Monday, Jun 24, 2024

11:00 a.m. PT

San Francisco, California

Transcript

The following transcript has been edited lightly for clarity.

Alex Mehran:

… her getting a master’s degree from the University of Illinois, and then getting her PhD from Syracuse University in economics. You can read about her becoming the 13th President of the Federal Reserve Bank of San Francisco, the largest bank in the reserve system by GDP, by population and by geography, by her becoming the head of the research department. You can read all that stuff online. You can even read online that when she was 15 years old, her family imploded. Her sisters went to live with her grandparents. She went to live with a friend and took three jobs working in a donut shop, a deli, and Target to put food on the table. Those are all facts, but I want to talk about Mary as a person. My close encounters of the third kind are instructive with respect to Mary. First, I met her when she was in the research department at the Fed, and I learned that she was a problem solver.

She clearly defines the problem. She does her research. She reaches her conclusions. She tests those conclusions in the real world. She is a problem solver. My next connection of the third kind was with Mary when she became the president of the San Francisco Fed where she was a missionary. Now you’ll hear a lot about the dual mandate of full employment and stable prices. That mandate is not just a Fed mandate. It is a mission for Mary to accomplish that in her job. She has organized her bank in a way to gather the best professionals she can. She has focused them on the mission, and she has communicated, both externally and internally, about how important it is to accomplish that mission. You can hear some of this on her podcast, Zip Code Economies. Mary is a missionary. Lastly, after I left the Fed, I remained as friends with Mary happily, and I recognized that Mary is also a humanitarian.

She understands that economic policies impact people from the donut shop to the Dow Jones investors. And she, because of her life story, understands the impact that economic policy has on individuals, and that individuals are fragile and economic policy matters. So Mary is a humanitarian. I want a quote from another great San humanitarian, Willie Mays. God bless Willie Mays. Willie said, “I believe that understanding is the important thing. In my talks with kids. I try to get that message across. It makes no difference whether you are black or white because we are all God’s children fighting for the same cause.” Well, Mary is fighting for economic prosperity for all God’s children. When I was the head of the search committee that selected Mary, I recognized her qualities as a problem solver, as a missionary, and as a humanitarian. She has exceeded our expectations in accomplishing her goals at the San Francisco Fed, and she exemplifies the best in American public service.

So after Mary makes her remarks, Deirdre Bosa will have an interview with her for a few moments. So with that, I want to say with great pride, please welcome my good friend Mary Daly to the podium.

Mary C. Daly:

Thank you. Okay. Wow, I’m really tall now. We’ll see how that works for everything. This is a different place to be in the world than I usually occupy, really high above everything. So Alex, I have heard you give so many introductions, and I have to say, I was saying to Alex, he’s the finest introducer I’ve ever met, and that was the most… That moved me. So thank you, Alex, for that introduction. It really means a lot to me. And thank you to the Commonwealth Club, world Affairs of California and the San Francisco Press Club for hosting this event. I love a packed room. I love YouTube. It’s really terrific to be thinking about the economy and the world we face, and I’m looking forward to a really lively conversation. Now, the last time I was here, it was November, 2021, and the world looked considerably different than it does today. We were still struggling to come out of the pandemic, inflation was high, the labor market was just starting to rebound, and the federal funds rate, the Federal Reserve’s primary interest rate tool was near zero.

So things have clearly changed. The federal funds rate is now over 5%, inflation has receded, although not completely, and the labor market has more than recovered and is moving gently and slowly back to a sustainable level. Now, that’s a lot of improvement, and I want to acknowledge that, but I also want to say that we’re not there yet. We must continue to do our work as the Federal Reserve to fully restore price stability and do so without a painful disruption in the economy. So today, I will review where we stand as an economy and what it will take to finish the job. But before I do, if you haven’t heard of Federal Reserve officials speak before, I have to give the normal disclaimer that my remarks today are my own and do not necessarily reflect those of my colleagues.

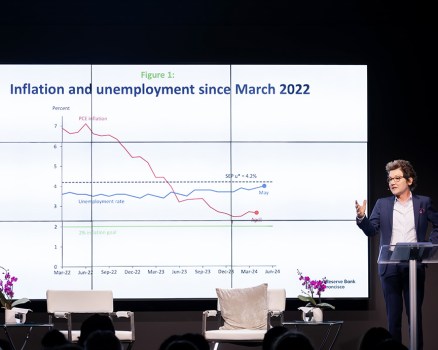

So where are we? Where are we at this point in time? Well, we’re still in a fight to bring inflation to 2%. We’ve made a lot of progress of, as I mentioned, but there’s still work to do. As the figure shows… Now I’m going to wait for the figure. Here it is. As the figure shows, FOMC began raising the interest rate. It came down from a bit over 7% to now just under 3% as of the most recent readings. Importantly, and this is something that I hear, I had a round table this morning of business leaders in the Bay Area, and we hear this from them, we hear it from households, inflation expectations or what we all expect to happen going forward have come down as inflation has, so people feel more confident that inflation is really on its path back to 2%.

And this has made it easier for the Federal Reserve to get a boost to further reach its goal. If households, businesses, and markets all expect inflation to come down, then that’s part of what continues to bring it that way. Now, the decline in inflation, that fairly large decline you see there owes to many factors, including importantly, improvements in supply. And supply includes supply chains, productivity and labor force growth, all of which contributed to this reregulating of inflation that you see.

San Francisco Fed Researchers have found that in fact, the lion’s share, most of the declines in inflation in that early period came from these supply factors. Now as higher interest rates have taken hold, supply factor improvements have got a boost from demand slowing, and that is really how monetary policy works. We raise the interest rate, demand slows, and then that becomes an important contributor. And since the second half of last year, demand rather than supply has been the key driver of falling inflation. Importantly, as demand is slowed, this is also how policy works, so has the labor market, and this is translated into slightly higher employment, or unemployment, as this blue line shows. So far, however, the rise in unemployment has been very modest compared to the decline in inflation. And right now, the unemployment rate is just below what many, many people think of as its natural settling level, the level it will be at when we only have people searching for jobs, but we have plenty of employment. That’s the full employment level. So so far, so good.

