a 2-year Treasury note dropped by 10 basis points after the announcement (Figure 2). Yields on 10-year Treasury notes fell by over 20 basis points. A similar pattern is seen after the FOMC extended the date-based guidance in January and September of 2012 (Figure 2). Clearly, time-based forward guidance proved a powerful tool at a time when the FOMC wanted to shift public expectations of future policy. That said, it also proved a very blunt instrument in that all the conditioning statements and caveats around the guidance tended to get drowned out in favor of the date itself. With the work of shifting expectations done, the FOMC moved to more data-based guidance in December 2012.

The lesson I draw from this experience is that the usefulness of explicit time-based forward guidance depends critically on the circumstances at hand. Therefore, one cannot overgeneralize to say it is “good” or “bad.” Although I do not see explicit forward guidance of this type as being beneficial away from the lower bound, it has definitely proven its value in case we find ourselves again constrained by the lower bound and in a similar predicament.3

So far I have been talking about the benefits of forward guidance. What about the costs? Feroli et al. (2016) enumerate various potential costs, but I will focus on the one for which we have the most evidence: the effect of forward guidance on market behavior regarding expectations of future interest rates. They claim that time-based forward guidance artificially dampens the public’s perceptions of future volatility in policy rates and makes expectations of future rates less sensitive to news. In other words, it creates excessive certainty about the future path of rates relative to what is implied by truly data-dependent policy. Whether this reduction in volatility is a good thing or a bad thing when rates are constrained by the lower bound is an open question I’ll leave aside. Instead, I’ll focus on the empirical evidence regarding the effects of guidance on market behavior.

The authors’ theory that time-based guidance causes these market phenomena faces a thorny identification problem because the presence of the lower bound by itself will tend to mute perceptions of volatility of future interest rates and bond rate responsiveness to news.4 And, most uses of forward guidance have occurred when policy is constrained by the lower bound. Thus, the dilemma: If we see evidence of depressed responsiveness to news, is it because of the lower bound or because of forward guidance?

The authors aim to distinguish between these alternative explanations in two ways. First, the Fed used forward guidance in the early 2000s when the funds rate was well above zero, so that provides some independent variation in the data.5 Second, they try to get additional variation in the data by distinguishing between different types of guidance over time. Using these approaches, they find that time-based forward guidance depressed bond market responsiveness to news and implied volatility, beyond what would occur owing to the lower bound.

I am not convinced by this evidence. First, the confidence bands on these estimates, although not reported in the paper, must be wide. Second, in practice it’s hard to make clear distinctions between types of guidance and such attempts are subject to considerable judgment and measurement error. Of course, the FOMC hasn’t made this any easier, tending to mix data- and date-based guidance together. For this analysis to be more convincing, one needs more data.

Fortunately, we do have more data if we look at the international evidence. The Federal Reserve is not the only country to have been constrained at the lower bound and used forward guidance. The Bank of Japan, Bank of Canada, Bank of England, the European Central Bank (ECB), and others have used various forms of forward guidance at different times while at the lower bound.6 Comparing their experiences to the Fed’s provides independent information on the connections between forward guidance, the lower bound, and market behavior.

Consider the cases of the Federal Reserve, the Bank of England, and the ECB. The U.S. and U.K. examples are particularly interesting because both countries reached the lower bound at about the same time and had been expected to exit the lower bound in 2015 or 2016. The big difference between the two is that the Fed has employed a variety of types of forward guidance since 2008—including explicit date-based guidance, and issuing interest rate projections starting in 2012 (the “dot plots”)—while the Bank of England came to use forward guidance late in the game in 2013 and has made limited use of forward guidance since 2014.7 Therefore, if forward guidance on its own has a big effect, we should see a sizable difference between market behavior in the U.S. and U.K.

