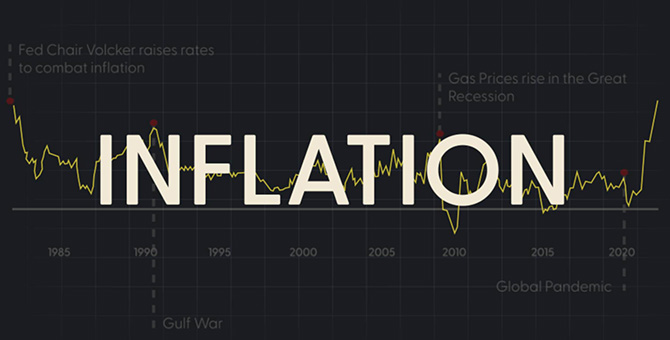

This first video in our 60-Second Explainer series provides a brief review of how higher interest rates can help bring inflation down. These videos aim to provide quick insights on economic conditions, monetary policy, and how the Fed is working for you. Stay tuned for additional videos in the months ahead.

A brief explainer on how interest rates affect inflation. (video, 1:04 minutes).

Transcript

Inflation is much too high, and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down. (Federal Reserve Chair Jerome Powell, Press Conference, May 4, 2022)

To help lower inflation, the Federal Open Market Committee (FOMC) has started tightening monetary policy by incrementally raising the target range for the federal funds rate.

In other words, the Fed is raising interest rates.

Why is this important?

This increases short-term borrowing rates for commercial banks. The rate then gets passed down to consumers and businesses, raising interest payments for debt like auto loans, credit cards, business loans and mortgages.

When it costs more to borrow, economic activity tends to slow down, both through reduced investment activity by businesses and reduced spending by consumers.

This reduction in overall demand can offset price pressures and bring inflation down.

With these actions, the FOMC is aiming for a policy path that will bring inflation back to its average 2% goal while keeping the labor market strong.

Una breve explicación sobre cómo las tasas de interés más altas pueden ayudar a bajar la inflación (video, 1:10 minutos).

Este primer video de nuestra serie de cortometrajes informativos de 60 segundos ofrece una breve explicación sobre cómo las tasas de interés más altas pueden ayudar a bajar la inflación. La serie tiene como propósito brindar información de manera rápida y sencilla sobre las condiciones económicas y la política monetaria de los Estados Unidos, y sobre cómo la Reserva Federal está trabajando para todos. No se pierdan nuestros videos adicionales en los próximos meses.

Transcripción

La inflación está demasiado alta, entendemos las dificultades que está causando, y nos estamos moviendo rápidamente para reducirla. (Jerome Powell, Presidente de la Junta de Gobernadores de la Reserva Federal, 4 de mayo, 2022)

Para ayudar a bajar la inflación, el Comité Federal de Mercado Abierto (“FOMC” en inglés), ha iniciado una política monetaria más restrictiva.

Es decir, la Reserva Federal (o “Fed”) está subiendo las tasas de interés.

Esto es importante porque aumenta las tasas de préstamo a corto plazo para los bancos comerciales, y esto a la vez se transmite a empresas y consumidores subiendo los pagos de intereses por deudas, tales como los préstamos para la compra de autos, hipotecas, tarjetas de crédito y préstamos comerciales.

Cuando los préstamos cuestan más, la actividad económica disminuye debido a la reducción de la inversión empresarial y a la reducción del gasto de los consumidores.

Esta reducción de la demanda agregada puede aliviar la presión sobre los precios y reducir la inflación.

Con estas medidas, el FOMC busca bajar la inflación hacia su objetivo del 2% anual, mientras preserva la fortaleza del mercado laboral.

You may also be interested in:

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.