In this departure of this kind of reregulating of the economy we’ve had so far, both supply and demand factors have contributed to the reduction in inflation, and we’ve done all of this without a big disruption in the labor market. When I put all this together, I think monetary policy is working, but there’s still more work to do. We’re not at 2% inflation, and that is our target. As we navigate to this next point where we get fully to 2% inflation, it will require balance. Now, the bumpiness of inflation data so far this year has not inspired confidence. So of course, we have to think about inflation. Recent readings are more encouraging. We had that one month of good CPI data, but it is really hard to know yet whether we’re on track to get to price stability. And importantly, when we’re thinking about forecasting out the path of inflation, we won’t be able to count on all the supply factors that helped us last year.

Supply chains are largely mended, domestic labor force participation has largely recovered, so it is unlikely we’re going to get as much help this year as we got last year. Now, I always remain open to positive supply responses or developments, especially living in the Bay Area where we’re the center of all its technology and generative AI and others. So we have a lot of innovation that could come and help productivity, but we really can’t count on that. So in order to get inflation down to target, it is very likely it will take more of a demand restraint to do the job.

And that naturally brings the labor market into the conversation, because as I mentioned, when you slow demand, the labor market slows. So as I showed a moment ago, so far the adjustments in the labor market have been modest, not really pushing up the unemployment rate, but we are getting nearer to a point where the outcomes on employment may be less benign. Although job growth remains quite strong, most other measures of labor market strength or most labor market conditions have basically returned to their pre pandemic levels, telling you that things are pretty much in balance. And importantly, we’ve got metrics that show that the balance between demand and supply of workers has largely normalized. Now, I said we had metrics because I want to show you one. Now, this is a chart that I am sure many of you do not have hanging in your house.

If you’re an economist, you have to have this, especially a labor economist, but it’s a really important graph called the beverage curve. It’s received a considerable amount of attention of late, and the reason is because it captures the relationship between job vacancies, which is on the vertical axis, and unemployment on the horizontal axis. If you can think of vacancies as demand for workers, how many firms are posting vacancies, and you can think of unemployment as the supply of workers, how many workers are available to take those jobs? And that black line in the figure, that shows the historical path fitted across the last couple of decades of the dots. The dots show these specific examples in a particular month, and the red dots point to the very recent history.

Now, if you look at the very top of those red dots, that’s March of 2022, what you see is a lot of vacancies and low unemployment, and that’s because firms posted historically large numbers of job openings. They were scrambling. If you remember, firms are scrambling. The labor market is tight. They’re scrambling to find workers. They’re trying to manage their turnover and their hiring to keep up with the surge in demand that came after we all came out of lockdown. So we exit, we start buying things, we’re out in the communities, we’re going to restaurants and other places, firms are trying to keep up, and they post a lot of vacancies and they have a lot of churn.

The consequence of that is we go up what’s called the steep part of the beverage curve. You’re going to be extremely popular in cocktail conversation now. So we were on this steep part of that beverage curve. Vacancies are high, unemployment is low. Now as interest rates rose and the economy became less frenzied, the vacancy reversed. Vacancy started coming down that curve. You can see this by getting all the way to the April, 2024 dot where you see that over that period of time we’ve been sliding down. So we’ve been sliding down the vacancy curve or the beverage curve where you can reduce vacancies. Firms can pull them back. They don’t put as many out. They’re settling in, and you do all of that without increasing unemployment. It’s just fewer vacancies chasing about the same number of workers.

Now this is the part that I showed the chart for to show you this final point. Going forward, this benign relationship where you can reduce vacancies, you can slow the labor market and it doesn’t increase unemployment may be coming to an end. It’s possible. The reason is if you look at the latest job market data, April, 2024, it shows that we’re getting very near the flatter portion of this curve, and the flatter portion of the beverage curve means that any labor market slowing that happens additionally could… And I underscore could here. Let’s underline could. It isn’t a must, it could translate into higher unemployment as firms go past adjusting vacancies and they start adjusting jobs. So all of this is to say that at this point, inflation’s not the only risk we face, hence the balance I mentioned. We will need to keep our eye both on inflation, that part of our mandate, and on full employment, the other part of our mandate, to really achieve our goals. So then the question I think on everybody’s mind is, what does this mean for policy? Well simply put, that we need to be vigilant and studious, but also open. We have two goals, one tool, and a lot of uncertainty. So being definitive and predetermined is not that helpful. What is helpful is planning, evaluating scenarios that could happen, and then imagining or understanding, and even studying how policy would need to respond. In other words, to be appropriate, policy has to be conditional, and we have to think in scenarios. If inflation turns out to come down more slowly than expected, feels a little stickier, then holding the federal funds rate higher for longer would be the right thing to do.

If instead inflation falls rapidly or the labor market starts to soften more than expected or more than desired, and when I say desired here, I don’t mean… And it’s really, it’s often considered a poor choice of words. What desired means is we need to have the labor market slow a little bit as we slow the economy to bring inflation down. But the ultimate goal is to give people full employment so that everyone who wants a job can get one. And that we have price stability. Those are the goals we’re trying to manage. But if instead you see that inflation’s coming down rapidly or the labor market’s slowing too much, well then we will need to lower the policy rate. That will be the necessary outcome to manage those two scenarios. And finally, if we continue to see the gradual declines in inflation and the gradual slowing of the labor market, we have seen then normalizing policy over time, as many people expect would be the right thing to do.

The truth is, as I talk with you, any of the three scenarios I just described are in the realm of reasonable. Any of them are possible and we will need to respond to however the economy evolves, hence the conditionality. So I’d like to end where I started. This is not 2021 or 2022 or even 2023: we are in a very different place. I would offer a better place.Inflation has come down, the labor market is solid, and businesses and households believe that we can finish the job. But as I mentioned, we are not there yet, and whether you call it the final mile, completing our work or simply delivering fully on our dual mandate goals, there is more to do.

But we will need to exhibit care as we do it. To really thrive, people need both full employment and price stability. And I think in many ways this is obvious, but I knew this from my own experience. I lived it in my own experience. I grew up in Baldwin, Missouri in the 1970s, the last period of high inflation. And in my world, many people struggled. Inflation imposed a corrosive tax. It eroded earnings, it made it hard to pay bills and it made it hard for families in my community to do anything other than manage the day-to-day. And worst of all, when I remember that time is there was no end in sight. We couldn’t see a different future. Now, the Volcker disinflation remedied that, but the medicine was harsh. And my family, like many other families, went from being constrained by high inflation to hampered by job loss. Looking back, that medicine seemed necessary. It reflected the conditions we had at the time. But I see the world today and I know we are not in that world. The Federal Reserve has credibility that it didn’t have back then. Businesses, household markets know that we will get the job done. And all of this means that our journey today can be different than the Volcker disinflation, not just avoiding a painful recession, not just that kind of difference, but instead balancing policy so that we can achieve and maintain full employment while we get to price stability. That is the economy we are striving for and that is the economy we at the Fed are working to deliver. Thank you very much.

