The U.S. unemployment rate has held steady at 4.1% in recent months (through March 2018). This is near historical lows, indicating a very tight labor market.

By contrast, the broader measure of labor market tightness called U6 has remained somewhat elevated compared with past lows. Why? The main reason is that U6 includes individuals who are employed part time but want a full-time job—the so-called “involuntary part-time” group, or IPT, labeled “part time for economic reasons” by the U.S. Bureau of Labor Statistics. Policymakers have flagged the extent of IPT work as one important indicator of the state of the labor market in the wake of the Great Recession (Yellen 2014).

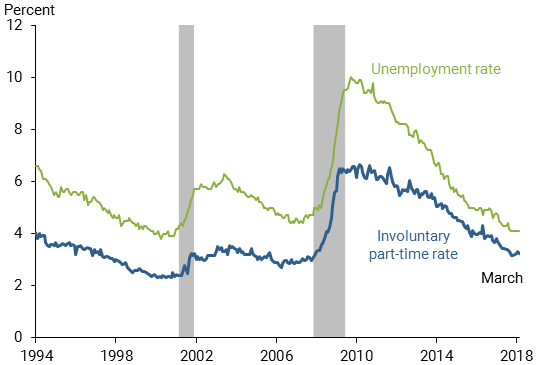

Figure 1

Involuntary part-time rate vs. unemployment

Note: Involuntary part-time rate expressed as share of total civilian employment. Gray shading denotes NBER recession dates.

Figure 1 displays the IPT and unemployment rates over the past few decades. The IPT rate has remained somewhat high compared with the unemployment rate during the recovery from the Great Recession of 2007-09. The gap between the two series closed from 2010 to 2014 and has been quite narrow since then, compared with earlier periods.

During early 2018, involuntary part-time work was running nearly a percentage point higher than its level the last time the unemployment rate was 4.1%, in August 2000. This represents about 1.4 million additional individuals who are stuck in part-time jobs. These numbers imply that the level of IPT work is about 40% higher than would normally be expected at this point in the economic expansion.

In a 2015 FRBSF Economic Letter, a coauthor and I asked whether elevated IPT in the aftermath of the Great Recession was here to stay (Valletta and van der List 2015). Or, did it represent labor market slack—that is, weakness associated with the business cycle—that would completely dissipate as the recovery proceeded? Using data through 2014, we uncovered an important contribution of persistent structural factors, suggesting that IPT was likely to remain elevated even as the unemployment rate fell. Figure 1 largely confirms this earlier prediction.

An updated, more complete analysis pins down the factors associated with high levels of involuntary part-time work (Valletta, Bengali, and van der List 2018). Our analysis relies on annual data for the 50 U.S. states plus the District of Columbia for 2003 through 2016. Beyond IPT and unemployment rates, we include direct measures of structural features of state labor markets that affect the demand and supply for part-time work, such as industrial composition and demographics of the workforce. For example, industry composition matters because industries differ in their reliance on part-time work schedules, with high rates in selected service industries such as leisure and hospitality—consider hotels and restaurants. Conversely, the demographics of the workforce could matter because some groups, such as teenagers, work part time voluntarily, thereby reducing the incidence of IPT.

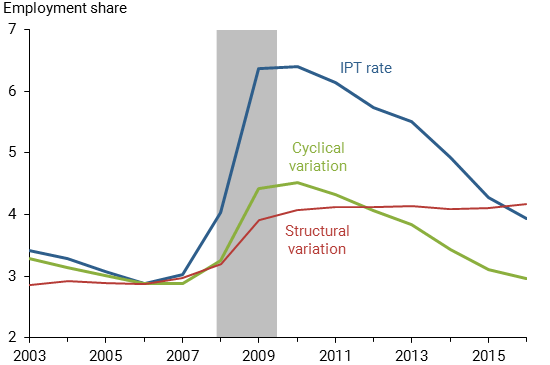

We find that the changing structural features of state labor markets have propped up IPT work in the aftermath of the Great Recession. This is shown in Figure 2 below, which breaks down the overall changes since 2006 into portions of IPT attributable to the business cycle and to the measured structural factors (see the research paper for details on how we do this).

Figure 2

Components of involuntary part-time employment rate

Note: Series measured as shares of total civilian employment. Gray shading denotes NBER recession dates.

Most of the variation over time has been cyclical. As of 2016, however, the cyclical component had returned approximately to its pre-recession level. Most importantly, the structural factors account for about a percentage point of the elevated IPT share through 2016. This is consistent with the discussion of Figure 1, with very little change in its overall contribution since the recovery began in 2010.

Changes in industry composition account for almost all of this slow shift toward increased IPT work. Rising employment in the leisure and hospitality sector and in the education and health-services sector, both of which have high rates of part-time employment, made especially large contributions to the overall change. We also found evidence that the amount of IPT work and informal “gig” economy jobs tend to move in tandem at the state level.

The shift toward service industries with uneven work schedules and the rising importance of the gig economy appear to be long-term trends that are unlikely to reverse in the near future. As such, in the absence of public policies aimed directly at altering work schedules, it looks like higher rates of involuntary part-time work are here to stay.

Rob Valletta is vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Valletta, Robert G., Leila Bengali, and Catherine van der List. 2018. “Cyclical and Market Determinants of Involuntary Part-Time Employment.” FRBSF Working Paper 2015-19. Updated March 2018.

Valletta, Rob, and Catherine van der List. 2015. “Involuntary Part-Time Work: Here to Stay?” FRBSF Economic Letter 2015-19 (June 8).

Yellen, Janet. 2014. “Labor Market Dynamics and Monetary Policy.” Speech at the FRB Kansas City Economic Symposium, Jackson Hole, Wyoming (August 22).

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.