Access to the financial system is fundamental to full participation in the U.S. economy. The moves to limit in-person contact and the transition to online contact as a result of the COVID-19 pandemic highlighted this all the more acutely. Participation in the financial system facilitates payment for employment and the ability to purchase goods and services. Perhaps most important, it allows one to invest in the future, whether through debt-financed investments in education or homeownership, or through long-term savings. But access to quality financial services, particularly those that are immediate, low-cost, and digital, is not equal: both low-income people and people of color face barriers to seamless access to and use of these services.

Financial inclusion has long been a goal of community development. However, only recently has there been more widespread recognition that facilitating access to low-income communities and communities of color are not one and the same. Although people of color are more likely to be low-income, it is not solely their income that makes accessing financial services challenging, and people of color across the income spectrum often receive inferior access to financial services relative to their White peers. These differences persist despite the existence of anti-discrimination and fair lending laws, and systemic issues continue to hamper the ability of people of color to participate fully in the economy and save for their futures. As a result, discussion of financial inclusion benefits from being explicit about the structural barriers that continue to limit the full participation of communities of color and acknowledging that we all gain by creating a more inclusive financial system.

In this issue of the Community Development Innovation Review, we have invited authors to reflect on the ways in which financial technology (fintech)1 may facilitate participation in the financial system for marginalized communities, including communities of color, as a starting place for a growing dialogue. But first, this article sets the context for the extant inequities in the financial system.

Structural Inequities Are at the Root of Financial Exclusion

To solve the problem of financial inclusion, we must first understand and acknowledge the roots of financial exclusion. Othering2 on the basis of race has been persistent in U.S. history and plays a key role in financial exclusion and the racial wealth gap. As has been well documented,3 various forms of institutional and interpersonal discrimination—for example, in homeownership and employment—have led to disproportionately fewer wealth-building opportunities for people of color. These disparities compound over time and are consequential, as wealth is an essential buffer against economic shocks and also enables individuals and families to plan for the future and invest in the next generation.

Homeownership, the main driver of wealth accumulation and intergenerational transfer in the United States, was encouraged by the U.S. government starting in the 1930s and 1940s through the Federal Housing Administration and Veteran’s Administration, both of which extended government-backed, low-cost loans to millions of Americans. Government appraisers, however, used the Federal Home Owner’s Loan Corporation rating system, which led to widespread redlining, systemically denying mortgage credit on the basis of race.4 Combined with other practices, such as racially restrictive covenants, racial steering, and blockbusting,5 redlining led to widespread patterns of economic and racial segregation in urban areas across the United States. At the same time, investments in highways and the development of racially exclusive suburbs and disinvestments in central-city areas at a time of major economic restructuring resulted in even greater economic and racial segregation, whereby even people of color who did own their home reaped fewer returns on their investments. In addition to discrimination in housing markets, persistent employment discrimination and segregation have resulted in many people of color having less stable jobs, lower wages, and fewer retirement benefits at work.

These inequities compound through families and generations over time, as those who lack homeownership and retirement savings receive disproportionately fewer savings advantages and tax benefits. Inheritances, gifts, and down-payment assistance enable wealth-building over time; on average Black and Hispanic families receive fewer of these types of financial supports than White families.6 Intergenerational wealth transfer is also critical to attainment of higher education, which subsequently shapes employment outcomes, as well as small business development. Middle-class Black and Hispanic people can be doubly impacted, as they are not only less likely to receive financial assistance from their parents, but may also need to support lower-income family members, making it more difficult to accumulate savings.

Although civil rights legislation has made explicitly race-based discrimination illegal, these and other practices have left a legacy of racialized concentrated disadvantage and neighborhood disinvestment, where people of color have had fewer opportunities to access capital and social mobility.7 Under-resourced schools (which often rely on property taxes), less access to jobs and transportation, more reliance on predatory financial products, and fewer opportunities for wealth-building have led to myriad negative outcomes that go beyond financial well-being and continue to compound. In addition, current practices have been documented that continue to perpetuate these inequities, such as a disproportionate marketing or steering of subprime loans to people of color prior to the Great Recession,8 and racialized scoring of municipal bonds.9

Where Are We in 2021?