Deirdre Bosa:

President Daly, was great and I’m so honored to chat with you. You are a regular figure on our air at CNBC, and I’m so happy to welcome you in our own hometown as part of the San Francisco Press Club. So, thank you.

Mary C. Daly:

Delighted to be here.

Deirdre Bosa:

Welcome to everyone, by the way.

Mary C. Daly:

Indeed.

Deirdre Bosa:

Please get in your questions. We’re going to be collecting them and not too long from now. So President Daley, your remarks just now, they focus largely on the risk of cutting rates too early and a wait and see mandate right now. But how worried are you about waiting too long and the risk of a serious downturn, which can happen by the time you see that evidence?

Mary C. Daly:

You’re absolutely right, and it’s one of the reasons I mentioned balance because at this point in my judgment at this point, we are in a place where the risks to the inflation side of our mandate and the risk to the employment side of our mandate are in better balance. And so, we have to be thoughtful about not loosening too early, but we have to be thoughtful about not holding too long because if you hold too long, that tightens the economy too much and then you can have things like a faltering labor market and that is not good for people. That’s the point of the end of my talk is that really you want to do both and to do both, you have to have balance, keeping an eye on both sides of the mandate.

Deirdre Bosa:

I guess the worry from some in the camp who would like to see rates cut sooner is that you won’t see those signs, you won’t know that you waited too long until the downturn is already here: what is the case to be made for the Fed to preemptively cut rates?

Mary C. Daly:

Well, let me come back to the data. And first of all, I do think that preemptive cutting is something that you do when you see risks, but right now what I see is a strong labor market that’s come into balance. I said it was good but not frothy. And that is what we’re hearing from our contacts. We hear regularly, we get out in the world. We just had a round table this morning where we ask people, “What are your hiring plans? How are you thinking about investing? What are you doing?”, and we don’t see there a lot of pessimism: we see cautious optimism.

They may not be going full out because they’re waiting to see how things go, but they don’t see signs that were falling off a cliff either. So with that in mind, I look at the data, I see a strong labor market, I see initial claims for unemployment insurance, which is usually an early warning sign, be actually coming in low still. People are finding jobs, people are getting jobs and firms are continuing to hire. So if I see any of those weaknesses, obviously then we can have a different conversation. But right now we’re not seeing them. So right now, all that I’m really focused on is both of our mandated goals are into the lens. We have our mind on both things.

Deirdre Bosa:

Right. When you spoke to business leaders at that business round table, what were their concerns?

Mary C. Daly:

This is really interesting, and I’ve been hearing this for the last six months, that the concerns now are the ones we had in 2019: we don’t have enough housing, how can the workforce get jobs and have a living and how can I pay them when there’s no housing that they can afford? And that’s across the country, not just here in the Bay Area. So, we’re hearing some of those things. We’re hearing about the evolution of the economy and how some in our economy, that inflation is a corrosive tax while others have been able to manage through it, and it’s creating two types of economies, one for those who have the ability to manage and one for those who are having a harder time bearing it. I think of those as really important issues we should discuss in our economy. But last year at this time, all I heard about was inflation, inflation and inflation. So I see this as us moving more towards the things that we really are always thinking about in our society.

Deirdre Bosa:

What do you say to that group of people or business owners or consumers who are having a tough time in this economy, who are sitting on more debt than they are cash, which can earn a better yield in this interest rate environment. Homeowners who are looking to refinance first time home buyers who are looking at higher mortgage rates, and there’s this idea that the effects of inflation coming down aren’t being felt by many Americans. So, what do you say to them about policy?

Mary C. Daly:

I do think that we have some relief. I am hearing less pain, but the pain’s still there, so it’s definitely true that inflation’s still with us. I showed that on the chart. That’s the concept of we’ve got a lot of progress, but we don’t want to declare a victory because there’s a ways to go because so many Americans are still struggling. What I say to people though is that we’re going to be resolute until we finish the job. That’s why not taking preemptive action when it’s not necessary is so important because if you take preemptive action and it’s not necessary, you leave inflation at 3% on a higher base of prices: that is actually not price stability, and it’s not importantly the promise we made. So, we are going to actively work on this so that we can get inflation down.

Ultimately, what I want for all of those individuals and families and businesses is that inflation becomes something that’s no longer considered, that really, it’s about careers, your communities, the way you live your life. And businesses can go back to thinking about, how do I grow? How do I increase my footprint, my market share? How do I engage? We talked a lot about an inclusive economy this morning in the round table, people really want to get back to work that kind of work. And you do that by bringing inflation down fully.

Deirdre Bosa:

Right. You highlighted a few different scenarios or laid them out, I should say. The scenario that scares some of the folks we talked to on CNBC is stagflation: high inflation, slow economic growth, high unemployment. One, are those fears overblown? And two, what tools does the Fed have to respond to that kind of scenario?

Mary C. Daly:

I don’t want to ever say to someone of your fears are overblown what I wanted, because I think that’s just an emotional reaction to, what’s the worst thing that could happen? So, what I would say is we don’t see evidence that those, what I would call tail risks are really in our future. So last year, in fact, many people that, many more people thought that we might have a recession, but we haven’t had a recession, and I think that is reassuring to people.

And when you think of stagflation, I mean stagflation means that we get inflation stuck at a high level, unemployment is high and we are not growing as an economy. But there’s no evidence for this: you see businesses investing, you see our GDP growth is solid, our labor market is still very solid, and importantly, inflation’s coming down. So what I say is that I understand what you might be worried about, but let’s look at the information, and when you look at the information, what you see is an economy that looks quite a bit different than the stagflation economy.

Deirdre Bosa:

Right, and you made that comparison to the ’70s when you said it was really tough medicine to take to get back to that normalization.

Mary C. Daly:

It was.

Deirdre Bosa:

Jamie Dimon, the CEO and chairman of JP Morgan, he’s someone who has sort of highlighted those stagflation fears. He says that he fears America’s headed for a repeat of the 1970s, says everything felt great, and then quickly about turned to a period of stagflation. The argument that you don’t see it until it’s already here: what is he seeing that is different than what the Fed is seeing?

