Mary C. Daly’s Keynote at the Chapman University Shadow Open Market Committee Conference 2022

Summary

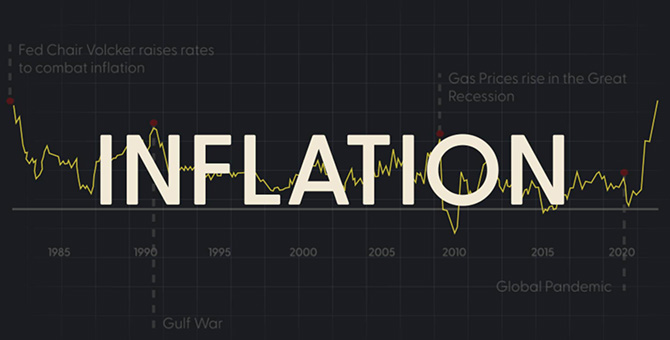

President Daly delivers the keynote address at the Shadow Open Market Committee 2022 Conference at Chapman University in Orange, CA. In her speech, Mary discusses her outlook for inflation, the tools we have to combat it, and how monetary policy needs to adjust as persistent high inflation moves from risk to reality.

Following her address, Mary is joined by Peter Ireland, professor of economics at Boston University for a moderated Q&A.

Sign up for notifications on Mary C. Daly’s speeches, remarks, and fireside chats.

About the Speaker

Mary C. Daly is president and CEO of the Federal Reserve Bank of San Francisco and helps set American monetary policy as a Federal Open Market Committee participant. Since taking office in 2018, she has committed to making the SF Fed a more community-engaged bank that is transparent and responsive to the people it serves. Read Mary C. Daly’s full bio.

Related

LinkedIn Live: Inflation and the Federal Reserve

Tune in on June 28th at 9:30 a.m. PST for a discussion, live on LinkedIn, about the state of the economy with President Daly and LinkedIn’s Chief Economist Karin Kimbrough.

60-Second Explainer: How the Fed Is Working to Lower Inflation

How is the Fed working to lower inflation? The first video in our 60-Second Explainer series provides a quick review of how higher interest rates can help bring inflation down

How Much Do Supply and Demand Drive Inflation?

Inflation has remained at levels well above the Federal Reserve’s inflation goal of 2% for over a year. Supply factors explain about half of the run-up in current inflation levels. Demand factors are responsible for about one-third, with the remainder resulting from ambiguous factors.

Watch FOMC Rewind: What the Fed’s June 2022 Decision Means for You

Inflation has remained at levels well above the Federal Reserve’s inflation goal of 2% for over a year. Supply factors explain about half of the run-up in current inflation levels. Demand factors are responsible for about one-third, with the remainder resulting from ambiguous factors.

Steering Toward Sustainable Growth

Watch Mary C. Daly’s last policy speech where she discusses her plan for fighting inflation and why agile and data-driven policy adjustments are key.