This legacy of discrimination and exclusion continues to affect communities of color today. Black and Hispanic families have lower levels of wealth, more limited asset ownership, and more debt than White families. On average, these groups also have more limited access to banking services, greater use of high-cost financial services, and more limited access to capital. This section briefly covers major sources of financial inequities beyond income and education.

Racial Wealth Gaps

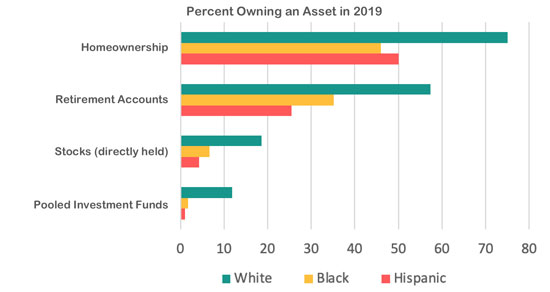

The racial wealth gap is large, and though its size has varied over time, it is not consistently shrinking.10 Recent research from the Federal Reserve Board found that in 2019 the median net worth of Black families was $24,100, relative to $188,200 for White families. The disparity between Hispanics and Whites is smaller but still large, as the median Hispanic family has $36,100 in wealth.11 The same report notes that though the median wealth of Black and Hispanic families has grown more quickly than that of Whites since the Great Recession, both of these groups experienced both larger and more sustained declines between 2007 and 2013.12 This wealth gap is driven, in part, by large differences in access to homeownership.13 In 2020, 45.9 percent of Black households and 50.1 percent of Hispanic households owned their homes, compared with 75.0 percent of White households.14 Ownership of other types of financial assets is also heavily skewed, as Black and Hispanic families are less likely to own retirement accounts, like IRAs or 401(k)s,15 or have non-retirement investments in stocks, bonds, certificates of deposit, or investment funds (see Figure 1).16 The U.S. government subsidizes many types of savings vehicles through the tax code, but the evidence suggests that the vast majority of these tax benefits go to the highest-income households.17 These assets matter not only because they serve as a way for people to save and invest in their future, but also because they serve as a connection to the financial system and provide business relationships to financial institutions.

Figure 1

Asset Ownership Varies Widely by Race

Barriers to Financial Services for People of Color

Access to basic financial services is crucial to building savings; without it, consumers must pay higher costs to cash paychecks and pay bills and have no way to safely save. An estimated 7.1 million American households are unbanked. Black and Hispanic households are disproportionately likely to be unbanked: 13.8 percent of Black and 12.2 percent of Hispanic households are unbanked, relative to 2.5 percent of White households.18 There are many reasons why people lack bank accounts. Though a subset of unbanked consumers does not trust banks or avoids banking for privacy reasons, large shares cite cost and access concerns.19 Accounts usually require a minimum balance, minimum number of deposits, or other utilization factors to avoid paying account fees. For individuals earning low wages or with irregular incomes, it may be hard to meet these requirements, and monthly fees (including costly overdraft fees) can represent a nontrivial amount of their earnings. Evidence also suggests that fees for opening and maintaining basic checking accounts are higher in Black and Hispanic neighborhoods than White ones.20 Without access to traditional banking services, consumers may rely instead on services with high transaction costs, like check cashers, money orders, or bill payment services; Black and Hispanic households are more than twice as likely to have used a check-cashing service or money order than White households.21 These types of financial services are often located in low-income communities and communities of color, may have operating hours outside of traditional banking hours, and frequently make funds available quickly. And although the fees may be higher than those for traditional banking services, they can be more predictable as an upfront cost, rather than an unexpected fee, like an overdraft charge. Traditional banking services may also be literally inaccessible to consumers of color because there are fewer bank branches in their neighborhoods,22 and lower-income and rural consumers are less likely to have internet access to use online or mobile banking services.23