Mary C. Daly:

And again, let me just reference that I’m speaking for myself here, that when I look at the difference now in the ’70s, there’s all the things I just noted about inflation coming down and the in consumers in households and markets expecting inflation to come down. It’s interesting, the very first talk I gave at the Commonwealth Club, and I think this was back in 2019, was about how the inflation process works. And one of the things I noted because it’s true historically, is that inflation expectations, meaning how people see the future evolving is one of the critical tools in keeping inflation well anchored around our target. So we look at metrics, and right now you see short-term inflation expectations are heading back down as actual inflation prints medium and longer run inflation expectations have remained relatively stable over the entire time of high inflation, meaning especially those longer run inflation expectations.

People knew that the Fed was going to get inflation down and our aggressive hiking campaign rate hiking campaign sort of solidified that. And so at this point, I don’t see the ingredients of the sort of problems that we had back in the ’70s where people expected inflation to be high, they asked for higher wages, then firms gave them higher wages and then raised prices. And that we got in that vicious wage price spiral. We have not been in a wage price spiral. And so those ingredients aren’t there. The final thing I’ll say on this point is one of the, if you read a lot of history as I do of the Fed, one of the mistakes that was made, which we’ve been really strongly not making, is to declare victory too early and take preemptive action and then find ourselves in a place where inflation stays stubbornly high while the economy falters. If you go back and ask, “Why not preemptive action?”, because the commitment is to price stability, defined as 2%.

Deirdre Bosa:

I’ve heard it been called trust but verify, which I thought was a good way of putting it.

Mary C. Daly:

Yeah, trust but verify. I always like trust but verify, by the way. So, that’s a good thing in general.

Deirdre Bosa:

It is an election year. I realize the Federal Reserve is apolitical, it’s very difficult to be apolitical in this world at the moment: when you think about the timing of rate cuts and the idea too that consumer sentiment around the economy still feels negative, are you concerned that that negative perception of the economy could shape the way that people vote?

Mary C. Daly:

You are right: we are apolitical, and I will say it is actually not hard to be apolitical. It is the requirement of service if you work at the Federal Reserve, and it’s something I’ve never had a trouble holding up because Congress gave us this role, said, “You must be independent.” Alex in the introduction said… Or, it wasn’t Alex. I’m sorry Alex, I almost credited you for something else. But one of the speakers at the round table said that when he travels to other countries, we are held as a bank with independence and people from other countries admire that. That comes with us clearly being apolitical. And as Chair Powell has said before, our interest rate decisions are meant to do the things that Congress gave us, full employment and price stability, and we’ll make those decisions accordingly. So in terms of how people are feeling, the thing that I worry about as a policymaker for the Fed is this, that there seems to be a gap between the published data and how people feel about their future economic prospects.

So, one of the things we do when we go out, I don’t know how many of you know about what regional Fed presidents do, but we spent a lot of time in the communities asking firms and community groups and importantly groups of workers, what is it that they’re feeling in the economy and how they’re thinking about it going forward. And increasingly, I’m hearing the following thing, “I feel like I’m okay, but I’m worried about the world around me.”

So, I do think that people are worried that the future doesn’t look quite as bright. But one of the true things I know myself is that if you have low inflation and stable prices, then people feel better about things because they don’t have that worry that they think about when they get up in the morning and think about before they go to bed at night. So, that’s our goal, that’s our mandate, and whatever happens in our nation around us, the Fed is always going to do the job that Congress gave us.

Deirdre Bosa:

How does that come back into balance? Is that why policy, you’re taking this stay-pat attitude towards it, and if inflation comes down and the economy remains relatively strong, that gap will come more in line?

Mary C. Daly:

I think it historically has, that consumers, one of the things that you learn if you’ve done economics or you’ve done this job or you’ve just lived in the world, inflation is hard. It is one of the hardest things for people because you’re earning and inflation is eroding how you feel about those earnings. It’s interesting. If I may, I’ll just share a story because it was so meaningful to me. So I was in a major retail outlet last year and I like to go out and collect information, especially on weekends, about how people are feeling about the economy and shopping. And I never disclose who I am, but I just ask them questions and people are more than willing to talk to me. That’s a whole another question you can ponder.

Deirdre Bosa:

If you see President Daly at your Target asking you questions about what you’re buying—

Mary C. Daly:

I’m coming up to you. But I ran into a young gentleman. He had a wife and two children, and he was talking about how he had plenty of jobs. He had more jobs than he could actually do. You only have so many hours in a day. And he was earning more than he ever had earned in his life and more than he had ever imagined he could earn. And every week they came to the place to buy their basic necessities, he could have less and less in his cart. And he said that was demoralizing. That was painful. And so that’s the toll that inflation takes. And when I see the sentiment, whether it’s by younger workers, if you think of Gen Z and others, they’re thinking about how is this economy going to work? I completely understand that and that’s why I’m devoted to bringing… Alex said a missionary. I’m a missionary to do those jobs, to bring inflation down, because that’s what people deserve. And to do it as gently and well as we can so that we don’t tip ourselves into a downturn that costs them jobs.

Deirdre Bosa:

What if that gentleman and his family were looking at their counterparts of family in Europe or Canada where the central bank has cut rates? Maybe preemptively, they haven’t got inflation totally under control, but they’re doing so because they see the trajectory of the data coming in line. What would you tell him as to why his country’s central bank is waiting versus others around the world?

Mary C. Daly:

Let me just say that central banks make their decisions differently, but all towards the same goal, to ensure that they get back to their price stability target. Now, I am not part of those commentaries, and so I can’t say what those central banks were thinking, but I do read the commentary from policymakers in those other places, and they are using, in my judgment, the same metrics as we’re using. Are they confident that they’re on their way to price stability? Are they worried that their economy is slowing more than they would like to see? So you put those two things into balance, and it’s not surprising that certain countries who have a little bit better progress on inflation so far, the data have been coming in a little bit better, or they’re a little weaker, might make adjustments before ours. Ultimately, our role is for the American people and our job is to make sure that we are fully confident that inflation in the United States is on a path back to price stability. And we’re not there yet.

Deirdre Bosa:

Right. And you mentioned some signs that monetary policy has been restrictive. There’s also data to the contrary. Certainly, we see that on CNBC with equities at record highs, with a ton of money being raised, especially in a place like the Bay Area and generative AI. Commodity prices remain high. How do you square those indicators with how restrictive you want or believe monetary policy to be?