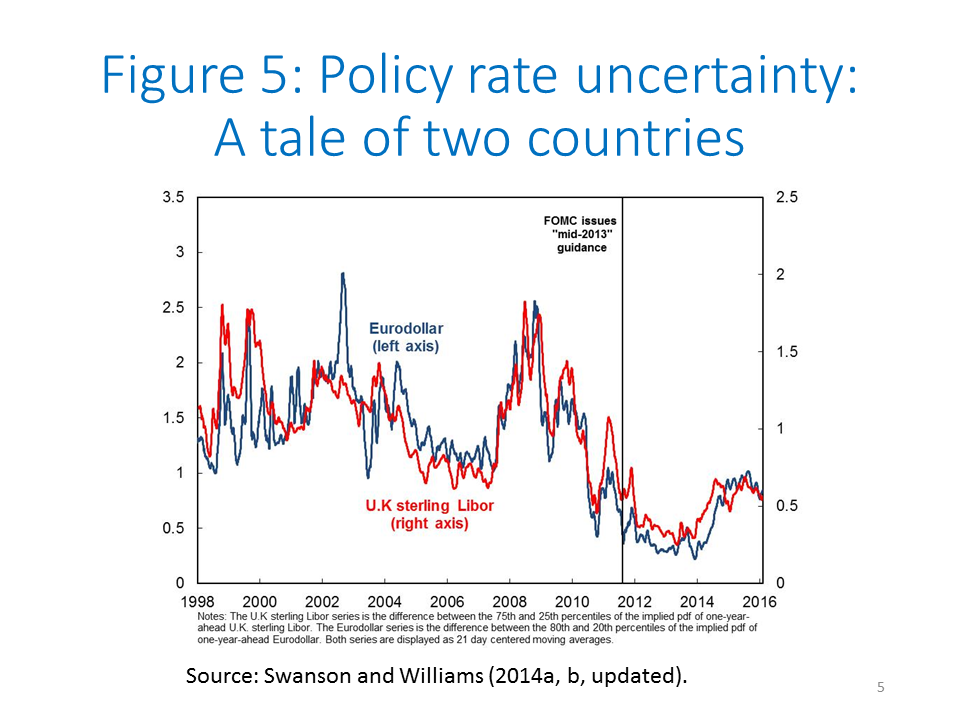

I look at two pieces of evidence regarding public expectations of future policy rates, following the methodology of Swanson and Williams (2014a, b). First, I examine how the response of the yield on a zero-coupon two-year government bond to economic news changes over time in each country. Second, I look at the perceived volatility of short-term interest rates implied by options on 12-month-ahead short-term interest rates in the U.S. and U.K.