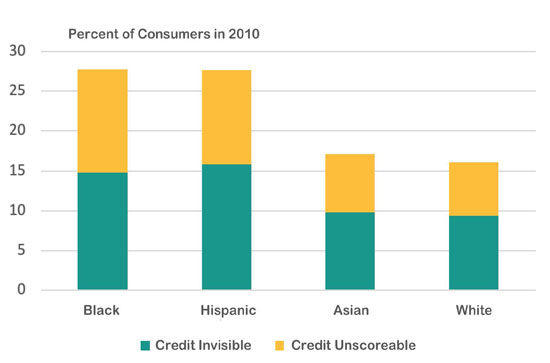

These differing levels of wealth and access to financial services result in large differences in access to credit. Affordable and nonpredatory credit are crucial to investing in wealth-building opportunities, whether it be education, homeownership, or small business. The first barrier to credit access is thin credit files. Because low-income consumers and consumers of color are less likely to have traditional banking relationships, they are disproportionately likely to be credit invisible24 or are “unscoreable” by traditional credit models (see Figure 2),25 despite sometimes having a long history of regular payments on bills like rent or utilities, which are not typically reported to the credit bureaus. But even when these consumers have sufficient credit history to apply for loans, their experiences can differ substantially from those of White consumers. Across mortgage, small business, and auto loans, Black and Hispanic consumers are more likely to be denied credit or receive higher interest rates when they do get a loan; sometimes this is due to financial characteristics, like credit score, but differences still often exist when compared with similar White borrowers.26 Secret shopper studies have shown that Black and Hispanic consumers receive different information from bankers when applying for loans as well.27 Fear of disparate treatment and discrimination may also cause some potential borrowers to opt out of applying entirely. The more limited availability of traditional, affordable credit may push these consumers into predatory products or those with very high interest rates, like payday loans, or may result in reliance on traditional—but more expensive—types of debt, like credit cards.

Figure 2

Shares of Consumers Who Are Credit Invisible or Unscoreable Vary Widely by Race

Promises and Pitfalls of Fintech

Fintech offers an opportunity to reach many who have been excluded from the financial system by approaching financial products with a new eye. Fintech companies are disrupting traditional ways of thinking about financial services across a variety of dimensions: focus on the user experience, shifts to mobile payments, different ways of evaluating creditworthiness, and digital-first financial products, among other innovations. These companies hope to reduce costs by operating at scale and limiting traditional overhead, like maintaining bank branches. By offering improved products (or traditional products at lower costs), via accessible internet or mobile apps, or with nontraditional forms of underwriting, these companies may be able to serve low-income people and people of color who have been historically excluded from mainstream financial services due to cost and the legacies of historical (and lingering) inequities built into the financial system.

But with new opportunities come new risks. Depending on the specifics of a new technology and the institution doing the innovating, similar technologies may face different regulatory environments at both the state and federal level. And even the best-intentioned actors in the fintech space may be unintentionally perpetuating existing inequities or creating new ones. As more financial services move online and fewer in-person locations are available for assistance, those without internet and smartphones (or with limited data plans) may face hurdles in accessing their financial accounts. The use of algorithms in the provision of financial services may reproduce existing inequities (and potentially run afoul of fair lending laws) even when race is not explicitly part of the algorithm or training data; AI has been shown to perpetuate inequities in other contexts, such as hiring and health care.28 Internet-based financial services also raise questions about data privacy. Additionally, lack of racial and ethnic diversity in the fintech ecosystem may result in fewer supports for founders of color and a lack of founders with lived experiences of poverty, discrimination, and financial exclusion, which may yield lower-impact projects.

Moving Toward Equity

Access to quality and affordable financial services is critical to the financial security of families and their abilities to save and invest in their futures (to be discussed in more detail in the following framing article by Melford, Shaw, and Wallace). Additionally, the financial exclusion of low-income individuals and people of color—and the reductions in opportunities for savings and investment that come with it—inhibit not just wealth-building in those communities but growth in the economy overall. Recent research from the Federal Reserve Bank of San Francisco indicates that the U.S. economy could have gained $2.6 trillion in annual output if gaps by race and gender in the labor market were eliminated.29 Some of the gaps they analyzed were the result of differences in educational attainment. As has been discussed in this framing article, one of the results of limited access to financial systems is more limited savings or access to credit to finance investments in education. Another analysis, looking at Black-White differences in wages, education, housing, and business investment, suggests that $5 trillion could be added in GDP over the next five years if the inequities between these two groups were eliminated.30