Mary C. Daly:

One thing that is really important is that when we think about financial conditions being restrictive or supportive, you have to look at a broad range of indicators. Those indicators are the funds rate, car and auto loans, mortgages, auto loans, mortgage rates, bank rates, all these types of borrowing rates. If you were going to build something in your house or if you’re a commercial developer, all of those things are part of financial conditions, as are bond prices and the stock market. But the stock market’s only one component, and the stock market importantly reflects enthusiasm or optimism for the future. So if the stock market investors are looking past this period of high inflation and seeing strong growth, a good labor market and lots of innovation on the way, then of course it could rally. But when I look at the effect that higher interest rates are having on the economy, it’s very clear that monetary policy is in a restrictive stance. You don’t see that decline in inflation and a lot of that being demand-driven and you don’t see that gentle slowing in the labor market unless policy is having an effect.

Deirdre Bosa:

How are you viewing consumer spending, another indication?

Mary C. Daly:

Well, consumer spending is coming down slightly. It’s been a surprise, its resiliency, but I also think that just because it’s been surprisingly strong in the past, we should imagine it’s always going to be this strong. A lot of what helped consumers spend is, well, first, the labor market. The labor market is the most important thing for consumer spending, and that remains solid. But the other thing that consumers had was excess savings, and you had excess savings accumulated during the pandemic. And at this point, San Francisco Fed research and other research suggests that those have been largely exhausted as of earlier this year, and so you should start to see consumer spending slow. And honestly, we’re seeing a rise in some delinquency rates across some different loan categories, especially among low and moderate-income workers and families. And so I do think that consumer spending is slowing and that consumers are getting to the point where it’s much more what they are earning is determining what they spend.

Deirdre Bosa:

Right. I want to get into the San Francisco and Bay Area economy. Start with a two-part question. What grade would you give the American economy at large? And what grade would you give to the San Francisco economy?

Mary C. Daly:

So this is why I’m a Fed official, not a teacher, because I always thought, well, grades are just a single thing that doesn’t really reflect the nuance of our realities. And so much like I would tell my students when they’d say, “Give me the grade, I just want the grade,” I would say, “Well, okay, I’ll give you a grade because I must, but you have to sit down with me.” They didn’t like that too much. But I’m going to sit down with you on the American economy. I think the American economy is been remarkably resilient. If you look at some of our counterparts across the globe, remarkably resilient. I trace that back to just the spirit of the American worker, of American businesses, of the American consumer just saying, “We’re going to get back in there. We have an economy that we want to thrive.” That said, inflation has always been, in my entire lived history and my entire experience being an economist, a toxin. It just erodes faith and confidence in how the economy’s doing, and it makes people more worried than they would otherwise be. So inflation remains higher than our target and we need to bring that down. But if we get inflation and continue to bring it down, and we can do that without a large disruption in the labor market, then I think we are really going to be well on our course to have people go back to the things that they really care about and want to do. So I would give that a high score in terms of where the American economy is.

Deirdre Bosa:

You’re above B.

Mary C. Daly:

Oh, yeah. We’re above B, but I’m a lifelong learner and I expect us all to be, so we need to keep going, and that’s why we have more work to do. Now, what other part of the economy did you want me to talk about?

Deirdre Bosa:

San Francisco economy.

Mary C. Daly:

Well, so here’s the most common question, if I’m outside of San Francisco, I get asked. Is San Francisco in a doom loop? Is the world over?

Deirdre Bosa:

The apocalypse is one that I sometimes—

Mary C. Daly:

No, and I always just say, “Mm-hmm. Okay. Well, let me see.” We have some of the most educated workforce in the nation. The Magnificent Seven reside in the West, not all in San Francisco, but in the West. The innovation here, you can see it everywhere. The commercial real estate that is available. There are big companies doing AI and other things looking for that real estate. People are coming back to work every day. Every week I come, traffic is worse. I see that as a good thing, frankly, sometimes. In a world where I could get across the bridge in no time at all, this is a much better place to be. It does suggest that San Francisco is starting to thrive.

Now, I’ll also add that I came to work at the Fed in 1996, and one of the first things I had to do was after the… 1996, I’m in the roaring nineties, we get to the dot-com bust. And I was asked to be on a panel. The title of the panel was San Francisco’s finally come to its end. Silicon Valley is no more. Yeah. This is the epicenter. All the jobs are going to go to Austin, Texas and Boston and Portland.

Deirdre Bosa:

What year was that? That was after the—

Mary C. Daly:

That was 2001.

Deirdre Bosa:

Wow. Almost copy, paste.

Mary C. Daly:

Yes. And so they said, “Do you have a view?” And I said, “Well, I guess I’m maybe a contrarian.” And all the people in the audience stood up and said, “No, we’re with you.” But I said, “It’s hard as an economist and a historian to say that if you’ve got talented people, a beautiful place to live, great infrastructure and an innovative entrepreneurial spirit, that you’re going to be held back.” So I think that’s where San Francisco is. Again, we’re not there yet. There’s a lot of things that we need to do to make this city better and live up to its potential and to make the surrounding area better and live up to its potential. But I just know that the spirit is here and the job will get done.

Deirdre Bosa:

I happen to agree with you.

Mary C. Daly:

Excellent.

Deirdre Bosa:

I try to say a similar thing when I go over there. However, I do speak to a lot of founders and CEOs who are really worried about the San Francisco economy. It’s taken longer for people to get back to work—

Mary C. Daly:

It has.

Deirdre Bosa:

… relative to other companies. You do have issues in the commercial real estate market, one of the highest vacancy rates of any major city.

Mary C. Daly:

That’s right.

Deirdre Bosa:

They talk about things like the gross receipts tax that hurts economic growth here. What do you tell them who are seeing these very real problems?

Mary C. Daly:

Well, I’m on record for having told people this, so I might as well just say it here publicly. If you’re the founder of something, and you’re part of this, well, then let’s change it. This isn’t being done to us. We live in the city, so together we can help and assist. So I do think commercial real estate, of course, there’s very many empty spaces and those have to be absorbed. But I feel like commercial real estate owners and developers are very aware of their situation and working hard to make it better. We’re not out of the woods on it. And by any means, I’m looking at Alex over there, but we’re not out of the woods. But we’ve got diligent people working on it. That’s what I think.