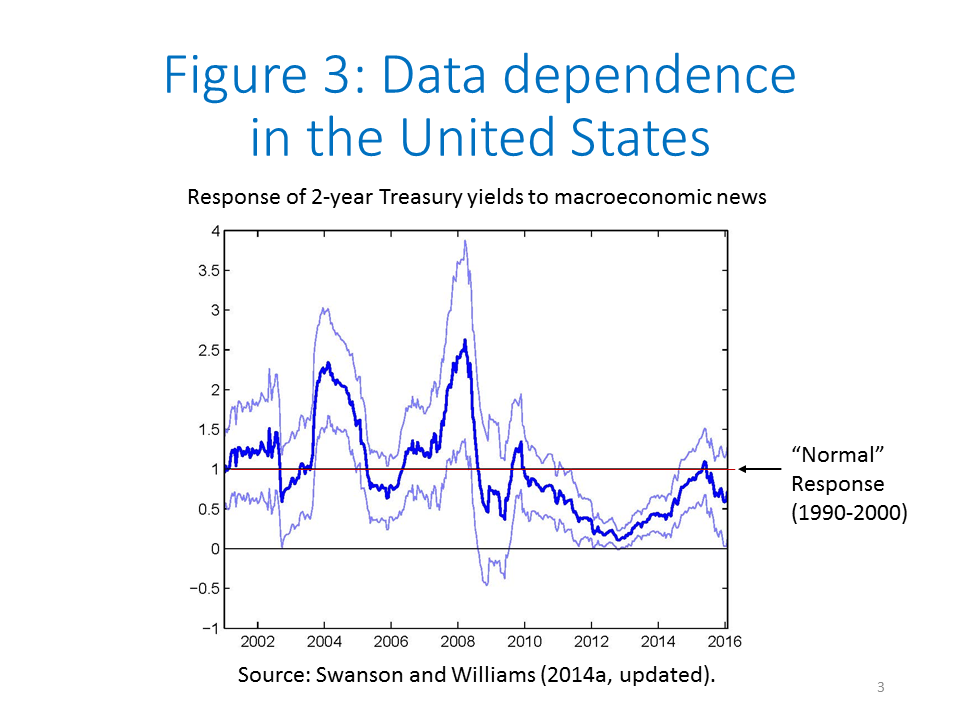

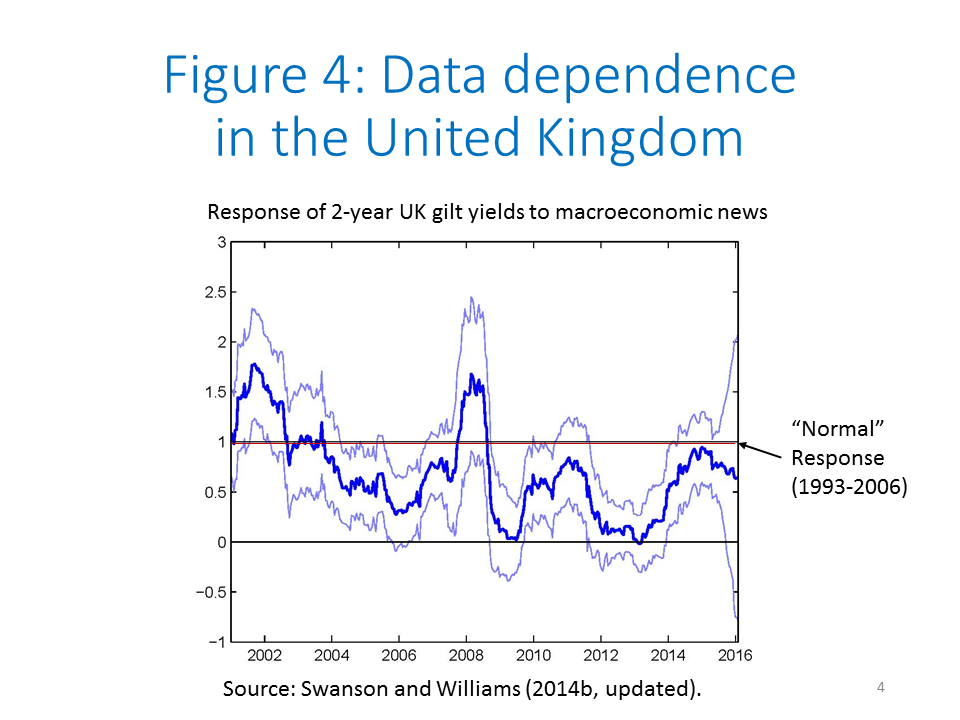

The first finding is that, despite significant differences in forward guidance in the U.S. and U.K., bond market responsiveness to news has been very similar in the two countries since 2012 (Figure 3 and Figure 4). Although not shown here, the same pattern is evident in one-year yields. This similarity in the face of different policies is reinforced by the evidence from implied volatility of future short-term rates: There is no discernible difference in the pattern in market perceptions of future variability in short-term interest rates between the two countries (Figure 5).

The second finding is that both countries have seen a sizable increase in market responsiveness and implied volatility over the past year as expectations of liftoff came nearer. Although these measures are still somewhat below their respective historical norms, the return to data dependence in market behavior is clear.8 The differences in forward guidance across these two countries is exerting no discernible imprint on these measures of market behavior across the two economies.

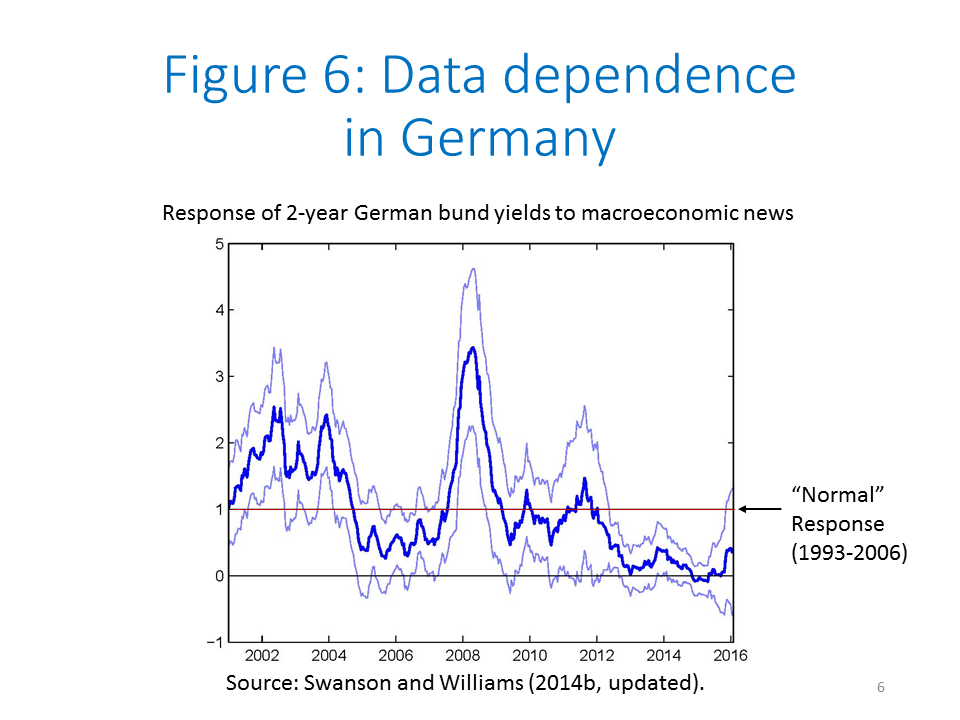

Finally, market responsiveness to news remains very low in Germany, reflecting expectations of being stuck at the lower bound for quite some time (Figure 6). In this regard, the ECB provides another interesting example in that their use of forward guidance has been limited to saying since July 2013 that it “expects the key ECB interest rates to remain at present or lower levels for an extended period of time.”9 Nonetheless, market responses to news are negligible, and there is no evidence of a return to data dependency in market behavior, unlike in the U.S. and U.K.