Fintech represents one way to improve economic outcomes for all American families by improving financial inclusion. But it is important that those considering the use of financial technologies consider their impacts on racial equity and ensure that inequities do not continue to be built into our systems and institutions, as they have in the past. Players in the fintech ecosystem can begin by reflecting on their positions in organizations and consider what they can leverage to create more equitable solutions. More broadly, fintech firms and funders can create a culture of lifting up voices that have been traditionally absent in the fintech ecosystem. Fintech solutions designed by and with people from communities who have been historically excluded have more potential for building trust, as well as a more nuanced understanding of the issues.31 In addition, a targeted universalism32 approach may be promising, whereby approaches designed to meet the challenges facing those who have been most excluded (for example, with greater clarity, transparency, and fewer barriers to access) often work better for everyone.33

Although much work remains to achieve a vision of an inclusive and equitable financial system, we hope this issue of the Review provides frameworks and approaches to start on the path.

The Community Development Innovation Review focuses on bridging the gap between theory and practice, from as many viewpoints as possible. The goal of this journal is to promote cross-sector dialogue around a range of emerging issues and related investments that advance economic resilience and mobility for low- and moderate-income communities and communities of color. The views expressed are those of the authors and do not necessarily represent the views of the Federal Reserve Bank of San Francisco or the Federal Reserve System.

End Notes

1. For this work, the SF Fed defines financial technology as anything that is digitally based, including new technologies, techniques, and business models.

2. Othering is “a set of dynamics, processes, and structures that engender marginality and persistent inequality across any of the full range of human differences based on group identities.” john a. powell and Stephen Menendian, “The Problem of Othering: Towards Inclusiveness and Belonging,” Othering and Belonging (blog), June 29, 2017, https://otheringandbelonging.org/the-problem-of-othering.

3. See, for example, Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing, 2017); or Mehrsa Baradaran, The Color of Money: Black Banks and the Racial Wealth Gap (Cambridge, MA: Harvard University Press, 2017); or Robert J. Sampson, “Neighborhood Effects: The Evolution of an Idea.” Essay. In Great American City: Chicago and the Enduring Neighborhood Effect, 31–49. (Chicago: University of Chicago Press, 2013).

4. Color-coded maps were used to assess how secure neighborhoods were for investment. Neighborhoods deemed low-risk for investment were granted an “A” grade and noted in green on the maps, while those deemed high-risk, or “hazardous,” received a “D” grade and were shaded as red on the maps, thus the name “redlining.” Racial composition was a key indicator in assigning grades. For example, a neighborhood shaded red and graded “D” from Oakland, CA, describes “infiltration of Negros and Orientals” as key “detrimental influences,” which outweighs some of the favorable qualities of proximity to schools, shopping districts, and transportation. See archived redlining maps and documentation for metropolitan areas throughout the United States at the Mapping Inequality project. “Mapping Inequality: Redlining in New Deal America,” accessed May 24, 2021, https://dsl.richmond.edu/panorama/redlining/.

5. Racially restrictive covenants are lists of obligations written on deeds by existing owners that purchasers of properties must assume, which frequently included language promising to never sell or rent to people of color. An example from a 1950 covenant on a property in Daly City, CA detailed, “The real property above described, or any portion thereof, shall never by occupied, used or resided on by any person not of the white or Caucasian race, except in the capacity of a servant or domestic employed thereon as such by a white Caucasian owner, tenant, or occupant” (Rothstein, 2017, p. 78‒79). Racial steering describes practices adopted by real estate agents that steered homebuyers away from predominantly white neighborhoods (Rothstein, 2017, p. vii). Blockbusting refers to the practice of telling white homeowners that Black people are moving to induce concern about forthcoming declines in property values, which sometimes led to sales at a loss that were then sold to Black people at a profit (Rothstein, 2017, p. 95).