But seriously, this city, any city, any place doesn’t thrive on its own. It thrives with people making those investments. And I do think enough people are here, and so it’s just about putting public-private partnerships together, working collectively to make sure that this is the place we want our kids to live and other people to come. We have to do something to start this up. I was in New York back when it was revitalizing. This is several decades ago. And one of the things that I learned there is that I happened to be at a council meeting and someone said, “This city will not change unless we change the city,” and I think that’s the mantra.

Deirdre Bosa:

How can CEOs and founders help change it?

Mary C. Daly:

Talk about what you need to fix and also encourage your people to come back to work. This is another interesting thing about the workforce. I think we face this real point in time where we have to decide. So yeah, a lot of people say, “It’s great to work all remotely,” and it does offer convenience and abilities, and it gives opportunities to people that might otherwise not have them. But I’ve got a whole group of younger people sitting right in front here who are the interns at the San Francisco Fed, and they’re not different than any other younger new-career people in the country. They need people our age at the office working with them. Zoom is not a replacement for in-person contact for those individuals. And so for founders and developers and business owners and CEOs, bring your people back to work. We would be able to get a compromise between remote and in-person, and hybrid seems to be the way that we can do that.

So I’m a big champion of hybrid work, but I also think about the younger generation. And I think of how many benefits I received by sitting next to people who knew a lot more than me about that particular thing and how I could develop my career. I’m here today because of all the people who helped me, and so I think that’s how we do things. We help others.

Deirdre Bosa:

I see your interns nodding there.

Mary C. Daly:

They’re right here.

Deirdre Bosa:

Do you like being back in the office? Yeah.

Mary C. Daly:

They like the office. They like seeing us.

Deirdre Bosa:

What if remote work isn’t the problem? I’ve been tracking since the beginning of this year layoffs, and either shrinking workforces at some of the biggest tech companies in the world, the Magnificent Sevens, or slower growth rates, and they’re attributing it to artificial intelligence now. How do you see that trajectory and how do you fix that?

Mary C. Daly:

Well, I first back up, and I say there’s a lot of things going on in the economy, not just the development of AI. So one thing that’s going on in the economy is the interest rates. We’ve raised the interest rates, and the way that monetary policy works is we ready to see interest rates. As I showed, demand slows and the labor market slows. So that’s going on in the backstop. The second thing that’s happened, especially in the tech sector, is that the tech sector by their own admission got really optimistic during the pandemic when growth was at double digits and then ended up with a larger workforce than they felt they needed for the growth rate going forward. So there was a lot of rebalancing in the tech sector, and that contributed to a lot of the layoffs.

And then of course, you have technology and globalization that have long been taking some of the work from actual paid employees, so technology’s not a new thing. If you live in the Middle West where I grew up, this has been a process where technology and automation replaced people doing work on machine lines with technology and robots doing work on machine lines, so this is a natural evolution of the economy. AI and generative AI looks to be doing similar things in terms of being able to replace tasks, but we do a lot of roundtables on AI. We opened an emerging tech economic research network at the San Francisco Fed in January. It’s really something for the whole Federal Reserve system. And as part of that, we have research and study, but we also do outreach and we have CEO roundtables. We ask them various questions about how they’re using AI. And right now, I’d say the lion’s share of what we’re hearing is that we’re definitely experimenting. We definitely want to see if we can harness it, and we’re using it to replace certain tasks.

But that doesn’t translate into replacing those people, because now those people can do different things that are also important to the economy and to the business that they couldn’t do before because they were too busy doing these other more routinized tasks. If you’re talking about AI, people are usually doomsayers or utopians. I’m in the middle. Again, a student of history. In history, there’s been no technology ever in the course of any technology that has reduced employment on net. The issue is there’s often a large timeframe in between when it replaces individuals, when it augments individuals, and when it creates new opportunities. That timeframe could be shorter with generative AI. I’m just going to look at you. It could make your job easier and you more productive because using your time to do other things.

Deirdre Bosa:

It could also make me obsolete.

Mary C. Daly:

I don’t think so, because you know what we’re never going to replace? This.

Deirdre Bosa:

Yeah.

Mary C. Daly:

I’m not going to have an avatar interviewing me. That’s not going to be successful for the folks here. And importantly, generative AI is a cool thing. I am totally there. It is a cool thing. It does not do what people do. It doesn’t look at the room and say, “Wow, I see a lot of nodding heads, when people talk about how challenging inflation is. Let me ask another question.” You do that.

Deirdre Bosa:

Fair point.

Mary C. Daly:

And so I think it’s too gloomy to think we’ll all be replaced. I think what we really will have to do is remember that 10 years from now when we look at what this technology has done for us or not for us, it’s not about the technology. It’s a hammer. It’s just a tool. It’s about the decisions we make.

Deirdre Bosa:

And how you use that.

Mary C. Daly:

And how we use it. If we use it wisely, we’ll be better off. If we don’t, we won’t.

Alex Mehran:

You talked about technology, increasing productivity, the number of workers in the longer term. It’s also been deflationary historically. The price of a TV in the US fell 98% between 1997 and 2022. Computer and software items stay 74% cheaper than 25 years ago. How do you think about AI’s deflationary impact? How does that impact your model’s planning?

Mary C. Daly:

This just happened this morning, so we had… Our roundtable was telling us where they’re using AI and I said, “Is it changing your cost structure?” Yes, absolutely. So it changes the cost structure of firms because it reduces costs because you’re doing things that can be routinized with technology, and it does pass through onto prices. And so then it becomes a disinflationary force which helps hold prices down. And you’re right, the prices of goods fell tremendously, TVs, all kinds of things, because we could automate those processes and that has been a benefit to the US economy. But the important part of that equation is then we have to have our workforce taking up other opportunities, and that’s where I think we can be more optimistic about AI and what it can do. It can help us do things better and engage more people because they have a sidekick really, in learning. You can speed up your learning curve on things, but again, these are all of our own decisions.

So I do think productivity growth is possible, but I don’t want to count on extreme productivity growth. I’d be happy if we can get some regular productivity growth, which is around 1.5% per year. That would be terrific.

Alex Mehran:

Got it. I’m going to get to some audience questions. If there’s more, feel free to write them down and they’ll be handed up to me. It’s a classic and a goodie, “Is 2% inflation still the right goal?” From Bob Walker.

Mary C. Daly:

Yes.

Alex Mehran:

Okay.

Mary C. Daly:

Yes.

Alex Mehran:

Yes.