Taken together, this international evidence suggests that being stuck at the lower bound is the primary driver of the muted responsiveness of the bond market to news and implied volatility of future short-term rates. Although forward guidance undoubtedly can affect market expectations of future policy, it appears to do so by affecting expectations of being constrained by the lower bound, rather than the behavior of rates away from the lower bound.

In conclusion, we have learned a lot from the experience of forward guidance, both in the United States and across the globe. One practical lesson is that it is most effective when it’s both simple and explicit. Vague hints about future policy seem to be ineffective. Although it’s understandable to want to communicate a comprehensive view of monetary policy with all of its incumbent uncertainties, the public has only so much bandwidth dedicated to central bank messaging. Intricate and conditional messages tend to be ignored as well. So, like a sledgehammer, strongly worded forward guidance can be a powerful tool when it’s needed. But, like a sledgehammer, care needs to be taken when and where it is used.

End Notes

1. See Williams (2006), Woodford (2013), and Swanson and Williams (2014a, b).

2. Board of Governors of the Federal Reserve System (2011).

3. See Williams (2013b).

4. See Swanson and Williams (2014a, b) for a lengthy discussion of this issue.

5. See Rudebusch and Williams (2008) for a detailed discussion of the FOMC’s use of forward guidance before the financial crisis.

6. See Carney (2012), Bank of England (2016), European Central Bank (2014), and Shirai (2013).

7. The Bank of England’s main two uses of forward guidance were the introduction of a short-lived 7 percent unemployment threshold in August 2013, and the replacement of that in February 2014 with a description of the likely eventual rise in rates as “gradual.”

8. The “normal” level shown in each figure refers to a benchmark period in which the zero bound was not a concern for that country.

9. See European Central Bank (2014) for further discussion of the ECB’s use of forward guidance.

References

Bank of England. 2016. “Forward Guidance.” Bank of England website.

Board of Governors of the Federal Reserve System. 2011. “Press Release.” August 9.

Carney, Mark. 2012. “Guidance.” Remarks to the CFA Society Toronto, Toronto, Ontario, December 11.

European Central Bank. 2014. “The ECB’s Forward Guidance.” ECB Monthly Bulletin, April, pp. 65–73.

Feroli, Michael, David Greenlaw, Peter Hooper, Frederic Mishkin, and Amir Sufi. 2016. “Language after Liftoff: Fed Communication Away from the Zero Lower Bound.” Paper prepared for the 2016 U.S. Monetary Policy Forum, February 26.

Rudebusch, Glenn D., and John C. Williams. 2008. “Revealing the Secrets of the Temple: The Value of Publishing Central Bank Interest Rate Projections.” In Asset Prices and Monetary Policy, ed. John Y. Campbell. Chicago: University of Chicago Press, pp. 247–284.

Shirai, Sayuri. 2013. “Monetary Policy and Forward Guidance in Japan.” Speeches at the International Monetary Fund and the Board of Governors of the Federal Reserve System, September 21.

Swanson, Eric T., and John C. Williams. 2014a. “Measuring the Effect of the Zero Lower Bound on Medium- and Longer-Term Interest Rates.” American Economic Review 104(10, October), pp. 3,154–3,185.

Swanson, Eric T., and John C. Williams. 2014b. “Measuring the Effect of the Zero Lower Bound on Yields and Exchange Rates in the U.K. and Germany.” Journal of International Economics 92(S1), pp. 2–21.

Williams, John C. 2006. “Monetary Policy in a Low Inflation Economy with Learning.” In Monetary Policy in an Environment of Low Inflation; Proceedings of the Bank of Korea International Conference 2006. Seoul, Korea: The Bank of Korea, pp. 199–228.

Williams, John C. 2013a. “Lessons from the Financial Crisis for Unconventional Monetary Policy.” Panel presentation at the NBER conference, Boston, MA, October 18.

Williams, John C. 2013b. “Will Unconventional Policy Be the New Normal?” FRBSF Economic Letter 2013-29, October 7.

Woodford, Michael. 2013. “Forward Guidance by Inflation-Targeting Central Banks.” Presented at Riksbank Conference on “Two Decades of Inflation Targeting: Main Lessons and Remaining Challenges,” June 3.