6. Signe-Mary McKernan et al., “Private Transfers, Race, and Wealth,” Opportunity and Ownership Project (Washington, DC: Urban Institute, n.d.), https://www.urban.org/sites/default/files/alfresco/publication-pdfs/412371-Private-Transfers-Race-and-Wealth.PDF; Hyojung Lee et al., “The Role of Parental Financial Assistance in the Transition to Homeownership by Young Adults,” Journal of Housing Economics 47 (March 1, 2020): 1–8, https://doi.org/10.1016/j.jhe.2018.08.002.

7. Daniel Aaronson, Daniel Hartley, and Bhash Mazumder, “The Effects of the 1930s HOLC ‘Redlining’ Maps.” Working Paper (Chicago: Federal Reserve Bank of Chicago, 2017), https://www.chicagofed.org/publications/working-papers/2017/wp2017-12.

8. Jackelyn Hwang, Michael Hankinson, and Kreg Steven Brown, “Racial and Spatial Targeting: Segregation and Subprime Lending Within and Across Metropolitan Areas,” Social Forces 93 (3) (March 1, 2015): 1081–108, https://doi.org/10.1093/sf/sou099; Jacob S. Rugh, Len Albright, and Douglas S. Massey, “Race, Space, and Cumulative Disadvantage: A Case Study of the Subprime Lending Collapse,” Social Problems 62 (2) (2015): 186–218; Paul S. Calem, Jonathan E. Hershaff, and Susan M. Wachter, “Neighborhood Patterns of Subprime Lending: Evidence from Disparate Cities,” Housing Policy Debate 15 (3) (2004): 603–22, https://doi.org/10.1080/10511482.2004.9521515.

9. Destin Jenkins, “The Fed Could Undo Decades of Damage to Cities. Here’s How …,” Washington Post, April 27, 2020, https://www.washingtonpost.com/outlook/2020/04/27/fed-could-undo-decades-damage-cities-heres-how.

10. In this section, we focus on Black and Hispanic racial groups because there is limited wealth data for other groups, such as Native Americans and Native Hawaiians and Pacific Islanders. Also, although mean and median wealth levels for Asian households are similar to those of White households, these statistics mask large variations in wealth by subgroups within the Asian category; lower-income Asian households have less wealth than lower-income White households, and on average, Asian American households have lower homeownership, owe more debt, and have fewer retirement benefits than White households. For more, see Christian Edlagan and Kavya Vaghul, “How Data Disaggregation Matters for Asian Americans and Pacific Islanders,” Washington Center for Equitable Growth, December 14, 2016, https://equitablegrowth.org/how-data-disaggregation-matters-for-asian-americans-and-pacific-islanders/; or Christian E. Weller and Jeffrey Thompson, “Wealth Inequality Among Asian Americans Greater Than Among Whites,” Center for American Progress, December 20, 2016, https://www.americanprogress.org/issues/race/reports/2016/12/20/295359/wealth-inequality-among-asian-americans-greater-than-among-whites.

11. Board of Governors of the Federal Reserve System et al., “Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances,” FEDS Notes (Washington, DC: Board of Governors of the Federal Reserve System, September 28, 2020), https://doi.org/10.17016/2380-7172.2797.

12. Board of Governors of the Federal Reserve System et al.

13. Thomas Shapiro, Tatjana Meschede, and Sam Osoro, “The Roots of the Widening Racial Wealth Gap: Explaining the Black-White Economic Divide” (Waltham, MA: Institute on Assets and Social Policy, February 2013), https://heller.brandeis.edu/iasp/pdfs/racial-wealth-equity/racial-wealth-gap/roots-widening-racial-wealth-gap.pdf.

14. Housing Vacancy Survey, “Table 6. Homeownership Rates by Race and Ethnicity” (U.S. Census Bureau, 2020).

15. Board of Governors of the Federal Reserve System et al., “Disparities in Wealth.”

16. “The Fed – Chart: Survey of Consumer Finances, 1989‒2019,” accessed April 14, 2021, https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/.

17. C. Eugene Steuerle et al., “Who Benefits from Asset-Building Tax Subsidies?” (Washington, DC: Urban Institute, September 24, 2014), https://www.urban.org/research/publication/who-benefits-asset-building-tax-subsidies.

18. Federal Deposit Insurance Corporation (FDIC), “How America Banks: Household Use of Banking and Financial Services, 2019 FDIC Survey,” October 2020, https://www.fdic.gov/analysis/household-survey/index.html.

