Millions of people lost their jobs and filed for unemployment insurance (UI) as the coronavirus disease 2019 (COVID-19) spread through communities and businesses shut down to slow its progression. The severity of the situation prompted Congress to pass the Coronavirus Aid, Relief, and Economic Security (CARES) Act. It included Pandemic Unemployment Compensation (PUC), which provided an additional $600 per week to supplement regular unemployment benefits during the initial outbreak of COVID-19 though the end of July 2020.

The generosity of the program raised concerns that it could slow the labor market recovery. If unemployed people earned more per week with the additional support than they had from their previous jobs, would they reject offers to return to work?

What goes into a worker’s decision to accept a job offer?

This concern overlooks the dynamic nature of employment, comparing static weekly earnings to benefit amounts. Instead, it’s important to compare the value an entire job spell to the value of remaining unemployed.

The average U.S. worker, for example, earns around $1,000 per week in a job that typically lasts two years. The value of a job offer is therefore much greater than the weekly pay, and must be compared to a weekly income while unemployed that may expire before another job can be found.

This insight about the decision problem a worker faces may be summarized with a simple statistic. Their decision depends on what they believe the state of the labor market is—how long it will take to find an alternative job offer—and the number of weeks before UI compensation runs out. The summary statistic measures the dollar amount of weekly UI payments necessary for a person to be indifferent between accepting a job offer at the previous wage and rejecting it to remain unemployed. A worker will accept a job offer if the current level of UI benefits is below this reservation benefit.

Estimating the reservation benefit for different occupations

The reservation benefit statistic can be calculated for the period covered by the CARES Act using data from the Bureau of Labor Statistics’ Current Population Survey. The details of this method are discussed at length in Petrosky-Nadeau (2020). The results suggest that few categories of workers would refuse an offer to return to work at their previous pay.

For example, consider a typical high school educated worker who earns $800 weekly from work. Although they would receive UI payments under CARES of $1,000 per week, or 125% of their previous wage, they would not have been deterred from accepting a job offer in early May 2020. In fact, the PUC payment would need to be topped off by an additional $250 per week before this person would consider rejecting the job offer.

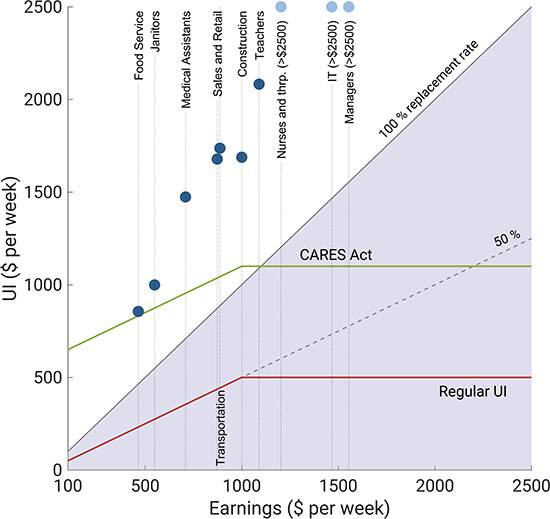

State UI systems and payment levels vary substantially. A typical program offers 50% of prior weekly earnings up to a $500 cap. Figure 1 shows regular unemployment benefits by level of weekly earnings (red line), and with expanded PUC payments (green line), based on previous earnings. The blue shaded area depicts UI payments below 100% of the previous wage. The blue dots indicate the reservation benefit levels for selected occupations.

Figure 1

Weekly unemployment payments versus estimated reservation benefits for selected occupations

Consider the situation during the first week of June 2020, with only eight weeks of supplementary UI payments remaining and states moving to reopen their economies. In this case, it turns out that only workers in the lowest paid occupation—food services, with typical earnings of $460 per week—would be indifferent between accepting an offer and remaining unemployed. For all other occupations wage replacement rates over 100% during the pandemic were unlikely to cause people to reject job offers. The value of a job, especially in a depressed labor market, significantly outweighs the value of the temporary additional UI income.

The values of the reservation benefits calculated here are in line with other research findings. Early studies into the effects of the expansions to UI under the CARES Act have found little impact of the increased generosity on exit rates out of unemployment. Both Bartik et al. (2020) and Altonji et al. (2020) find that states with more generous UI systems have not experienced weaker labor market rebounds during the initial phase of reopening.

Taken together, the additional income provided to the unemployed through the CARES Act has likely had little labor supply induced impact on the unemployment rate over the past couple of months. Rather, the additional income acted as an effectively targeted fiscal stimulus to support aggregate demand throughout the economy.

Nicolas Petrosky-Nadeau is a vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Image credit: SDI Productions via iStock.

References

Altonji, Joseph, Zara Contractor, Lucas Finamor, Ryan Haygood, Ilse Lindenlaub, Costas Meghir, Cormac O’Dea, Dana Scott, Liana Wang, and Ebonya Washington. 2020. “Employment Effects of Unemployment Insurance Generosity During the Pandemic.” Yale University Manuscript.

Bartik, AlexanderW., Marianne Bertrand, Feng Lin, Jesse Rothstein, and Matthew Unrath. 2020. “Measuring the Labor Market at the Onset of the COVID-19 Crisis.” Brookings Papers on Economic Activity Conference draft.

Petrosky-Nadeau, Nicolas. 2020. “Reservation Benefits: Assessing Job Acceptance Impacts of Increased UI payments.” Federal Reserve Bank of San Francisco Working Paper 2020-28. Available at https://doi.org/10.24148/wp2020-28

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.