Mary C. Daly:

Yes, it is a good goal.

Alex Mehran:

We’ll move on. [inaudible 00:52:58].

Mary C. Daly:

I’m just going to say it’s a good goal. The very first question I was asked literally by the President of the San Francisco Fed when I started is, “Do you think 2%’s a good goal?” And I thought, “This is a trick question. What am I supposed to say?” We didn’t have a target back then. We just had an aspiration, but the reason is if you study the history of inflation, it’s a good goal because 2% is a level where if you’re mismeasuring, you don’t end up in deflation where you end up in where Japan has been, that’s a struggle, and you don’t end up with inflation being so high that people think about it. What you want is for inflation not to be something people think about. I would be happiest when people don’t know what the word means. Everybody knows what the word means right now.

Alex Mehran:

This is another good question. This comes from Max Harrison-Caldwell at the SF Business Times. “Where are we with downtown San Francisco’s economic recovery? Are downtown’s economic challenges unique or do they represent a regional drag?”

Mary C. Daly:

I don’t think they represent a regional drag. I think San Francisco’s challenges are different than some of the others. I go back and forth, but Seattle also has them. Portland also has them. LA is interestingly revitalizing it a little bit faster pace if you go down into the area, but I do think we’re on a timeline. It’s just a matter of tourism coming back and people coming back into the city and importantly, workforce coming back into the city. And we’re hearing that tourism is coming back and that people are coming back and more and more businesses I speak to anyway are bringing their workforces back at least part of the week, and that’s a helpful thing.

Alex Mehran:

Traffic is always worst on Tuesday, Wednesday and Thursday, [inaudible 00:54:38].

Mary C. Daly:

Yeah, hybrid and going to sort onto Tuesday, Wednesday and Thursday. Those are the high traffic days. I like to come in Monday and Friday.

Alex Mehran:

Same here. Let’s avoid all of that. This is a similar tone and I understand it because there is a lot of concerns about what we see here in San Francisco. So put another way. I don’t know who this comes from, but I’m going to read it anyways because I think it’s a good question. Raise your hand if you want to be acknowledged. “Wells Fargo is the only bank of significant proportions remaining headquartered in the Bay Area, yet all of its executives are now in New York and they have reduced hiring in California. Do you expect this to change?”

Speaker 1:

Sorry, that was me. I forgot to [inaudible 00:55:14]

Mary C. Daly:

That’s okay.

Alex Mehran:

Thank you for raising your hand. Your name and affiliation?

Speaker 1:

Well, I work at Wells Fargo, but I must say—

Mary C. Daly:

Okay.

Speaker 1:

My comments do not represent—

Alex Mehran:

Okay. The disclaimer.

Speaker 1:

I’ve worked there since 2000.

Alex Mehran:

Fair.

Speaker 1:

[inaudible 00:55:31].

Alex Mehran:

And Wells Fargo isn’t the only one.

Mary C. Daly:

No. One of the things that… And I can’t comment on Wells Fargo specifically or any business specifically, but what I will say is that we are in a world where people can live and work in different places and where businesses are looking across the nation and the globe for talent, and those decisions are really something that they’re able to make that they think are the right things for their company or business. I think that it’s also beneficial to think about what we can put here in the Bay Area and how we can keep individuals here and working and be part of a productive enterprise. So I can’t say anything specifically about Wells Fargo, but I can say there are many businesses who do want to hire here, who do want to stay here and who do want to work here.

One of the challenges that they continue to tell me is we’ve got to get some housing problems solved in order to make that equation work. There’s an ecosystem that has to happen if you want a thriving economy. You have to have housing, you have to have jobs, and you have to have communities. If you have all of those things, then you have that virtuous cycle which makes a community thrive. If one of those things is off balance, well, then you have challenges. And there’s no one I talk to in the Bay Area who doesn’t remind me that it’s not commercial real estate people talk about, it’s housing. That’s the thing that I hear the most. Housing, we don’t have enough of it.

Alex Mehran:

I’m always in awe whenever I go to New York where my company is headquartered, and you can just walk forever in Manhattan and we just don’t have that same kind of mix here in downtown San Francisco. There’s not a lot of residential housing and that has to do a lot with the policies that are in place. How do you fix that housing problem?

Mary C. Daly:

So I think ultimately, and I’ve talked about this in the past, and so you can look up other remarks I’ve made if that’s of interest to you, but really, what you have to do is you have to recognize this as a public-private partnership. The private sector won’t be able to do this on their own. The public sector won’t be able to do this on their own, but there is this idea that we might have to think differently going forward about how we want our communities to look than we have thought about historically. So if that means changing zoning laws or that means changing the way we think about producing capital stacks and putting things together, then we’re likely going to have to do that in order to meet these significant challenges. I think it’s all doable if people work on those things. Frankly, let me just end with this. There are places in the 12th District even, who are putting those models together, places like Salt Lake City, up in Portland, places in Washington State. So I think those models are there and it’s about learning what those models look like and trying to bring them to places that need them.

Alex Mehran:

This is a really fun question. Again, unattributed. Raise your hand—

Mary C. Daly:

Fun for who?

Alex Mehran:

What’s that?

Mary C. Daly:

Fun for who?

Alex Mehran:

I think it’ll be fun for you.

Mary C. Daly:

Okay. I just want to [inaudible 00:58:27] so I don’t get my expectations up.

Alex Mehran:

The next question is not fun for you though.

Mary C. Daly:

Oh, okay.

Alex Mehran:

But I’m going to save that. I’m hoping this is one’s fun.

Mary C. Daly:

I like the clarity you’re providing me. That’s good.

Alex Mehran:

“Describe the American economy of 2034 as compared to today?”

Mary C. Daly:

Oh, wow.

Alex Mehran:

Right? It’s interesting.

Mary C. Daly:

That is a fun question.

Alex Mehran:

Does anyone want to take credit for that question? Maybe it’s on YouTube.

Mary C. Daly:

So I barely will speculate about next month, but I’m going to go all the way to 2034. But let me tell you what I hope for, this is what I hope for. I think we should all hope for this frankly, is that we have an economy that recognizes that we’ve left so much talent on the table, unutilized for too long, that we all work better as a nation when everybody has opportunities that give them the ability to invest in themselves, in their families, in their businesses and in their communities. If we have that, I’m less worried about how generative AI works or other things than I am about us recognizing that we all do better when we all do better, that when we participate and work as individuals in an inclusive economy, the entire pie grows. And we’ve had those periods in our history and those periods are not just in our past, they can be in our future. That’s the 2034 I’m looking for.