19. Federal Deposit Insurance Corporation (FDIC).

20. Jacob Faber and Terri Friedline, “The Racialized Costs of ‘Traditional’ Banking in Segregated America: Evidence from Entry-Level Checking Accounts.” Race and Social Problems 12, no. 4 (2020): 344-361

21. Federal Deposit Insurance Corporation (FDIC), “How America Banks.”

22. Faber and Friedline, “The Racialized Costs of ‘Traditional’ Banking.”

23. Monica Anderson, “Mobile Technology and Home Broadband 2019,” Pew Research Center: Internet, Science & Tech (blog), June 13, 2019, https://www.pewresearch.org/internet/2019/06/13/mobile-technology-and-home-broadband-2019/.

24. This means they have no credit record at one of the nationwide consumer reporting agencies.

25. Kenneth Brevoort, Philipp Grimm, and Michelle Kambara, “Data Point: Credit Invisibles” (Washington, DC: Consumer Financial Protection Bureau, May 2015), https://files.consumerfinance.gov/f/201505_cfpb_data-point-credit-invisibles.pdf.

26. Alexander W. Butler, Erik J. Mayer, and James Weston, “Racial Discrimination in the Auto Loan Market,” SSRN Scholarly Paper (Rochester, NY: Social Science Research Network, March 31, 2021), https://doi.org/10.2139/ssrn.3301009; Timothy Bates and Alicia Robb, “Loan Availability Among Small Businesses Operating in Urban Minority Communities.” In Conference Paper, Federal Reserve System Community Development Research Conference, 2013; Young Jo et al., “Data Point: 2019 Mortgage Market Activity and Trends” (Washington, DC: Consumer Financial Protection Bureau, June 2020), https://files.consumerfinance.gov/f/documents/cfpb_2019-mortgage-market-activity-trends_report.pdf.

27. Anneliese Lederer et al., “Lending Discrimination Within the Paycheck Protection Program” (Washington, DC: National Community Reinvestment Coalition, July 15, 2020), https://ncrc.org/lending-discrimination-within-the-paycheck-protection-program/; Anneliese Lederer et al., “Lending Discrimination During Covid-19: Black and Hispanic Women-Owned Businesses” (Washington, DC: National Community Reinvestment Coalition, November 10, 2020), https://ncrc.org/lending-discrimination-during-covid-19-black-and-hispanic-women-owned-businesses/; Margery Austin Turner et al., “All Other Things Being Equal: A Paired Testing Study of Mortgage Lending Institutions” (Washington, DC: U.S. Department of Housing and Urban Development, 2002), https://www.huduser.gov/Publications/PDF/aotbe.pdf.

28. Ziad Obermeyer et al., “Dissecting Racial Bias in an Algorithm Used to Manage the Health of Populations,” Science 366 (6464) (October 25, 2019): 447–53, https://doi.org/10.1126/science.aax2342; Jeffrey Dastin, “Amazon Scraps Secret AI Recruiting Tool That Showed Bias against Women,” Reuters, October 10, 2018, https://www.reuters.com/article/us-amazon-com-jobs-automation-insight-idUSKCN1MK08G.

29. Shelby R. Buckman et al., “The Economic Gains from Equity” (San Francisco: Federal Reserve Bank of San Francisco, 2021).

30. Dana M. Peterson and Catherine L. Mann, “Closing the Racial Inequality Gaps: The Economic Cost of Black Inequality in the U.S.” Citi GPS: Global Perspectives & Solutions, 2020.

31. For example, firms like Ellevest (women), Grind Banking (Black), and Daylight (LGBTQ) target specific audiences with their financial products.

32. john a. powell, Stephen Menendian, and Wendy Ake, “Targeted Universalism: Policy & Practice: A Primer,” (Berkeley, CA: Haas Institute for Othering and Belonging, May 2019), https://belonging.berkeley.edu/targeteduniversalism.

33. Angela Glover Blackwell, “The Curb Cut Effect,” Stanford Social Innovation Review (Winter 2017), https://ssir.org/articles/entry/the_curb_cut_effect.