Alex Mehran:

That’s a great answer.

Mary C. Daly:

And I hope I do get a cool avatar too.

Alex Mehran:

We’re talking through our avatars or something, but I’ll still be—

Mary C. Daly:

I like Star Trek, so if you’re too young to remember Star Trek, go look it up. But it was a cool show.

Alex Mehran:

I’m sure we have a few Trekkies in the audience, so [inaudible 01:00:01].

Mary C. Daly:

I can’t say I’ve ever dressed up and been a Trekkie, but I’m definitely a follower.

Alex Mehran:

Okay, here’s the question I don’t think is going to be as much fun for you. “Trump plans to reduce the independency of the Fed. If he returns to the presidency, what would be your response?”

Mary C. Daly:

So it’s an important question that again—

Alex Mehran:

Is that you, your question?

Mary C. Daly:

We are an apolitical organization, the Federal Reserve. We were given our responsibilities in 1913 by Congress and we hold to those, and Congress can change our responsibilities or not. But the important thing is the best way to continue to earn the trust of the American people and our elected officials is to do our work. So my mind is 100% focused on restoring price stability and doing it as well as we can without a large disruption to the economy. So that’s what I think about, that’s how I’ll respond, continuing to do our work, our core work and ensure that we have an inclusive economy that works for everyone.

Alex Mehran:

Would you do this work if it wasn’t independent?

Mary C. Daly:

I don’t speculate about what my future will hold. I’ll just say I’ll keep doing the work. Alex said these very kind things about me. I’m dedicated as a public servant. I want to make the San Francisco Fed literally the best in public service. I think that it should be something, and it is something that every San Francisco Fed employees… We have a sign at the beginning of our hallway that says, “Our work serves every American and countless global citizens.” Our work is important, it’s essential, and that’s where the integrity comes in. I will hold up on that front and do that no matter what happens.

Alex Mehran:

Okay. This is from Greg Salmson, and I know you don’t comment on fiscal policy, but—

Mary C. Daly:

Wow, you really got this going now. [inaudible 01:01:59]

Alex Mehran:

But he does ask, “What does the Fed think? Some say the federal budget deficit doesn’t matter. Some say it’s dangerously high.”

Mary C. Daly:

Sure.

Alex Mehran:

What do you think?

Mary C. Daly:

So the thing that I’ll say as an economist, and we’ve talked about this before as policy makers, as a Federal Reserve official, we take the economy we’re given. We don’t make decisions about how the economy evolves. We work on the economy we have and by delivering on our dual mandate goals. One of the things I know as an economist though, is eventually, and I think everybody understands this, sovereigns even, have to be able to fund themselves and fund themselves in a way that matters for the future. Ultimately, what I want as a person living in this country is a country that works better for the future generations than it has. That’s the sort of mantra, we should leave the world better than we got it.

And so that’s where I think these issues of debt and deficit stack up is what are we doing it for? Are we investing in a future that delivers better value for the next generations or are we not? And that’s the question that we all have to ask ourselves. That’s not a Federal Reserve responsibility, but it is something that I think we can all as members of this nation aspire to achieve.

Alex Mehran:

I heard you give a great anecdote at the end of your last discussion, I think it was in April, about meeting a valet driver who said that he had dropped out of school because he could make enough money and it was appealing to become a valet driver, but the upper trajectory of that was not great. Have you had any conversations that have changed that sentiment? And I just love your personal anecdotes of the family that you saw at a shopping store. Anything else you’d like to share along those anecdotal lines?

Mary C. Daly:

So I think that that’s a really important… Actually, back in 1996, the economy’s thriving, right? When I joined the Fed and I went out to Las Vegas. And in Las Vegas, it’s the middle of the day, I’m getting ready to give a talk, and the car that we’re in pulls up to the hotel and it’s a weekday, middle of the day. And all these high-school looking kids come out and they’re parking our car. So I asked them, “What are you doing?” And they’re like, “Well, we dropped out of high school so we can park cars because I can make a lot of money.” That is not an economy that is what I think of as a virtuous cycle. That’s an economy that’s causing people to make choices that may not fare very well.

So I think right now, getting the economy back to a sustainable pace takes the edge off of things. It takes the froth away. It makes workers less frantic to try to find jobs, to try to make means meet, to pay for higher prices and high inflation. And it makes businesses more able to invest in the longer term career trajectory of their employees, and I’m starting to hear that.

I was in Utah, I think this was at the roundtable we were at, but it could have just been in one of my meetings in the community. And someone said, “Well, how’s your business faring?” And she said, “I’m so happy because workers are staying and now I can provide them… I had these education benefits but nobody was taking them. I have this and that, and nobody was taking it.” And now she was feeling good because ultimately, many of our businesses, they want to see the future brighter too. And they want people to go to school, get training, move on, rise up. Those are the kinds of things.

So the anecdote I have right now is that people feel when I talk with them that we’re getting there, but they also know that we’re not there yet. And what I try to convey regularly is that I will do my part to try to get us there, and I am confident that we eventually will. That’s how I do my work each day and that’s why I get up each morning. And if you want the little poster, we can give you the poster that says, “Our work serves every American and countless global citizens.”

Alex Mehran:

Well, that is a perfect note to end on. President Daly, thank you so much for taking the time today.

Mary C. Daly:

Thank you.

Summary

Mary C. Daly delivered remarks on the state of the economy and the need to balance policy to protect full employment while restoring price stability. Her remarks were followed by a Q+A moderated by Deirdre Bosa, “TechCheck” Anchor at CNBC.

Presented in partnership with the Commonwealth Club World Affairs of California and the San Francisco Press Club, President Daly’s remarks are available as a recording above.

Quick Clips

From the Event

Photo credits: Sarah Deragon and Peopletography/Sarah Gonzalez

Sign up for notifications on Mary C. Daly’s speeches, remarks, and fireside chats.

About the Speaker

Mary C. Daly is president and CEO of the Federal Reserve Bank of San Francisco and helps set American monetary policy as a Federal Open Market Committee participant. Since taking leadership of the SF Fed in 2018, she has chartered a vision of the Bank as a premier public service organization dedicated to promoting an economy that works for all Americans and supporting the nation’s financial and payment systems. Read Mary C. Daly’s full bio.